"It always seems impossible until it is done." I wanted to share some experience as it relates to technical story stocks. I've been drawn to them in my career. Anyone who follows me knows that for the last 2 years, I've been really focused on $ASTS

These stocks fall to the event-driven crowd, at least at first. They are not yet mature enough or have large enough market caps for long-only's. These become the fodder for idea dinners and analysts relentlessly pitch each other their book until something happens.

However, in the lead-up, analysts do a lot of expert calls and DD. We saw @KerrisdaleCap do the same. Standard operating procedure. They generally use the same expert networks I use. Companies go recruit "experts" on my behalf and you pay $1k/hr to talk to them. It's useful

What's the result? Snippets like this. Read the comment at face value and you are scared. But step back - what's actually happening here? The expert is identifying an engineering challenge. All the points Kerrisdale identified represent engineering questions and challenges.

Let's step back a bit more. Originally, NASA and everyone said that landing a rocket defied the laws of physics. Lines blur between perceived statements of impossibility vs. identifying hard engineering challenges

Experts are great at identifying the engineering questions and challenges. Entrepreneurs found companies to solve those challenges. Big difference that expert miss, but a natural byproduct of those who do, and those who consult

For example, here's what government experts say:

"Flight by machines heavier than air is impractical and insignificant, if not utterly impossible,” Director of the US Naval Observatory, Simon Newcomb, 1902

Here's a fun historical list of others

news.com.au/technology/inn…

"Flight by machines heavier than air is impractical and insignificant, if not utterly impossible,” Director of the US Naval Observatory, Simon Newcomb, 1902

Here's a fun historical list of others

news.com.au/technology/inn…

Experts put forth their personal opinion based on what they know and what is industry art at the time. They often CORRECTLY identify the questions and the challenges of doing something.

That exercise is often presented to investors as CONCLUSIONS. Socrates had it right.

That exercise is often presented to investors as CONCLUSIONS. Socrates had it right.

Let's look at @KerrisdaleCap's work on Straight Path, which is one of the most bizarre M&A bidding wars I had seen. Their report is totally logical. They asked lots of experts about the spectrum and drew conclusions based on what outsiders could know

kerrisdalecap.com/wp-content/upl…

kerrisdalecap.com/wp-content/upl…

Kerrisdale could not know what legions of engineers at $V and $T were working on. How could they? There were countless engineers and billions of dollars doing something AHEAD of the curve. Note it's hard to look "inside" on what AT&T is doing...for a reason. Stock went insane

This brings us back to the hard engineering questions that experts are good at identifying, but for which we commonly confuse as dispositive of answers. So how do they solve those questions? It takes capital & teams.

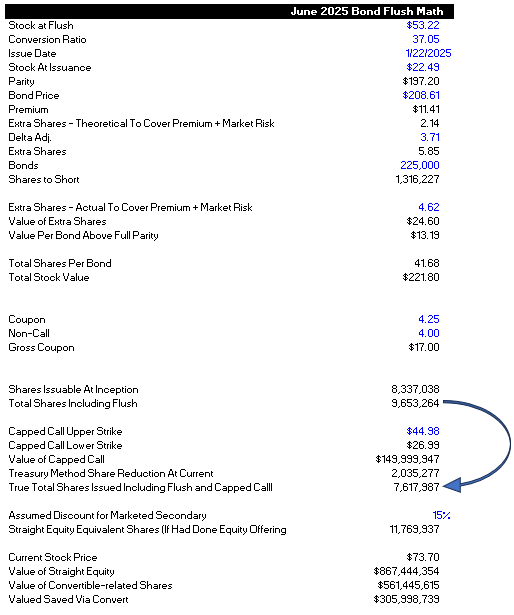

Going back to $ASTS as the subject, Kerrisdale identified a lot of the right engineering challenges. Among other issues, how to meet the link budget, how to unfurl, how to power, how to be thermally stable, etc. $ASTS had to answer these questions and started a Company to do so

So what did they do? They raised a total of around $600MM and hired ~400 engineers as well as subject matter expertise from consultants. This isn't easily replicated. That's why Telco's are coming to them as a carrier-neutral partner

What's the result of those resources? We have a satellite launched into orbit that by all accounts appears to work (early days) and has very important milestones ahead of it. With the resources and talent that is behind that satellite, perhaps the questions have been answered?

Let me leave on one note. Kerrisdale seems like a total jerk. Trolling $ASTS investors with the red A is really telling about the his lack of respect for the little guy trying to invest for their own personal goals. #SpaceMob might be wrong in the end, but we are informed

We know their process by this one screw up in their research. I had been told the exact same issue. The difference is I asked the company about it. So we know Kerrisdale is using what I call a “false specificity” attack to try to overwhelm the audience into submission

https://twitter.com/thekookreport/status/1570465614506127367

• • •

Missing some Tweet in this thread? You can try to

force a refresh