About -

Craftsman Automation Ltd, established in 1986, is a diversified engineering co with vertically integrated manufacturing capabilities. Co has 12

strategically located manufacturing facilities across 7 cities in India (Coimbatore, Pune, Faridabad, Bangalore, Jamshedpur,

Craftsman Automation Ltd, established in 1986, is a diversified engineering co with vertically integrated manufacturing capabilities. Co has 12

strategically located manufacturing facilities across 7 cities in India (Coimbatore, Pune, Faridabad, Bangalore, Jamshedpur,

Sriperumbuthur & Pithampur) with a total built-up area of over 1.5 million sq. ft. Co has recently commissioned a new unit in Pune with high end fully automated Italian and Swiss equipment.

Company has three subsidiaries, one in Netherlands (Craftsman Europe B.V) & two

in India.

Company has three subsidiaries, one in Netherlands (Craftsman Europe B.V) & two

in India.

Business Overview -

Co is engaged in three business segments :

1. Automotive (Powertrain and Others) -

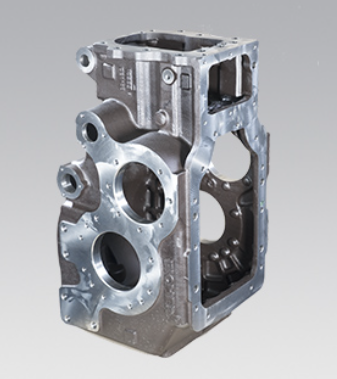

Key products in this segment are highly engineered & include engine parts such as cylinder blocks & cylinder heads, camshafts, transmission parts, gear box housings, turbo

Co is engaged in three business segments :

1. Automotive (Powertrain and Others) -

Key products in this segment are highly engineered & include engine parts such as cylinder blocks & cylinder heads, camshafts, transmission parts, gear box housings, turbo

chargers & bearing caps, catering to CV, SUV, tractor & off highway OEMs. Powertrain segment contributed 52% of total revenue & 72.8% of EBIT with 27.2% EBIT margin (most profitable segment for the company) in FY21.

2. Automotive (Aluminium Products) -

The aluminium products segment produces products like crank case & cylinder blocks for two-wheelers, engine & structural parts for passenger vehicles & gearbox housing for heavy commercial vehicles.

The aluminium products segment produces products like crank case & cylinder blocks for two-wheelers, engine & structural parts for passenger vehicles & gearbox housing for heavy commercial vehicles.

This segment contributed 21% to the total revenue and 0.84% to the EBIT with 0.77% EBIT margin in FY 21.

3. Industrial & Engineering (I & E) -

I & E segment is divided into two sub-segments, Contract Manufacturing & Storage Solution & Material Handling. I & E segment

3. Industrial & Engineering (I & E) -

I & E segment is divided into two sub-segments, Contract Manufacturing & Storage Solution & Material Handling. I & E segment

contributed 26.86% of FY 21 revenue & 26.27% of EBIT with margins at 18.98%. Within this vertical, 86% of sales was contributed by high-end precision products business and storage solutions business contributed remaining 14% in FY 21.

Powertrain business growth target set at more than 20% in FY23E and FY24E -

The powertrain business (52% of topline and 79% of EBIT margins in FY22) is driven mainly

by the CV OEMs who are 54% at the end of Q4 v/s 51% qoq. With rise in CV industry &

thereby sales of CV OEMs,

The powertrain business (52% of topline and 79% of EBIT margins in FY22) is driven mainly

by the CV OEMs who are 54% at the end of Q4 v/s 51% qoq. With rise in CV industry &

thereby sales of CV OEMs,

Co’s Power-train business saw a healthy growth in the quarter at 17.4% yoy. Margins came in close to 26% v/s 27% yoy.

The Co has won an order for PV cylinder block from a big OEM as it intends to divert business from Europe to India under its localization plans. FY22 Powertrain

The Co has won an order for PV cylinder block from a big OEM as it intends to divert business from Europe to India under its localization plans. FY22 Powertrain

business has grown by 42.3% yoy on the back of solid surge in CV business especially HCV business which contributed 85% of the CV portfolio of CAL.

