1/ With a lot of discussion of the oil price cap many forget to think about what it means for Russia's fiscal accounts. Can Russia 🇷🇺afford to wait it out? The short answer is yes. A thread 🧵

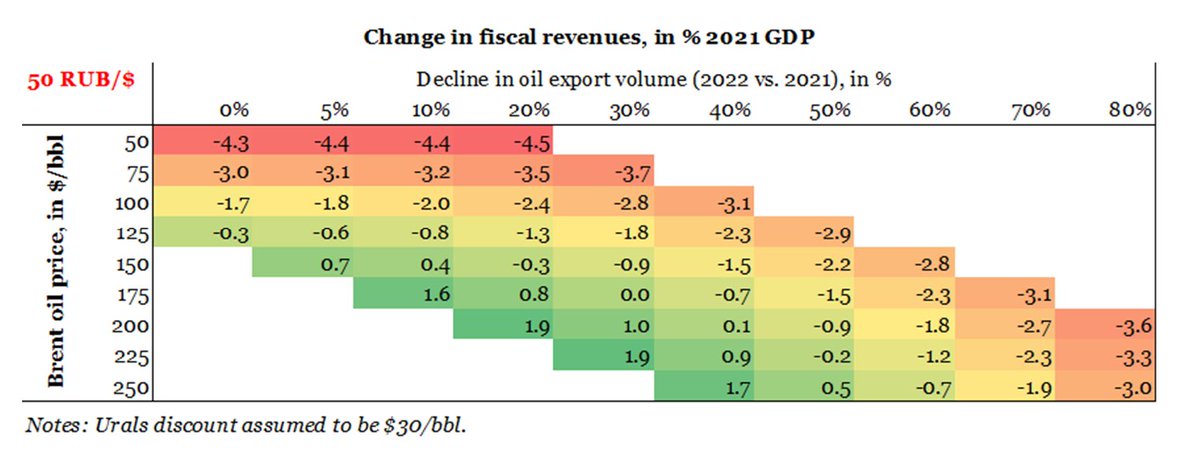

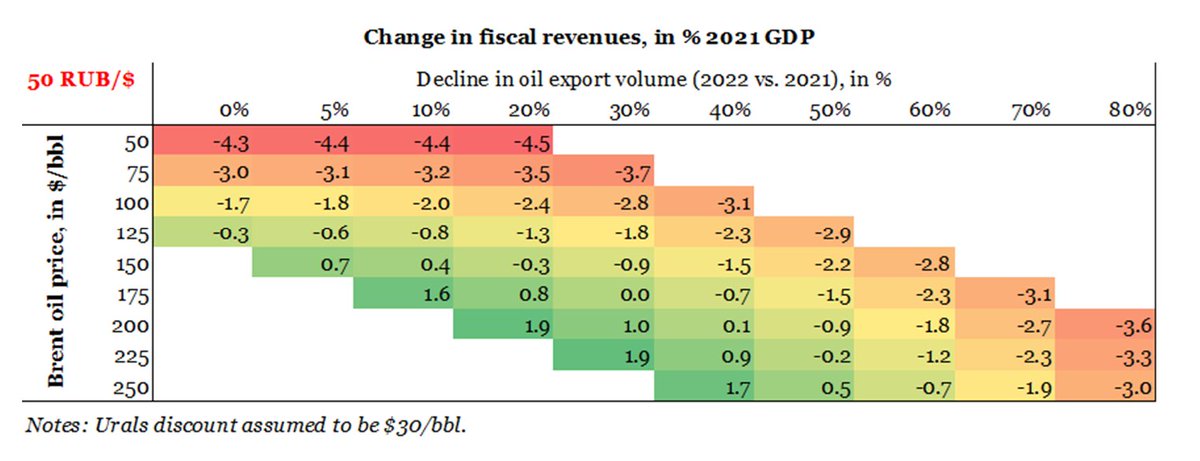

2/ The purpose of the oil price cap is to give an exit valve for Russian oil (to bring more Russian oil to the market, not less) at a lower price, as concern was that the EU oil embargo to come on in early 2023 will be too binding. Here are the scenarios.

3/ With the Ruble that is way too high (the extreme scenario of the Ruble at $50), Russia can reduce oil export volume by 10% and face the oil price of $75, and lose about 3.2% of GDP in fiscal revenues. This means its deficit would be roughly 3.2pp higher up to 6% of GDP.

4/ With the Ruble weakening to as much as $150, Russia might gain should it cut oil exports by 10% and face an oil price of $75, as its revenues would be higher than otherwise.

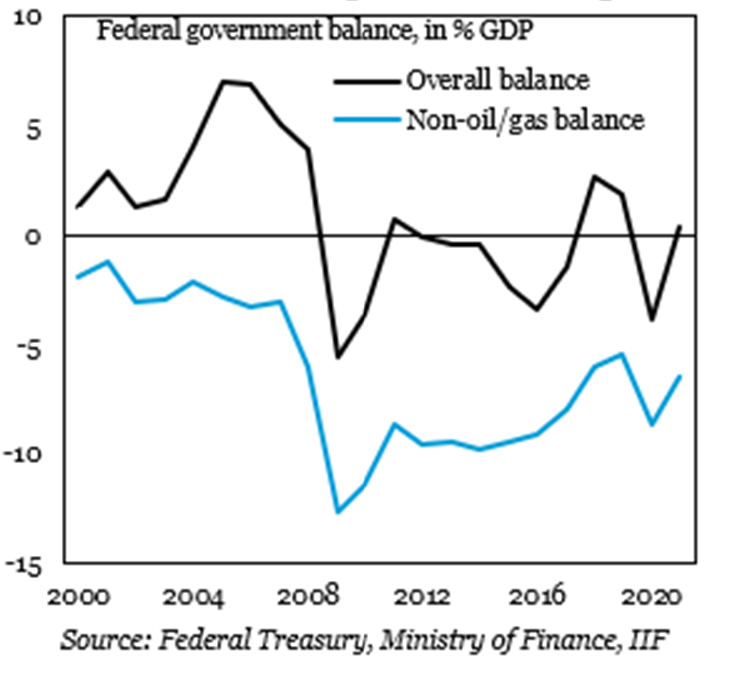

5/ I do not mean to say Russia is immune, not at all; without oil and gas revenues, Russia would have been in consistently large fiscal deficits over the last decade. However, using oil and gas revenues is more akin to "dissaving" or living off selling your parents' apartment.

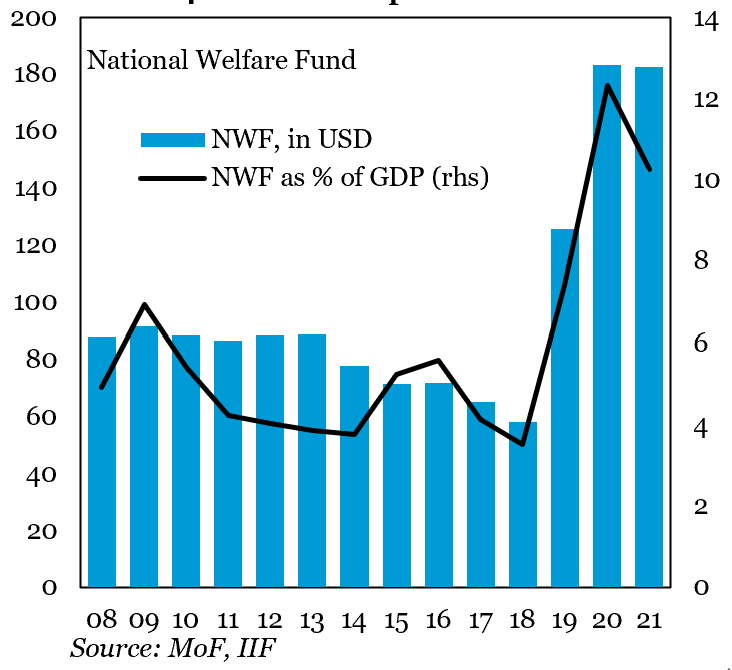

6/ Russia is aware of the risk and attempted to save for the rainy day ~10% of GDP at end-2021. However, ~34% of it is already committed to spending, and possibly >21% were arrested with frozen reserves, leaving only ~ 4% of GDP by the end-2023.

7/ Russia itself expects its Revenues to go down 25% over the next 3 years because of the EU's pivot away from Russia's energy and a fall in global commodity prices. It can cut spending, as it has done post-2014.

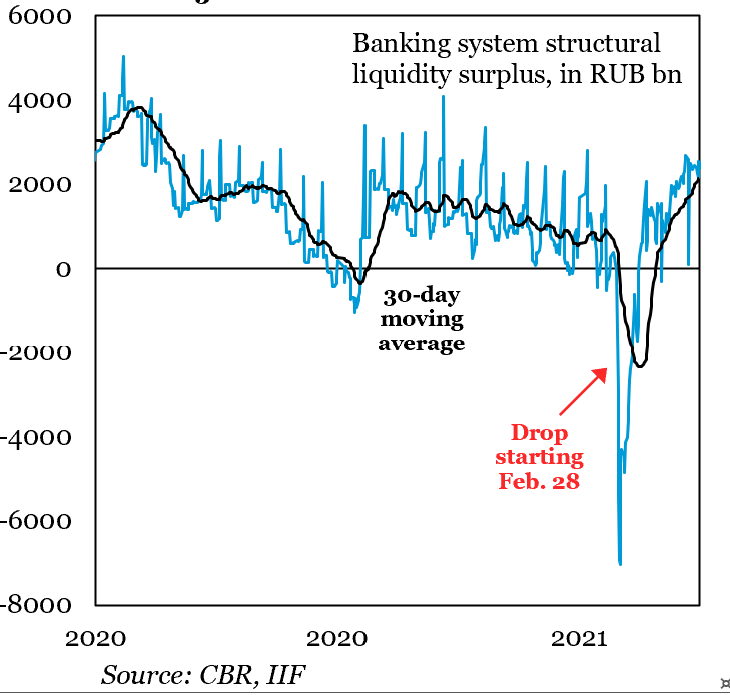

8/ Russia also can lean on the banks. After all, Russia’s financial sector is dominated by public banks (accounting for more than two-thirds of total assets) that have room to increase their holdings. But who will then finance the grand reverse structural transformation?

9/ To sum up Russia is far from suffering enough from the sanctions. The oil price cap gives it an out to sell more oil. With oil price, volumes, and Ruble moving is hard to generate a painful fiscal scenario.

Permanently moving away from Russia's energy is what will hurt Russia

Permanently moving away from Russia's energy is what will hurt Russia

• • •

Missing some Tweet in this thread? You can try to

force a refresh