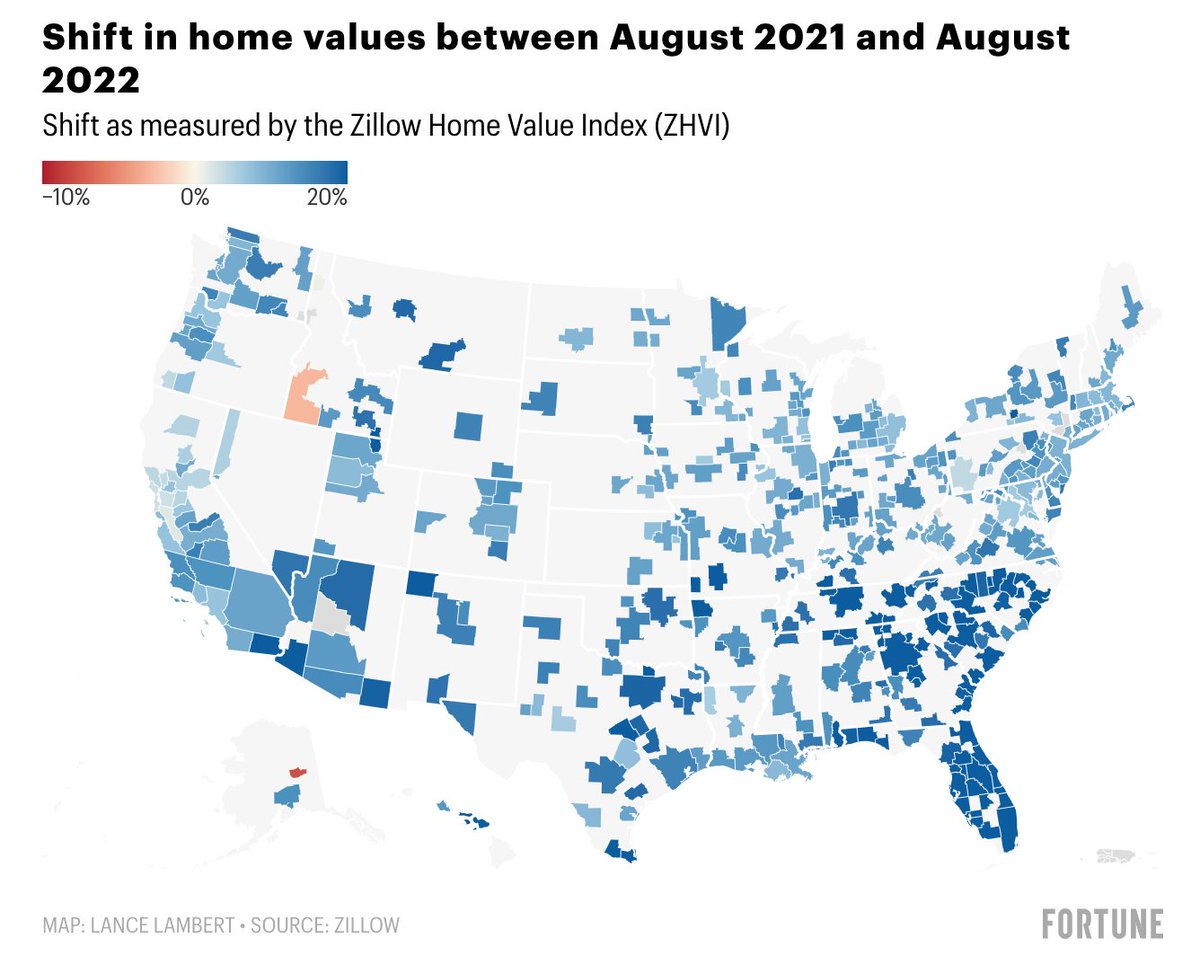

#NEW Boise becomes the first major U.S. housing market to post a negative YoY home price reading.

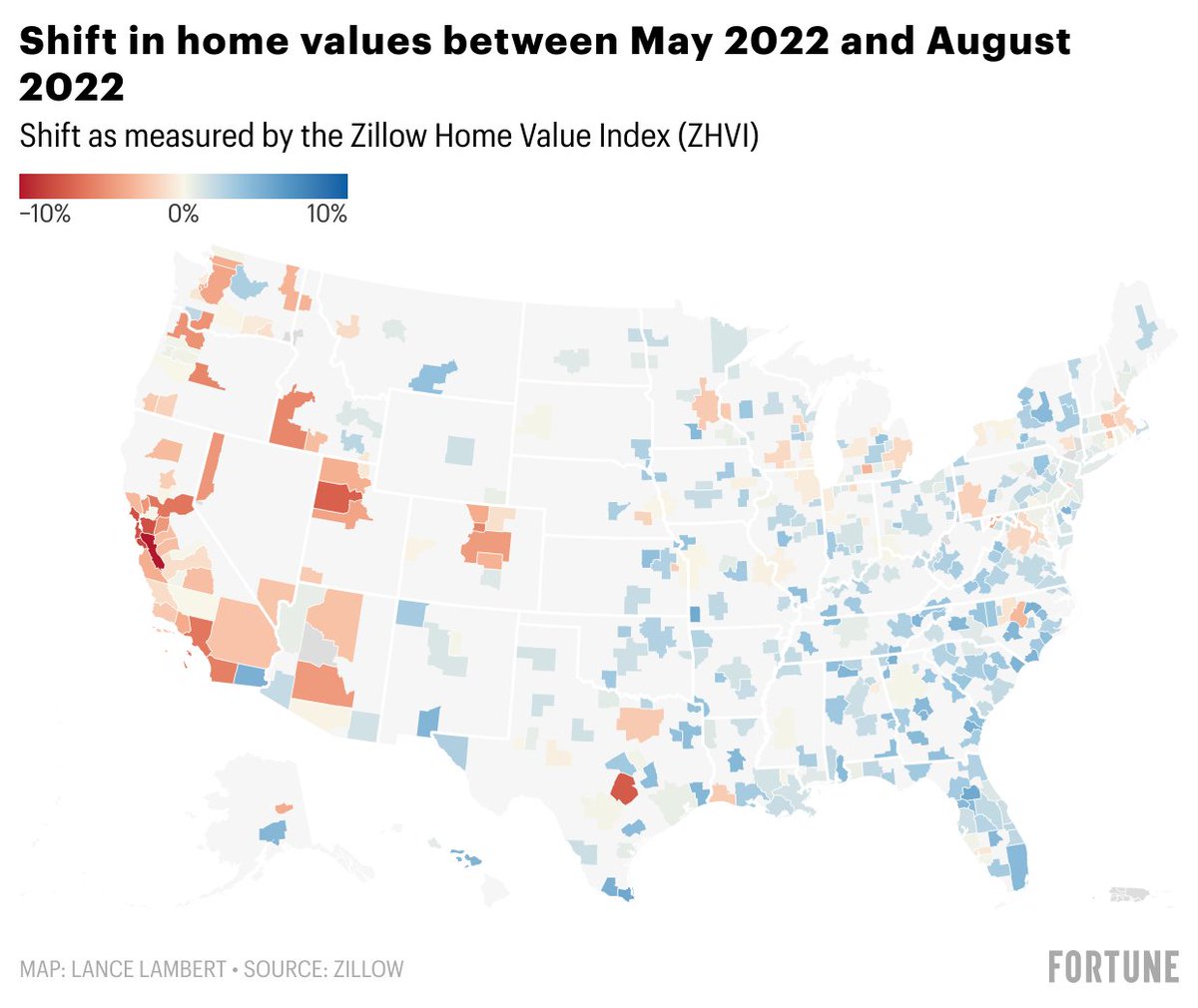

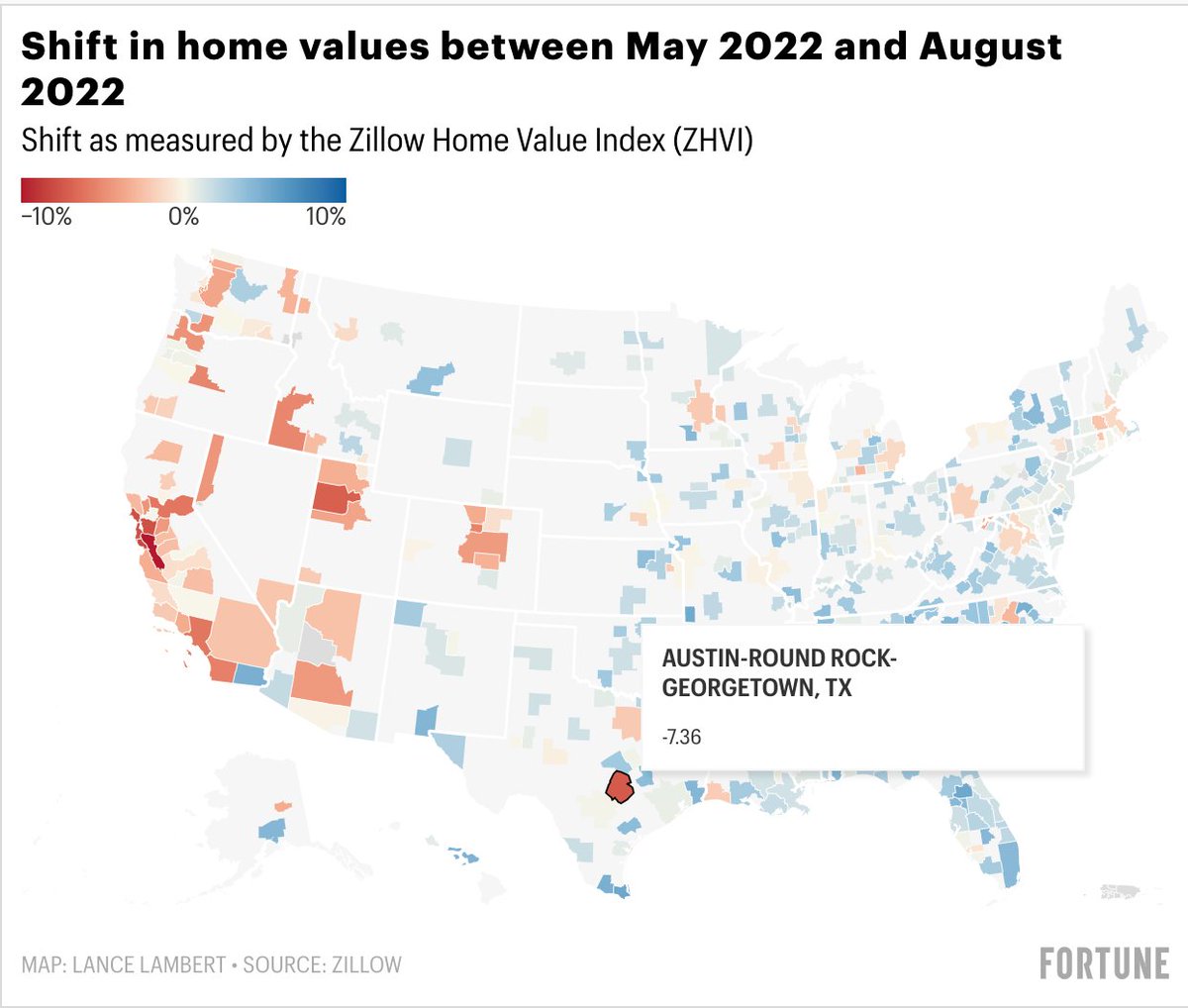

As measured by the Zillow Home Value Index (ZHVI).

Simply put: The housing correction has already wiped out a year of Pandemic Housing Boom gains in Boise.

I view Boise as a housing bust.

https://twitter.com/NewsLambert/status/1565894120173961216?s=20&t=C-eNIyiLJiqr0mSMGNPBEg

Boise—unlike places like Phoenix—was already losing steam heading into 2022. That's one reason it hit its negative YoY so fast.

• • •

Missing some Tweet in this thread? You can try to

force a refresh