Still too many people who want to invest for the long term believe that the stock price tells them a very important story. Sometimes, it does, but often it doesn't, especially not in bear markets.

Let me give you a prime example.

👇

1/5

Let me give you a prime example.

👇

1/5

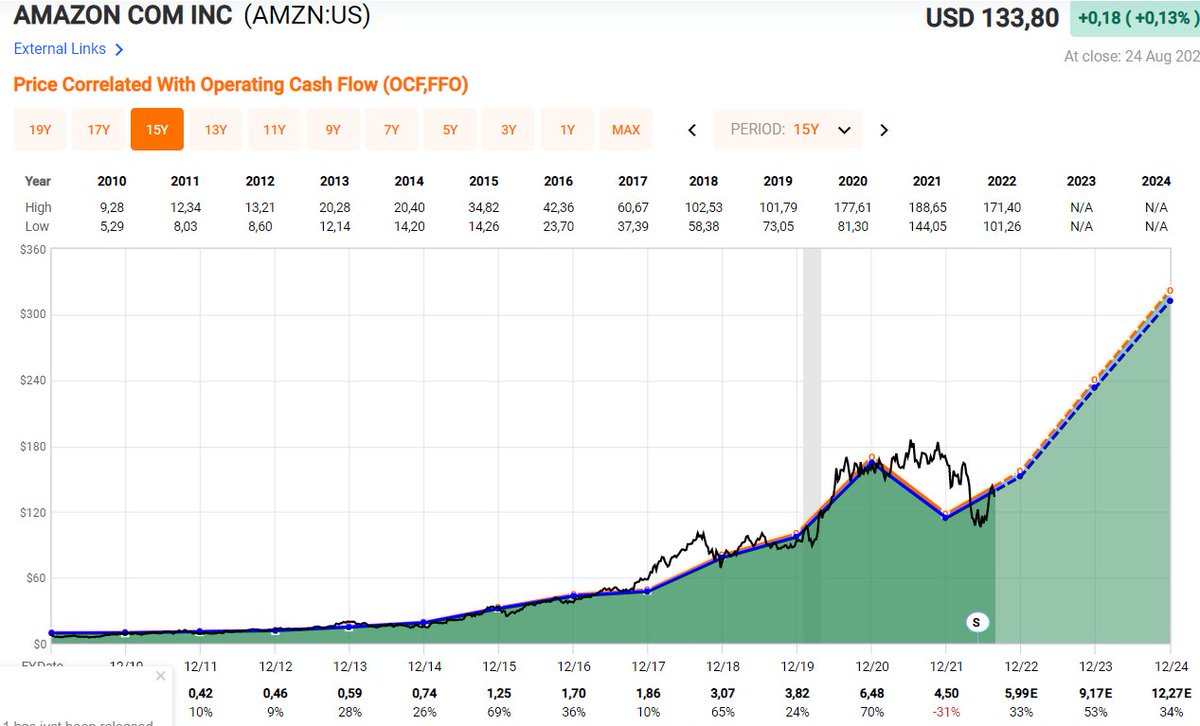

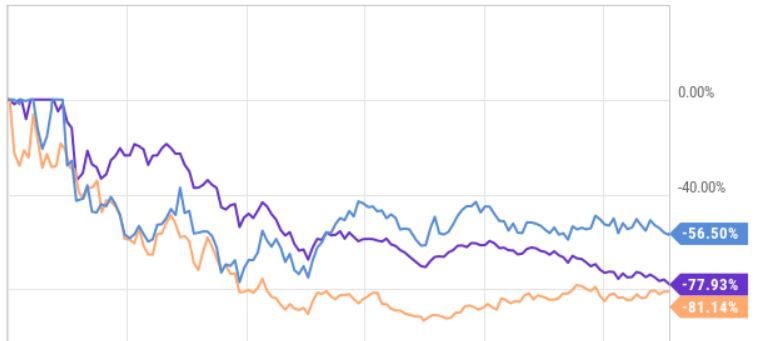

We all know what happened during the dotcom bust. The #NASDAQ dove almost 80% and many companies even more. A prime example is of course $AMZN, down more than 90% from its previous all-time high at a certain moment.

2/5

2/5

So, without knowing which are these, which one would you have chosen based on price action from 1999 to 2001?

I think we can agree that it's the light-blue one. Especially if you know something more about this stock.

3/5

I think we can agree that it's the light-blue one. Especially if you know something more about this stock.

3/5

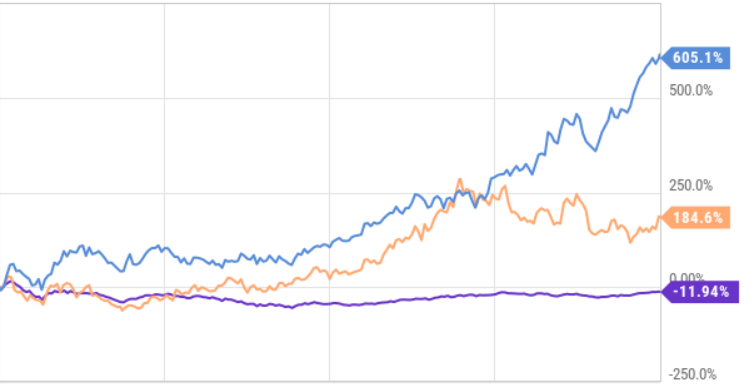

Your choice would even become more obvious if you look at the period 2001-2004, in which the light blue stock rose more than 600%. It was very profitable, unlike a lot of other dotcom stocks. What's not to like, right?

4/5

4/5

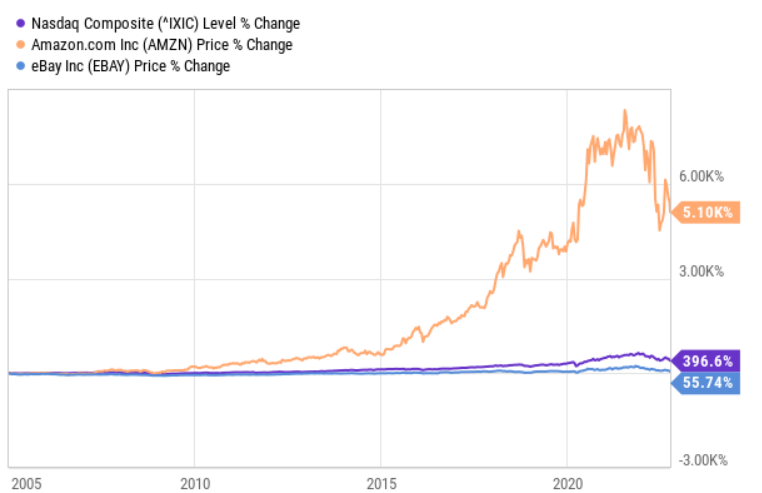

Now, look at the return from January 2005. The light blue stock was $EBAY, the orange $AMZN and the dark blue #NASDAQ

I know that $AMZN is an exception but I just wanted to show the future is not as certain as some think and short-term price action does not mean that much.

5/5

I know that $AMZN is an exception but I just wanted to show the future is not as certain as some think and short-term price action does not mean that much.

5/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh