Oil is down 25% over the last 3 months and economic growth is on the ropes, yet we are still bullish on energy stocks.

Here are the 4 reasons why 🧵

#COM #EFT #OOTT

Here are the 4 reasons why 🧵

#COM #EFT #OOTT

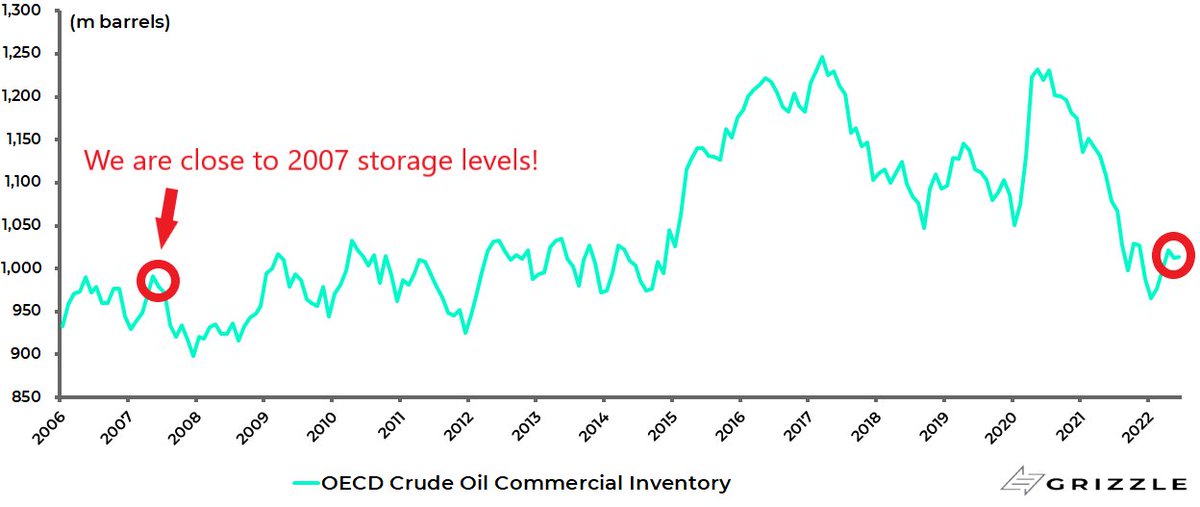

Oil inventories usually build in the first half of the year and draw in the second. That didn't happen and we are near 2007 storage levels and 20 days of supply vs 18 at the low point back then.

We all know what happened in 2008...

We all know what happened in 2008...

OPEC production looks tapped out.

From May-July OPEC missed quotas by a combined 1.26mb/d. The planned July production hike of ~400k b/d turned into a 1.2m b/d miss with August even worse at a 1.4mb/d miss

From May-July OPEC missed quotas by a combined 1.26mb/d. The planned July production hike of ~400k b/d turned into a 1.2m b/d miss with August even worse at a 1.4mb/d miss

The US SPR releases are adding 1% of global demand (1mb/d) to the market but they won't last forever.

SPR releases are falling to 300k b/d in November and stopping by December. This is a million barrels of daily supply poof 💨..

SPR releases are falling to 300k b/d in November and stopping by December. This is a million barrels of daily supply poof 💨..

And lastly China..

Demand is down 1M b/d over the last year due to COVID lockdowns. If traffic in Tier 1 cities is any indication, things are going back to normal and demand with it.

Demand is down 1M b/d over the last year due to COVID lockdowns. If traffic in Tier 1 cities is any indication, things are going back to normal and demand with it.

You may be saying.. but a recession?!

In the last normal recession ('08-'09) demand fell 2.5mb/d in its worst quarter.

With China + SPR making up 2mb/d of transitory supply, we don't think prices will decline for long, if at all even if we are headed into another recession.

In the last normal recession ('08-'09) demand fell 2.5mb/d in its worst quarter.

With China + SPR making up 2mb/d of transitory supply, we don't think prices will decline for long, if at all even if we are headed into another recession.

The source of this thread can be found in our latest global strategy research note. More great charts and a detailed explanation of why we are still owning energy.

grizzle.com/have-supply-sh…

grizzle.com/have-supply-sh…

And if you want weekly access to a strategist with one of the best track records of any macro thinker working today (I'm not exaggerating) our newsletter is free, give it a try: grizzle.com/subscribe-chri…

Here is another great thread from our own @ScottW_Grizzle with even more charts telling you why energy may outperform tech for once.

https://twitter.com/ScottW_Grizzle/status/1551524078208421888?s=20&t=w10E3XJyMIfyut9nSiOgCw

• • •

Missing some Tweet in this thread? You can try to

force a refresh