1) In today's market it's increasingly difficult to select high quality cryptocurrencies.

Most fade away and as such we need to search for the best fundamentals.

A thread on $CPOOL and why you should take a look at this cryptocurrency.

Read on 🧵👇

@ClearpoolFin #Clearpool

Most fade away and as such we need to search for the best fundamentals.

A thread on $CPOOL and why you should take a look at this cryptocurrency.

Read on 🧵👇

@ClearpoolFin #Clearpool

2) DeFi enthusiasts looking to have access to liquidity are faced with a lot of challenges today.

The DeFi space is still quite underdeveloped when compared to its traditional counterpart.

For example, there are no reliable credit scores, risk profiles, etc.

The DeFi space is still quite underdeveloped when compared to its traditional counterpart.

For example, there are no reliable credit scores, risk profiles, etc.

3) Clearpool is focused on developing lending in the DeFi space to become comparable with traditional finance.

This protocol is focused on revolutionizing the way institutions have access to uncollateralized liquidity.

This protocol is focused on revolutionizing the way institutions have access to uncollateralized liquidity.

4) Founded by Robert Alcorn, Alessio Quaglini and Jakob Kronbichler, Clearpool is a top-notch platform brought to life by the increasing need for access to liquidity.

The platform also enjoys stellar custody and compliance services such as ID verification and KYC.

The platform also enjoys stellar custody and compliance services such as ID verification and KYC.

5) With Clearpool, lenders will have access to important details like a borrower’s creditworthiness, risk profiles, etc.

The functions Clearpool plans on introducing to the DeFi space will bring institutions on-chain.

The functions Clearpool plans on introducing to the DeFi space will bring institutions on-chain.

6) This will expose them to the vast pool of crypto-native capital and reveal the incredible innovations of DeFi” to them.

Clearpool introduced "smart lending".

Single-borrower liquidity pools give you the ability to decide which institutions to lend to.

Clearpool introduced "smart lending".

Single-borrower liquidity pools give you the ability to decide which institutions to lend to.

7) • Compare and select borrower pools.

• Supply USDC liquidity and receive cpTokens in return.

• Start earning USDC interest and CPOOL rewards.

• CPOOL tokens can be delegated to participate in governance.

• Redeem at any time. No lock-up.

• Supply USDC liquidity and receive cpTokens in return.

• Start earning USDC interest and CPOOL rewards.

• CPOOL tokens can be delegated to participate in governance.

• Redeem at any time. No lock-up.

8) CPOOL is the utility and goverance token that powers the Clearpool ecosystem.

Borrowers stake CPOOL before launching liquidity pools.

Delegated staking earns additional rewards and helps to secure the Clearpool economy.

Borrowers stake CPOOL before launching liquidity pools.

Delegated staking earns additional rewards and helps to secure the Clearpool economy.

9) There's also a protocol buyback and burn mechanism on the way.

This will make CPOOL a deflationary asset in the future.

Want to start using CPOOL to borrow or lend?

The product is live and working and can be used at app.clearpool.finance

This will make CPOOL a deflationary asset in the future.

Want to start using CPOOL to borrow or lend?

The product is live and working and can be used at app.clearpool.finance

10) CPOOL is backed by a large number of business and featured in some notable magazines.

You can look these up if you want (including the artikels written about them).

You can look these up if you want (including the artikels written about them).

11) Robert Alcorn, Co-founder and CEO was Previously Executive Director and Head of Repo Trading APAC at first Abu Dhabi bank.

Alessio Quaglini, Co-founder and Senior Advisor previously worked at First Abu Dhabi Bank, BBVA, Accenture and CONSOB.

Alessio Quaglini, Co-founder and Senior Advisor previously worked at First Abu Dhabi Bank, BBVA, Accenture and CONSOB.

12) Jakob Kronbichler, Co-Founder and CCO was

Previously Commercial Director at Aspire - South East Asia’s leading digital Neobank and Rocket Internet.

