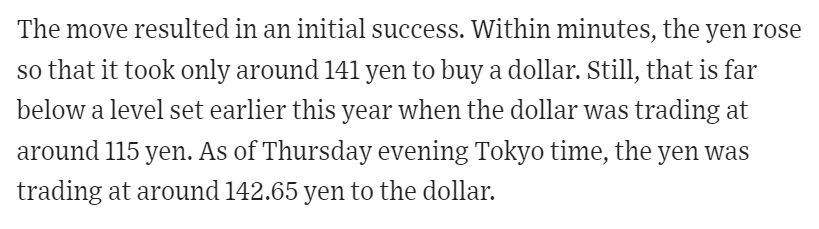

Bloomberg's tanker tracking is quite impressive.

It seems like Russian seaborne crude shipments fell off in the first part of September without any impact on global pricing.

1/n

bloomberg.com/news/articles/…

It seems like Russian seaborne crude shipments fell off in the first part of September without any impact on global pricing.

1/n

bloomberg.com/news/articles/…

Russia exports product as well crude -- and has pipeline exports as well as seaborne exports. But a sustained falloff in exports to the EU without offsets in volume to Asia or tightness in the global market would be a good result.

2/

2/

At the same time, it would be a mistake to underestimate Russia's short-term financial resilience.

@elinaribakova has rightly drawn attention to Russia's low level of fiscal debt. Debt is only 20% of GDP, and Russia can fund deficits domestically.

3/

@elinaribakova has rightly drawn attention to Russia's low level of fiscal debt. Debt is only 20% of GDP, and Russia can fund deficits domestically.

3/

https://twitter.com/elinaribakova/status/1572105269035008000

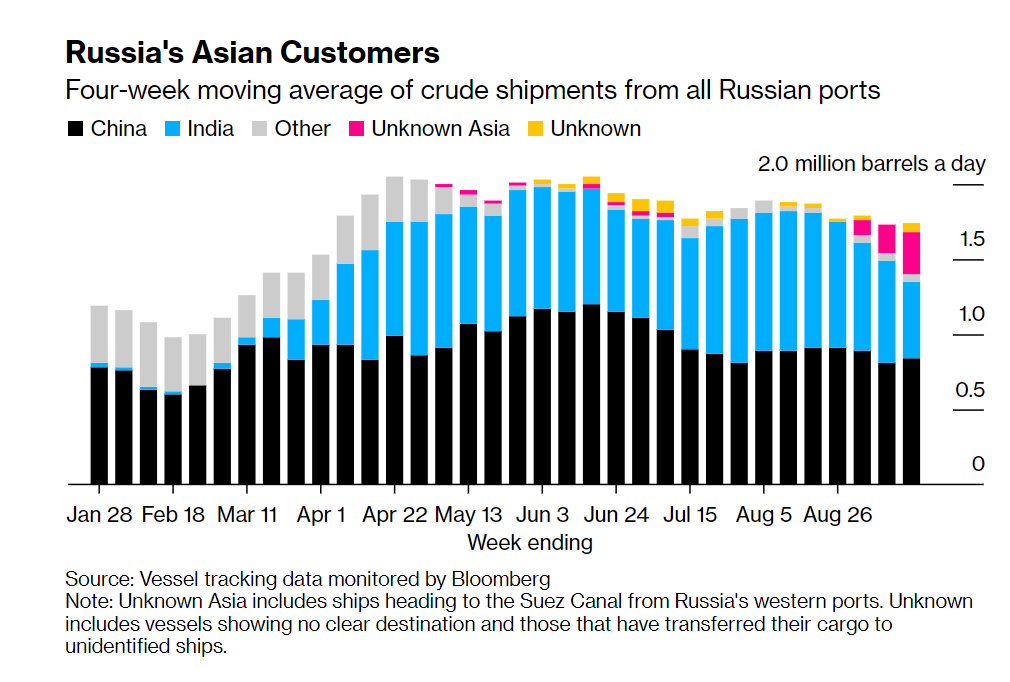

As Elina notes, a weaker ruble also acts as a natural fiscal buffer in the face of falling revenue from oil sales, keeping domestic revenues up. Russia has managed through some quite large fiscal squeezes in the past (revenues are in dollars in the chart)

4/

4/

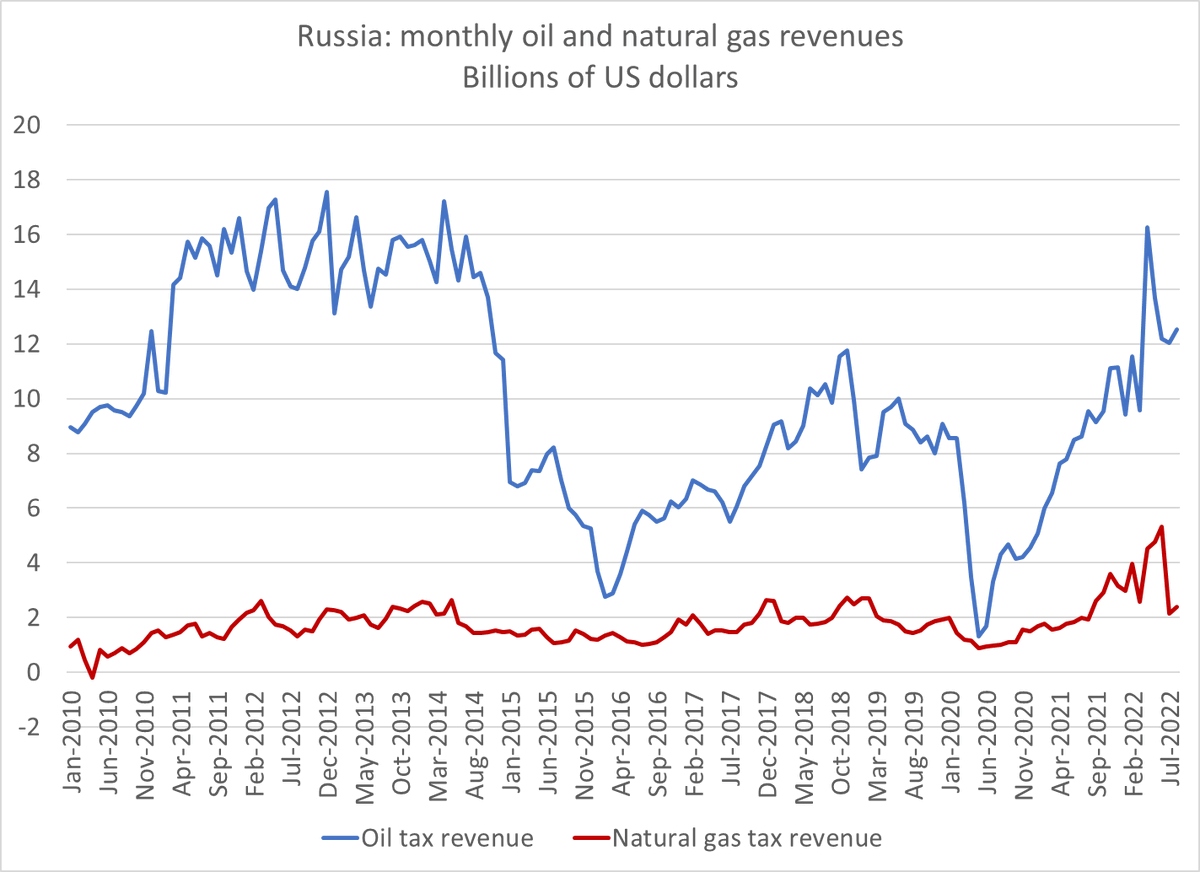

And there is an additional factor that should get more attention -- higher non-oil exports and limited imports have pushed Russia's current account break even oil price down to quite low levels.

Under $20 a barrel going into 2022

5/

Under $20 a barrel going into 2022

5/

The current account break even is the oil price that balances Russia's external accounts.

It assumes constant export volumes -- or ~ 8 mbd of oil. But it is still a useful benchmark: there are lots pf price/ volume combinations that match 8 mbd at $20 a barrel.

6/

It assumes constant export volumes -- or ~ 8 mbd of oil. But it is still a useful benchmark: there are lots pf price/ volume combinations that match 8 mbd at $20 a barrel.

6/

So I agree with @elinaribakova --

A fall off in Russia's oil export proceeds will squeeze Russia over time, but it is unrealistic to think Russia faces an immediate financial constraint (unfortunately).

7/7

A fall off in Russia's oil export proceeds will squeeze Russia over time, but it is unrealistic to think Russia faces an immediate financial constraint (unfortunately).

7/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh