Dear #Spacemob, this is the $ASTS bear case. The benefit of this is that now, in theory a lot of funds will look into the stock. Knee-jerks will pass. More eyes and more money engaged in a battle ground stock gives investors their day in court. Ignored no more.

https://twitter.com/KerrisdaleCap/status/1570438634272169985

As we start this evaluation of their piece, let's first start with a character assault. I mean, we have to soften up the witness on the stand, right? Sahm Adrangi would not get NASA clearance to launch anything, ever. But I digress...

cnbc.com/2016/08/15/hed…

cnbc.com/2016/08/15/hed…

The first part of their thesis is that the satellite are destined to fail because of management's "uninspiring" backgrounds. An immigrant from an oppressive socialist wasteland moves to the U.S. and becomes a self-made rich person...uninspiring???

https://twitter.com/thekookreport/status/1435640787564253184?s=20&t=Nq_5wWTGpXplAFvSaZGuiw

The next point is the delays: the time line WAS a concern for those who were not following the stock closely; $ASTS had to redesign the satellite last year after testing. They crossed every "t" and dotted every "i" to make sure the satellite would work. And it's up in orbit now

Kerrisdale spoke to 'experts' who were 'terrified' of BW-3's size. A BBC (Big BlueBird Constellation) can be scary when someone drops their "farings" for the first time, but size can be good. Did their "experts" have NDAs to get real data? He did:

Maybe ask a board member who is also the Chief Technology Officer of American Tower $AMT. Aside from knowing a lot about RF technology, this guy can also pass a drug test

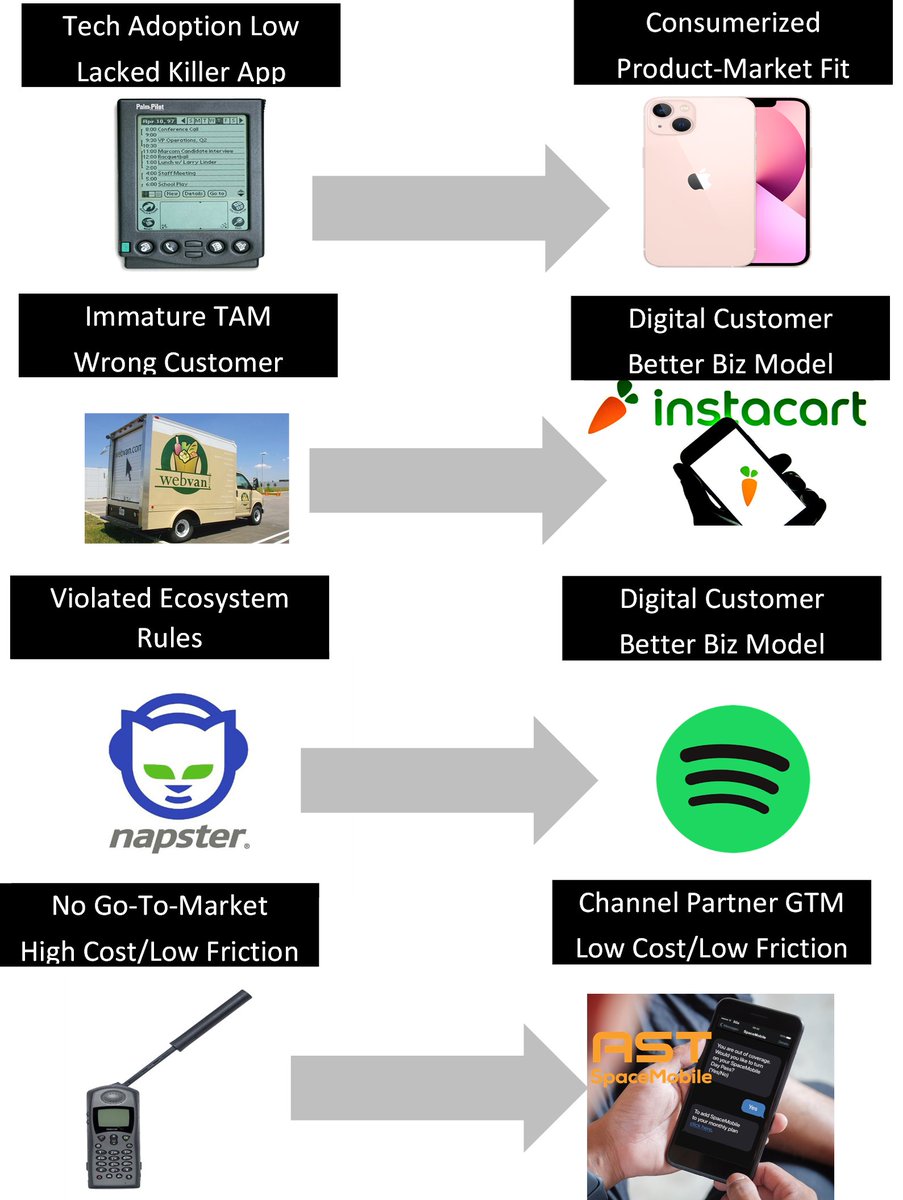

The next issue is business model. I knew people could doubt the TAM, but this market has rapidly evolved in $ASTS's favor. $TMUS and $AAPL blowing the lids off proved this point

https://twitter.com/thekookreport/status/1569775057916018689?s=20&t=0Qlu-h27Y2uFGzNoTeNfKw

On the issue of reliable service, I'd again point people to what $ASTS's partners say. AT&T is a conservative company. Kerrisdale is run by a coke head. You choose. But I'm just being objective here.

https://twitter.com/thekookreport/status/1569775105584304129?s=20&t=Nq_5wWTGpXplAFvSaZGuiw

On the issue of costs, I have confirmed that $ASTS does NOT underwrite Starship. Everything is based on Falcon 9; Starship is upside. They are vertically-integrating production, at scale, and have world-class vendors. Maybe costs go up, but the economics should be very fat

He points out that SpaceX and Apple pose a treat. True, kinda. @spacanpanman made a nice table. Apple had to rely on bankrupt $GSAT. SpaceX is legit, but a bit tied up on how it can partner correctly. See my analysis on this issue

https://twitter.com/thekookreport/status/1569775076614217728?s=20&t=Nq_5wWTGpXplAFvSaZGuiw

Why does Starlink have a dilemma? Telco's are not going to hand over their subs, or give Starlink a chance at stealing their subs. Telco's have and will partner with a carrier-neutral provider. That company is $ASTS

They then attack the MOUs. I mean, ok. Kerrisdale knows how this works and is just trying to insinuate something that is not there. The intent is there. The market is there.

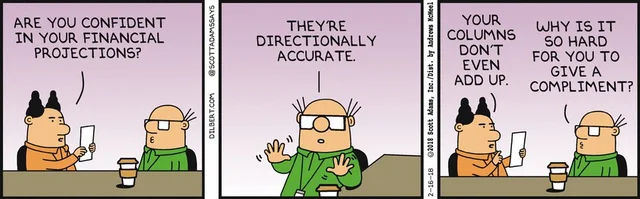

Kerrisdale's point on the original SPAC projections are fair. However, are those projections directionally correct is the real question.

Regarding the timing, the BlueBirds will start launching in late 2023 and the Company has been very aggressive at getting its production facilities up, hiring, and expanding its footprint

I've also previously touched on the funding. Here is a recent thread on that issue

https://twitter.com/thekookreport/status/1569420138084179968?s=20&t=Nq_5wWTGpXplAFvSaZGuiw

This is an interesting piece of their research. So...it works? The power issue is part and parcel with size. It's huge and has a lot of room for solar on the back of the array

Some boogey men sound scary, and could well be true. However, I've bet on the team here and not on the opinion of someone who has a good title but has not been under the hood and for all I know has hid behind a government salary because they can't think big

Not to be too coy, but perhaps asking someone from a bankrupt satellite company about a non-bankrupt satellite company...when that person was not been involved, nor had access to, the underlying data could leave you with a partial picture?

Only because I had asked this when originally speaking to management, I bring this up. Kerrisdale went on Wikipedia and saw Gallium Arsenide used to be core for satellite power arrays, but neither Starlink or $ASTS use it. Oops. Gotcha! They found cheaper substitutes

This is actually one of the most interesting aspects. Market-access is a huge issue. This is where satellite companies used to fail: they didn't know their customer. $ASTS has this nailed down very well. The Telco's will acquire the customers for them

Now we have a two-sided debate in the market. If all goes well, $ASTS becomes a battle ground stock and funds engage. Unfortunately, Kerrisdale is just a smash & grab shorter, so they will just cover today and move on. Shame that they won't remain short

“He that sells what isn’t his’n, must buy it back or go to prison.”

I guess the Kerrisdale founder has “been there, done that.”

I guess the Kerrisdale founder has “been there, done that.”

Looking at Kerrisdale's other shorts - some are obvious, but I see they have had huge misses because they did not understand strategic value. Take Straight Path ($STRP) which was strategically crucial for 5G mobile. They missed a fundamental shift in what industry was doing

Last detail. Where a short thesis is underpinned by the idea that management is deceptive, it's useful to remember that the CEO:

- Takes $0 of salary

- Owns 78MM shares

- Has not sold a share

He's aligned with shareholders.

The picture below is of 'aligned satellites'!

- Takes $0 of salary

- Owns 78MM shares

- Has not sold a share

He's aligned with shareholders.

The picture below is of 'aligned satellites'!

• • •

Missing some Tweet in this thread? You can try to

force a refresh