Thinking more about reactions to the Truss/Kwarteng not-a-budget released Friday. While I yield to nobody in my disdain for their embrace of zombie economics, I'm puzzled by all the talk about a looming sterling crisis 1/

Just an aside: I can't be the only one who noticed the parallel between the declaration that a budget wasn't a budget, just a "fiscal event", and Putin's insistence that his war isn't a war, just a "special military operation". No moral equivalence, of course. But wow 2/

But back to sterling. I'm supposed to know something about currency crises — I did invent the academic field! And as far as I know there are two ways a country with a floating exchange rate can have a currency crisis, neither of which seems to apply to the UK 3/

Since the 1990s, most currency crises have involved balance sheet effects: a country (either public or private sector, or both) has large external liabilities in foreign currency. In that case depreciation worsens balance sheets, creating a self-reinforcing downward spiral 4/

That was the story for Asia in the 90s, the Argentine crisis 2001, part of the problem in Turkey now. But while the UK has a lot of external liabilities, they're overwhelmingly sterling-denominated; the UK also has external assets, largely direct investment 5/

The result is that sterling depreciation actually *improves* Britain's net international investment position (the same thing happens to the US). So a balance-sheet currency crisis story doesn't seem to make sense 6/

The other way you can have a currency crisis is if markets believe that you can't or won't service your public debt, and will monetize it instead; this was the story behind the 1926 franc crisis and, I think, the 1976 sterling crisis (which needs revisiting) 7/

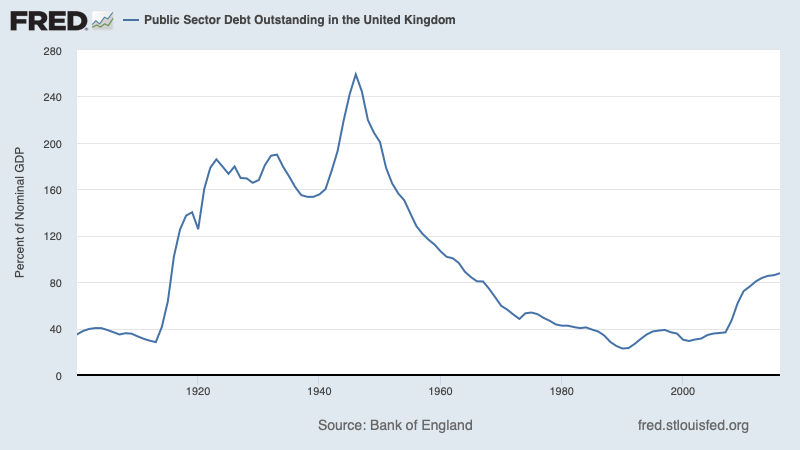

But the Bank of England is independent these days, and unlikely to monetize debt. And despite everything, UK debt isn't *that* high by long-run standards 8/

So why did zombie Reaganomics produce currency depreciation, not the excessively *strong* currency caused by the original version? Well, it did say bad things about the competence of the new government 9/

https://twitter.com/darioperkins/status/1573562451748069376

But at a guess, the moron risk premium has now been priced in. I guess I don't see the mechanism for a continuing sterling crisis. What am I missing? 10/

• • •

Missing some Tweet in this thread? You can try to

force a refresh