Bhav Bhagwan Hai (Price is God)

Lekin Open Interest (OI) Bhagwan ka Baap Hai (OI is Father of God)

This is what some traders claim about Open Interest (OI)😄

Is it True or Not?

Check These Features about OI & Decide Yourself!

Thread 🧵

#openinterest #OI

(1/N)

Lekin Open Interest (OI) Bhagwan ka Baap Hai (OI is Father of God)

This is what some traders claim about Open Interest (OI)😄

Is it True or Not?

Check These Features about OI & Decide Yourself!

Thread 🧵

#openinterest #OI

(1/N)

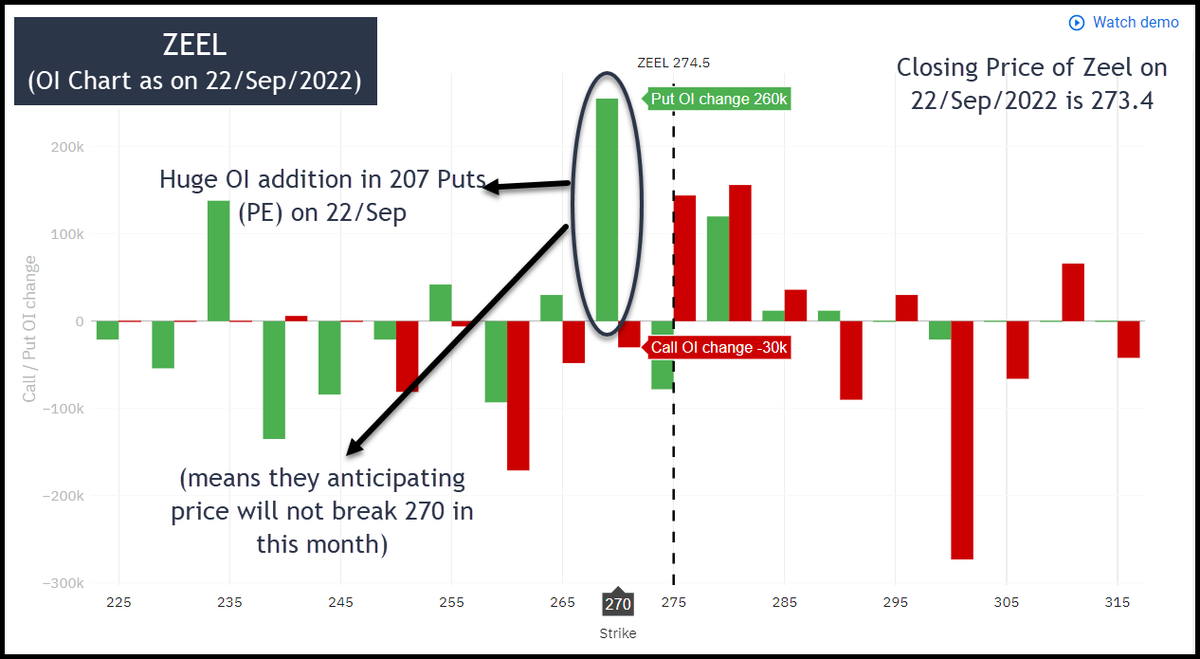

Check the ZEEL OI Change Chart as of 22/Sep/2022

There was a huge spike in 270 Puts (PE).

It means people sold 270 PE anticipating the price would not close below 270 before this month's expiry.

But the closing price of ZEEL on the next day (23/Sep) is 260.95.

(2/N)

There was a huge spike in 270 Puts (PE).

It means people sold 270 PE anticipating the price would not close below 270 before this month's expiry.

But the closing price of ZEEL on the next day (23/Sep) is 260.95.

(2/N)

Now can you imagine the conditions of these 270 PE sellers?

They have trapped - Either they have to book a huge loss or shift their position (it brings more risk to the table).

On 23/Sep, most people closed their position in 270 PE.

(3/N)

They have trapped - Either they have to book a huge loss or shift their position (it brings more risk to the table).

On 23/Sep, most people closed their position in 270 PE.

(3/N)

Also, many traders sold 270 CE, which adds more pressure to the fall.

270 PE opened at 6.9 and closed at 13.5 (close to 100% losses for options sellers) on 23/Sep.

(4/N)

270 PE opened at 6.9 and closed at 13.5 (close to 100% losses for options sellers) on 23/Sep.

(4/N)

Open Interest (OI) provides all this information (and many more).

What is Open Interest (OI)?

OI is the total number of outstanding derivative contracts (both futures and options) that have not been settled (still open).

(5/N)

What is Open Interest (OI)?

OI is the total number of outstanding derivative contracts (both futures and options) that have not been settled (still open).

(5/N)

If an option buyer and option seller initiate a new position, then OI will increase by 1.

Similarly, if both close their position, then OI will decrease by 1.

(6/N)

Similarly, if both close their position, then OI will decrease by 1.

(6/N)

But if an option buyer or seller passes their position to a new person, OI remains unchanged (volume count increases in this case).

Read this chart carefully a few times!

(7/N)

Read this chart carefully a few times!

(7/N)

Then what is the difference between Open Interest and Volume?

Volume count will be added irrespective of old or new player participation.

Have a look at the same example for volume.

(8/N)

Volume count will be added irrespective of old or new player participation.

Have a look at the same example for volume.

