NEW

OBR confirms on record my story from 9 days ago that it prepared a draft forecast for new Chancellor waiting for him on first day at Treasury 6th September, and that an offer for a legally compliant forecast to accompany the mini-budget was rejected.

bbc.co.uk/news/business-…

OBR confirms on record my story from 9 days ago that it prepared a draft forecast for new Chancellor waiting for him on first day at Treasury 6th September, and that an offer for a legally compliant forecast to accompany the mini-budget was rejected.

bbc.co.uk/news/business-…

In a letter from OBR chief Richard Hughes to SNP MPs @alisonthewliss and @ianblackford_MP

* We sent a draft economic and fiscal forecast to the new Chancellor on 6 September, his first day in office. We offered, at the time, to update that forecast

* We sent a draft economic and fiscal forecast to the new Chancellor on 6 September, his first day in office. We offered, at the time, to update that forecast

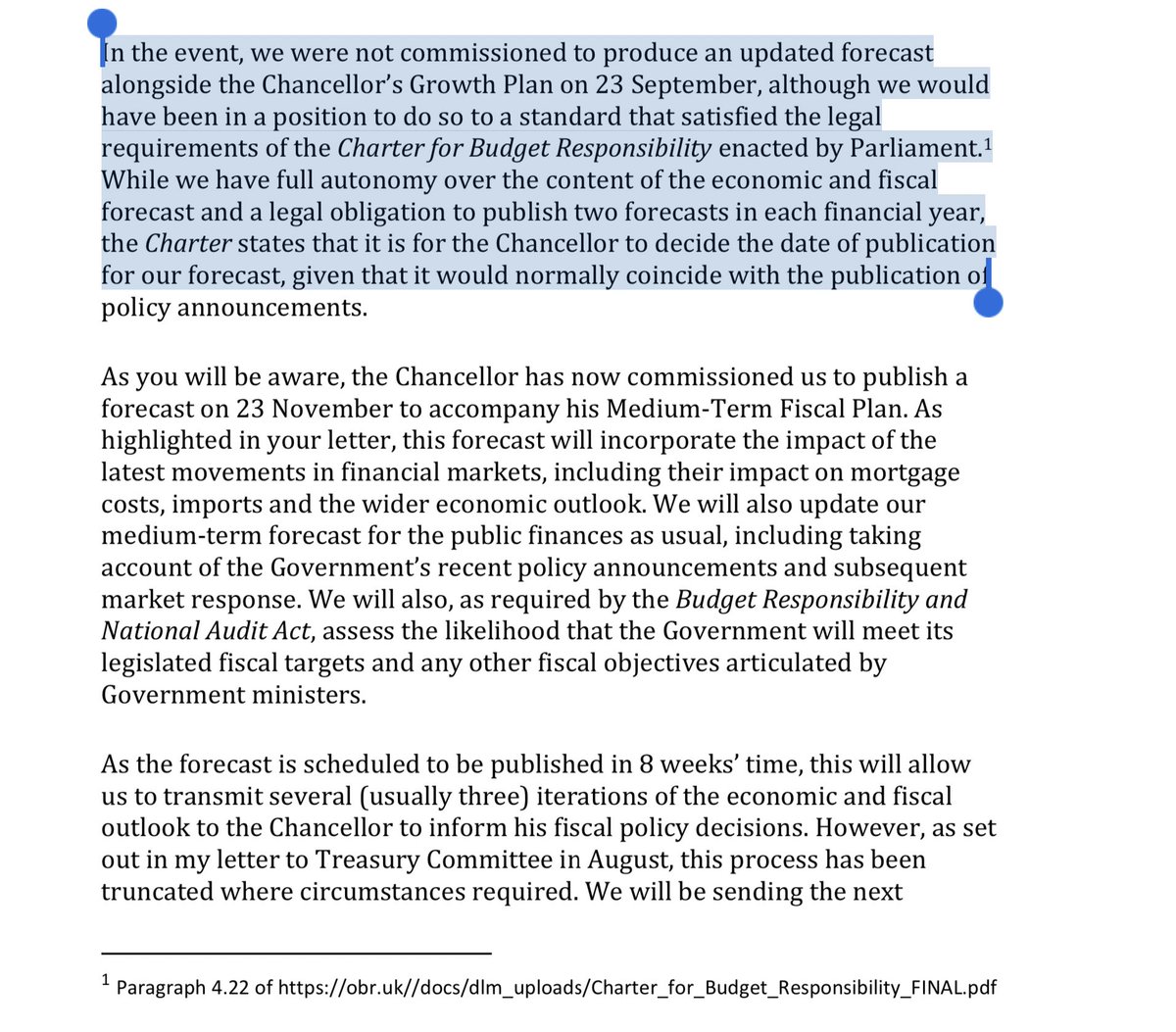

“In the event, we were not commissioned to produce an updated forecast alongside the Chancellor’s Growth Plan on 23 September, although we would have been in a position to do so to a standard that satisfied the legal requirements of the Charter for Budget Responsibility”… OBR

HM Treasury have previously told me that the OBR acknowledged that the forecast it could have published alongside the mini Budget, would not have been as full a document as normal, which is acknowledged by OBR, but it still would have been to legal standards.

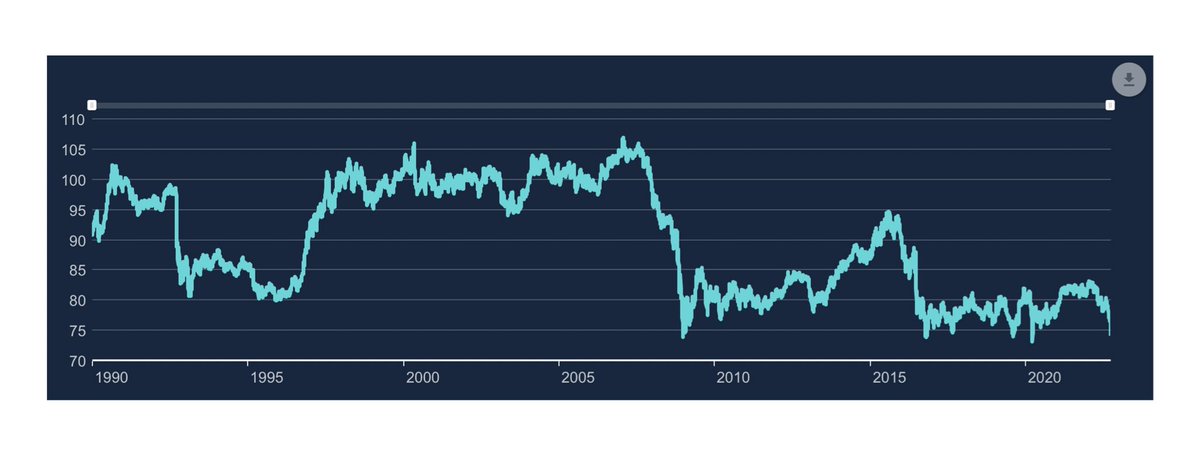

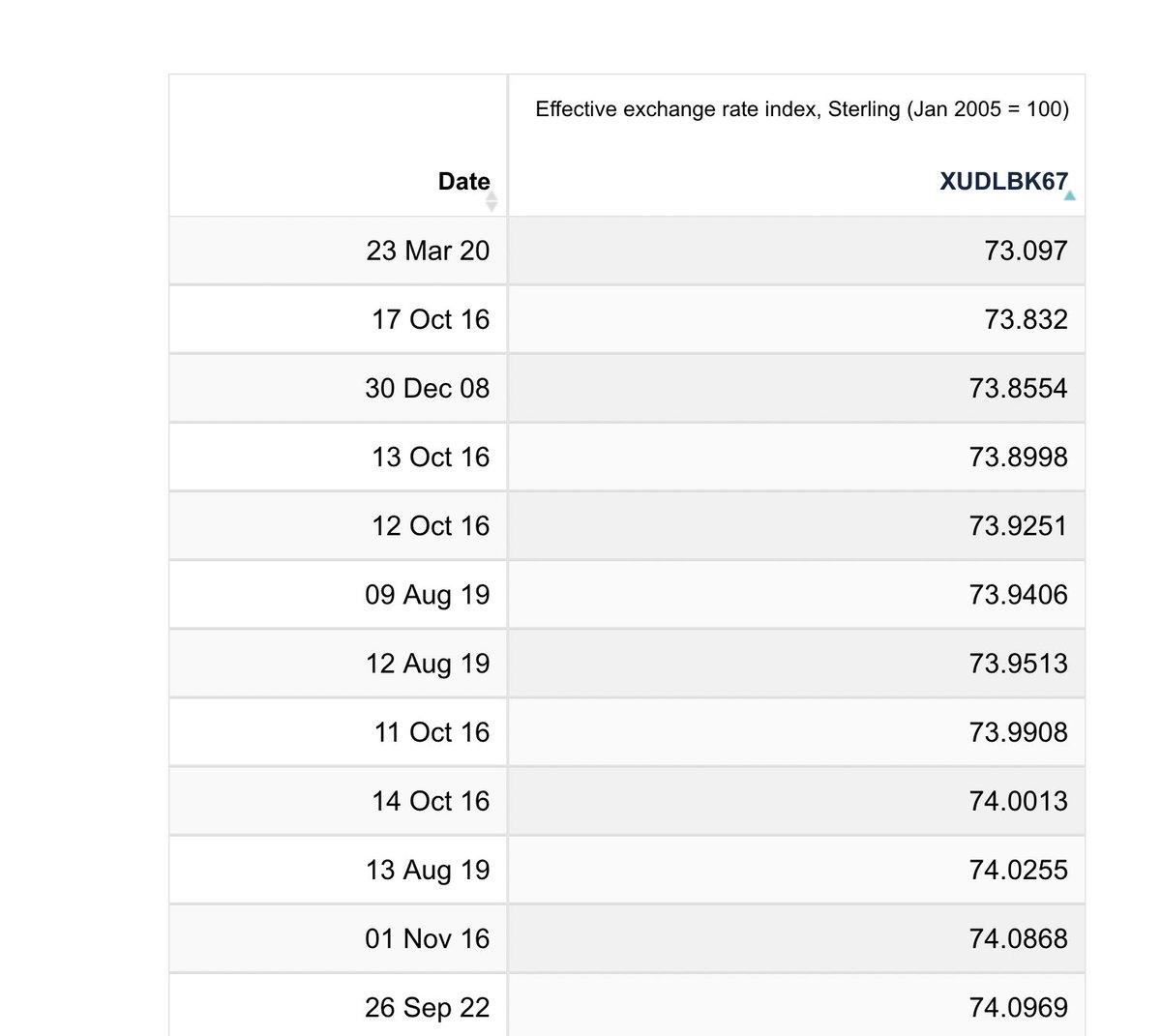

Many market participants, traders, & eg ex BoE Governor Carney have identified this rejection of borrowing forecasts in mini budget as an important factor in the loss of market confidence seen… part of a “pattern” of undercutting independent institutions Carney told @bbcr4today

And to add to this, as I reported earlier this week, it is clear that the Bank of England insisted on more prominence for the OBR process as part of its “calm the markets” statement - and that will have some consequences…

bbc.co.uk/news/business-…

bbc.co.uk/news/business-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh