Economic statecraft, int macro, Russia, Ukraine, Senior Fellow at @piie @Bruegel_org. Director International Program @kse_ua

4 subscribers

How to get URL link on X (Twitter) App

2/ Federal budget is back to a large deficit in April. A deficit of 3.4 trillion for the first four months of 2023—already 17% above the full-year budget target.

2/ Federal budget is back to a large deficit in April. A deficit of 3.4 trillion for the first four months of 2023—already 17% above the full-year budget target.

2/ Publication on what is and what is not working on oil price cap/embargo and how it can be made better.

2/ Publication on what is and what is not working on oil price cap/embargo and how it can be made better. https://twitter.com/elinaribakova/status/1628391879057317890

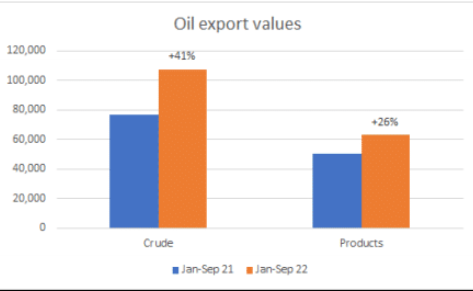

2/ Russia's export of crude and products is sharply up and behind Russia's large current account surplus.

2/ Russia's export of crude and products is sharply up and behind Russia's large current account surplus.

2/ New friends that export semiconductors to Russia, top suppliers in 2022.

2/ New friends that export semiconductors to Russia, top suppliers in 2022.

2/ The MinFin lacked creativity forecasting taxes as a constant to GDP. VAT is Russia's second most important tax after oil and gas; it depends on domestic consumption and imports. Profit taxes depend on the domestic economy and dividends, with Gazprom being the largest payer

2/ The MinFin lacked creativity forecasting taxes as a constant to GDP. VAT is Russia's second most important tax after oil and gas; it depends on domestic consumption and imports. Profit taxes depend on the domestic economy and dividends, with Gazprom being the largest payer

2/ The oil price cap, if set at this price, will fully water down the EU embargo, providing convenient shipping services to Russia to help it meet its budgetary needs.

2/ The oil price cap, if set at this price, will fully water down the EU embargo, providing convenient shipping services to Russia to help it meet its budgetary needs.

2/ Russia's GDP number collected by Rosstat has always been problematic. Issues related to the deflator, sectoral composition, input from the regions. 1-2pp off before 2022. 2Q2022 is probably arbitrary. Nice comments on the personalities involved here. carnegieendowment.org/politika/87404

2/ Russia's GDP number collected by Rosstat has always been problematic. Issues related to the deflator, sectoral composition, input from the regions. 1-2pp off before 2022. 2Q2022 is probably arbitrary. Nice comments on the personalities involved here. carnegieendowment.org/politika/87404

2/ Ruble is no largely determined by Russia's trade balance. Current account surplus ($180bn YTD in Aug.) this year will be enough to rebuild most of the reserves frozen by sanctions (~$300bn)

2/ Ruble is no largely determined by Russia's trade balance. Current account surplus ($180bn YTD in Aug.) this year will be enough to rebuild most of the reserves frozen by sanctions (~$300bn)

