A thread on how cutting the top rate of tax will raise MORE revenue

International evidence shows clearly that cutting top marginal tax rates invariably increases revenue and just as importantly that raising them reduces revenues. Here are some international and UK examples: 1/16

International evidence shows clearly that cutting top marginal tax rates invariably increases revenue and just as importantly that raising them reduces revenues. Here are some international and UK examples: 1/16

The top rate of US income tax was raised to 71% during WWI with dire economic results and was later cut to 25% by Presidents Coolidge & Harding. As a result, revenues nearly doubled. The share of tax paid by those earning over $100k rose from 28% in 1921 to 51% in 1925. 2/16

President Kennedy's 1963 tax cuts reduced taxes at all levels, cutting the top rate from 91% to 70%. Total income tax revenue increased from $68.8 bn in 1964 to $95.7 bn in 1968. The share of tax paid by those earning over $50k went up from 12% in 1963 to 15% in 1966. 3/16

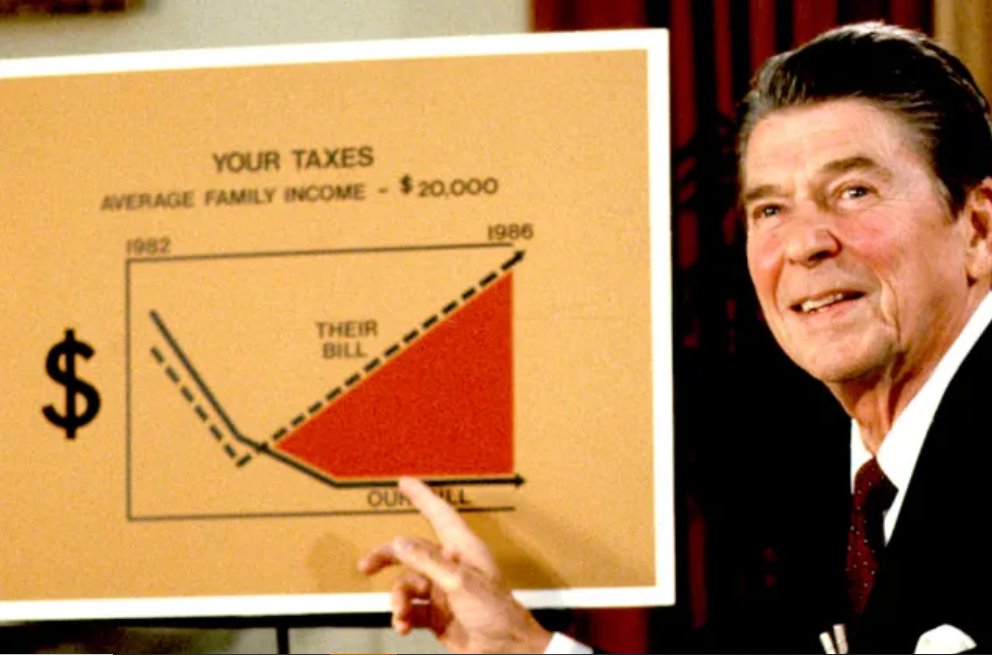

President Reagan cut the top rate of US income tax from 70% to 50% in 1981 and cut the top rate again to 28% in 1986. The share paid by the top 10% of taxpayers increased from 48.0% in 1981 to 57.2% in 1988. 4/16

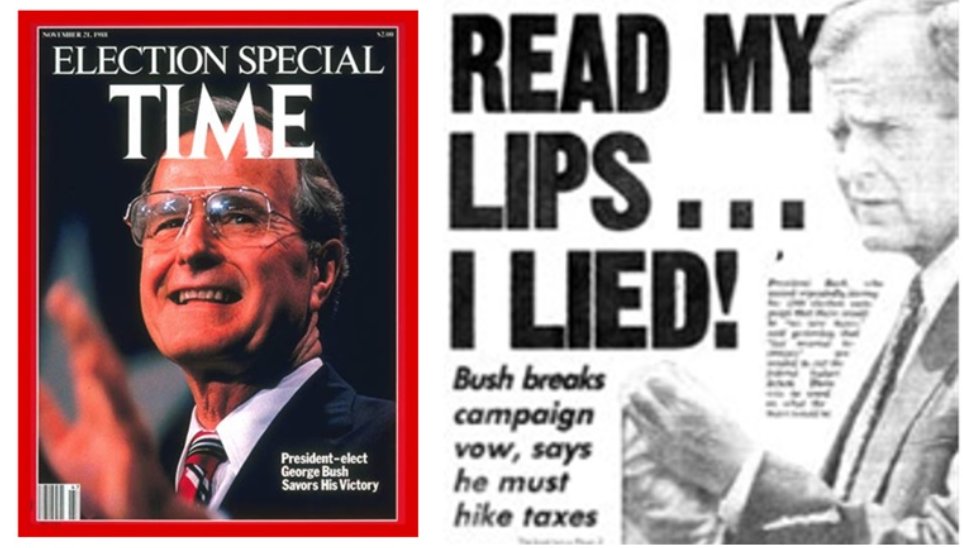

President George HW Bush raised the top marginal income tax rate to 31% in 1990. Tax receipts fell as a % of GDP and in 1991 after the tax increase richer taxpayers paid $6.5 billion LESS than they had in 1990. 5/16

In 2003 President George W Bush reduced the highest rate of income tax from 39.6% to 35% and the dividend tax from 39.6% to 15%. From 2004 to 2007 federal tax receipts increased by $785 billion with the bulk of that coming from the better off. 6/16

During the period 2003 to 2006 the number of Americans filing tax returns claiming income of over a million almost doubled, from 181,000 to 354,000. The total taxes paid by these millionaire households rose by 107% in just two years, from $132 billion to $273 billion. 7/16

When the top federal tax rate in Canada was cut from 45% in 1981 to 29% in 1990, the share of tax receipts paid by the top 10% of taxpayers grew from 29% in 1981 to 45% in 1992. 8/16

India in 1984 reduced its top income rate from 65% to 50%. As a result, tax revenue in the 1985 fiscal year rose by 20% over 1984. 9/16

In 1997 Indian income tax rates were reduced for all taxpayers with the effective tax rate declining from 22% to 16.3%. Over the following six years revenue rose by a ratio of 1:1.4 - for each 1% decline in the tax rate, revenue increased by 1.4%. 10/16

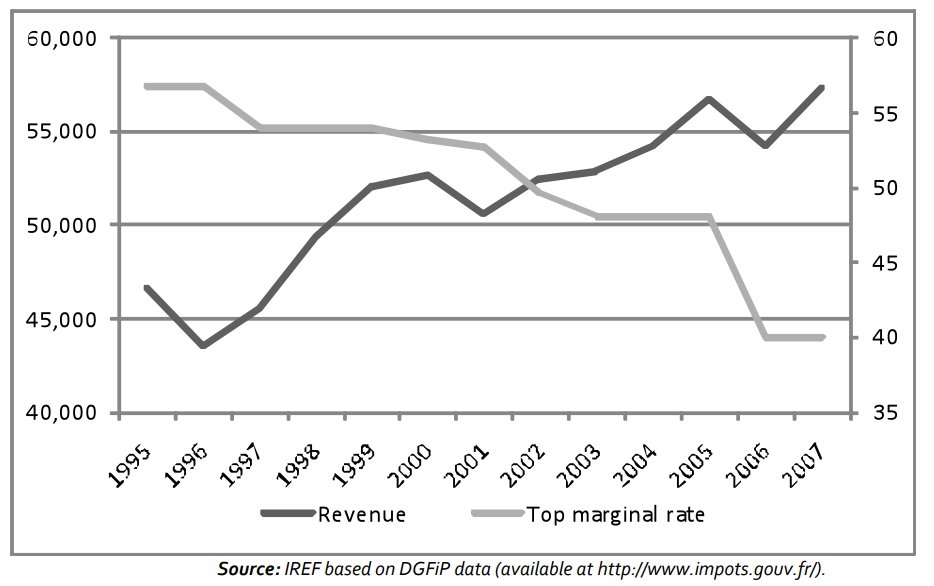

France in 2006 reduced the top marginal rate from 48.09% to 40%. That and further cuts in marginal tax rates until 2007 resulted in substantially higher tax receipts as this graph shows: 11/16

Sweden increased income tax for high-earners by 3% to 60% in 2016. The affected group reduced their earnings and less revenue was raised. 12/16 bit.ly/3RnM6Wd

In 1979 Chancellor Geoffrey Howe cut the top rate from 83% to 60%. Before the cut, the top 1 percent of UK taxpayers paid only 11% of the total income tax take. By 1988 they were paying 14% of income tax revenue. 13/16

In 1988 Nigel Lawson cut top rates from 60% to 40% and receipts rose further. By 1997 the top 1% of earners paid a huge 21% of the total tax bill. This chart shows the huge increases paid by higher earners as a result of the Howe-Lawson reforms: 14/16

In April 2013 Chancellor Osbourne cut the additional rate of income from 50% to 45%. In the subsequent year £8bn more revenue was raised. The top 1% of taxpayers now pay 30% of income tax. 15/16

All the evidence suggests that the cut in the top UK rate from 45% to 40% will increase tax revenue and that any subsequent raising of the rate from 40% would decrease revenue. 16/16

• • •

Missing some Tweet in this thread? You can try to

force a refresh