ANALYZE A BUSINESS IN 22 STEPS

Are you lost when your PM asks you "hey, go look at XYZ stock?" I've been there. While the business research process is a creative process with no set standard, I'd like to give you my roadmap in case it is helpful.

Ultimately as investors, we

Are you lost when your PM asks you "hey, go look at XYZ stock?" I've been there. While the business research process is a creative process with no set standard, I'd like to give you my roadmap in case it is helpful.

Ultimately as investors, we

are business analysts. Only by deeply understanding the current state of the business can we hope to forecast the business accurately over time.

And, finance 101, stocks are discounting mechanisms for collective investor expectations of free cash flow.

And, finance 101, stocks are discounting mechanisms for collective investor expectations of free cash flow.

To accurately value NFLX, for example, we must have the least foggy crystal ball on the 30 years of cash flows of the business. Yes, stocks move around a LOT on quarters. Since the out year future is so uncertain, each near term catalyst can change perceptions of the LT cash

flows of a business. But the fundamental truth remains. Only 18% of NFLX's value is ascribed to the next 5 years of cash flows, and only 39% over the next 10. When we buy NFLX, we are making an explicit or implicit bet on the long-term FCF generation ability of the company.

So, how do be become an expert in a business like NFLX so that we may develop some clearer sight on the future of the business? Here are 22 steps.

1) READING STACK. I generally start on a research process by printing a bunch of documents, turning off my computer, and reading

1) READING STACK. I generally start on a research process by printing a bunch of documents, turning off my computer, and reading

them with a highlighter in hand. I know, it's old school, and "save the trees", but I'm hopeless at reading 400 pages of documents on a computer screen (my monkey brain is way too easily distracted).

I will start by plowing through the key sections of the 10-K, skipping the

I will start by plowing through the key sections of the 10-K, skipping the

legalese and many of the footnotes (I will come back on those). My first step is to just understand the business - the products, the market, the competition, how the company talks about their strategy & key drivers. I'm working to obtain what I call OWNER'S KNOWLEDGE. As an owner

of the business, what would you like to know? If I own a pizza shop, I want to know everything about the business. Profile of my customers, pricing power, margin structure, where I buy my dough, what my capex needs are, etc. The same is true for a public market investment process

Your reading stack may vary, but this is generally what is in that 400 page reading stack.

1) 10-K

2) Last 4 earnings calls

3) Last 4 sell-side conference transcripts, w/ decks

4) Last investor day transcript & deck, if applicable

5) Two sell-side initiation reports

1) 10-K

2) Last 4 earnings calls

3) Last 4 sell-side conference transcripts, w/ decks

4) Last investor day transcript & deck, if applicable

5) Two sell-side initiation reports

This reading stack is going to help me get a head start on obtaining owner's knowledge. If I'm in a coverage model and ramping, I'll do this on all stocks in coverage - if covering medtech, I'm doing this for SYK, BSX, ZBH, ISRG, DXCM, MDT, etc. Public disclosures are so fulsome

and sell-side is generally very good at business analysis, that simply reading these documents is a good way to learn about a business.

2) ANALYZE SECULAR REVENUE DRIVERS. Ultimately in a research process you are looking for differentiation from market embedded expectations on

2) ANALYZE SECULAR REVENUE DRIVERS. Ultimately in a research process you are looking for differentiation from market embedded expectations on

two core elements of the business, 1) revenue, 2) profits. You are working to see what others don't see. What are the secular drivers of the business? What is the industry tailwind or headwind? Understand deeply what drives demand. For NFLX, the decline of traditional TV and the

rise of streaming (supported by strengthened bandwidth) is the core secular driver.

3) ANALYZE CYCLICAL DRIVERS. What drives the quarter to quarter, year to year fluctuation in a business? Businesses are driven by both secular & cyclical drivers, and differentiating the two

3) ANALYZE CYCLICAL DRIVERS. What drives the quarter to quarter, year to year fluctuation in a business? Businesses are driven by both secular & cyclical drivers, and differentiating the two

is CRITICAL in seeing differentiation. For NFLX, there was a cyclical tailwind in subs during COVID, an increase in competition (is this level of competitive intensity cyclical or structural?) and volatility around the slate of releases. I need to analyze these cyclical factors

to make a call on the business.

4) PRICING POWER. Work to disaggregate revenue growth from volume vs. pricing power. Pricing power is a sign of a good business, and the price lever can be a powerful profit driver. Persistent declines in pricing can be a problem for profitability

4) PRICING POWER. Work to disaggregate revenue growth from volume vs. pricing power. Pricing power is a sign of a good business, and the price lever can be a powerful profit driver. Persistent declines in pricing can be a problem for profitability

of a business (a persistent nag to areas of medtech for example. And the beauty of a business model like UNH is persistent price increases). Part of what drove the massive move up in NFLX from 2013-2021 was strong pricing, ARPU went from $8 to $12, and that helped drive margins

from 6% to 21%. The future at NFLX will look a lot different is ARPU can go to $18 vs. stay at $12. Having a strong view here is critical.

