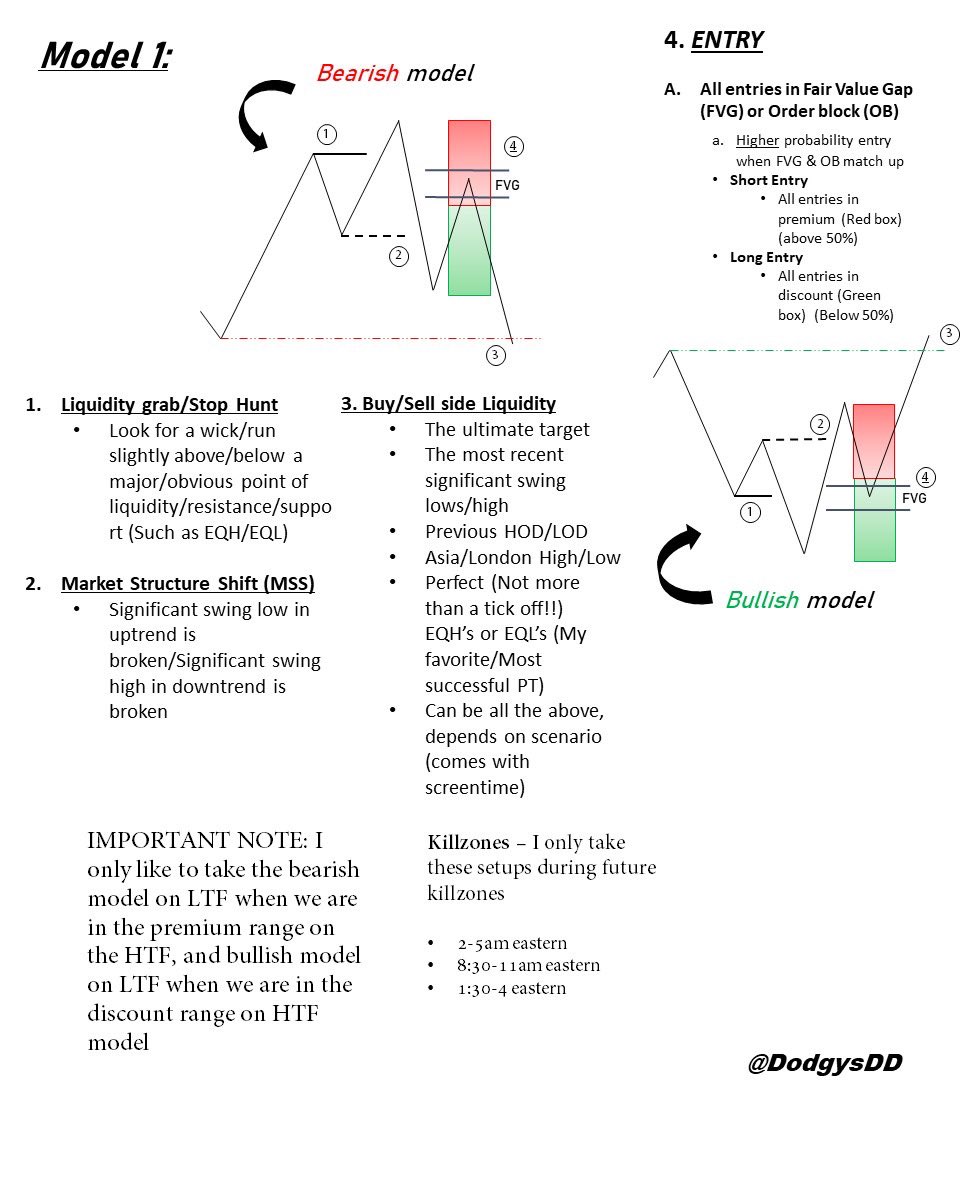

Here’s my second perfect setup I always look for that has given me almost a 100% win rate

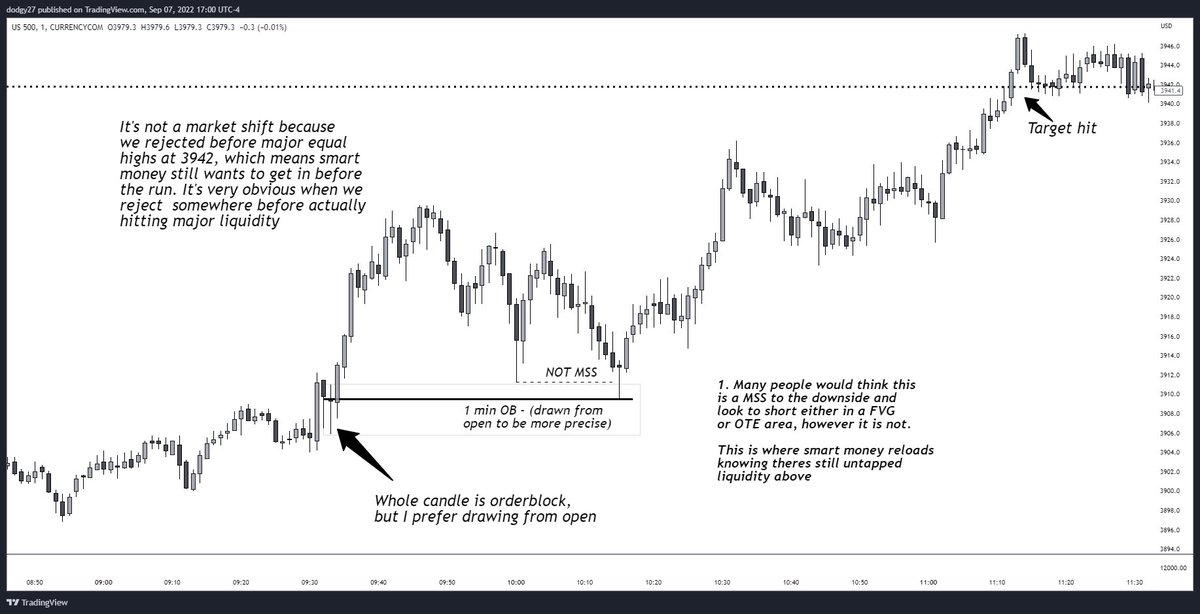

Real example from today below👇🏽

Real example from today below👇🏽

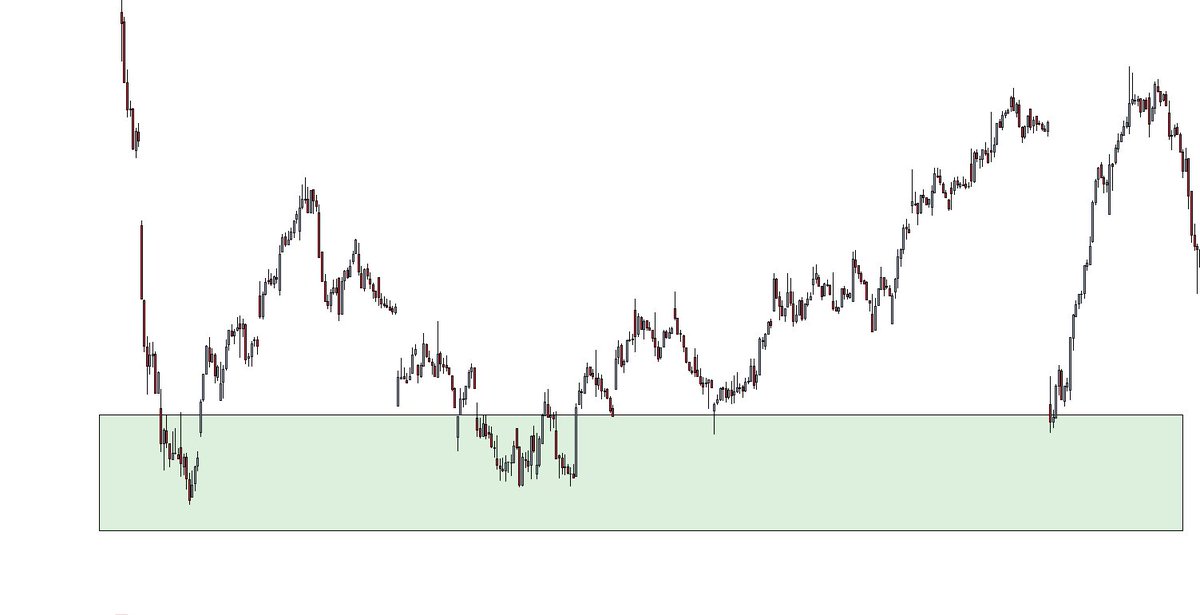

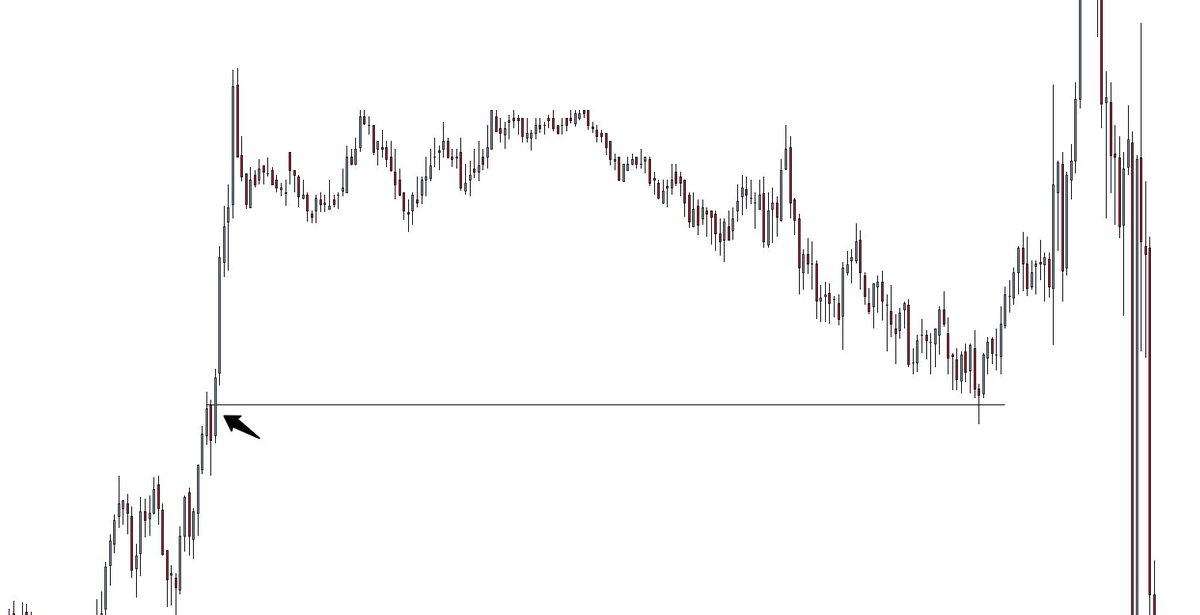

PLEASE READ! The most important thing you must understand about this setup that I currently have almost a perfect win rate with is only when the liquidity is equal highs or lows, not single swing highs and lows. Read both these chart annotations then read the next reply…

The main thing you should notice when finding these setups is equal highs or equal lows, and then a rejection just below the EQH or just above the EQL, then a retrace to a perfect fvg or OB. Why does this happen? Well it’s so smart money can get in before we hit the

actual liquidity the market is targeting. The market makers do this on purpose to 1, mess up retail making them buy puts after the fake MSS, and then use them for liquidity to get in

Study carefully, it’s a bit more complex than the one I posted the other day, but very very useful.

DM me if you have any questions. Remember, look for a rejection below liquidity, and ask yourself why would we reject at a random spot and not hit liquidity? It’s because smart money wants to get in

100 likes for my third and final setup

credit to @I_Am_The_ICT once again

entry is at the orderblock on this purple dot, in some scenarios it may be an fvg, i like to enter somewhere from .62-.79 on a fib if it linked up with an OB or FVG, i usually takes whatever it lines up with

hello again for people finding themselves here

this model played out today perfectly. can anyone find it?

this model played out today perfectly. can anyone find it?

• • •

Missing some Tweet in this thread? You can try to

force a refresh