Strap in - The New York Times just published a report on Congress trading stocks and the findings are incredible!

- 97 Congress Members flagged

- 3,700 trades with a potential conflict of interest

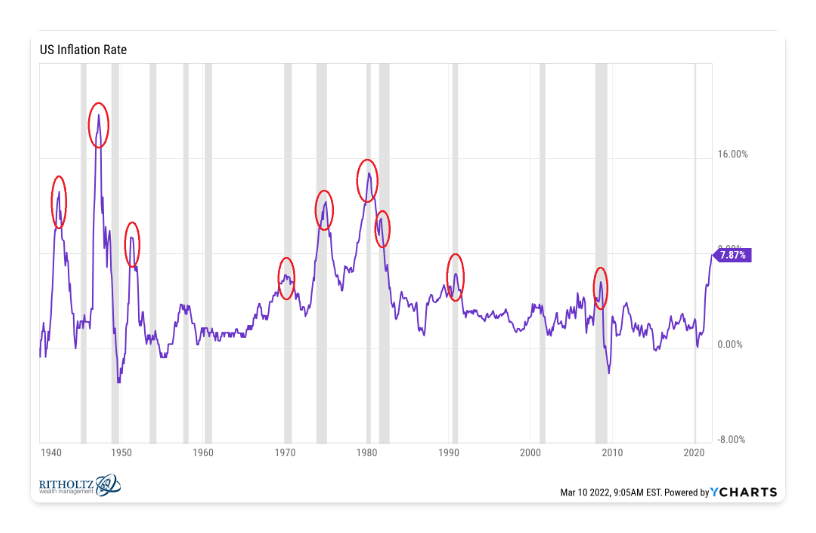

- Stock plays with staggering accuracy

It's a big club, and we ain't in it 🧵

- 97 Congress Members flagged

- 3,700 trades with a potential conflict of interest

- Stock plays with staggering accuracy

It's a big club, and we ain't in it 🧵

They found that 44 of the 50 members of Congress who were most active in the markets traded securities in companies over which *their committee assignments could give them some degree of knowledge or influence.*

The analysis also shows that 13 lawmakers (or immediate family members) had traded shares of companies that were under investigation by their committees between 2019 and 2021.

Let that sink in for a minute - They were trading stocks of companies they were supposed to monitor!

Let that sink in for a minute - They were trading stocks of companies they were supposed to monitor!

Here are some examples of incredible trades made by some of them 👇!

Alan Lowenthal, Rep from California, sold Boeing shares on March 5, 2020 — one day before a House committee on which he sits released damaging findings on the company’s handling of its 737 Max jet

Alan Lowenthal, Rep from California, sold Boeing shares on March 5, 2020 — one day before a House committee on which he sits released damaging findings on the company’s handling of its 737 Max jet

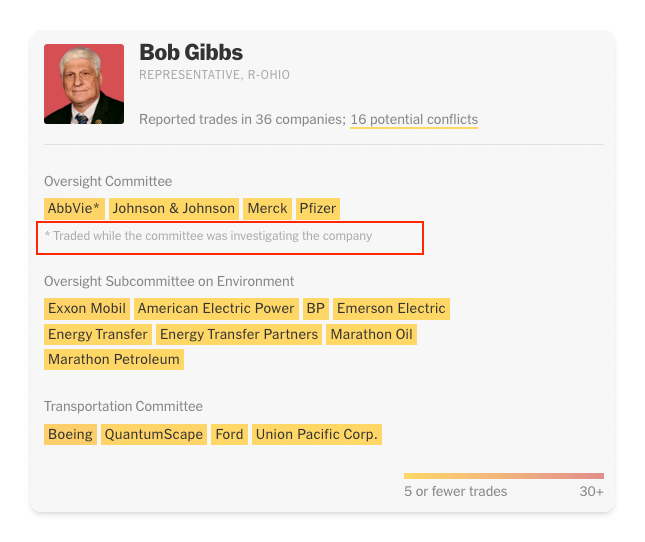

Bob Gibbs, Rep from Ohio working on the House Oversight Committee, reported buying shares of the pharmaceutical company AbbVie in 2020 and 2021, while the committee was investigating AbbVie and five rivals over high drug prices.

Rep John W. Rose from Tennessee, sold between $100K and $250K worth of Wells Fargo stock in 2019, a few months before the committee issued a sharply critical report on Wells Fargo that coincided with a steep decline in the bank’s share price.

Mr. Tuberville as a member of the Senate health committee traded shares of major pharmaceutical and medical services companies.

He also sold put options on Microsoft less than two weeks before the software company lost a $10 billion contract with the Defense Department.

He also sold put options on Microsoft less than two weeks before the software company lost a $10 billion contract with the Defense Department.

This is just the tip of the iceberg - Do check out the full report from @nytimes

nytimes.com/interactive/20…

nytimes.com/interactive/20…

@nytimes It's not just the New York Times who are following trades by Congress.

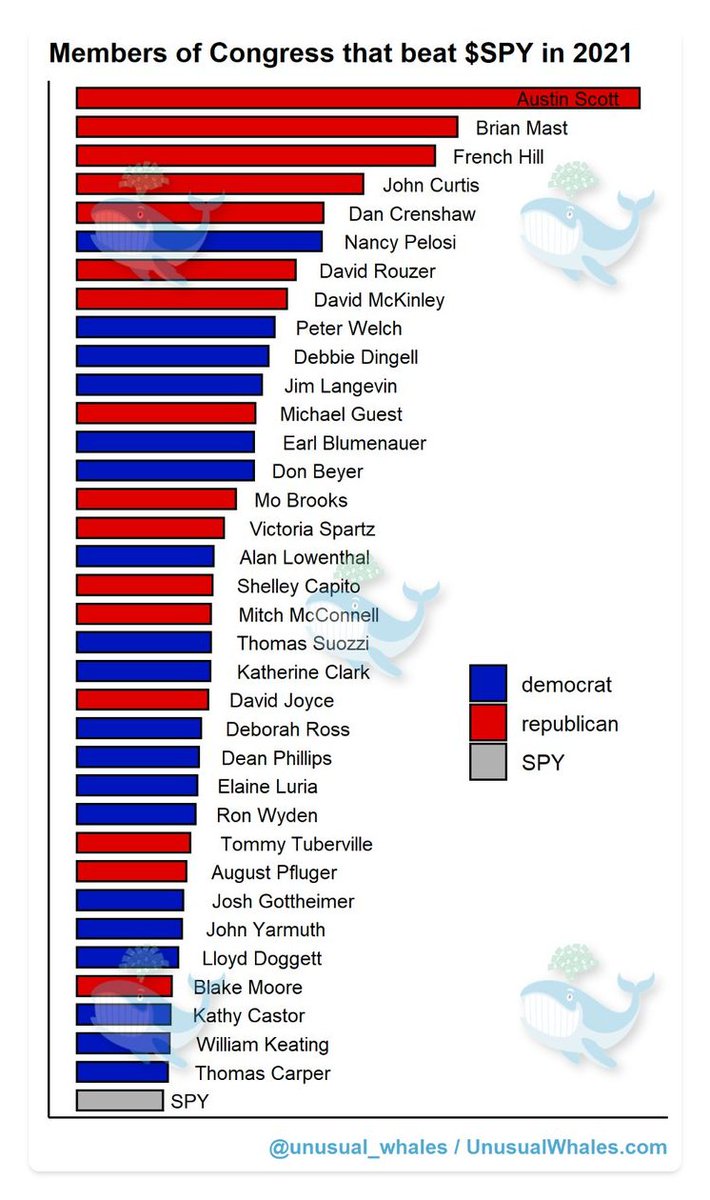

@unusual_whales released a full report where they showed all the members of congress who beat the market in 2021!

unusualwhales.com/i_am_the_senat…

@unusual_whales released a full report where they showed all the members of congress who beat the market in 2021!

unusualwhales.com/i_am_the_senat…

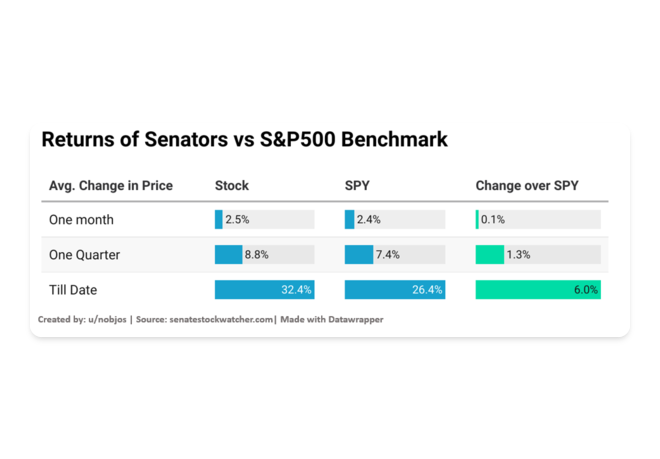

@nytimes @unusual_whales @mkt_sentiment showed that you could beat the market by following trades of Senators

marketsentiment.substack.com/p/2020-congres…

marketsentiment.substack.com/p/2020-congres…

@nytimes @unusual_whales @mkt_sentiment This is not even getting into investors like Nancy Pelosi who have made millions of dollars from the stock market and have dedicated trackers that just track her stock plays.

@PelosiTracker_

@PelosiTracker_

@nytimes @unusual_whales @mkt_sentiment @PelosiTracker_ I left out the party affiliation as this is about more than which side you are on.

It's high time that Congress Members are banned from trading stocks.

I am angry and you should be too! Its time for this to end.

It's high time that Congress Members are banned from trading stocks.

I am angry and you should be too! Its time for this to end.

https://twitter.com/GrahamStephan/status/1571139303534632960

Follow me @GrahamStephan for more interesting breakdowns and insights into the world of personal finance, investing and stock market.

• • •

Missing some Tweet in this thread? You can try to

force a refresh