Record production of railway wheels. 6.5x in H1FY22 compared to H1FY21. Who is delivering this? Read on..

#Railwaycapex

#Railwaycapex

As per Texmaco Q1 earnings call, "typically the industry has never produced more than 15,000 wagons in a year and today the entire industry is supposed to provide approx. 30,000 wagons annually."

A rail wagon has 6-8 wheels. So that 1.8L to 2.4L wheels every year.

A rail wagon has 6-8 wheels. So that 1.8L to 2.4L wheels every year.

The key supplier is Rail Wheel Factory, an arm of Indian railways.

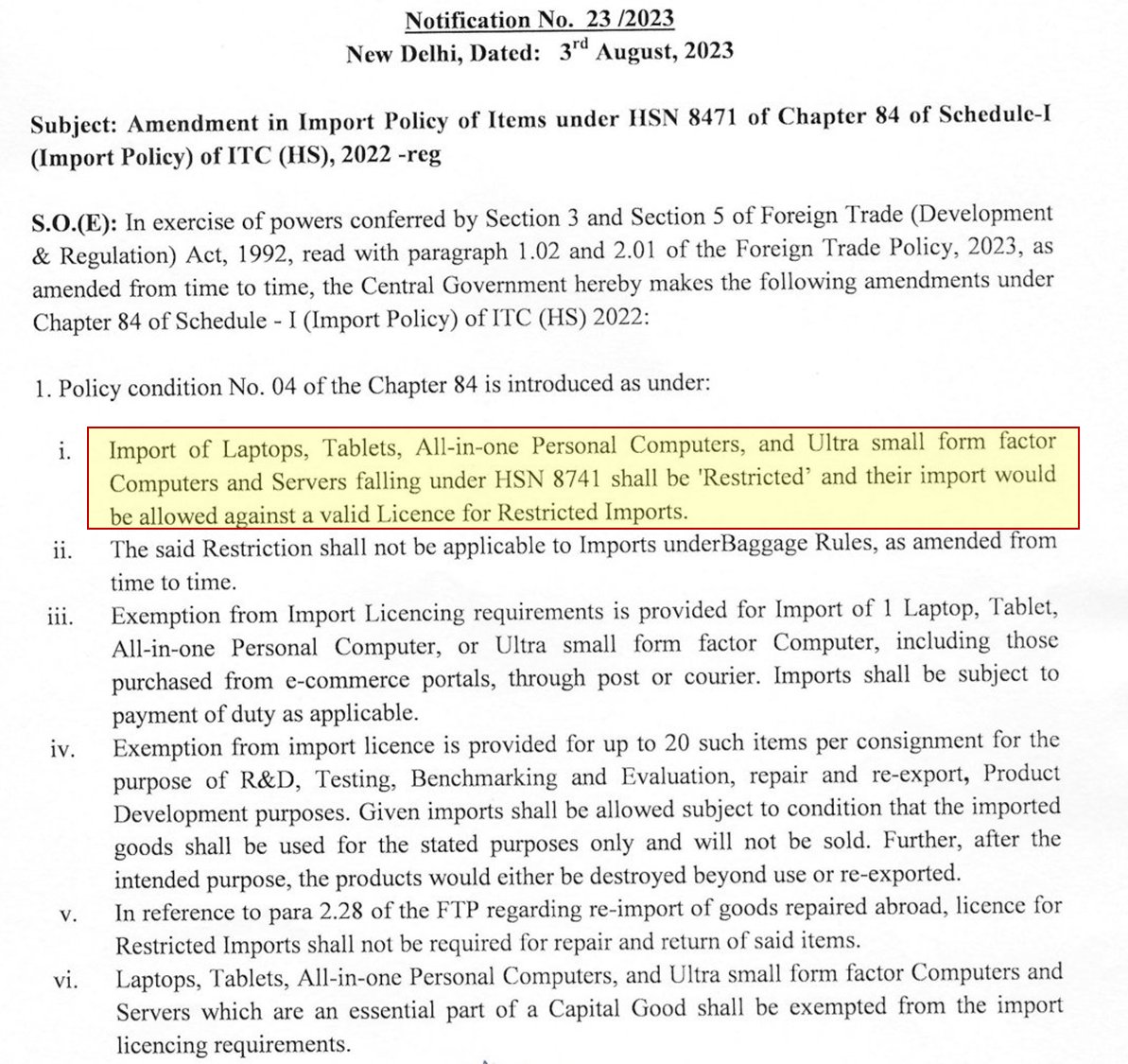

One key private vendor is Texmaco Rail. This extract explains the situation of ground. Demand > domestic supply. So dependence on China and margin pressure..

Also shows challenges of dealing in a B2G business.

One key private vendor is Texmaco Rail. This extract explains the situation of ground. Demand > domestic supply. So dependence on China and margin pressure..

Also shows challenges of dealing in a B2G business.

Given the increased railway demand, private players have stepped up production. Here are the players:

1. Jindal Steel and Power - JSPL is the first private firm to get "regular supplier" tag from Railways in December 2020. From steel to Rails to now wheels.. See filing:

1. Jindal Steel and Power - JSPL is the first private firm to get "regular supplier" tag from Railways in December 2020. From steel to Rails to now wheels.. See filing:

2. Hilton Metal Forging: In November 2021, this microcap claimed to become the first Indian MSME company to develop Indigenous and aatamnirbhar Solid Forged Railway Wheels. The results show in Q1FY23 numbers.

Note: Stock is already up from 15 to 62 since Nov 21.

Note: Stock is already up from 15 to 62 since Nov 21.

3. There are some niche players claiming to supply for the Rail wheel capex - Balu Forge, Rolex Rings, etc

Clearly railway capex is on big upswing..

What is the reason for the same. Again this is nicely explained in Q1 earning call of Texmaco. The share of railway freight was 80% during independence and now down to 27%. Target is to increase it back to 40% by 2030/ 2027.

What is the reason for the same. Again this is nicely explained in Q1 earning call of Texmaco. The share of railway freight was 80% during independence and now down to 27%. Target is to increase it back to 40% by 2030/ 2027.

Credits for helps in research to @captwist_in - makes it easier to search keywords across company filings.

If you like these quick bites, follow me on Multipie where I share more of these market and investing insights.

multipie.co/u/abhymurarka

multipie.co/u/abhymurarka

• • •

Missing some Tweet in this thread? You can try to

force a refresh