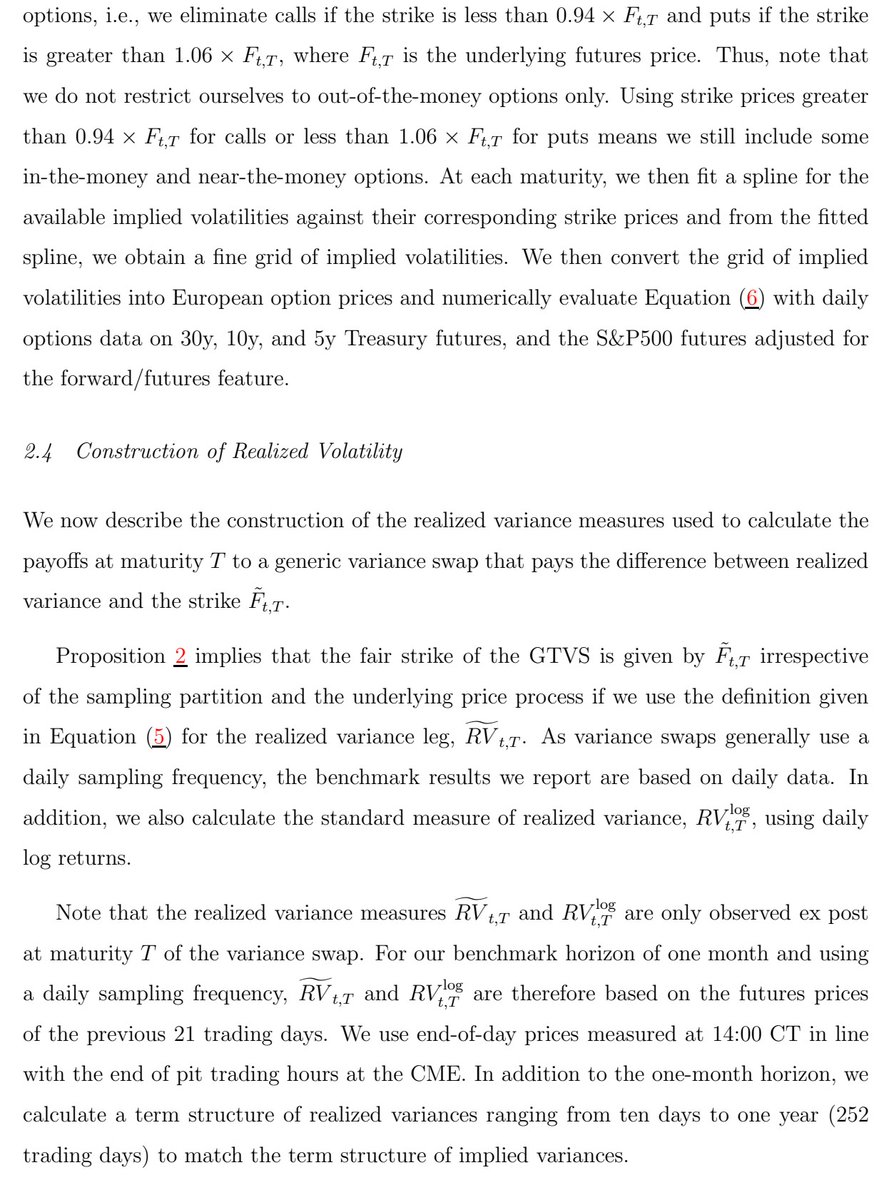

1/ Stock/Bond Correlation (AQR)

