SPX 666…3333…2222…>4444…3333

BofA: we are tactical bears…“short twos & spoos” ‘til Halloween…SPX 3333 to force “policy panic”

BofA: we are tactical bears…“short twos & spoos” ‘til Halloween…SPX 3333 to force “policy panic”

BofA suggests waiting ~ 6 months

“Big Low” not ‘til Q1 when recession/credit shocks = “peak Fed”, “peak yields”, “peak US$”; trade of ‘23 short $, long EM, small cap, cyclical.

"Markets stop panicking when Central Banks start panicking"

“Big Low” not ‘til Q1 when recession/credit shocks = “peak Fed”, “peak yields”, “peak US$”; trade of ‘23 short $, long EM, small cap, cyclical.

"Markets stop panicking when Central Banks start panicking"

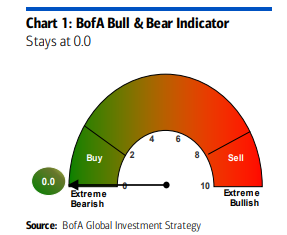

BofA Bull & Bear Indicator: 0.0

max bearish on deteriorating bond flows, credit technicals;

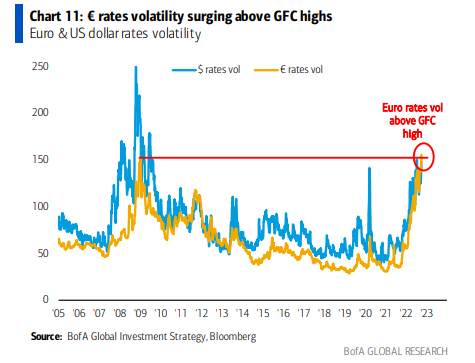

“contrarian buy” no workee when (as in 2008) 2sd credit event brewing

max bearish on deteriorating bond flows, credit technicals;

“contrarian buy” no workee when (as in 2008) 2sd credit event brewing

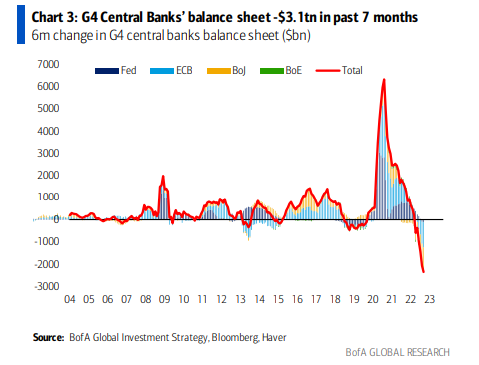

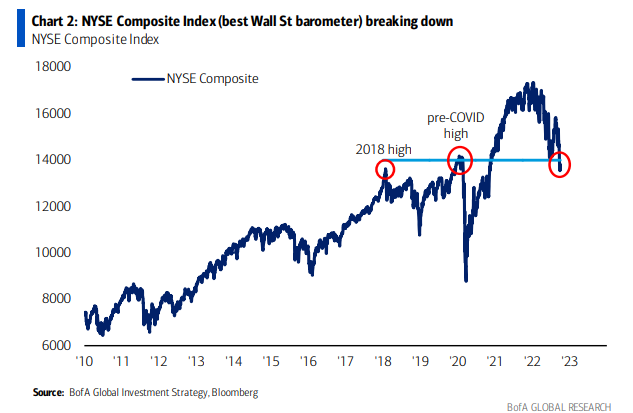

"Wall St disorder in 2022 reflects painful regime change as bullish deflationary era of peace, globalization, fiscal discipline, QE, zero rates, low taxes, inequality gives way to...

inflationary era of war, nationalism, fiscal panic, QT, high rates, high tazes, inclusion."

inflationary era of war, nationalism, fiscal panic, QT, high rates, high tazes, inclusion."

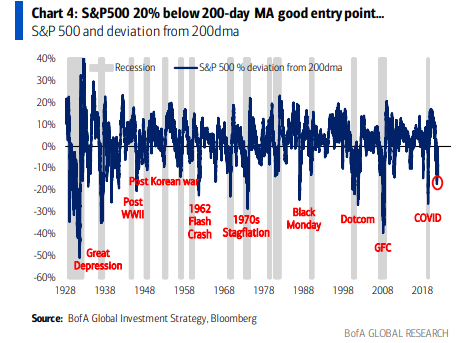

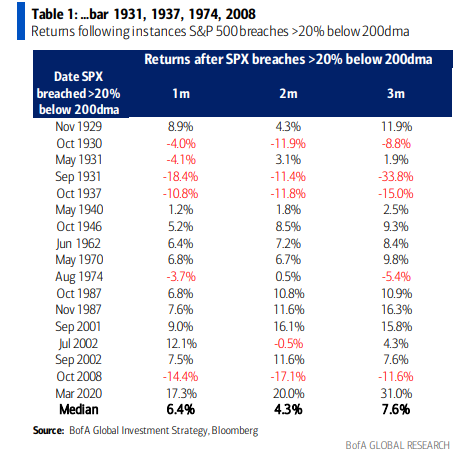

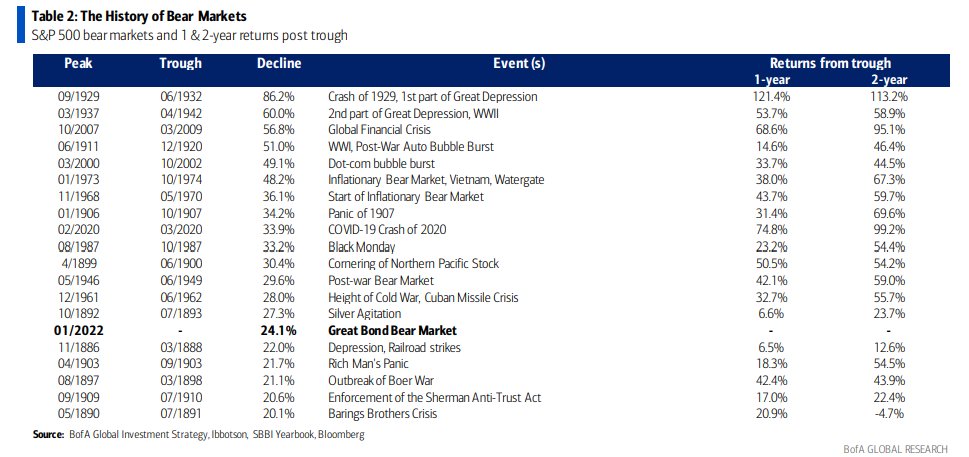

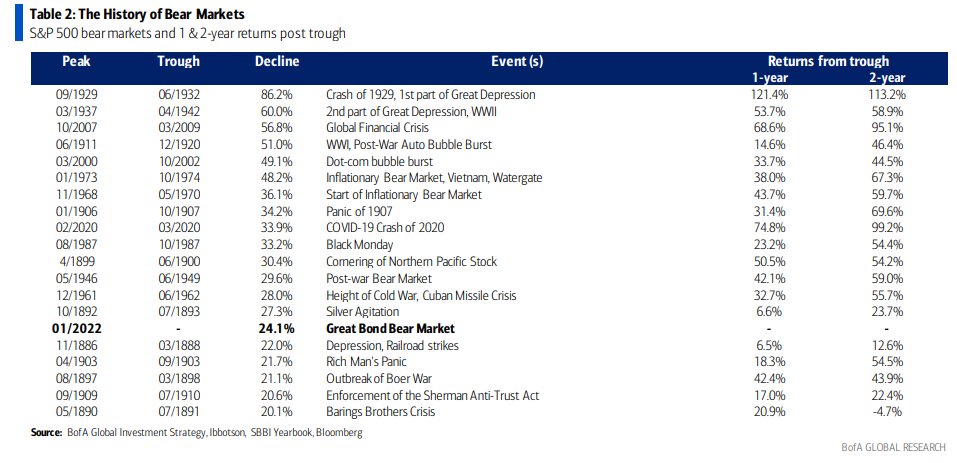

S&P 500 in 20th bear market past 140 years; ave peak to trough decline 37.3%, ave duration 289 days

history no guide to future but history says bear market ends Oct 19th 2022 (35th anniversary Black Monday) with S&P 500 @ 3020

history no guide to future but history says bear market ends Oct 19th 2022 (35th anniversary Black Monday) with S&P 500 @ 3020

BofA dubs this "The Great Bond Bear Market"

S&P 500 bear markets and 1 & 2-year returns post trough...

S&P 500 bear markets and 1 & 2-year returns post trough...

