@ResidentialClub Co-Founder, Editor-in-Chief. Analyzing the housing market—through a regional lens 🏡 📊 Subscribe to the ResiClub newsletter 👇

4 subscribers

How to get URL link on X (Twitter) App

In April, Zillow banned listings from appearing on its site if they had been marketed privately for more than 24 hrs before hitting the MLS

In April, Zillow banned listings from appearing on its site if they had been marketed privately for more than 24 hrs before hitting the MLS

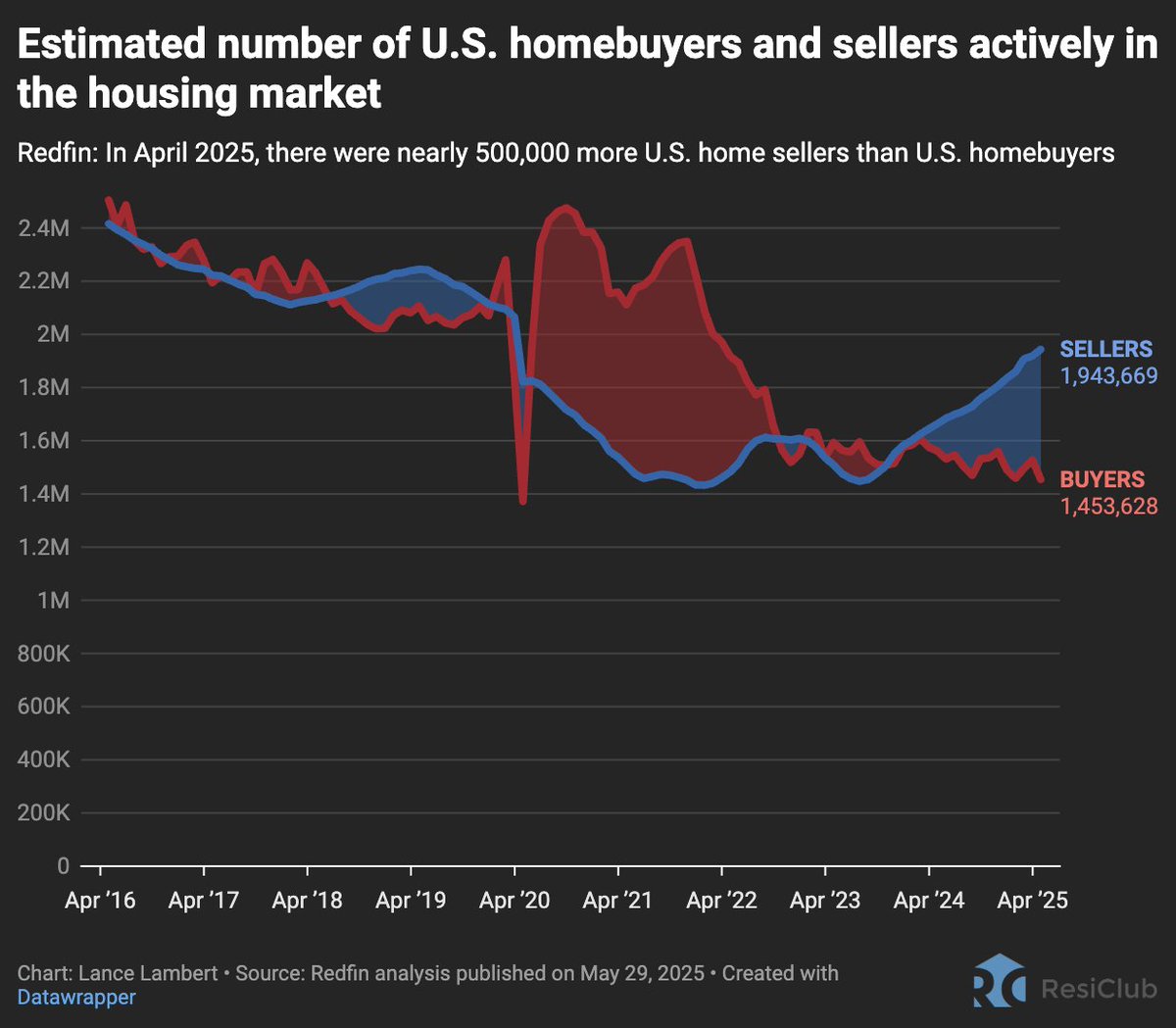

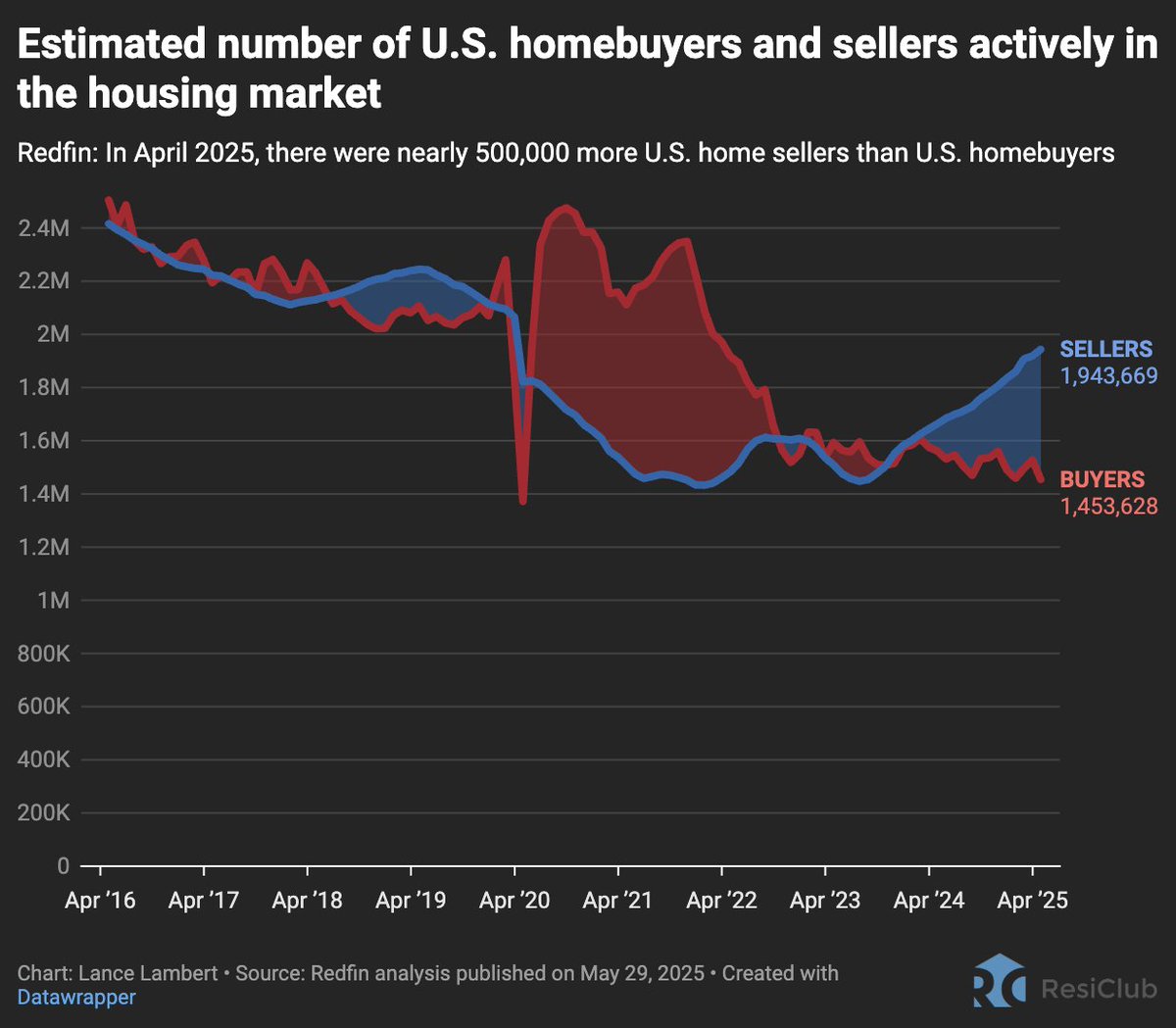

During the Pandemic Housing Boom, housing demand surged rapidly amid ultralow interest rates, stimulus, and the remote work boom—which increased demand for space and unlocked “WFH arbitrage."