Market leader in cylinder blocks and cylinder heads -

Co is the largest player in the machining of cylinder blocks & cylinder heads for the intermediate, medium & heavy commercial vehicles as well as for the construction equipment industry & is also among the top 3-4 players.

Co is the largest player in the machining of cylinder blocks & cylinder heads for the intermediate, medium & heavy commercial vehicles as well as for the construction equipment industry & is also among the top 3-4 players.

Growth drivers for Automotive – Powertrain segment :

~ Implementation of BS VI emission norms.

~ Incremental spending on infrastructure development.

~ Commissioning of dedicated freight corridors.

~ Implementation of BS VI emission norms.

~ Incremental spending on infrastructure development.

~ Commissioning of dedicated freight corridors.

Growth drivers for Automotive – Aluminium segment :

~ Usage of non-ferrous metals (aluminium) to reduce the weight of vehicles.

~ Growth in automobile sales (mainly two wheelers).

~ Cost competitiveness (demand from export market).

~ Usage of non-ferrous metals (aluminium) to reduce the weight of vehicles.

~ Growth in automobile sales (mainly two wheelers).

~ Cost competitiveness (demand from export market).

New business win from passenger vehicles and farm equipment -

In Q2 FY 22, co has won new long term orders from the PSA group (Citroen) & is expected to peak to Rs 200 Cr by FY 24. Co also has received orders to manufacture very large die-casting machines from the farm equipment

In Q2 FY 22, co has won new long term orders from the PSA group (Citroen) & is expected to peak to Rs 200 Cr by FY 24. Co also has received orders to manufacture very large die-casting machines from the farm equipment

manufacturer. Execution of PSA group orders not only strengthen the company’s presence in

the passenger vehicle space but also improve the capacity utilisation of AutoAluminium segment, which was not fully utilized in previous quarters (50% utilization in Q4 FY21).

the passenger vehicle space but also improve the capacity utilisation of AutoAluminium segment, which was not fully utilized in previous quarters (50% utilization in Q4 FY21).

Clientele -

Co supply its products to several domestic and global marquee OEMs of two/three wheelers, PV, CVs across its three business segments. Co has a diversified client base with its top 10 customers accounting for more than 58% in FY

21

Co supply its products to several domestic and global marquee OEMs of two/three wheelers, PV, CVs across its three business segments. Co has a diversified client base with its top 10 customers accounting for more than 58% in FY

21

Financial Summary -

Co reported total income of ₹678 cr during the period ended June 30,22 as compared to ₹436 cr during the period ended June 30,21.

Co posted net profit of ₹ 57 cr for the period ended June 30,22 as against net profit of ₹24 cr in June 30,21.

Co reported total income of ₹678 cr during the period ended June 30,22 as compared to ₹436 cr during the period ended June 30,21.

Co posted net profit of ₹ 57 cr for the period ended June 30,22 as against net profit of ₹24 cr in June 30,21.

Key Risks -

~ Co's business would be adversely affected by lose in market share & profit declines, If unable to respond adequately to the increased competition & pricing pressures from existing players & new entrants.

~ Loss of key customers or significant reduction in

~ Co's business would be adversely affected by lose in market share & profit declines, If unable to respond adequately to the increased competition & pricing pressures from existing players & new entrants.

~ Loss of key customers or significant reduction in

production & sales, or demand for production from significant customers would adversely affect Craftsman’s Business.

~ Risks arising from interest rate fluctuations, which could adversely affect results of operations planned expenditures & cash flows.

~ Risks arising from interest rate fluctuations, which could adversely affect results of operations planned expenditures & cash flows.

Conclusion -

The Power train business will be driven by expected pick up in Replacement cycle for HCVs in the coming quarters and also fresh demand risen by movement in the investment capex

cycle of the country. Dieselization demand from all over the world & localization of

The Power train business will be driven by expected pick up in Replacement cycle for HCVs in the coming quarters and also fresh demand risen by movement in the investment capex

cycle of the country. Dieselization demand from all over the world & localization of

diesel vehicle demand should lead to strong demand of >25% for Power trains. Rising infrastructure growth, construction, mining, agri-commodities transportation etc will all lead to a very strong revival in the CV industry. Co is well placed to capitalize the growth opportunity.

• • •

Missing some Tweet in this thread? You can try to

force a refresh