Campaign for lower taxes and a more democratic economy. A project of the Tax Reform Council @TaxReformUK.

How to get URL link on X (Twitter) App

11.Mohamed Mansour — billionaire businessman — Egypt

11.Mohamed Mansour — billionaire businessman — Egypt

"Even in her best-case scenario, rich-squeezing barely affects the public finances. [By her own estimates] her moves on inheritance tax, schools & non-doms together increase the tax haul by just below 0.5%. The real money is raised by stealth tax: freezing everyone’s tax-free allowance & catching more workers in higher tax brackets. And, of course, the big one: raising employers’ national insurance (NI), a tax paid indirectly by workers (through lower pay) and consumers (through inflation, now highest in the G7)."

"Even in her best-case scenario, rich-squeezing barely affects the public finances. [By her own estimates] her moves on inheritance tax, schools & non-doms together increase the tax haul by just below 0.5%. The real money is raised by stealth tax: freezing everyone’s tax-free allowance & catching more workers in higher tax brackets. And, of course, the big one: raising employers’ national insurance (NI), a tax paid indirectly by workers (through lower pay) and consumers (through inflation, now highest in the G7)."

Miatta & the NEF are fixated on forcing the transfer of private rented homes to the public sector. "Policy should be geared towards upgrading existing private rented homes to ensure they are energy efficient, & acquiring & repurposing them as homes for social rent," they write.

Miatta & the NEF are fixated on forcing the transfer of private rented homes to the public sector. "Policy should be geared towards upgrading existing private rented homes to ensure they are energy efficient, & acquiring & repurposing them as homes for social rent," they write.

She wants to grab people's pension pots, saying "those with comfortable pension pots must be expected to pay more towards the common good.”

She wants to grab people's pension pots, saying "those with comfortable pension pots must be expected to pay more towards the common good.”

Over £100k the tax rate on his £25,000 bonus was 60% i.e. £15,000. "On top of this, he pays 2% NI plus another 9% is deducted to pay for this student loan which is really a graduate tax. This means an effective tax rate of 71% i.e. £17,750." writes Adam Walker

Over £100k the tax rate on his £25,000 bonus was 60% i.e. £15,000. "On top of this, he pays 2% NI plus another 9% is deducted to pay for this student loan which is really a graduate tax. This means an effective tax rate of 71% i.e. £17,750." writes Adam Walker

"Labour ran for office saying repeatedly that their plans were “about prosperity, not higher taxes”. At its manifesto launch Angela Rayner announced that “we can’t tax our way to growth.” To which Rachel Reeves added that “we don’t have a tax-and-spend manifesto. We have a growth plan.”

"Labour ran for office saying repeatedly that their plans were “about prosperity, not higher taxes”. At its manifesto launch Angela Rayner announced that “we can’t tax our way to growth.” To which Rachel Reeves added that “we don’t have a tax-and-spend manifesto. We have a growth plan.”

In “The end of austerity?” (Resolution Foundation blog, 13 Jun 2017) Bell argued that ending austerity should mean lifting the public-sector pay cap and reversing benefit cuts. “…An extra £3bn a year would be needed for a 1% pay rise," he said.

In “The end of austerity?” (Resolution Foundation blog, 13 Jun 2017) Bell argued that ending austerity should mean lifting the public-sector pay cap and reversing benefit cuts. “…An extra £3bn a year would be needed for a 1% pay rise," he said.

"That the Resolution Foundation seems to think that the answer is yet more public spending says much about the Labour Left’s philosophy. Economic growth, it seems to believe, can only ever result from public investment, not private investment," notes Ross Clark

"That the Resolution Foundation seems to think that the answer is yet more public spending says much about the Labour Left’s philosophy. Economic growth, it seems to believe, can only ever result from public investment, not private investment," notes Ross Clark