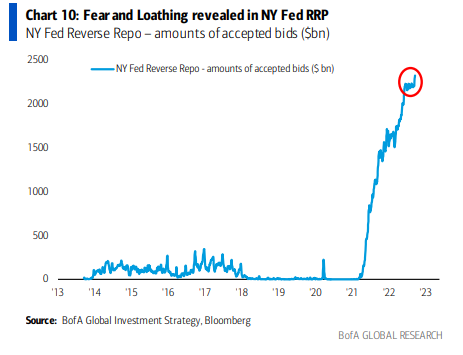

surge in bids accepted for NY Fed's overnight reverse repos $0 in Feb '21 to $2.4tn reflects broken, freaky post-QE financial system plumbing

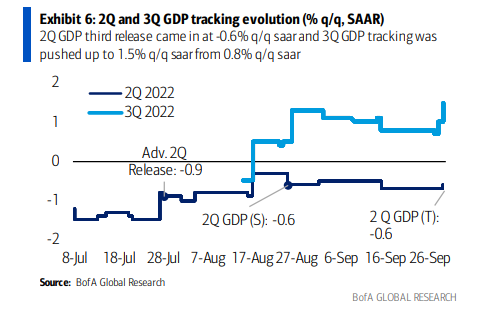

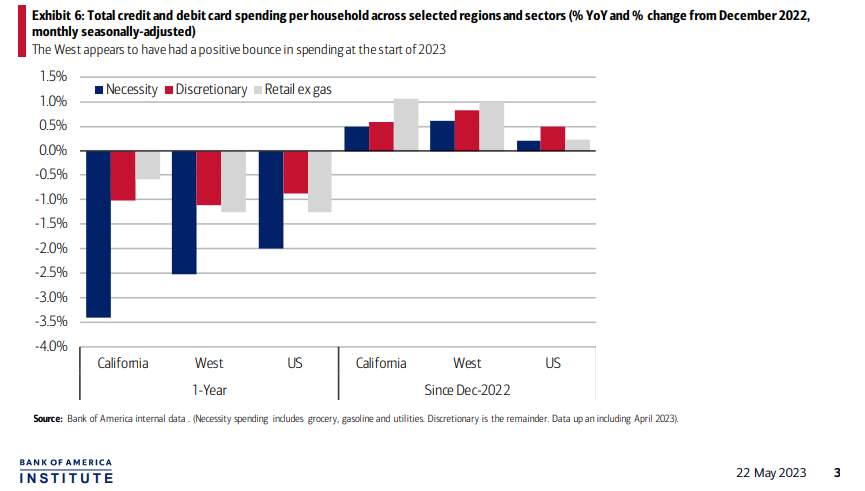

The personal saving rate was revised lower, suggesting households drew on savings to support spending amid rising inflation

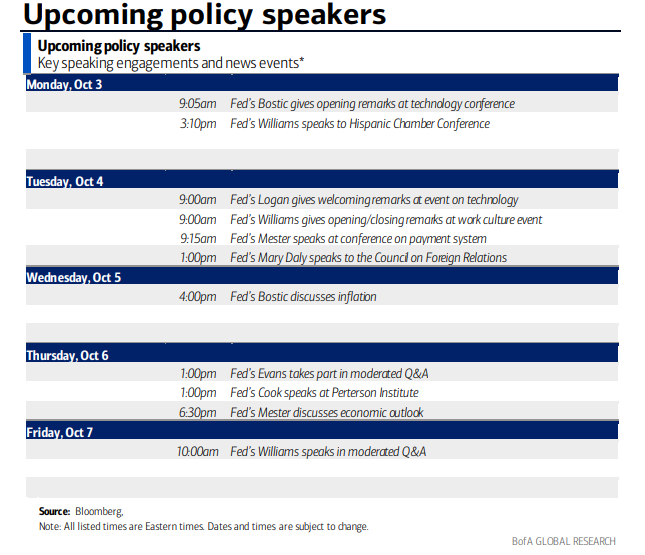

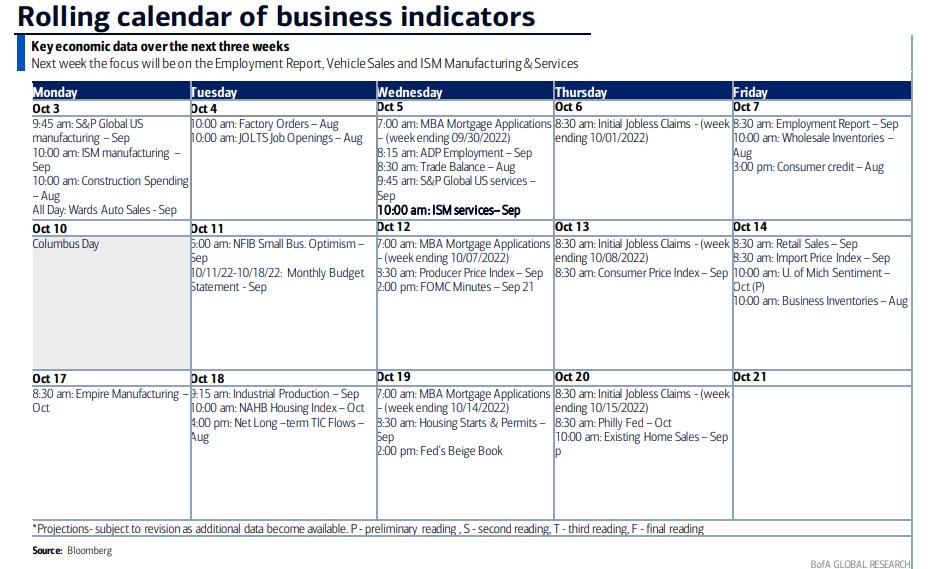

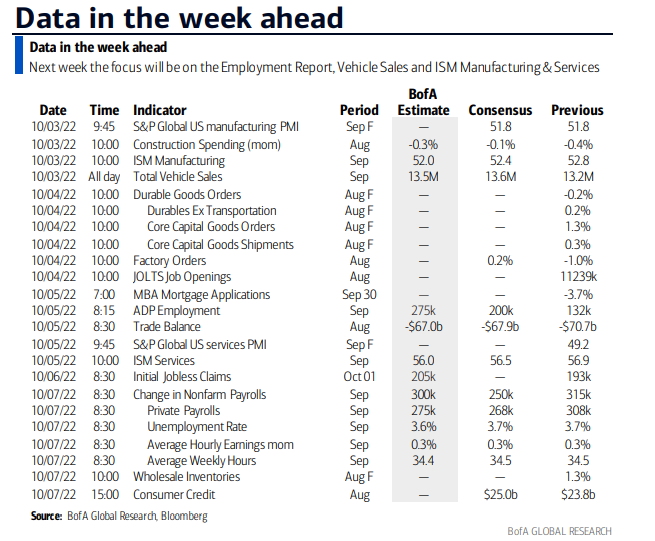

Next week the focus will be on the Employment Report, Vehicle Sales and ISM Manufacturing & Services

Data deck

Data deck

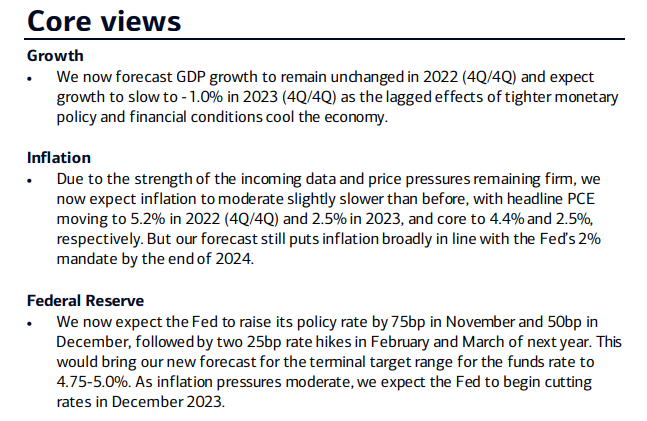

BofA:

