To validate exactly what I had said about the difficulty of determining the "unlock" - imagine my surprise when I woke up to see $ASTS up 5-10%. I was already prepared to be "pissed" at the stock being up 25-30% because I thought the stock deserved to be a lot more

Successful launch should have been routine, but for a stock where so much sentiment is tied up in BW-3, anything that deviated from plan would have been taken out of context (never mind that $ASTS accrued all the IP and learning value from getting BW-3 through testing)

In reality, the probability of a successful launch was ~100%, so there was not that much risk into launch, as dramatic as a launch is. I know I was a nervous wreck. Anyone who didn't have the finale of Koyaanisqatsi somewhere in their mind is lying en.wikipedia.org/wiki/Koyaanisq…

I personally think Efficient Market Hypothesis is a load of sh~t, but here we are. The market apparently priced launch correctly

So we continue to search for the elusive 'unlock' for $ASTS, which is the reason to own the stock now instead of waiting until everything is obvious. I wonder whether we get a Biotech-type move ever, or if it's a slow steady ascent

https://twitter.com/thekookreport/status/1534697612204421121?s=20&t=b_0_UtF0pjJuKea7R57q1A

I believe popular opinion is that the unfurling will be a major unlock. Let's unpack that idea (lol - what a great pun!)

https://twitter.com/i/status/1547580841651449856

First things first, it's clear that the $ASTS team measures twice and cut once. I'm not concerned at all about unfurling because I invested behind a team, not behind a piece of metal. #MeetTheTeam is exceptional and this is like watching the birth of a Qualcomm

When it comes to stocks, I believe you have to identify 'the obvious' and then move at least one click earlier. It's about the inflection of the 2nd derivative. If unfurling is the inflecting 2nd derivative, then you have to buy now in order to capture the big re-value

However, $ASTS stock might not work until we have actual monetization and/or demonstrate Bluebirds can be manufactured at scale. It could easily be the case that efficient market theory tells us "yeah dummy, the tech obviously works"...but the market doubts something else

So why own $ASTS now? You don't have to...but, re-valuation events occur suddenly and unexpectedly earlier than you think. Most return is compressed into short times. Are you sure you know when the unlock is? Are you sure you understand the game theory of how others will act?

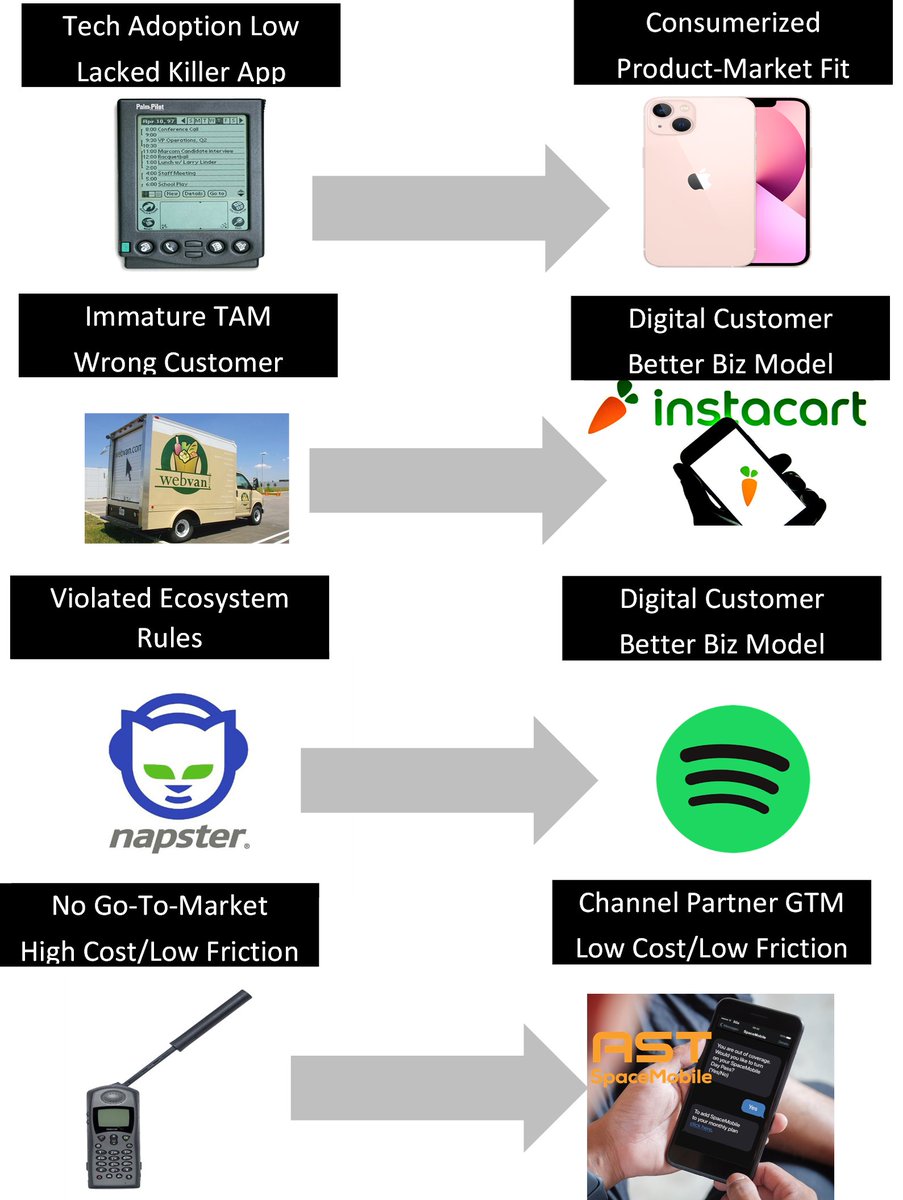

What I "worry about," especially after $TMUS / SpaceX / $AAPL / $GSAT is a sudden change in Wall Street understanding about the trend. $TSLA was left for dead forever because Wall Street doubted the TAM or customer preferences

Imagine an initiation by $MS that shows the unbelievable TAM and early market lead by $ASTS? Then imagine how stupid you'd feel if you had been trying to time things perfectly. Imagine Ron Baron pitches $ASTS at Ira Sohn...duh, what an obvious stock!

Ask yourself, would you really establish your position on a +30% break? Would you hesitate and pray for a pull back? Would it come? Returns streams can be compressed and unpredictable. Be careful not to outsmart yourself

• • •

Missing some Tweet in this thread? You can try to

force a refresh