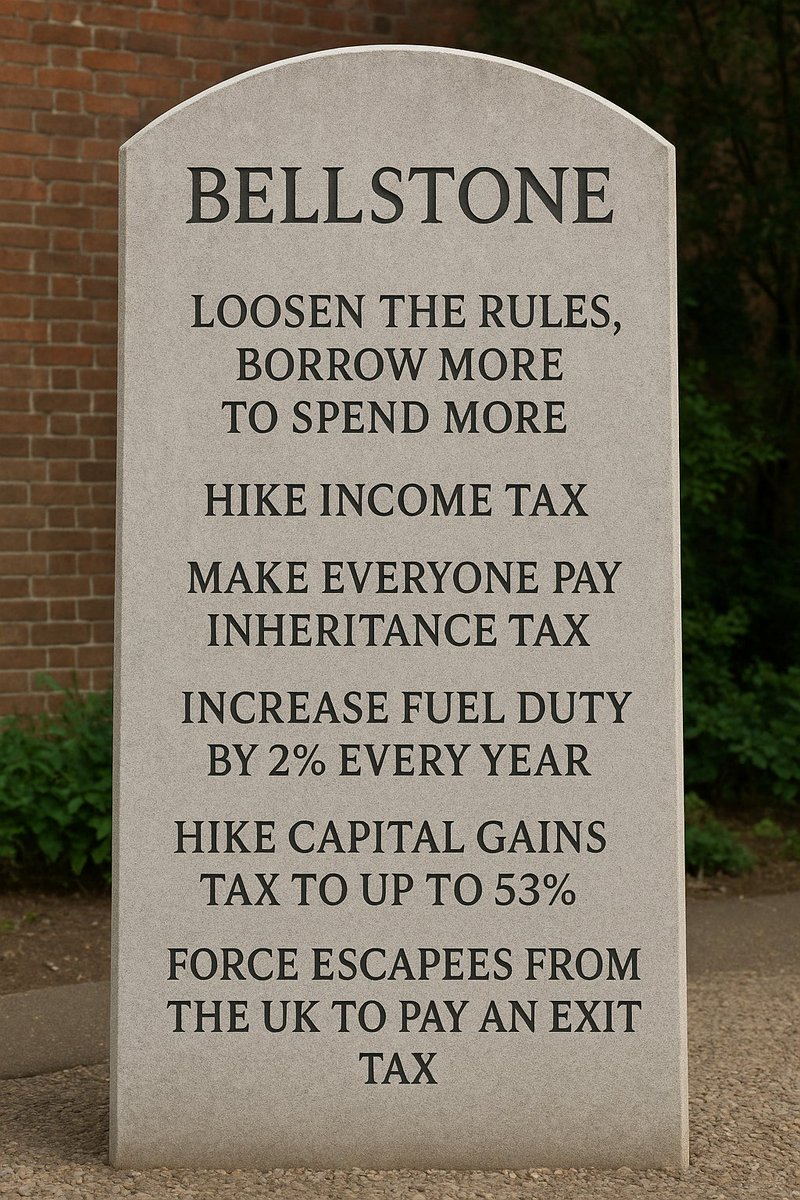

Raise the capital gains tax (CGT) rate on shares to 37% & on other assets (mainly real estate) to as much as 53%

Raise the capital gains tax (CGT) rate on shares to 37% & on other assets (mainly real estate) to as much as 53%

Saddat Abid from the property buying firm Property Saviour said his clients have been spooked. “A couple in their sixties were planning to downsize from their £800,000 family home, but have now postponed the sale completely. They’re concerned that the residence nil-rate band that currently gives them an extra £175,000 inheritance tax allowance will be scrapped."

Saddat Abid from the property buying firm Property Saviour said his clients have been spooked. “A couple in their sixties were planning to downsize from their £800,000 family home, but have now postponed the sale completely. They’re concerned that the residence nil-rate band that currently gives them an extra £175,000 inheritance tax allowance will be scrapped."

"Crucially, Stamp duty has a negative impact on the economy by discouraging people from moving to homes better suited to their life stage or relocating for better job opportunities elsewhere in the country. Stamp duty also hampers property renovation & has a substantial multiplier effect on the wider economy."

"Crucially, Stamp duty has a negative impact on the economy by discouraging people from moving to homes better suited to their life stage or relocating for better job opportunities elsewhere in the country. Stamp duty also hampers property renovation & has a substantial multiplier effect on the wider economy."

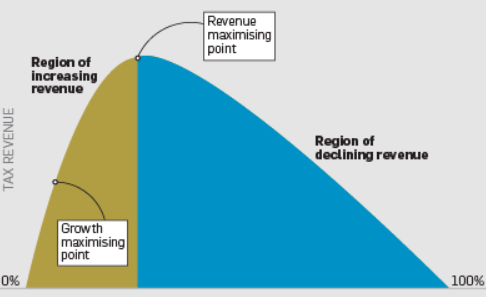

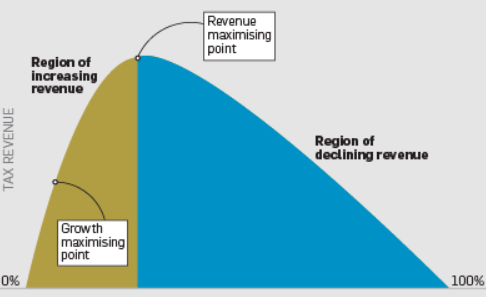

In 1979 Chancellor Geoffrey Howe cut the top rate from 83% to 60%. Before the cut, the top 1% of UK taxpayers paid only 11% of the total income tax take. By 1988 they were paying 14% of income tax revenue.

In 1979 Chancellor Geoffrey Howe cut the top rate from 83% to 60%. Before the cut, the top 1% of UK taxpayers paid only 11% of the total income tax take. By 1988 they were paying 14% of income tax revenue.

"It’s hard to imagine how so many single parents are going to find the time to continue running a business, juggling childcare but then also learn how to bookkeep & file quarterly updates without it putting a huge amount of pressure on top,” said Tom Bickle of JP Blackmoor Ltd.

"It’s hard to imagine how so many single parents are going to find the time to continue running a business, juggling childcare but then also learn how to bookkeep & file quarterly updates without it putting a huge amount of pressure on top,” said Tom Bickle of JP Blackmoor Ltd.

April exits were up 75% from 12 months earlier and the highest in 4 years.

April exits were up 75% from 12 months earlier and the highest in 4 years.

If the Government wants to get more pension money invested in British shares it should reverse Gordon Brown's tax grab & restore the pension dividend tax credit. And it should scrap stamp duty on shares.

If the Government wants to get more pension money invested in British shares it should reverse Gordon Brown's tax grab & restore the pension dividend tax credit. And it should scrap stamp duty on shares.

“Savers need confidence that the goalposts won’t constantly shift. Rather than constantly tweaking rules we need cross party consensus on issues like this to deliver the stability required,” Tully said.

“Savers need confidence that the goalposts won’t constantly shift. Rather than constantly tweaking rules we need cross party consensus on issues like this to deliver the stability required,” Tully said.

Tax hikes are programmed for April 1 and April 6.

Tax hikes are programmed for April 1 and April 6.

Under reforms introduced by Tony Blair’s Government, from the year 2002-03 business assets attracted a reduced rate of 10% CGT if held for more than 2 years. CGT revenues increased sharply as a consequence, doubling in 3 years.

Under reforms introduced by Tony Blair’s Government, from the year 2002-03 business assets attracted a reduced rate of 10% CGT if held for more than 2 years. CGT revenues increased sharply as a consequence, doubling in 3 years.

As well as hiking the rate, Labour is lowering the level at which firms have to start paying NI contributions to £5k a year instead of £9.1k a year.

As well as hiking the rate, Labour is lowering the level at which firms have to start paying NI contributions to £5k a year instead of £9.1k a year.

Dyson said that 60 of the top 100 UK taxpayers were owners of family businesses and together pay £3 billion a year in taxes. “Such companies employ 14 million people & contribute many more billions — year in, year out — funding vital public services,” he said.

Dyson said that 60 of the top 100 UK taxpayers were owners of family businesses and together pay £3 billion a year in taxes. “Such companies employ 14 million people & contribute many more billions — year in, year out — funding vital public services,” he said.

The family farm tax row, which will both dominate the news for months and threaten Labour’s 100 rural seats was a totally unnecessary blunder.

The family farm tax row, which will both dominate the news for months and threaten Labour’s 100 rural seats was a totally unnecessary blunder.