EVERYTHING YOU NEED TO KNOW ABOUT $QNT

One of the tokens with the fastest recovery since the Bitcoin drop, rising more than 230% in the last months.

A thread 🧵👇

One of the tokens with the fastest recovery since the Bitcoin drop, rising more than 230% in the last months.

A thread 🧵👇

WHAT IS $QNT?

It's an ERC-20 token fully compatible with all blockchains and protocols to easily integrate into MApps, DApps, and smart contracts.

It is a P2P protocol that uses smart contracts to enable people to create, manage, and trade their tokens on the network.

1/8🧵

It's an ERC-20 token fully compatible with all blockchains and protocols to easily integrate into MApps, DApps, and smart contracts.

It is a P2P protocol that uses smart contracts to enable people to create, manage, and trade their tokens on the network.

1/8🧵

HOW DOES QUANT ( $QNT) WORK?

The communication, interoperability, and scale hurdles frequently seen on blockchains were intended to be eliminated with the Quant protocol.

Layers are matched to tasks as follows:

➡️Transaction

➡️Messaging

➡️Filtering and Ordering

2/8🧵

The communication, interoperability, and scale hurdles frequently seen on blockchains were intended to be eliminated with the Quant protocol.

Layers are matched to tasks as follows:

➡️Transaction

➡️Messaging

➡️Filtering and Ordering

2/8🧵

HOW DOES QUANT ( $QNT) WORK?

Quant integrates several blockchains with enterprise applications without the need for new infrastructure. It is a plug-and-play solution.

Distributed ledger technology and APIs are used to connect several blockchains to one another.

3/8🧵

Quant integrates several blockchains with enterprise applications without the need for new infrastructure. It is a plug-and-play solution.

Distributed ledger technology and APIs are used to connect several blockchains to one another.

3/8🧵

THE OVERLEDGER IN $QNT

Users can construct and access multi-chain apps using the patented technology known as the Overledger OS, which is not open source.

The Overledger Network consists of the developers and enterprises that use the Quant Network

4/8🧵

Users can construct and access multi-chain apps using the patented technology known as the Overledger OS, which is not open source.

The Overledger Network consists of the developers and enterprises that use the Quant Network

4/8🧵

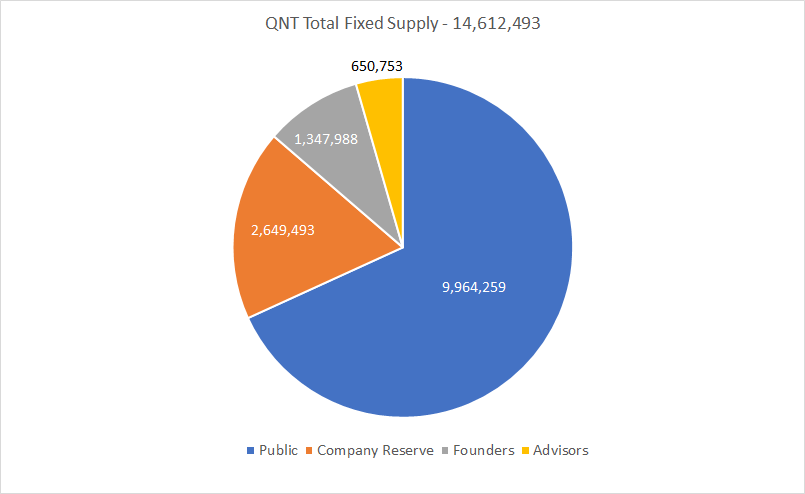

TOKENOMICS OF $QNT

- Market Cap: $2.5 billion

- Fully Diluted Market Cap: $3 billion

- Maximum Supply: 14.6 billion QNT

- Total Supply: 14.6 billion QNT

- Circulating Supply: approximately 12 billion QNT

Enough Company Reserve tokens to survive through a bear market.

5/8🧵

- Market Cap: $2.5 billion

- Fully Diluted Market Cap: $3 billion

- Maximum Supply: 14.6 billion QNT

- Total Supply: 14.6 billion QNT

- Circulating Supply: approximately 12 billion QNT

Enough Company Reserve tokens to survive through a bear market.

5/8🧵

TEAM BEHIND $QNT

Gilbert Verdian, the current CEO, started Quant in 2018. An initial coin offering (ICO) that raised $11 million was used to support the project.

Verdian has been working in the security sector for 20 years and founded the Blockchain ISO Standard TC307.

6/8🧵

Gilbert Verdian, the current CEO, started Quant in 2018. An initial coin offering (ICO) that raised $11 million was used to support the project.

Verdian has been working in the security sector for 20 years and founded the Blockchain ISO Standard TC307.

6/8🧵

PARTNERS OF $QNT

Oracle: Is the world’s largest database management company offering software and technology, cloud-engineered systems etc...

LACChain: A global alliance led by the IDB Lab.

SIA: A well-known hi-tech Italian company, is now part of Nexi Group.

7/8🧵

Oracle: Is the world’s largest database management company offering software and technology, cloud-engineered systems etc...

LACChain: A global alliance led by the IDB Lab.

SIA: A well-known hi-tech Italian company, is now part of Nexi Group.

7/8🧵

CONCLUSION ABOUT QUANT $QNT

Quant's future is dependent on a number of variables, including new technology developments for Quant projects, the crypto market environment, governmental policies, and more.

A project with a bright future

8/8🧵

Quant's future is dependent on a number of variables, including new technology developments for Quant projects, the crypto market environment, governmental policies, and more.

A project with a bright future

8/8🧵

I hope this thread has been helpful to you, if it has been, I would appreciate a rt and like 🔄❤

$QNT #Quant #crypto

$QNT #Quant #crypto

• • •

Missing some Tweet in this thread? You can try to

force a refresh