During the Pandemic Housing Boom, housing demand surged rapidly amid ultralow interest rates, stimulus, and the remote work boom—which increased demand for space and unlocked “WFH arbitrage."

During the Pandemic Housing Boom, housing demand surged rapidly amid ultralow interest rates, stimulus, and the remote work boom—which increased demand for space and unlocked “WFH arbitrage."

During the Pandemic Housing Boom, housing demand surged rapidly amid ultralow interest rates, stimulus, and the remote work boom—which increased demand for space and unlocked “WFH arbitrage."

https://twitter.com/NewsLambert/status/1887363804541165744

To be clear, the "IFs" in my top tweet don't mean that I think these are possible paths.

To be clear, the "IFs" in my top tweet don't mean that I think these are possible paths. https://x.com/ResidentialClub/status/1851409168894189704With today's 7% stock decline, D.R. Horton's share price is up 10% on the year

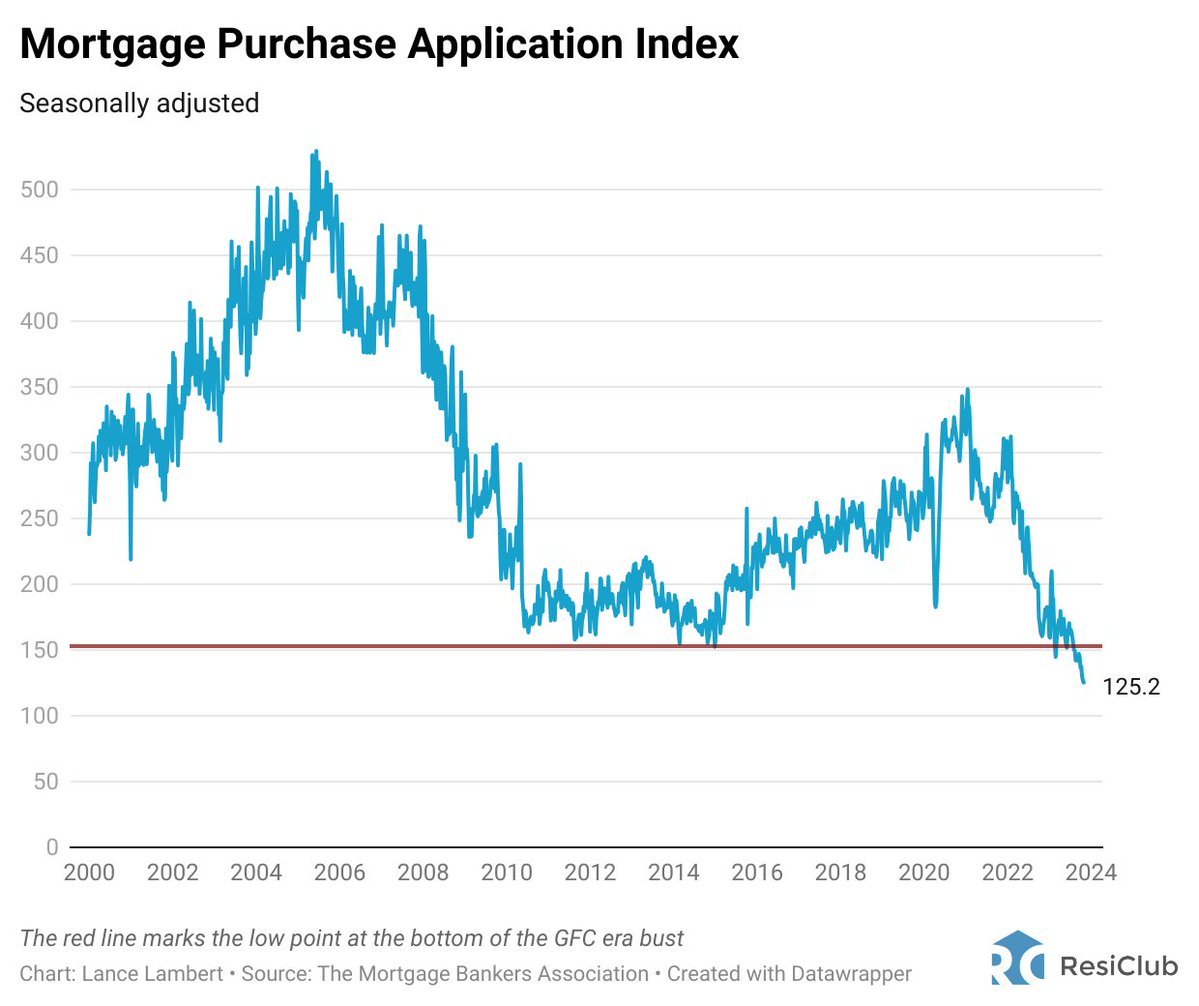

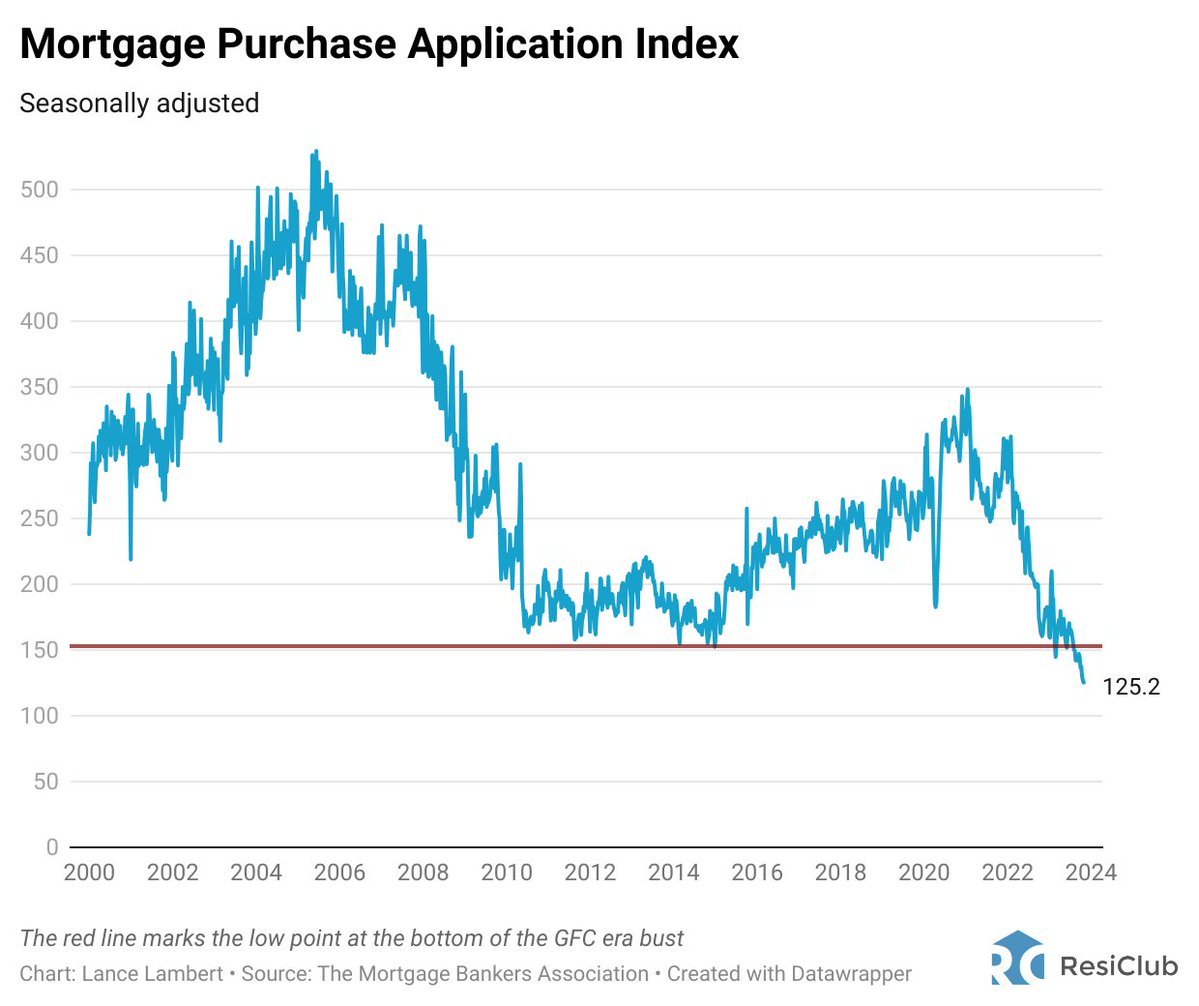

Traditional refi is RIP right now

Traditional refi is RIP right now

When it comes to Fed-induced recessions, employment in residential building construction typically starts declining well before the recession takes hold.

When it comes to Fed-induced recessions, employment in residential building construction typically starts declining well before the recession takes hold. https://x.com/NewsLambert/status/1587809011214213120?s=20

Layoffs (and mergers) are mounting in the mortgage industry.

Layoffs (and mergers) are mounting in the mortgage industry.

According to @ParclLabs, 36.8% of all institutional-owned homes can be found in just 6 markets: Atlanta (where 13.3% of institutional-owned homes can be found), Phoenix (5.4%), Dallas (5.4%), Houston (4.3%), Tampa (4.2%) and Charlotte (4.2%)

According to @ParclLabs, 36.8% of all institutional-owned homes can be found in just 6 markets: Atlanta (where 13.3% of institutional-owned homes can be found), Phoenix (5.4%), Dallas (5.4%), Houston (4.3%), Tampa (4.2%) and Charlotte (4.2%)

Among the 385 major housing markets tracked by Freddie Mac, only 35 markets are still down +3.00% from their pandemic peak.

Among the 385 major housing markets tracked by Freddie Mac, only 35 markets are still down +3.00% from their pandemic peak.

