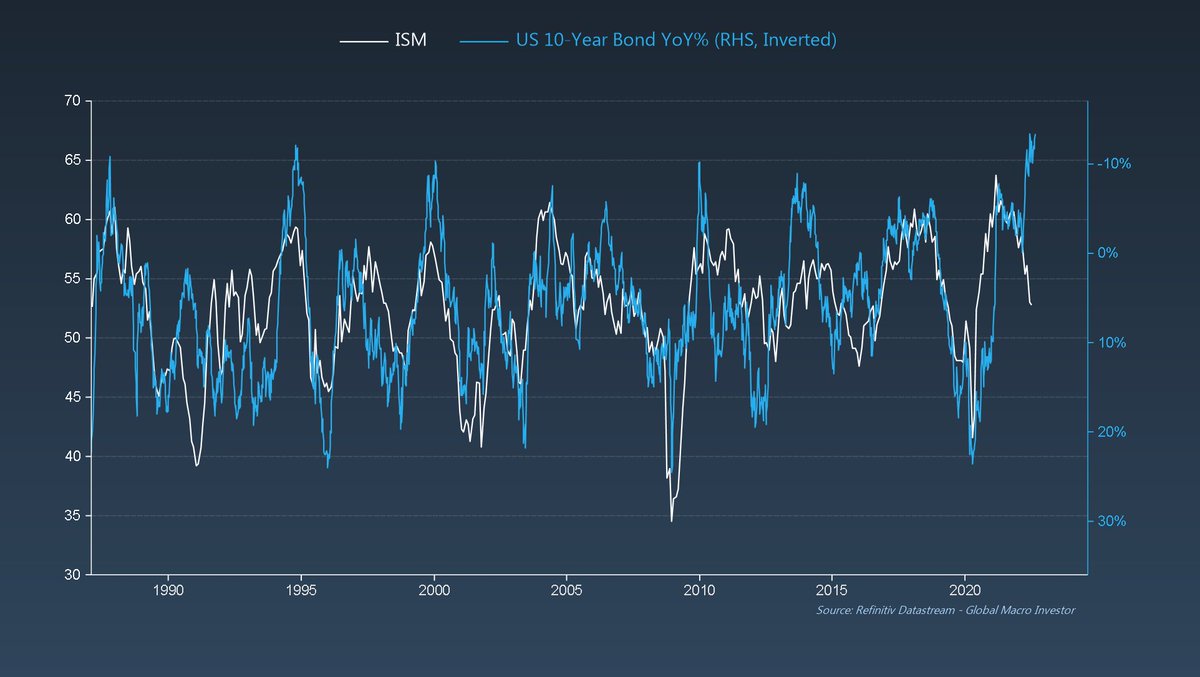

When you are a Boomer Central Banker, everything looks like the ghost of the 1970's...heuristic bias will give unexpected outcomes (deflation) when total debt to GDP is this

Meanwhile, memes rule the world and the Central Bankers in their late 60's worship this meme: Wrong person for these times.

But the politicians (in their 70's mainly) are focussed on this meme...The Pension Crisis, where the system is forced to bail out past unkept promises. Voters will win in the end and household bail outs will come.

Everyone else can just worship #REKTGUY as rents are unaffordable, property remains unaffordable, real wages cant rise and central bankers are busy destroying wealth to get on the front of a book.

Everyone has to figure out in this broken system how they are going to make it. WAGMI? Depends what you own. I like the own the thing that destroys the old system. You can fight technology or invest in it but it ain't going away...

You can fight QE but it ain't going away (the debt is too damned high and Boomers are too damned old).

The J-Po might want to be Volker but the politicians will win (its the voters, stupid!) and the cowbell will return and when it does...

The J-Po might want to be Volker but the politicians will win (its the voters, stupid!) and the cowbell will return and when it does...

You need to own the stuff that goes up the most.

• • •

Missing some Tweet in this thread? You can try to

force a refresh