Credit Education | Finance News | Random Thoughts ✨ IG: ShondaMartin & RoadTo750Plus

How to get URL link on X (Twitter) App

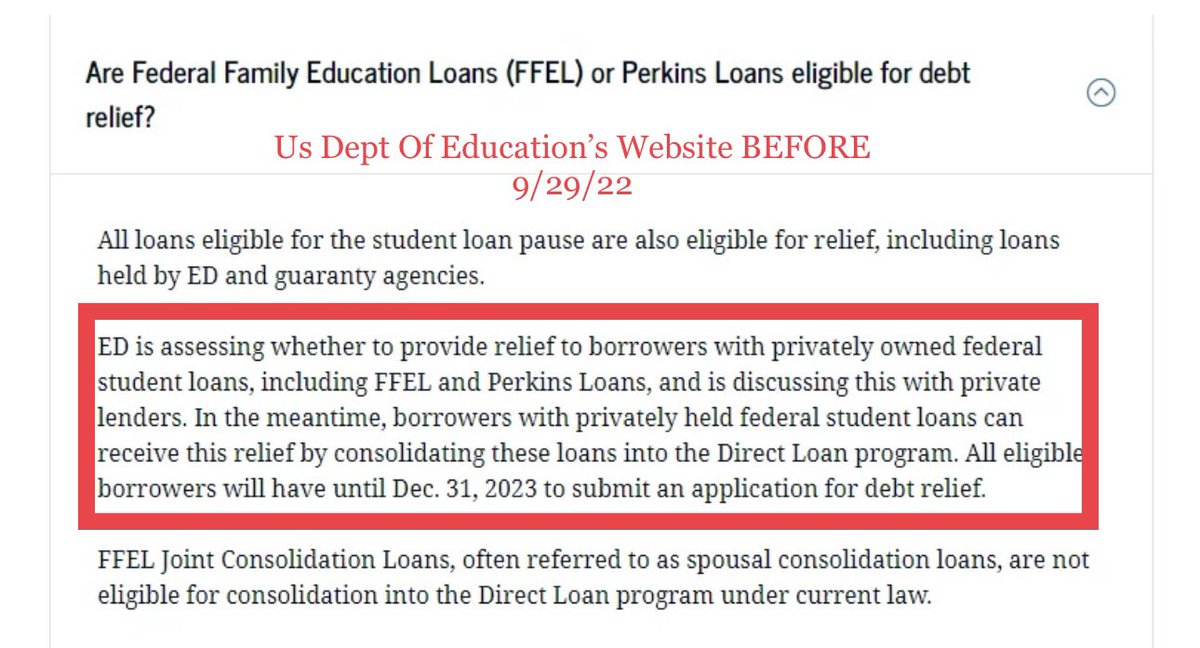

https://twitter.com/npr/status/1575539658951475202The Federal Family Education Loan Program (FFEL) was a system of private student loans which were subsidized and guaranteed by the government from 1965-2010. At one point it was the primary student loan type, this effects more than 4 million borrowers!