EXCESS vs. SPIKE

The same, but not the same. A thread on what they are and how I use them.

🧵 #marketprofile

The same, but not the same. A thread on what they are and how I use them.

🧵 #marketprofile

In its constant search for fair value, the market looks for selling exhaustion at the lows (the demand exceeds the supply and sellers are getting filled at higher prices so there’s no more interest to sell at lower prices)...

... and buying exhaustion at the highs (the supply exceeds the demand and buyers are getting filled at lower prices so there’s no more interest to buy at lower prices).

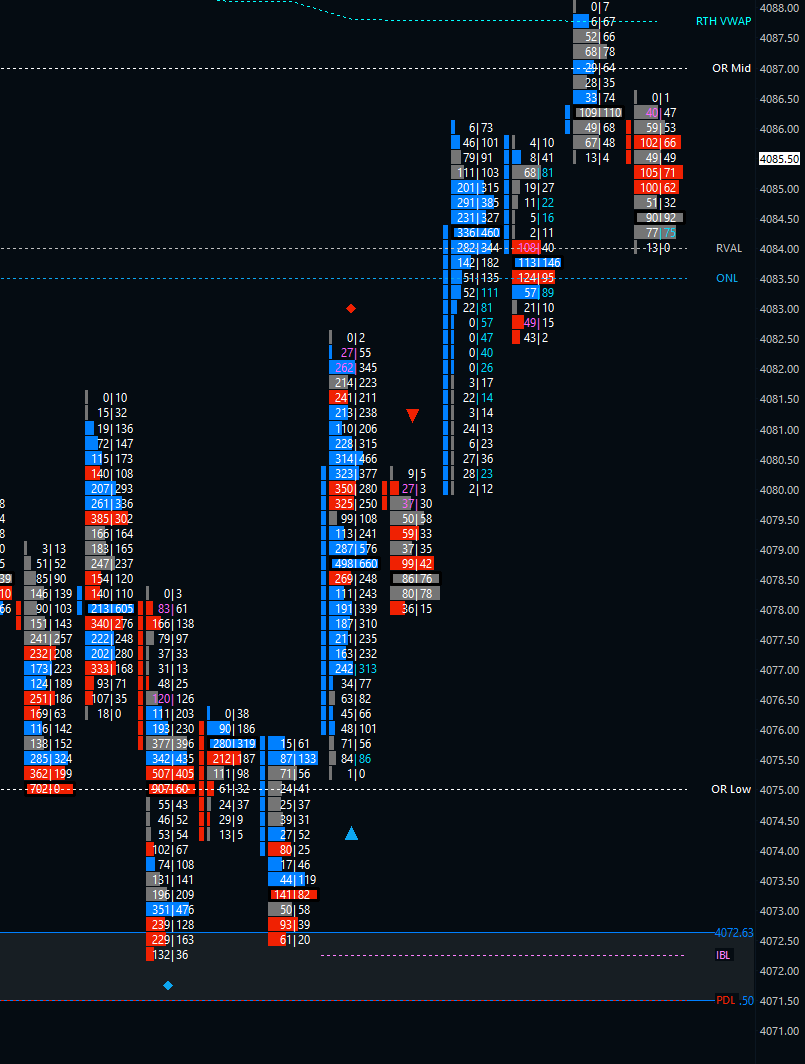

So, based on that principle, we’d like to see what’s called excess at the edges of an auction. In this example, we’ve got a nice excess both at the low and at the high of the session on the TPO profile and a nice tapering on the volume profile.

Now we also see the same profile but extended. These are basically 30min candles. We see that we had a breakout from the previous resistance, saw selling exhaustion at the top, buyers were unable to break out of value again and the session ended up closing right below the VPOC.

In this session we also have what looks like an excess but if we look at how the session developed, we can see that this “excess” was formed in the last half hour of the session. This is called a “spike”. So, what’s the difference between excess and a spike?

There are three components to an auction:

Price, which advertises opportunity.

Time, which regulates all opportunities.

Volume, which measures the success or failure of the advertised opportunities.

Price, which advertises opportunity.

Time, which regulates all opportunities.

Volume, which measures the success or failure of the advertised opportunities.