The rest of the team can be seen in the image below.

Previously Commercial Director at Aspire - South East Asia’s leading digital Neobank and Rocket Internet.

The rest of the team can be seen in the image below.

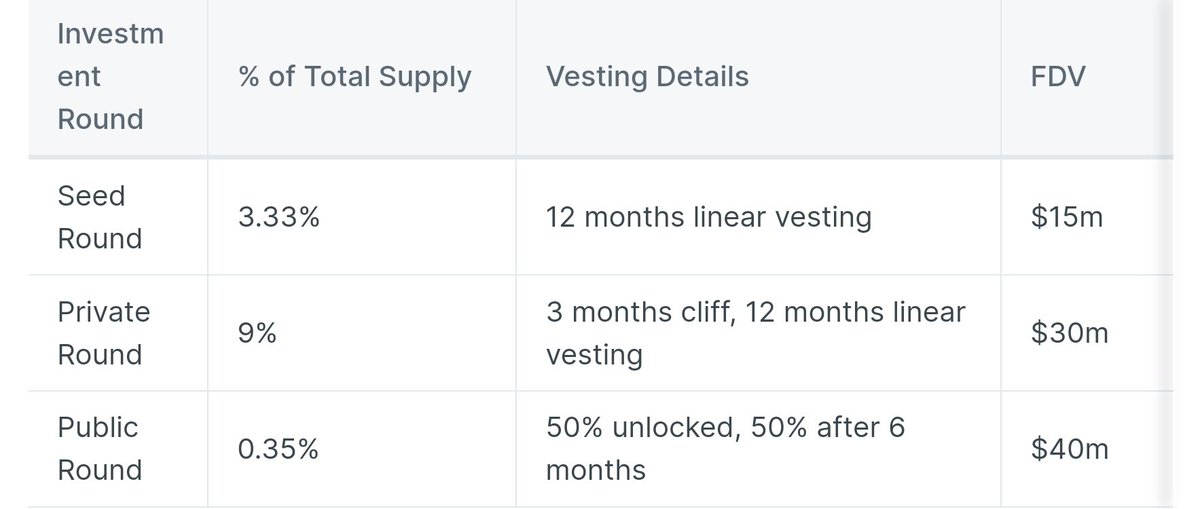

14) The token launched on 28th October 2021 and is since then partially in lockup by the team and partners.

See the vesting dates and amount in the images below.

See the vesting dates and amount in the images below.

15) DeFi protocols requiring much more collateral than borrowed money have emerged as a weakness for business institutions.

CeFi platforms depend less on collateral by reintroducing counterparty possibility, but present incredibly tiny possibility management for LPs.

CeFi platforms depend less on collateral by reintroducing counterparty possibility, but present incredibly tiny possibility management for LPs.

16) Clearpool solving these issues make it a strong contender in today's market.

For a deeper look I urge you to take a look at their official website and socials for more information (or use their product yourself).

clearpool.finance

Nova out ❤️

For a deeper look I urge you to take a look at their official website and socials for more information (or use their product yourself).

clearpool.finance

Nova out ❤️

17) If you want to keep up to date to most of my content and interesting projects give me a follow @CryptoGirlNova.

I also research the communities top voted cryptocurrency every week so you can keep track of all the most exciting projects.

Your favorite writer Nova 📘

I also research the communities top voted cryptocurrency every week so you can keep track of all the most exciting projects.

Your favorite writer Nova 📘

18) If you had value from this and liked this thread, it would really bring a smile to my face if you could retweet the first post so this can help as many people as possible.

Everyone deserves free knowledge 📘

Love you all ❤️

First post 👇

Everyone deserves free knowledge 📘

Love you all ❤️

First post 👇

https://twitter.com/CryptoGirlNova/status/1575176654082932736?t=5DnTH8pbxGMZbW7VqFVKMg&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh