Huge tax cuts and a borrowing surge: The Chancellor has opted to boost short term growth and interest rates while setting the public finances on an unsustainable path – here are five key takeaways from today’s #MiniBudget – THREAD

1 - £45 billion of tax cuts were announced today – going far beyond election promises to cancel corporation tax increases and reverse this year’s National Insurance rise.

2 - No previous Chancellor has increased borrowing by so much: The decision to combine the largely unavoidable higher deficit caused by rising energy prices/interest rates with permanent tax cuts will drive up borrowing by £411 billion in coming years.

Borrowing is expected to increase by £265 billion over the next five years, due to the additional packages of energy support combined with the deterioration of the economic outlook since March, while tax cuts of £146 billion will raise that to £411 billion.

3 – Future spending cuts could be on the cards: The Chancellor has said that debt falling remains his key metric for fiscal sustainability – but achieving that during the middle of this decade could require spending cuts of £35 billion in 2026-27.

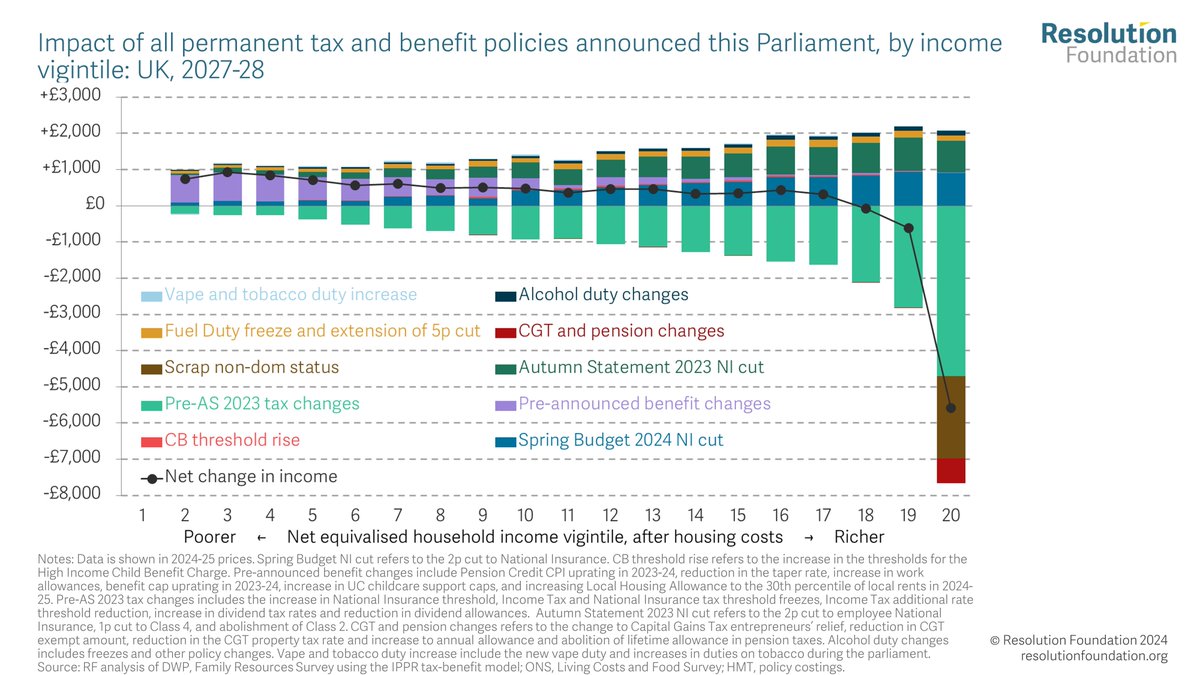

4 - Almost two-thirds (65%) of the gains from the personal tax cuts announced will go to the richest fifth of households...

.. meaning that this richest fifth of households will be better-off on average by £3,090 next year. Almost half of gains will go to the richest 5 per cent, while the poorest half of households will gain just £230 on average next year.

5 – Caution is needed on growth: While energy support will boost GDP this winter, the borrowing required will also mean higher interest rates. Growth in the years ahead is likely to be driven far more by the path of energy prices than the tax cuts announced today.

Read the full reaction from RF Chief Executive @TorstenBell here - and keep an eye out first thing tomorrow for out full overnight analysis resolutionfoundation.org/press-releases…

• • •

Missing some Tweet in this thread? You can try to

force a refresh