How to get URL link on X (Twitter) App

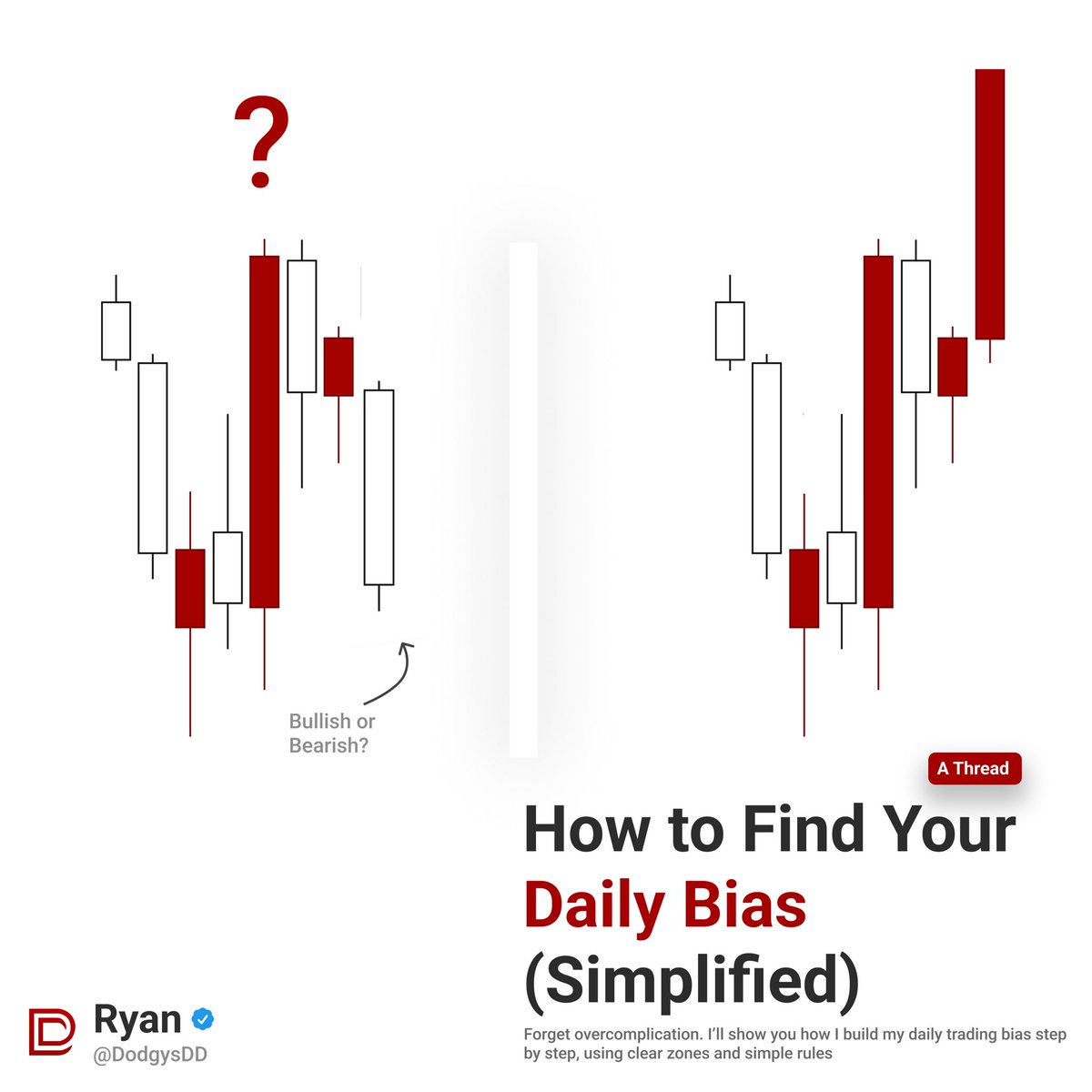

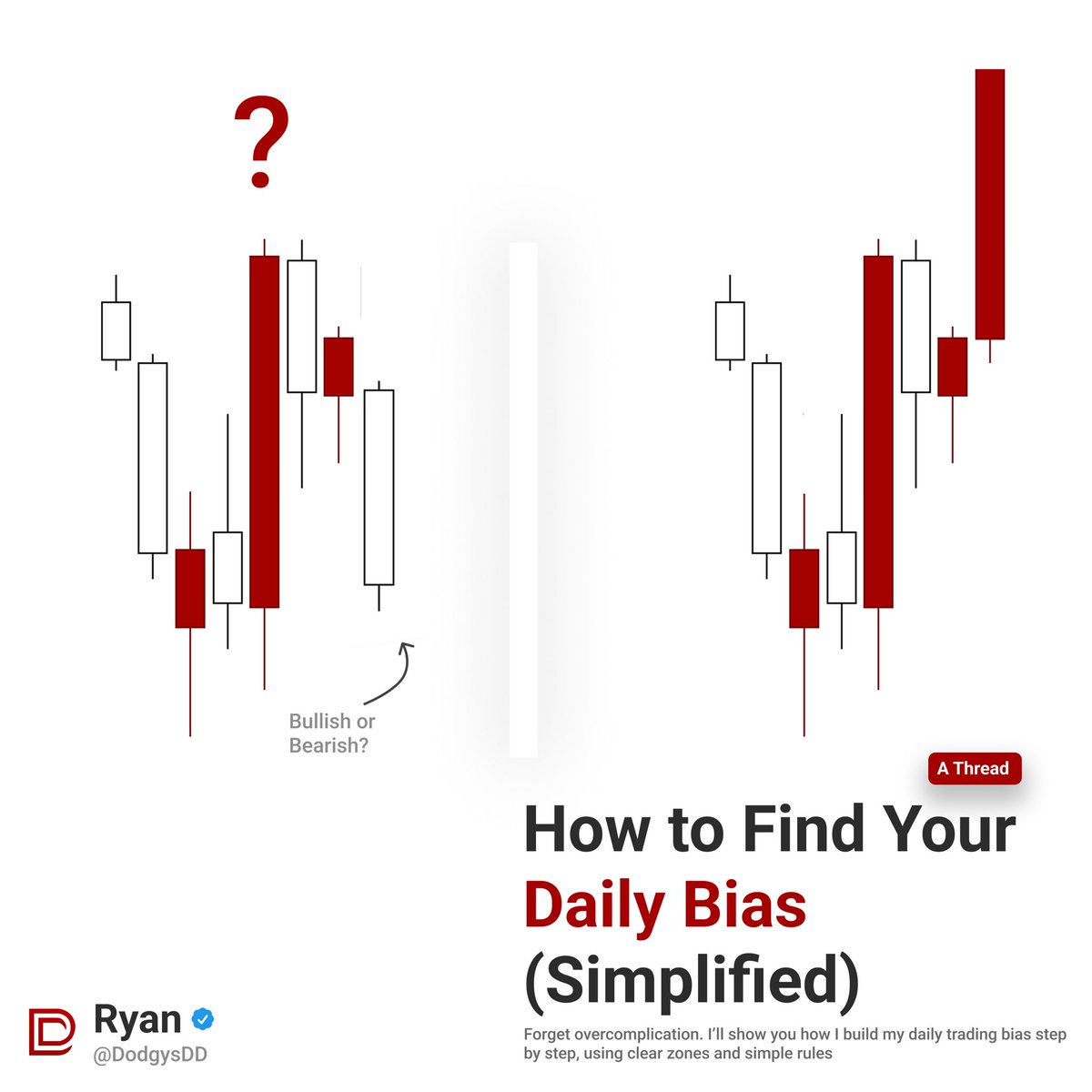

✅ Step 1 — Check the Daily & 4H

✅ Step 1 — Check the Daily & 4H

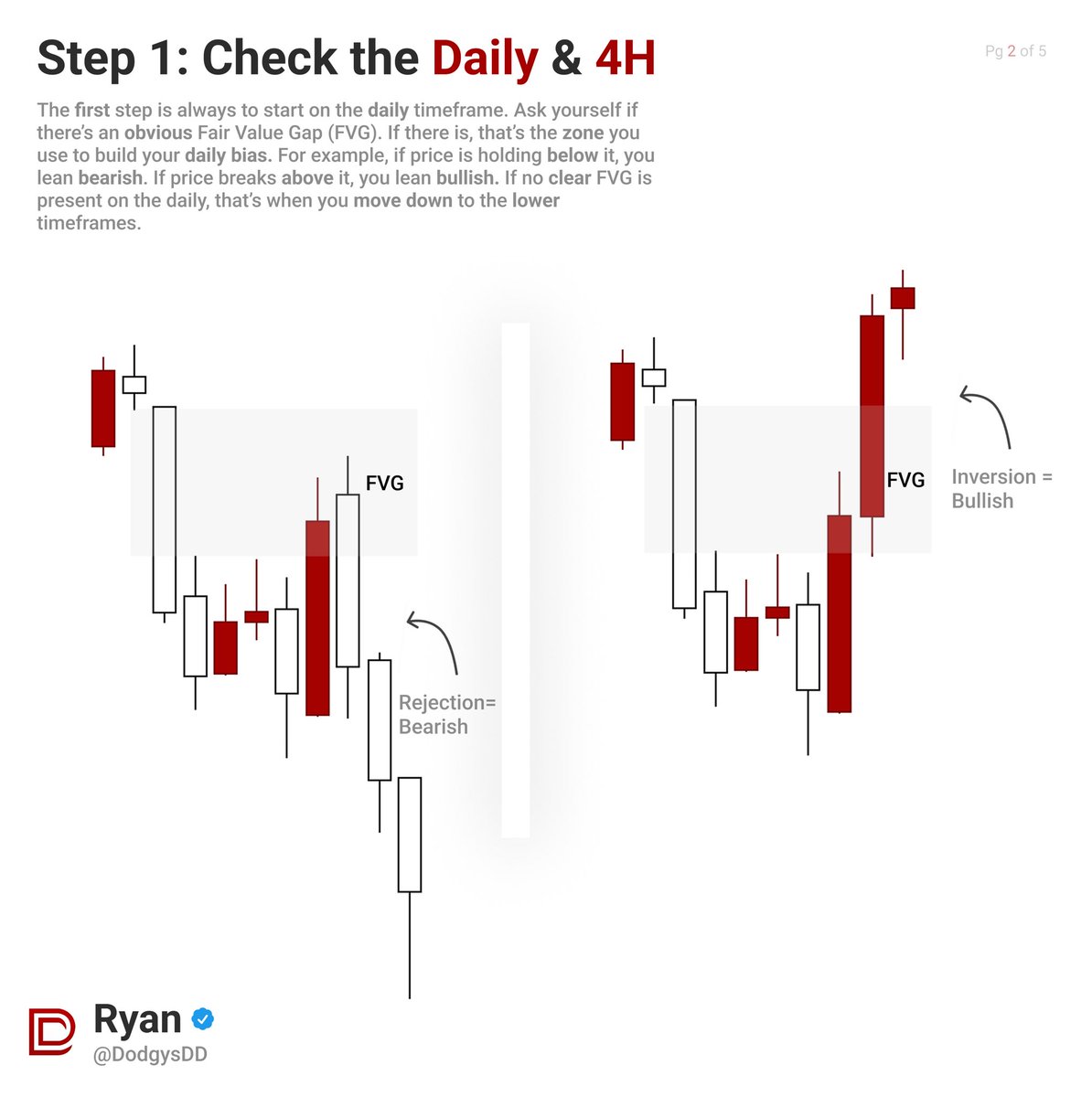

Each candle no matter the timeframe follows a specific sequence: OHLC (Open High Low Close) or OLHC (Open Low High Close)

Each candle no matter the timeframe follows a specific sequence: OHLC (Open High Low Close) or OLHC (Open Low High Close)

A Breaker Block forms through a specific sequence in price action:

A Breaker Block forms through a specific sequence in price action:

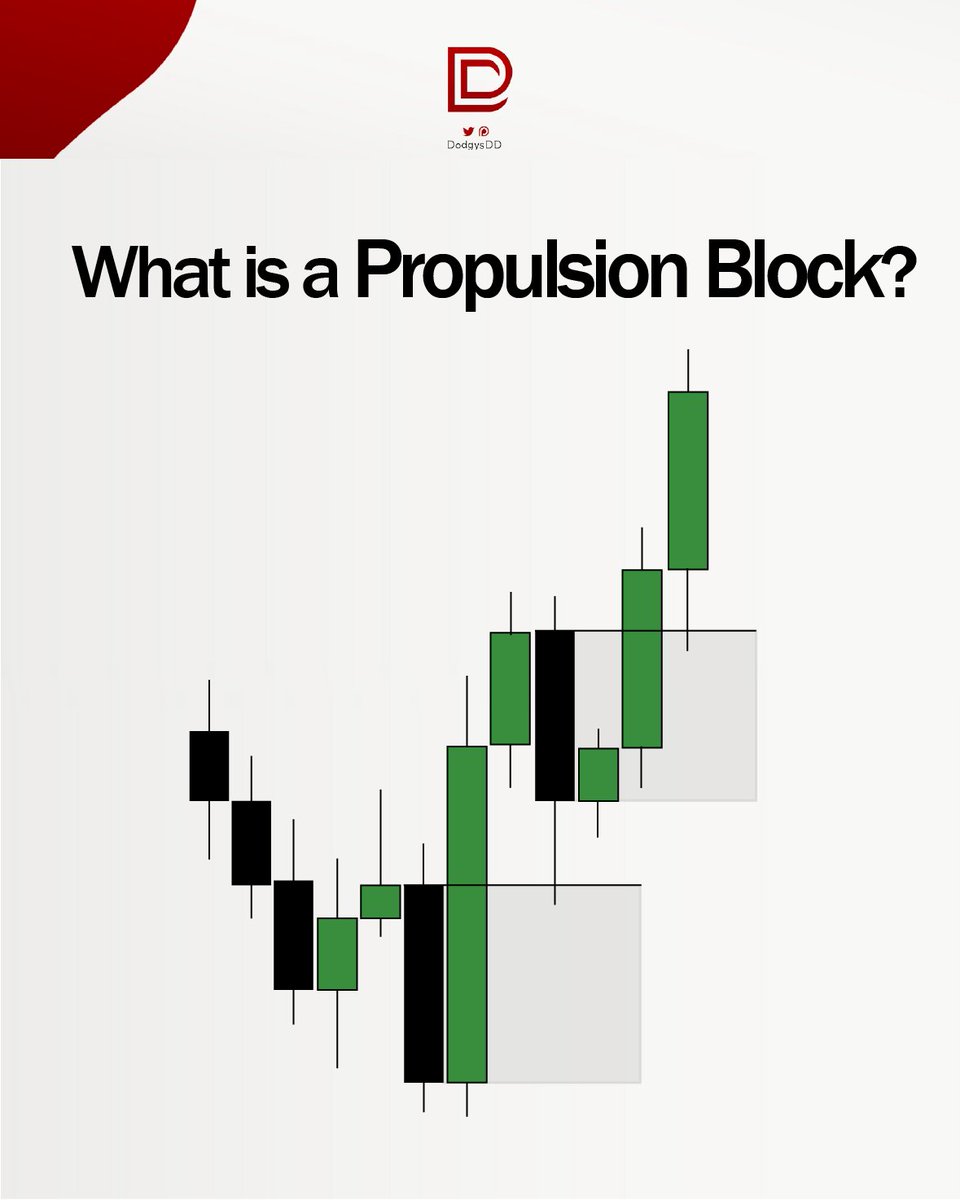

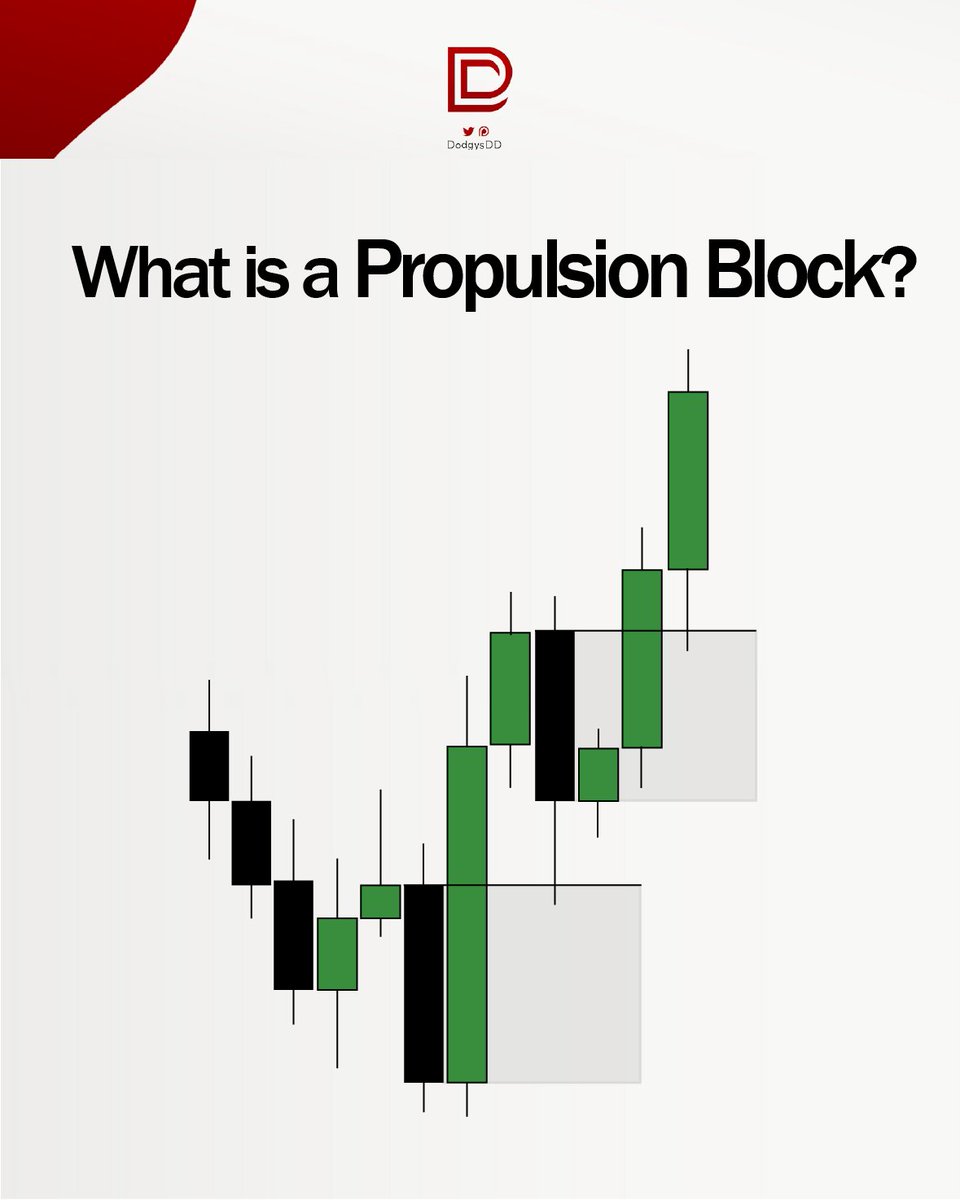

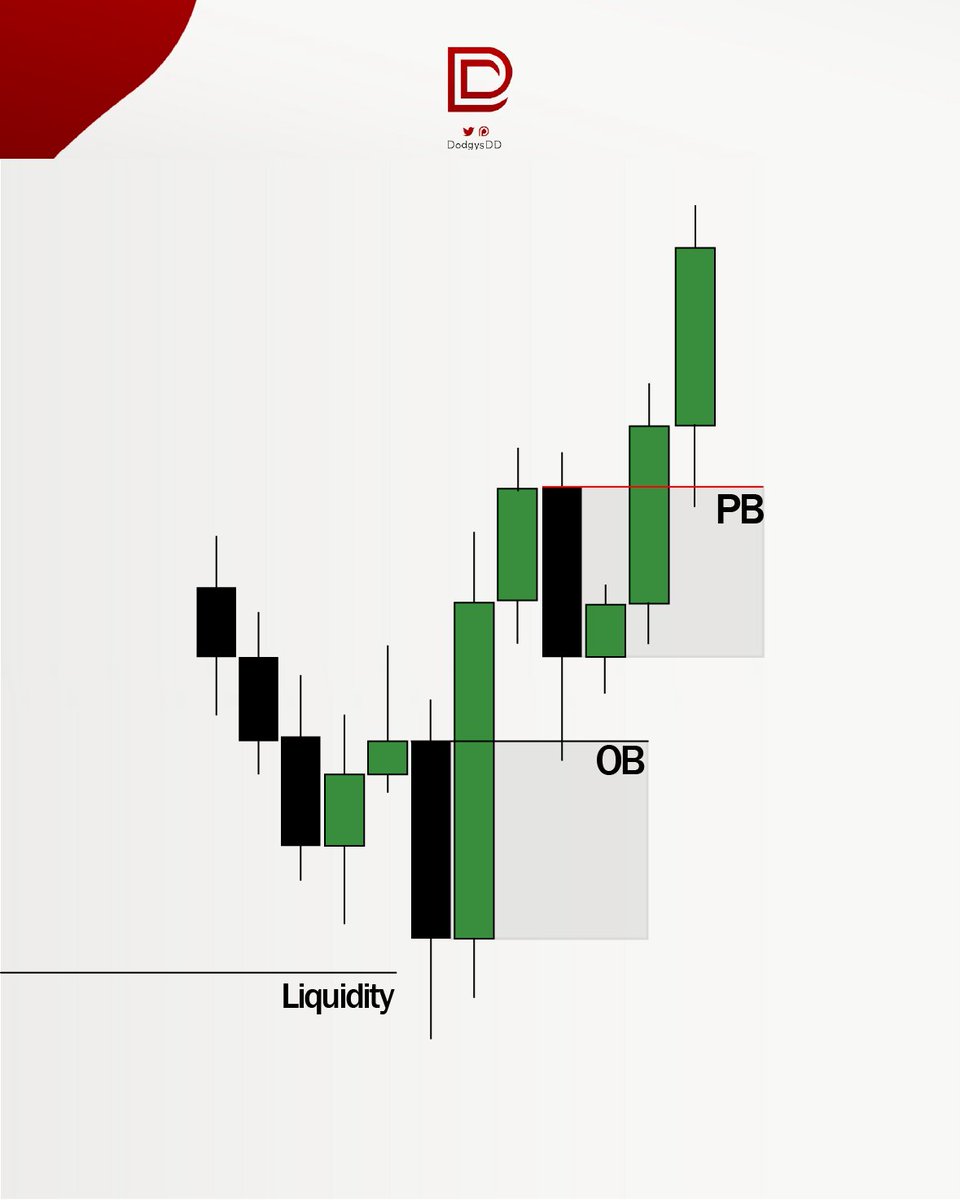

A Propulsion Block is a secondary Orderblock that forms immediately after price reacts to a prior OB

A Propulsion Block is a secondary Orderblock that forms immediately after price reacts to a prior OB

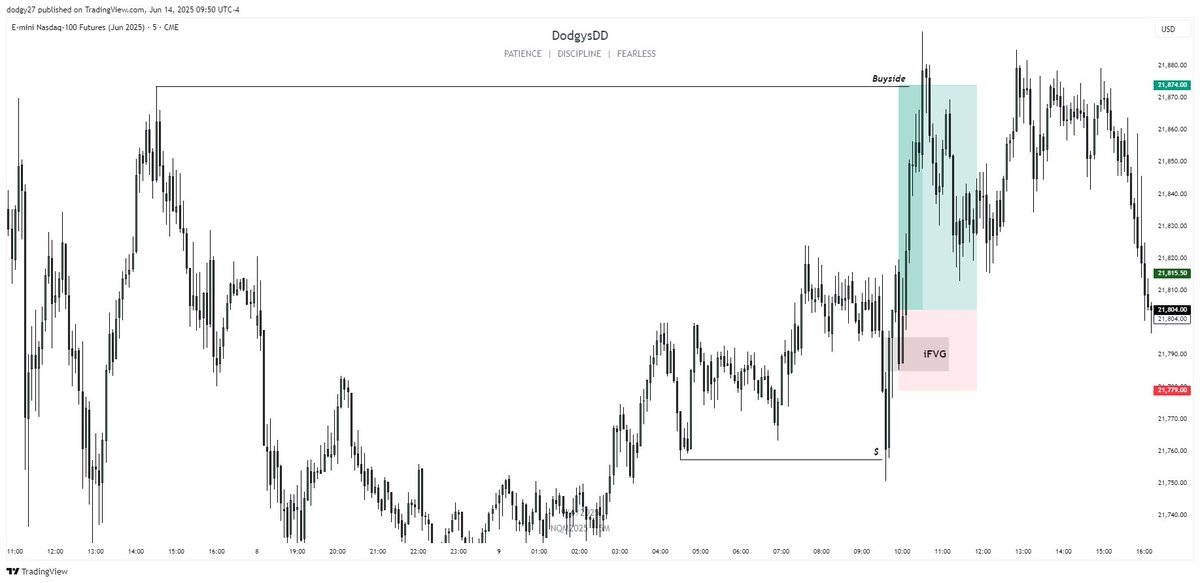

A Fair Value Gap, or imbalance is a three candle pattern that acts as support or resistance in the markets.

A Fair Value Gap, or imbalance is a three candle pattern that acts as support or resistance in the markets.

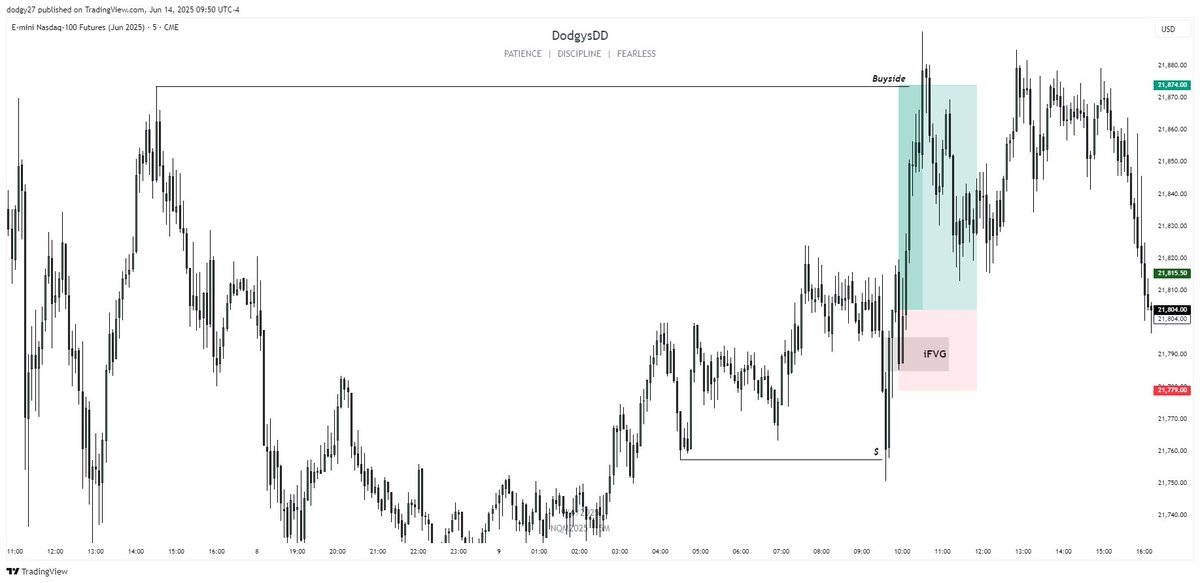

The way I trade is extremely unique. The reason this model works so well is because of how the breakeven works

The way I trade is extremely unique. The reason this model works so well is because of how the breakeven works