5) EXPOSURES & SENSITIVITIES. As you rip apart the business, try to understand where the company makes money. I was surprised to see that

5) EXPOSURES & SENSITIVITIES. As you rip apart the business, try to understand where the company makes money. I was surprised to see that

NFLX still generates $182m from DVD rentals. I'm guessing this is a very high cash margin business, so this might have driven HSD of 2020 cash flow. I had a short thesis on WBA in the past partly on the shrinking of a high margin photo-lab. Try to understand exposures &

sensitivities around where the business makes money and the direction of travel of those line items. DVDs seem small enough for NFLX to not matter, but if they were doing $1bn a year in FCF that would be a bigger headwind to chop through as that biz declines.

6) SUPPLY CHAIN. I look for potential read-through's as I go through my reading stack. On NFLX, I saw that they use AWS. On the Q2 call, I noticed they are working with MSFT on a large ad deal. As I go around my scuttlebutt process, meeting with these companies, mapping out the

supply chain to play my game of "connect the dots" is important on uncovering insights on the key drivers.

7) UNIT ECONOMICS. If I start a pizza shop selling a pie that costs me $12 for $10, people would call me an idiot. Yet many tech companies have done just that over the last

7) UNIT ECONOMICS. If I start a pizza shop selling a pie that costs me $12 for $10, people would call me an idiot. Yet many tech companies have done just that over the last

5 years. The underlying unit economics at a lot of "new era" companies are just AWFUL. I use the Casper mattress in a box example - great product, consumers loved it, but when you sell a $1,200 mattress for $1,000, OF COURSE customers will love it. WeWork had/has a material

unit economics problem. Bad unit economics do not scale, you can't grow your way out of it. On the surface, NFLX looks to have solid if not spectacular unit economics. The are making $12/user/month and spending $9, making $3 per user per month.

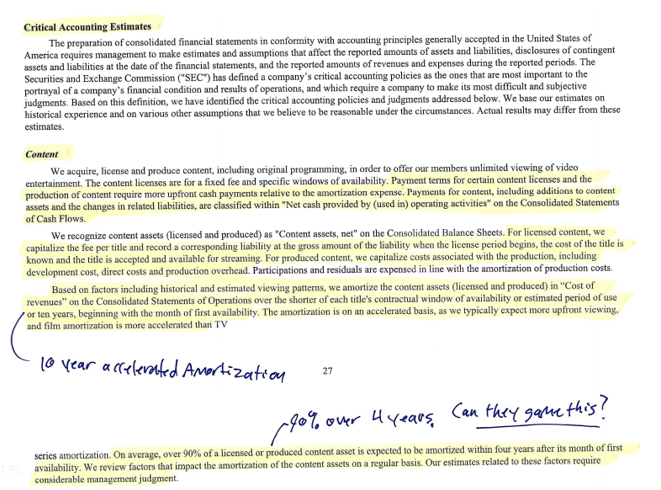

8) CASH ECONOMICS. However, GAAP accounting can be deceiving. I also want to analyze the cash economics of a business. In NFLX's case, content is a Year 1 cash outflow but is amortized over 4-10 years, and currently cash content spent is WELL above P&L content amortization.

On a cash basis, spending $17-18bn of content ($7 per user per month), the cash economics at NFLX DO NOT LOOK GOOD. This doesn't mean they cannot improve, but they are very weak currently (this is why, on an aggregate level, NFLX is not generating cash flow)

9) COST STRUCTURE. Go through the MD&A in the 10-K and see how the company explains the cost structure. For better or worse, NFLX' cost structure is highly fixed. in '21, $12bn of $23bn total COGS plus Opex was content amortization. As I begin to forecast NFLX's profit margins

over the next 5 years, it is really important to understand the current state cost structure so that I can forecast accurately.

10) INCREMENTAL MARGINS. A concept that comes out of cost structure. I want to forecast how much of an incremental dollar of revenue will drop to the

10) INCREMENTAL MARGINS. A concept that comes out of cost structure. I want to forecast how much of an incremental dollar of revenue will drop to the

bottom line. Generally, businesses with high fixed cost will have high incremental margins, and current incremental margins are a good predictor of future base margins. V and MA are the incremental margin GOATs. MA was doing 13% base margins in '04 and 60%+ incremental margins.

Fast forward 15 years and base margins are above 50%. The bear case on NFLX is "bad unit economics, penetrated TAM & competition" but the bull case is "competitive barrier to entry via scaled content spent and high incremental margin". NFLX has the *potential* to be a very high

incremental margin business in the future, and any bull case on NFLX must fully articulate why you believe that to be the case.

11) CAPITAL INTENSITY. Analyzing revenue & margins are a good start, but not sufficient. Future FCF (the driver of value) is a function of revenue

11) CAPITAL INTENSITY. Analyzing revenue & margins are a good start, but not sufficient. Future FCF (the driver of value) is a function of revenue

growth, margin and investment. Everything is a pizza shop. This is a viable business at $500k invested capital, but would not be at $1.5m of invested capital. The gas you put in the tank matters.

