4 Steps to Create A Systematic Trading Strategy

A Thread Covering basics of Rules Based Trading 🧵

A Thread Covering basics of Rules Based Trading 🧵

Traders gather past historical data and try to identify profitable trading opportunities, backtest their logic and develop profitable trading strategies

[2/17]

[2/17]

A Systematic Trading consists of four major components:

🔸 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 𝗜𝗱𝗲𝗻𝘁𝗶𝗳𝗶𝗰𝗮𝘁𝗶𝗼𝗻 - Finding a strategy and exploiting an edge.

🔸 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 𝗕𝗮𝗰𝗸𝘁𝗲𝘀𝘁𝗶𝗻𝗴 - Obtaining data and analysing strategy performance across years .

[3/17]

🔸 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 𝗜𝗱𝗲𝗻𝘁𝗶𝗳𝗶𝗰𝗮𝘁𝗶𝗼𝗻 - Finding a strategy and exploiting an edge.

🔸 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 𝗕𝗮𝗰𝗸𝘁𝗲𝘀𝘁𝗶𝗻𝗴 - Obtaining data and analysing strategy performance across years .

[3/17]

🔸 𝗘𝘅𝗲𝗰𝘂𝘁𝗶𝗼𝗻 𝗦𝘆𝘀𝘁𝗲𝗺 - Linking to a brokerage, automating the trading system and minimising transaction costs.

🔸 𝗥𝗶𝘀𝗸 𝗠𝗮𝗻𝗮𝗴𝗲𝗺𝗲𝗻𝘁 - Optimal capital allocation , strategy diversification and design.

What are the Pros and Cons of Systematic Trading

[4]

🔸 𝗥𝗶𝘀𝗸 𝗠𝗮𝗻𝗮𝗴𝗲𝗺𝗲𝗻𝘁 - Optimal capital allocation , strategy diversification and design.

What are the Pros and Cons of Systematic Trading

[4]

𝟭. 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 𝗜𝗱𝗲𝗻𝘁𝗶𝗳𝗶𝗰𝗮𝘁𝗶𝗼𝗻

All quantitative trading processes begin with an initial period of research. This research process encompasses finding a strategy, seeing whether the strategy fits into a portfolio of other strategies you may be running.

[5/17]

All quantitative trading processes begin with an initial period of research. This research process encompasses finding a strategy, seeing whether the strategy fits into a portfolio of other strategies you may be running.

[5/17]

𝟮. 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 𝗕𝗮𝗰𝗸𝘁𝗲𝘀𝘁𝗶𝗻𝗴

The goal of 𝘣𝘢𝘤𝘬𝘵𝘦𝘴𝘵𝘪𝘯𝘨 is to provide evidence that the strategy is profitable when applied to historical data.

This sets the expectation of how the strategy will perform in the "𝗿𝗲𝗮𝗹 𝘄𝗼𝗿𝗹𝗱".

[6/17]

The goal of 𝘣𝘢𝘤𝘬𝘵𝘦𝘴𝘵𝘪𝘯𝘨 is to provide evidence that the strategy is profitable when applied to historical data.

This sets the expectation of how the strategy will perform in the "𝗿𝗲𝗮𝗹 𝘄𝗼𝗿𝗹𝗱".

[6/17]

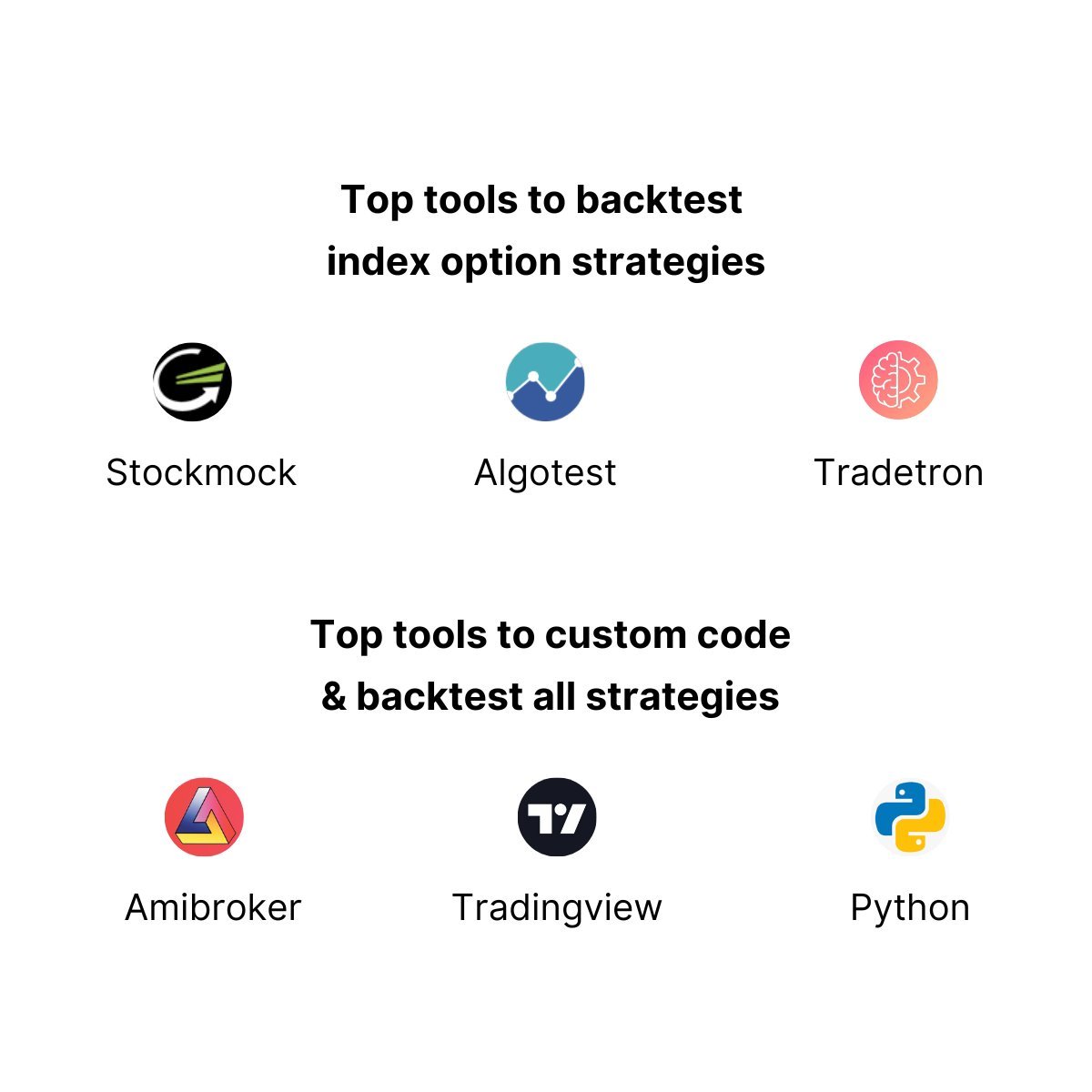

Where can you backtest Strategies ?

You can use 𝘚𝘵𝘰𝘤𝘬𝘮𝘰𝘤𝘬 , 𝘈𝘭𝘨𝘰𝘵𝘦𝘴𝘵 , 𝘛𝘳𝘢𝘥𝘦𝘵𝘳𝘰𝘯 for Backtesting Index Option Strategies and 𝘈𝘮𝘪𝘣𝘳𝘰𝘬𝘦𝘳, 𝘗𝘺𝘵𝘩𝘰𝘯, 𝘛𝘳𝘢𝘥𝘪𝘯𝘨𝘷𝘪𝘦𝘸 to custom code and backtest all other strategies

[7/17]

You can use 𝘚𝘵𝘰𝘤𝘬𝘮𝘰𝘤𝘬 , 𝘈𝘭𝘨𝘰𝘵𝘦𝘴𝘵 , 𝘛𝘳𝘢𝘥𝘦𝘵𝘳𝘰𝘯 for Backtesting Index Option Strategies and 𝘈𝘮𝘪𝘣𝘳𝘰𝘬𝘦𝘳, 𝘗𝘺𝘵𝘩𝘰𝘯, 𝘛𝘳𝘢𝘥𝘪𝘯𝘨𝘷𝘪𝘦𝘸 to custom code and backtest all other strategies

[7/17]

Link For Stockmock :

Backtest many options strategies for Nifty and Banknifty on Stockmock with ease.

stockmock.in/#!/signup?rb=9…

[8/17]

Backtest many options strategies for Nifty and Banknifty on Stockmock with ease.

stockmock.in/#!/signup?rb=9…

[8/17]

𝗘𝘅𝗲𝗰𝘂𝘁𝗶𝗼𝗻 𝗦𝘆𝘀𝘁𝗲𝗺𝘀

An 𝘦𝘹𝘦𝘤𝘶𝘵𝘪𝘰𝘯 𝘴𝘺𝘴𝘵𝘦𝘮 is the means by which the list of trades generated by the strategy are sent and executed by the broker

[9/17]

An 𝘦𝘹𝘦𝘤𝘶𝘵𝘪𝘰𝘯 𝘴𝘺𝘴𝘵𝘦𝘮 is the means by which the list of trades generated by the strategy are sent and executed by the broker

[9/17]

The key considerations when creating an execution system are

A. 𝗜𝗻𝘁𝗲𝗿𝗳𝗮𝗰𝗲 𝘁𝗼 𝘁𝗵𝗲 𝗯𝗿𝗼𝗸𝗲𝗿𝗮𝗴𝗲

B. Minimisation of 𝘁𝗿𝗮𝗻𝘀𝗮𝗰𝘁𝗶𝗼𝗻 𝗰𝗼𝘀𝘁𝘀

(including commission, slippage and spread)

[10/17]

A. 𝗜𝗻𝘁𝗲𝗿𝗳𝗮𝗰𝗲 𝘁𝗼 𝘁𝗵𝗲 𝗯𝗿𝗼𝗸𝗲𝗿𝗮𝗴𝗲

B. Minimisation of 𝘁𝗿𝗮𝗻𝘀𝗮𝗰𝘁𝗶𝗼𝗻 𝗰𝗼𝘀𝘁𝘀

(including commission, slippage and spread)

[10/17]

C. 𝗗𝗶𝘃𝗲𝗿𝗴𝗲𝗻𝗰𝗲 𝗼𝗳 𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗮𝗻𝗰𝗲 of the live system from backtested performance.

Example : You can use 𝘘𝘶𝘢𝘯𝘵𝘪𝘱𝘭𝘺 or directly use Python to deploy our strategies

[11/17]

Example : You can use 𝘘𝘶𝘢𝘯𝘵𝘪𝘱𝘭𝘺 or directly use Python to deploy our strategies

[11/17]

Link for Quantiply : app.quantiply.tech/auth/signup?re…

[12/17]

[12/17]

𝟰. 𝗥𝗶𝘀𝗸 𝗠𝗮𝗻𝗮𝗴𝗲𝗺𝗲𝗻𝘁:

Risk management encompasses 𝘰𝘱𝘵𝘪𝘮𝘢𝘭 𝘤𝘢𝘱𝘪𝘵𝘢𝘭 𝘢𝘭𝘭𝘰𝘤𝘢𝘵𝘪𝘰𝘯 , strategy diversification and inbuilt limits for losses within a strategy

[13/17]

Risk management encompasses 𝘰𝘱𝘵𝘪𝘮𝘢𝘭 𝘤𝘢𝘱𝘪𝘵𝘢𝘭 𝘢𝘭𝘭𝘰𝘤𝘢𝘵𝘪𝘰𝘯 , strategy diversification and inbuilt limits for losses within a strategy

[13/17]

This is the means by which capital is allocated to a set of different strategies and to the trades within those strategies

Example : 2 Lakh per lot for Option Selling , keeping buffer cash for drawdown and MTM Losses

[14/17]

Example : 2 Lakh per lot for Option Selling , keeping buffer cash for drawdown and MTM Losses

[14/17]

In Summary

How to 𝗯𝘂𝗶𝗹𝗱/𝗯𝗮𝗰𝗸𝘁𝗲𝘀𝘁 a strategy ?

🔸 Idea/Hypothesis

🔸 Specify entry,exit, SL

🔸 Position Sizing and Risk Mgt.

🔸 Trade log and Backtest Report

🔸 Test in diff. market conditions

🔸 Optimise the strategy

🔸 Track Real Time performance

🔸 Deploy

[15/17]

How to 𝗯𝘂𝗶𝗹𝗱/𝗯𝗮𝗰𝗸𝘁𝗲𝘀𝘁 a strategy ?

🔸 Idea/Hypothesis

🔸 Specify entry,exit, SL

🔸 Position Sizing and Risk Mgt.

🔸 Trade log and Backtest Report

🔸 Test in diff. market conditions

🔸 Optimise the strategy

🔸 Track Real Time performance

🔸 Deploy

[15/17]

🔸 𝗧𝗲𝗹𝗲𝗴𝗿𝗮𝗺 𝗟𝗶𝗻𝗸 : t.me/Techno_charts

🔸 Follow 𝗠𝘆 𝗜𝗣𝗢 𝗠𝗢𝗠𝗘𝗡𝗧𝗨𝗠 𝗣𝗢𝗥𝗧𝗙𝗢𝗟𝗜𝗢 which has given 15% in a month Join me now trin.kr/TechnoCharts

🔸 Follow 𝗠𝘆 𝗜𝗣𝗢 𝗠𝗢𝗠𝗘𝗡𝗧𝗨𝗠 𝗣𝗢𝗥𝗧𝗙𝗢𝗟𝗜𝗢 which has given 15% in a month Join me now trin.kr/TechnoCharts

• • •

Missing some Tweet in this thread? You can try to

force a refresh