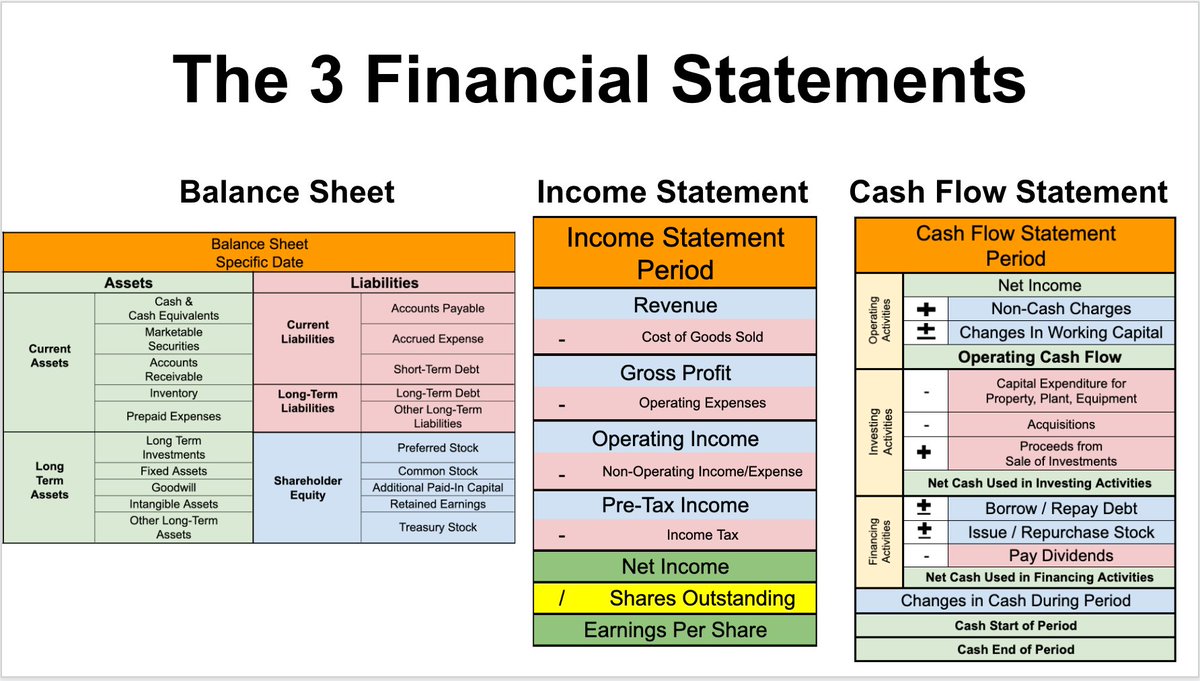

Every company has 3 financial statements.

Each answers a unique question:

1. Balance Sheet: What’s your net worth?

2. Income Statement: Are you profitable?

3. Cash Flow Statement: Are you generating cash?

Each answers a unique question:

1. Balance Sheet: What’s your net worth?

2. Income Statement: Are you profitable?

3. Cash Flow Statement: Are you generating cash?

The financial statements are interrelated.

Each views a company’s financials from a different angle.

When combined, they provide a more complete view of a company’s true financial position.

Each views a company’s financials from a different angle.

When combined, they provide a more complete view of a company’s true financial position.

1B: What I focus on first:

1⃣ Cash & Equivalents: How much?

2⃣ Debt: How much vs. cash?

3⃣ Goodwill: How much?

4⃣ Retained Earnings (+ T.S.): Positive?

5⃣ Receivables & Inventory: How much?

1⃣ Cash & Equivalents: How much?

2⃣ Debt: How much vs. cash?

3⃣ Goodwill: How much?

4⃣ Retained Earnings (+ T.S.): Positive?

5⃣ Receivables & Inventory: How much?

1C: Best Possible Answers

1⃣Cash & Equivalents: More than debt

2⃣Short & Long-Debt: None

3⃣Goodwill: Zero

4⃣Retained Earnings (+ T.S.): Positive

5⃣ Receivables & Inventory: None

1⃣Cash & Equivalents: More than debt

2⃣Short & Long-Debt: None

3⃣Goodwill: Zero

4⃣Retained Earnings (+ T.S.): Positive

5⃣ Receivables & Inventory: None

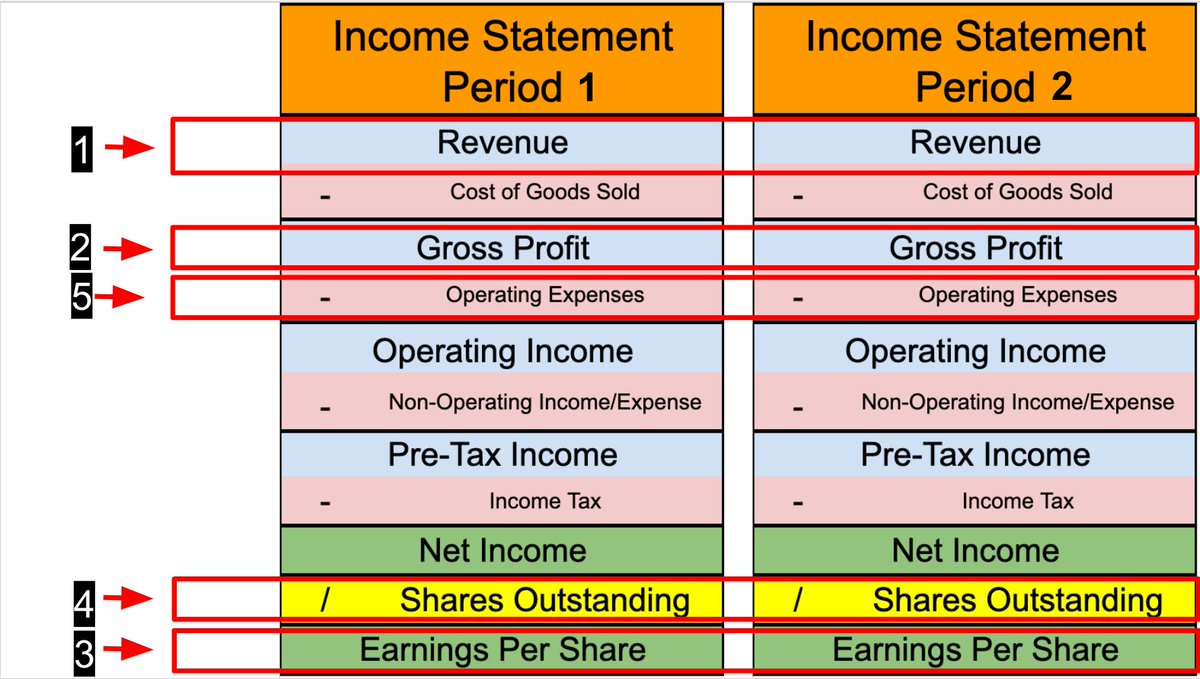

2A: The Income Statement

This tells you if a company is “profitable” or not during a period of time

Layout:

This tells you if a company is “profitable” or not during a period of time

Layout:

2B: I look at 2 income statements with comparable periods.

What I focus on first:

1⃣Revenue: Up or down?

2⃣Gross Profit: Up or down?

3⃣EPS (Diluted): Positive or negative?

4⃣Shares Outstanding: Up or down?

5⃣Operating Expenses: Up or down?

What I focus on first:

1⃣Revenue: Up or down?

2⃣Gross Profit: Up or down?

3⃣EPS (Diluted): Positive or negative?

4⃣Shares Outstanding: Up or down?

5⃣Operating Expenses: Up or down?

2C: Best Possible Answers

1⃣Revenue: Up 30%+

2⃣Gross Profit: Up 30%+

3⃣EPS: Up 30%+

4⃣Shares Outstanding: Down 4%+

5⃣Operating Expenses: Stable

1⃣Revenue: Up 30%+

2⃣Gross Profit: Up 30%+

3⃣EPS: Up 30%+

4⃣Shares Outstanding: Down 4%+

5⃣Operating Expenses: Stable

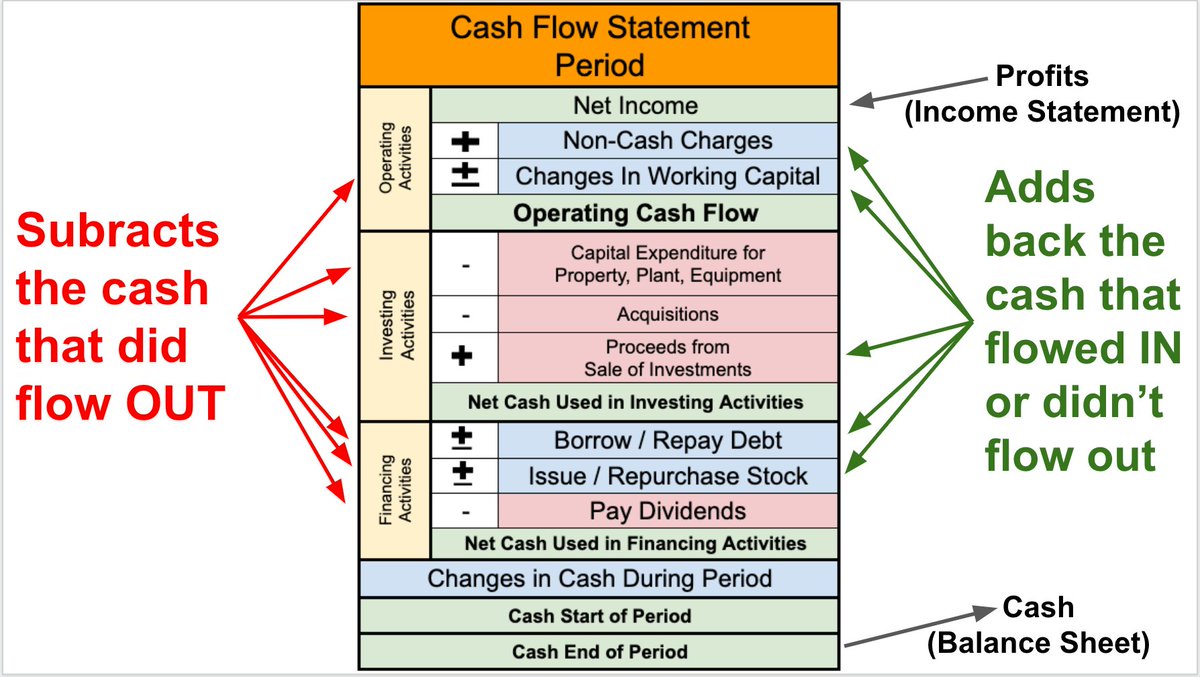

3A: The Cash Flow Statement

This tells you how cash moves in and out of a business over a period of time.

Layout:

This tells you how cash moves in and out of a business over a period of time.

Layout:

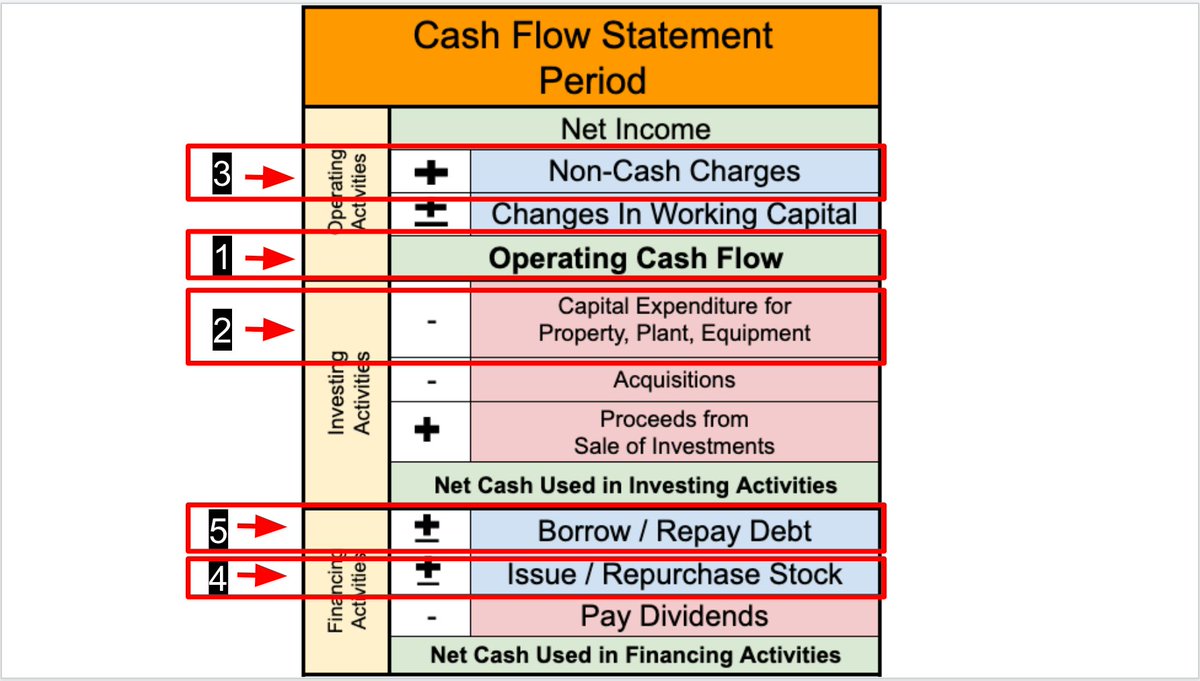

3B: What I focus on first:

1⃣OCF: Positive or negative?

2⃣CapEx: More or less than OCF?

3⃣NCC: Any big numbers? S.B.C.?

4⃣Stock: Issuance or buybacks?

5⃣Debt: Borrow or repay?

1⃣OCF: Positive or negative?

2⃣CapEx: More or less than OCF?

3⃣NCC: Any big numbers? S.B.C.?

4⃣Stock: Issuance or buybacks?

5⃣Debt: Borrow or repay?

3C: Best possible answers

1⃣ OCF: Positive (+ Growing)

2⃣CapEx: Much less than OCF

3⃣NCC: Nothing noteworthy + Low SBC

4⃣Stock: Buybacks ✅

5⃣Debt: Repayment✅

1⃣ OCF: Positive (+ Growing)

2⃣CapEx: Much less than OCF

3⃣NCC: Nothing noteworthy + Low SBC

4⃣Stock: Buybacks ✅

5⃣Debt: Repayment✅

I’d never make an investment decision without MUCH more analysis than this.

Accounting (and investing) is FILLED with nuance

Still, with <1 minute of analysis per financial statement, you can quickly identify a company's strengths + weaknesses

Accounting (and investing) is FILLED with nuance

Still, with <1 minute of analysis per financial statement, you can quickly identify a company's strengths + weaknesses

If you invest, you MUST learn accounting

That's why @Brian_Stoffel_ and I created a course that teaches accounting in plain English

Registration closes TONIGHT (9/18) at 11:59 PM EDT!

Interested? DM me for a special coupon code.

maven.com/brian-feroldi/…

That's why @Brian_Stoffel_ and I created a course that teaches accounting in plain English

Registration closes TONIGHT (9/18) at 11:59 PM EDT!

Interested? DM me for a special coupon code.

maven.com/brian-feroldi/…

Prefer to keep learning for free?

Read this thread I wrote about the cash flow statement next:

Read this thread I wrote about the cash flow statement next:

https://twitter.com/BrianFeroldi/status/1568936832439664641?s=20&t=b_kaBtytTPtc7kMfM7fRUg

• • •

Missing some Tweet in this thread? You can try to

force a refresh