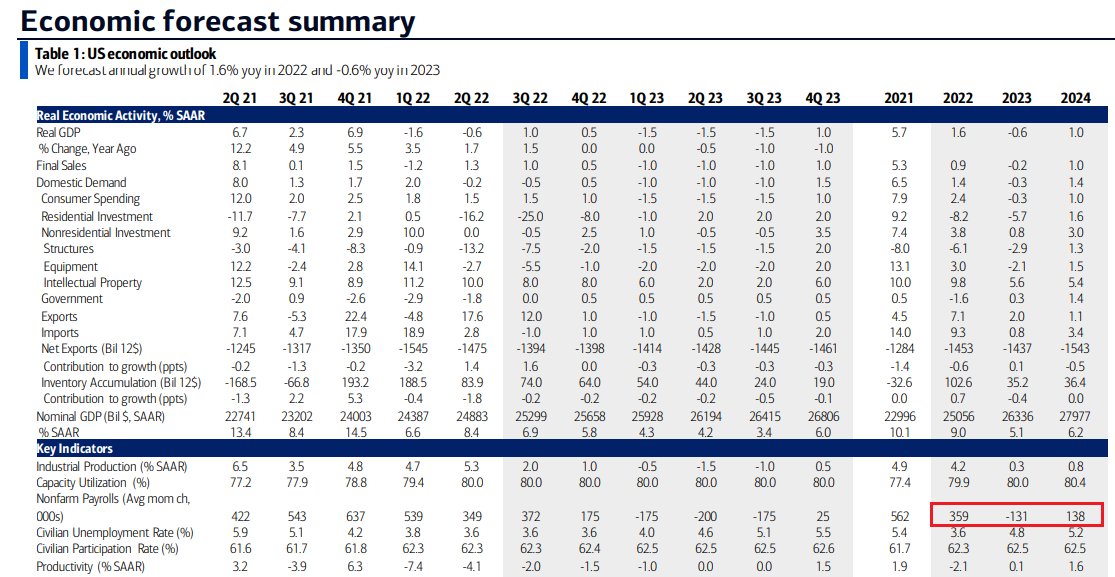

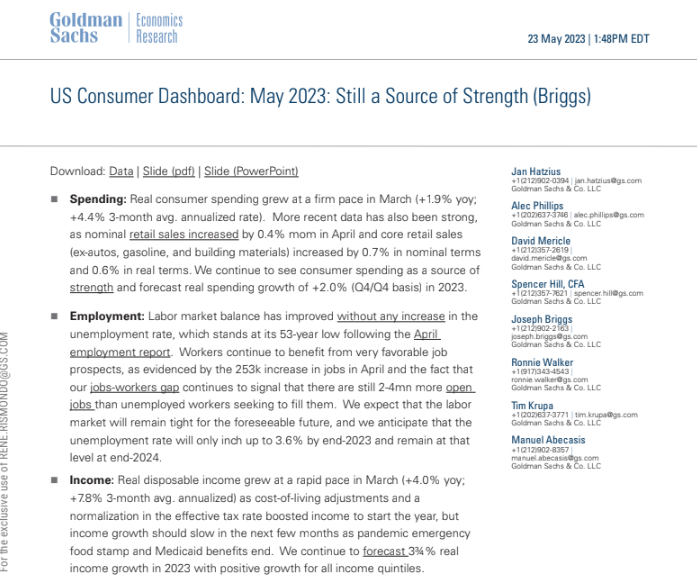

We now forecast GDP growth to remain unchanged in 2022 (4Q/4Q) and expect growth to slow to -1.0% in 2023 (4Q/4Q)

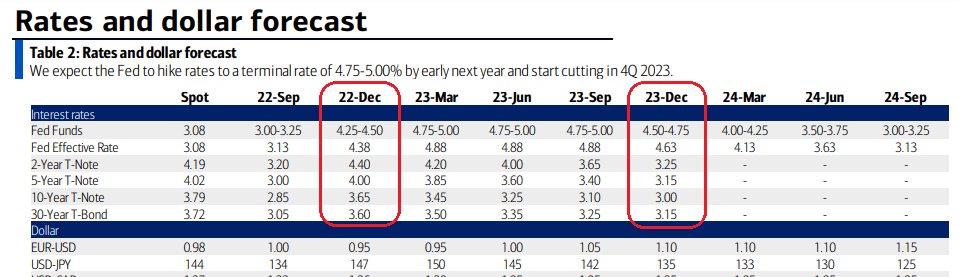

We now expect the Fed to raise its policy rate by 75bp in November and 50bp in December, followed by two 25bp rate hikes in February and March

We now forecast GDP growth to remain unchanged in 2022 (4Q/4Q) and expect growth to slow to -1.0% in 2023 (4Q/4Q)

We now expect the Fed to raise its policy rate by 75bp in November and 50bp in December, followed by two 25bp rate hikes in February and March

• • •

Missing some Tweet in this thread? You can try to

force a refresh