12) ROIC. Related to capital intensity, i want to see a business that can earn a material premium to its cost of capital. NFLX earns ROIC's >15%, which is solid (though measured on NOPAT, not cash), and has the *potential* to be a very high ROIC business if the industry scales

into a rational oligopoly in the future (a big IF).

13) CAPITAL USE. How is the business deploying capital? Buy-back, M&A, dividend, investing for growth? None of these are bad or good, per se, but capital deployment should be rational and aligned with business strategy. NFLX is

13) CAPITAL USE. How is the business deploying capital? Buy-back, M&A, dividend, investing for growth? None of these are bad or good, per se, but capital deployment should be rational and aligned with business strategy. NFLX is

mostly burning cash on content spend. A HUGE BET. And very risky. But if it pays off, that level of content spend likely creates a barrier to entry for new competitors.

14) EXECUTIVE COMP. Is this added back to EBITDA but then mitigated in the cash flow statement? Well, that's

14) EXECUTIVE COMP. Is this added back to EBITDA but then mitigated in the cash flow statement? Well, that's

something you should recognize when you start to discount cash flows and apply multiples. Incentives matter, so understand executive comp benchmarks.

15) BENCHMARKING OPPORTUNITIES. Is there a revenue or margin opportunity relative to peers? This isn't as applicable for NFLX,

15) BENCHMARKING OPPORTUNITIES. Is there a revenue or margin opportunity relative to peers? This isn't as applicable for NFLX,

but the ZTS analysis post PFE spin and the BAX separation were both purely margin benchmarking exercises. Compare key metrics to peers to assess how much theoretical opportunity there is.

16) SOURCES OF LEVERAGE. One of the most useful books for business analysis I've ever read

16) SOURCES OF LEVERAGE. One of the most useful books for business analysis I've ever read

is Competition Demystified by Bruce Greenwald. He talks about sources of leverage as competitive defense. It's stuck with me. As I look at NFLX, as much as I think $18bn of content spend is a little crazy, and surely risky, I do wonder whether that spend raises the stakes so much

that competitors cry uncle and ceded market share to NFLX, locking in their leadership and giving NFLX pricing power to improve unit economics. A HUGE bet, but possible.

17) COMPETITIVE DYNAMICS. On what dimensions do competitors compete? How long are customers locked in? For

17) COMPETITIVE DYNAMICS. On what dimensions do competitors compete? How long are customers locked in? For

NFLX, this is relatively straight forward. And there are some issues in that AMZN cross-subsidizes streaming and DIS has a huge built in baseload of content.

18) INCREMENTALISM. All new initiatives I try to break down onto a potential EPS basis. NFLX is creating an ad supported

18) INCREMENTALISM. All new initiatives I try to break down onto a potential EPS basis. NFLX is creating an ad supported

tier. What could this mean to future EPS? What are the sensitivities around this? I will walk through an example in the future.

19) KEY ACCOUNTING PROVISIONS. I never skip this in a 10-K.

19) KEY ACCOUNTING PROVISIONS. I never skip this in a 10-K.

I don't love this about NFLX, particularly the part about "considerable management judgment. Are they basically telling you they get to pick their COGS in any given year? Hmmm.

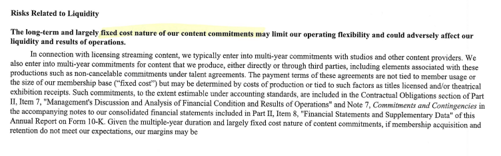

20) BUSINESS FAILURE POINTS. Once you've wrapped your hands around the business a bit, try to

20) BUSINESS FAILURE POINTS. Once you've wrapped your hands around the business a bit, try to

identify where a business can fail. For NFLX, it's obvious. They have made big fixed content commitments. If subs decline and ARPU comes under pressure, it's a problem.

21) BUSINESS MOMENTUM. One of my personal cardinal rules of investing is "respect the business momentum". The markets in '22 in some ways are a collective reflection of poor business momentum, and NFLX's big drop is the same. Generally, bad things happen when businesses slow.

Analyze and respect the business momentum.

22) IDENTIFY WHAT'S BAKED IN. Once I have a rudimentary understanding of the business, I will reverse engineer a DCF to assess what key drivers are currently baked into the price. This is my starting point for an assessment on

22) IDENTIFY WHAT'S BAKED IN. Once I have a rudimentary understanding of the business, I will reverse engineer a DCF to assess what key drivers are currently baked into the price. This is my starting point for an assessment on

investment opportunity and clarifies my research process. NFLX seems to be pricing in MSD/HSD revenue growth and modest operating margin expansion, with expanding FCF generation. If I think NFLX can get back to DD+ revenue growth and high incremental margins, this analysis tells

me there is material upside in the stock.

THAT'S ALL FOR TODAY. This is the sort of stuff you will see in Academy, where we will walk through these concepts in much greater detail, walk through this NFLX case study in great detail, and many other case studies.

HOPE THIS HELPS!

THAT'S ALL FOR TODAY. This is the sort of stuff you will see in Academy, where we will walk through these concepts in much greater detail, walk through this NFLX case study in great detail, and many other case studies.

HOPE THIS HELPS!

• • •

Missing some Tweet in this thread? You can try to

force a refresh