(8/N)

Interpretation of Futures OI

Rise in Price + Increase in OI -> Bullish

Fall in Price + Increase in OI -> Bearish

Rise in Price + Fall in OI -> Short Covering

Fall in Price + Fall in OI -> Long Unwinding

(9/N)

Rise in Price + Increase in OI -> Bullish

Fall in Price + Increase in OI -> Bearish

Rise in Price + Fall in OI -> Short Covering

Fall in Price + Fall in OI -> Long Unwinding

(9/N)

Interpretation of OI with Options (CE &PE)

First CE

Increase in CE + Increase in OI -> CE Long Build up

Decrease in CE + Increase in OI -> CE Short Build up

Increase in CE + Decrease in OI -> CE Short Covering

Decrease in CE + Decrease in OI -> CE Long Unwinding

(10/N)

First CE

Increase in CE + Increase in OI -> CE Long Build up

Decrease in CE + Increase in OI -> CE Short Build up

Increase in CE + Decrease in OI -> CE Short Covering

Decrease in CE + Decrease in OI -> CE Long Unwinding

(10/N)

Now PE

Increase in PE + Increase in OI -> PE Long Build up

Decrease in PE + Increase in OI -> PE Short Build up

Increase in PE + Decrease in OI -> PE Short Covering

Decrease in PE + Decrease in OI -> PE Long Unwinding

(10/N)

Increase in PE + Increase in OI -> PE Long Build up

Decrease in PE + Increase in OI -> PE Short Build up

Increase in PE + Decrease in OI -> PE Short Covering

Decrease in PE + Decrease in OI -> PE Long Unwinding

(10/N)

When we combine OI info from both CE and PE, many Variations are possible.

But below are the important ones:

CE Long Buildup + PE Short Buildup -> Super Bullish

CE Short Buildup + PE Long Build up -> Super Bearish

CE Short Buildup + PE Short Buildup -> Sideways

(11/N)

But below are the important ones:

CE Long Buildup + PE Short Buildup -> Super Bullish

CE Short Buildup + PE Long Build up -> Super Bearish

CE Short Buildup + PE Short Buildup -> Sideways

(11/N)

Check Nifty (spot) 15-min chart on 23/Sep/2022

There was a huge sell-off till 9.45 AM, and then it displayed some sideways move.

(12/N)

There was a huge sell-off till 9.45 AM, and then it displayed some sideways move.

(12/N)

Now check the same info on OI.

Most are CE Short Buildup and PE Long Buildup, right?

It denotes "BEARISH SENTIMENT"

(13/N)

Most are CE Short Buildup and PE Long Buildup, right?

It denotes "BEARISH SENTIMENT"

(13/N)

Important Point:

Exchange updates OI data every 3 minutes.

So there will be a lag of "3 minutes" with any software vendor.

If anyone claims he provides live OI data (tick), then he/she is fake!

(14/N)

Exchange updates OI data every 3 minutes.

So there will be a lag of "3 minutes" with any software vendor.

If anyone claims he provides live OI data (tick), then he/she is fake!

(14/N)

How to Know Support/Resistance using OI?

ICICI Bank CMP is 882.

But huge quantities of 900 and 920 CE have been solved by big people.

It means 900 & 920 act as crucial resistance zones!

(15/N)

ICICI Bank CMP is 882.

But huge quantities of 900 and 920 CE have been solved by big people.

It means 900 & 920 act as crucial resistance zones!

(15/N)

Let's look at one more example.

ACC CMP is 2507.

But the next small support is only at 2460 and the major support is only at 2400.

Now you know what happens to ACC in the next few days🤣

(16/N)

ACC CMP is 2507.

But the next small support is only at 2460 and the major support is only at 2400.

Now you know what happens to ACC in the next few days🤣

(16/N)

Caution - OI information changes in the live market; accordingly, we need to change our view!

If you get confused about analyzing options and OI, stick to Futures and OI information and manage your trades.

(17/N)

If you get confused about analyzing options and OI, stick to Futures and OI information and manage your trades.

(17/N)

Free Source to view OI information

fnotrader.com/landing

Please note this is 3rd party site. You need to divert any doubts/questions to them.

Besides, you need to validate the accuracy of OI.

(18/N)

fnotrader.com/landing

Please note this is 3rd party site. You need to divert any doubts/questions to them.

Besides, you need to validate the accuracy of OI.

(18/N)

Other Sources to get OI information (not in any order):

sensibull.com

oipulse.com/signin

options-decoder.truedata.in/login

quantsapp.com

PS - All are paid vendors, and I don't have any business association with them.

(19/N)

sensibull.com

oipulse.com/signin

options-decoder.truedata.in/login

quantsapp.com

PS - All are paid vendors, and I don't have any business association with them.

(19/N)

Enough for Today!

If you enjoyed this thread:

1. Follow me

@indraziths

for more threads on the stock market trading

2. RT the tweet below to share this thread with your audience

If you need more information about options trading, read this article

profiletraders.in/post/options-t…

If you enjoyed this thread:

1. Follow me

@indraziths

for more threads on the stock market trading

2. RT the tweet below to share this thread with your audience

If you need more information about options trading, read this article

profiletraders.in/post/options-t…

My conclusion is simple.

Give #1 preference to "Price Action" and check OI supports your logic.

If it supports, then it is double confirmation.

Also remember 3 mins delay in OI is crucial (as Nifty or Banknifty shows big moves nowadays in 3-5 mins candle).

Give #1 preference to "Price Action" and check OI supports your logic.

If it supports, then it is double confirmation.

Also remember 3 mins delay in OI is crucial (as Nifty or Banknifty shows big moves nowadays in 3-5 mins candle).

• • •

Missing some Tweet in this thread? You can try to

force a refresh