If we consider price an advertising mechanism, in the first example higher prices were advertised but market participants weren’t convinced that fair value was to be found up there so those prices were rejected later in the session, leaving that excess high.

In the case of the session ending with a spike, those higher prices are advertised close to the end of the session and therefore there’s not really enough time left to find out if those higher prices are really being validated by time and volume.

A validation, or a rejection, of those prices is then left for the following session. And that’s how we can use a spike to gauge the market in relation to the previous session. Using the area of the breakout from that last period as the spike base we can think of it this way:

1) Volume being built (2-way trade) within the spike (or higher): Those higher prices are being accepted.

2) Volume being built around the spike base: Indecision. No side seems to be convinced of where fair value is to be found.

2) Volume being built around the spike base: Indecision. No side seems to be convinced of where fair value is to be found.

3) Volume being built below the spike base: The higher prices have been, at least for the time being, rejected and we can consider that spike an excess.

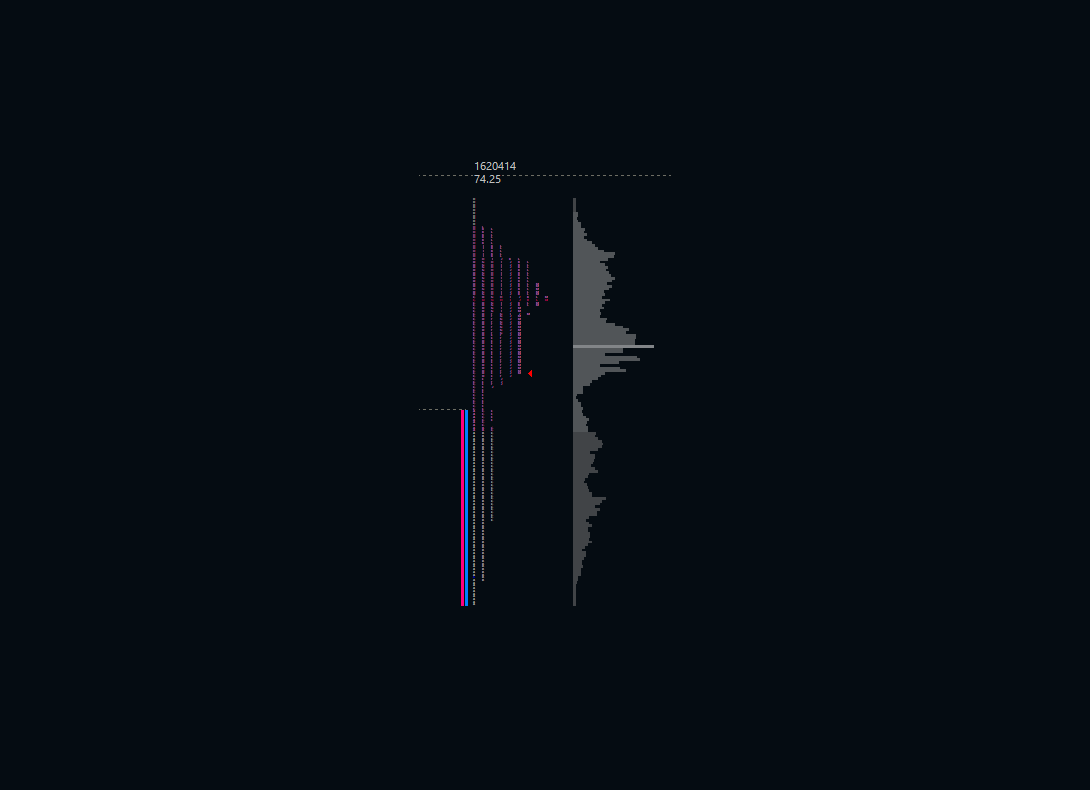

For those curious about what happened to that spike: it got quickly rejected at the beginning of the next session (sad trombone).

To add context: that spike turned out to be a failed breakout from a multiday consolidation.

To add context: that spike turned out to be a failed breakout from a multiday consolidation.

That failed breakout was followed by a large liquidation that took the market not only back inside the range but broke to the downside afterwards.

• • •

Missing some Tweet in this thread? You can try to

force a refresh