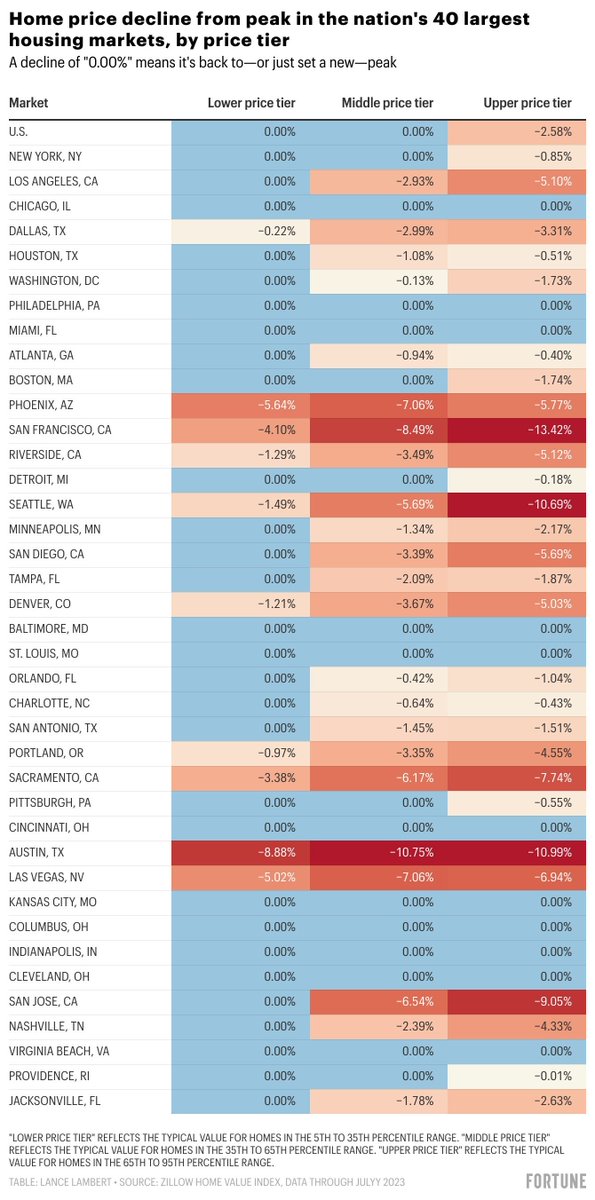

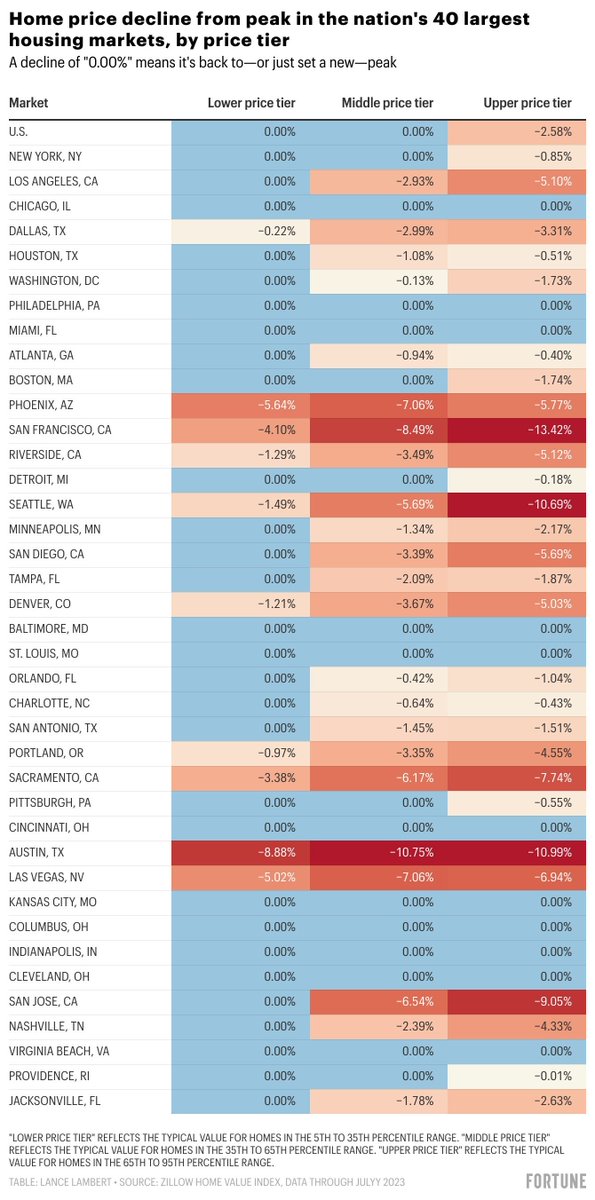

As mortgage rates spike/housing affordability deteriorates, buyers lower their expectations thus keeping the bottom half of the market warmer than the top half.

As mortgage rates spike/housing affordability deteriorates, buyers lower their expectations thus keeping the bottom half of the market warmer than the top half.

Even as the mortgage rate shock was clearly manifesting, Zillow argued in spring 2022 that home price appreciation had a lot of gas left in the tank & wasn't normalizing.

Even as the mortgage rate shock was clearly manifesting, Zillow argued in spring 2022 that home price appreciation had a lot of gas left in the tank & wasn't normalizing.

That said, it's likely that Invitation Homes will be a net buyer again—at least for the third quarter of 2023.

That said, it's likely that Invitation Homes will be a net buyer again—at least for the third quarter of 2023.