The STUDENT LOAN FORGIVENESS APPLICATIONS could open as soon as tomorrow! So here's a thread on how to tell if your loan actually qualifies and how to properly prepare for the application.

1/?

1/?

Qualifications for Student Loan Debt Relief:

- Adjusted Gross Income below $125k(Single), or $250k(Married or Head Of Household)

- Outstanding balance on a FEDERALLY OWNED student loan

- $10,000 Credit - No Pell Grant or Parent PLUS Loans)

- $20,000 Credit - Pell Grant Recipient

- Adjusted Gross Income below $125k(Single), or $250k(Married or Head Of Household)

- Outstanding balance on a FEDERALLY OWNED student loan

- $10,000 Credit - No Pell Grant or Parent PLUS Loans)

- $20,000 Credit - Pell Grant Recipient

Your Student loans are federally owned if they are serviced by one of the following:

-FedLoan Servicing (PHEAA)

-Aidvantage

-MOHELA

-Nelnet

-EdFinancial

-OSLA Servicing

-ECSI

-Great Lakes Edu

-Default Resolution Group

-FedLoan Servicing (PHEAA)

-Aidvantage

-MOHELA

-Nelnet

-EdFinancial

-OSLA Servicing

-ECSI

-Great Lakes Edu

-Default Resolution Group

Here's how to find out who your loan servicer is:

- Log into Studentaid.gov - Click Menu - Select "My Aid"

- Look at your credit report to see who's listed as the creditor

- Call the Federal Student Aid Information Center at 1-800-433-3243

- Log into Studentaid.gov - Click Menu - Select "My Aid"

- Look at your credit report to see who's listed as the creditor

- Call the Federal Student Aid Information Center at 1-800-433-3243

Already paid your student loans?

Borrowers who made payments between March 13, 2020, and Aug. 23, 2022, and now owe less than the $10,000-$20,000 threshold, can request a refund through their loan provider for the full amount forgiven.

Checks will be mailed out w/in 8 weeks.

Borrowers who made payments between March 13, 2020, and Aug. 23, 2022, and now owe less than the $10,000-$20,000 threshold, can request a refund through their loan provider for the full amount forgiven.

Checks will be mailed out w/in 8 weeks.

Do CURRENT students qualify for this relief credit?

YES! Well, partially. All loans taken out BEFORE 6/30/22 will be eligible for this relief credit & you may have to use your parent's income to qualify.

YES! Well, partially. All loans taken out BEFORE 6/30/22 will be eligible for this relief credit & you may have to use your parent's income to qualify.

Important to note:

- You only qualify for up to your outstanding balance

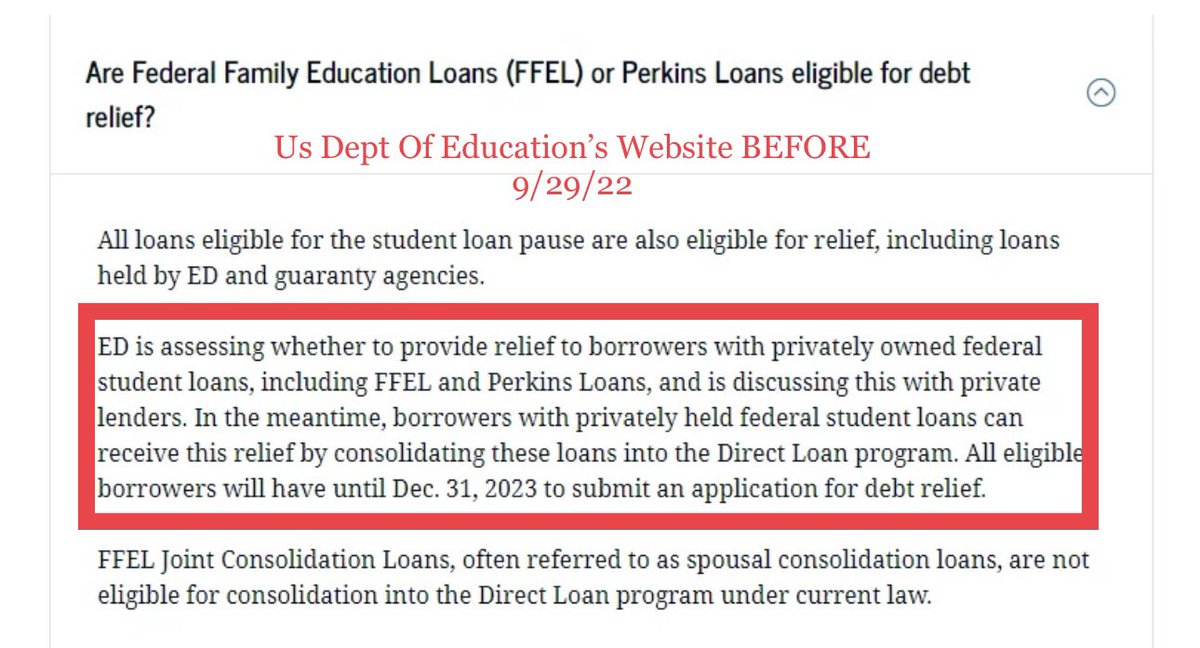

- Commercially owned FFEL Loans no longer qualify for this credit

- Income is based on '19, '21, or '22 taxes

- APPLICATIONS CLOSE 12/31/23

- You only qualify for up to your outstanding balance

- Commercially owned FFEL Loans no longer qualify for this credit

- Income is based on '19, '21, or '22 taxes

- APPLICATIONS CLOSE 12/31/23

How to apply for this forgiveness?

- Create an account on StudentLoan.gov

- Obtain an FSA ID (will be assigned when creating the account)

- Log in to apply when the application becomes available (October 2022)

- Create an account on StudentLoan.gov

- Obtain an FSA ID (will be assigned when creating the account)

- Log in to apply when the application becomes available (October 2022)

All Navient loans were transferred to AIDVANTAGE. Navient is now closed, however if they were your loan servicer, you still qualify, Your new servicer is AIDVANTAGE.

Here is Info regarding FFEEL Loans and figuring out if you’re qualify:

https://twitter.com/ShondaMartin_/status/1575845784058490880

• • •

Missing some Tweet in this thread? You can try to

force a refresh