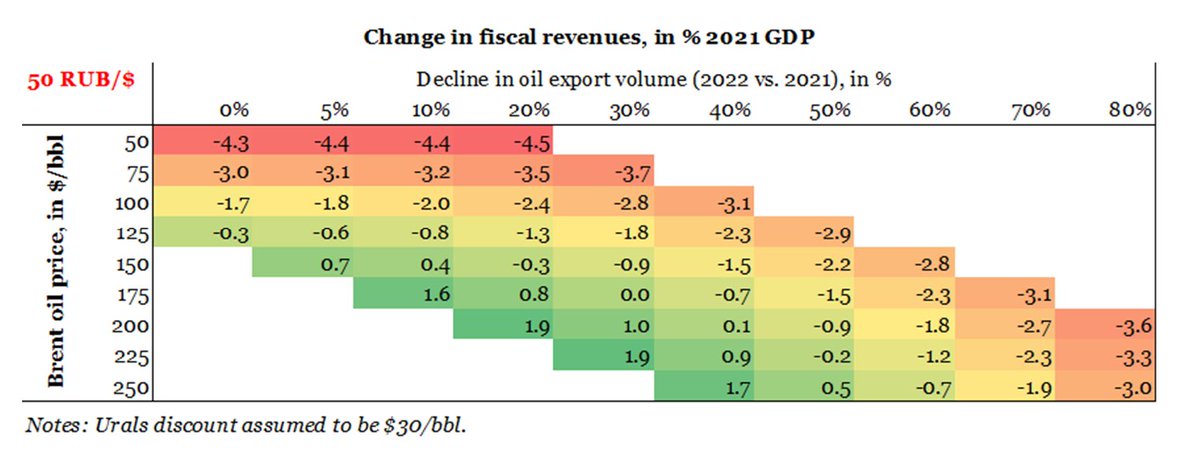

2/ The purpose of the oil price cap is to give an exit valve for Russian oil (to bring more Russian oil to the market, not less) at a lower price, as concern was that the EU oil embargo to come on in early 2023 will be too binding. Here are the scenarios.

2/ The purpose of the oil price cap is to give an exit valve for Russian oil (to bring more Russian oil to the market, not less) at a lower price, as concern was that the EU oil embargo to come on in early 2023 will be too binding. Here are the scenarios.

2/ Cross-border transactions for trade are still flowing freely. $ 167bn Jan-July in Current Account surplus. Gazprom bank plays a major role, being a de-facto Central Bank for Russia, even if not an effective one as the Ruble is strengthening too much for the budget.

2/ Cross-border transactions for trade are still flowing freely. $ 167bn Jan-July in Current Account surplus. Gazprom bank plays a major role, being a de-facto Central Bank for Russia, even if not an effective one as the Ruble is strengthening too much for the budget.

2/ The reasons are numerous and understandable. Our preliminary analysis suggests the importance of competing moral concerns, flexibility, and demand stability.

2/ The reasons are numerous and understandable. Our preliminary analysis suggests the importance of competing moral concerns, flexibility, and demand stability.

2/ 🇷🇺Exports are up 20% in 2q2022. Urals discount might have fallen marginally, Brent was up 64% to $113, and Russia's average Urals was $80 (the Urals was $70 in April based on monthly data). Gas, coal and aluminum prices are all up sharply; we know that.

2/ 🇷🇺Exports are up 20% in 2q2022. Urals discount might have fallen marginally, Brent was up 64% to $113, and Russia's average Urals was $80 (the Urals was $70 in April based on monthly data). Gas, coal and aluminum prices are all up sharply; we know that.

https://twitter.com/acgeoecon/status/15415454419926261772/ An oil embargo might not be politically immediately possible (see how complicated the EU negotiations on the 6th package were), so a cap is a second-best idea. The implementation here will be critical and secondary sanctions on non-aligned counties.

https://twitter.com/tashecon/status/1541112293064417280

2/ Ukraine got only $6.8 bn in cash from the international community since the beginning of the war. With the monthly fiscal gap reaching $4.5 in May alone, this is, I am sorry, peanuts.

2/ Ukraine got only $6.8 bn in cash from the international community since the beginning of the war. With the monthly fiscal gap reaching $4.5 in May alone, this is, I am sorry, peanuts.

https://twitter.com/blschmitt/status/15371245153728389122/ This is the reason Gazprom has always been taxed much lighter than oil (oil gives up most of its revenues over ~15$ plus oil price).

2/ Russia has accumulated more than $100 bn in FX since the beginning of the war. The budget is in RUB 1.6 tr surplus so far. Cutting off Russia for a few weeks from oil with a complete embargo would achieve nothing, but a spike in commodity prices that would hurt global growth.

2/ Russia has accumulated more than $100 bn in FX since the beginning of the war. The budget is in RUB 1.6 tr surplus so far. Cutting off Russia for a few weeks from oil with a complete embargo would achieve nothing, but a spike in commodity prices that would hurt global growth.

2/ Russia is enjoying historically high current account surpluses due to high oil and gas and other commodity prices. See what Russia 🇷🇺exports below (5 year average as shares vary a little due to price and volume changes).

2/ Russia is enjoying historically high current account surpluses due to high oil and gas and other commodity prices. See what Russia 🇷🇺exports below (5 year average as shares vary a little due to price and volume changes).