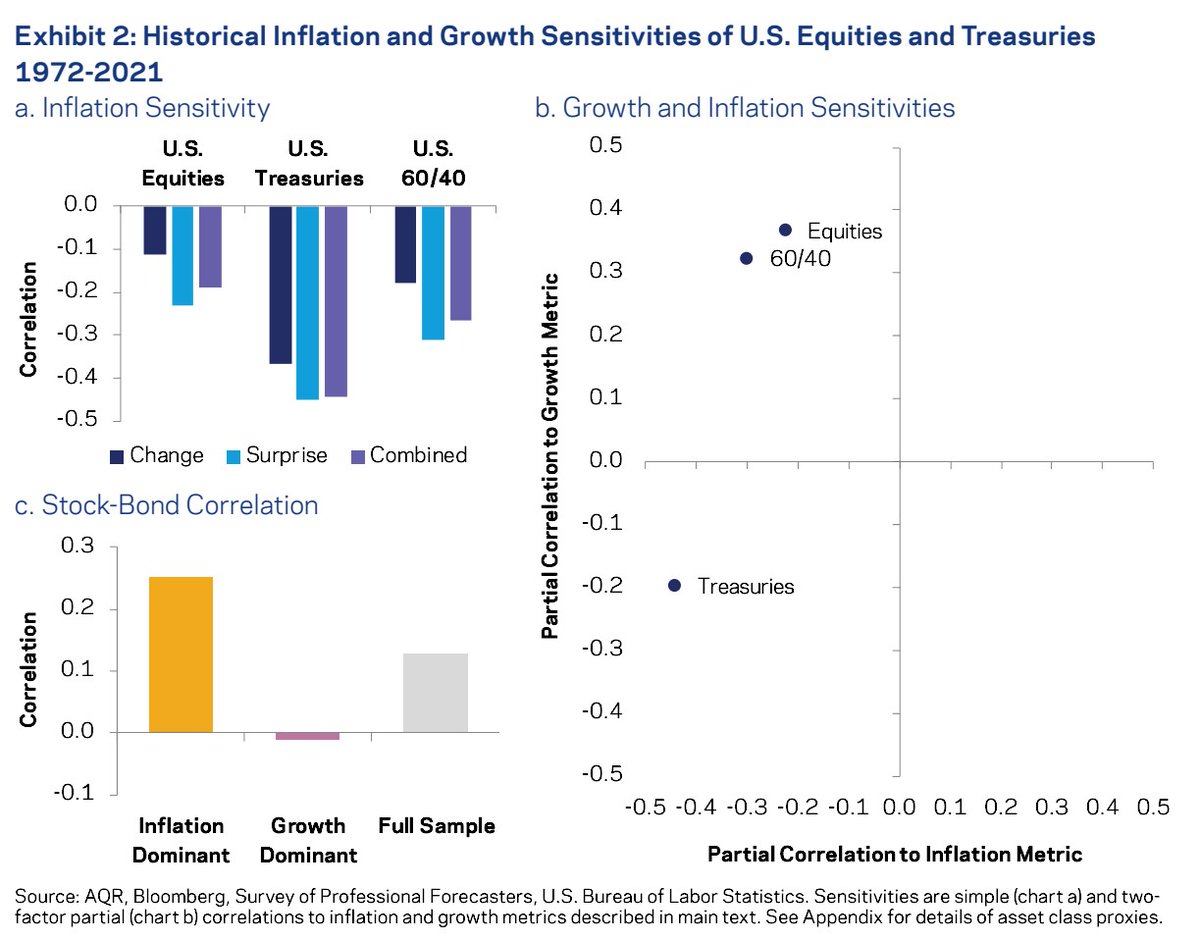

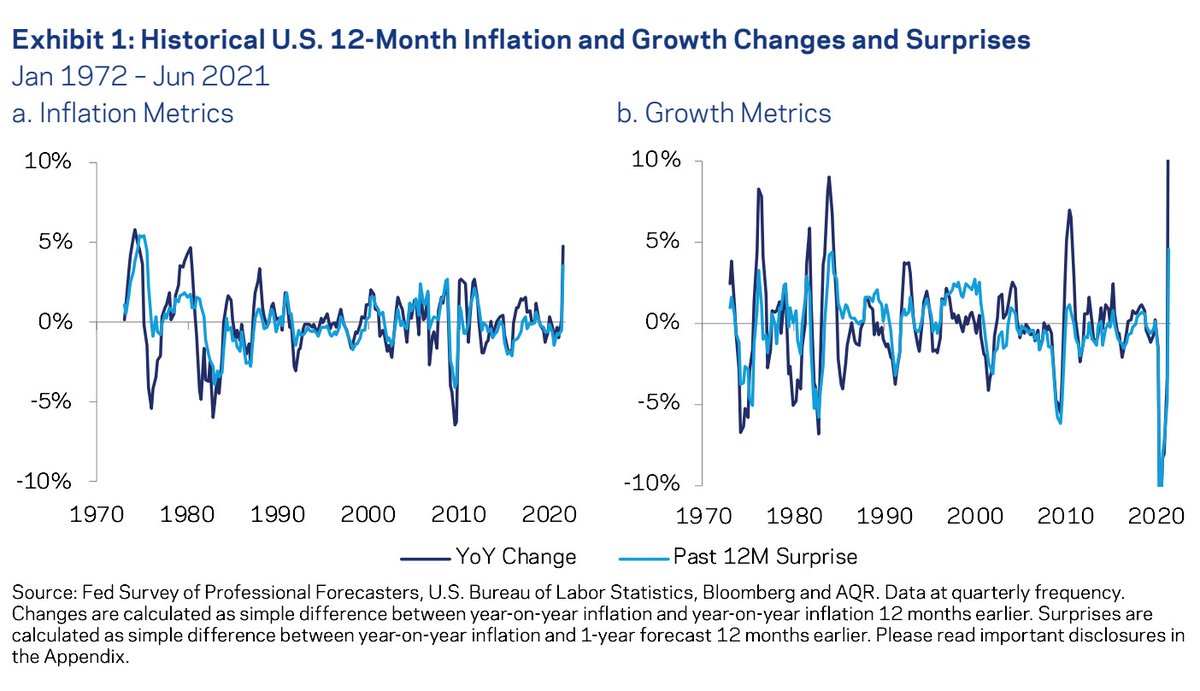

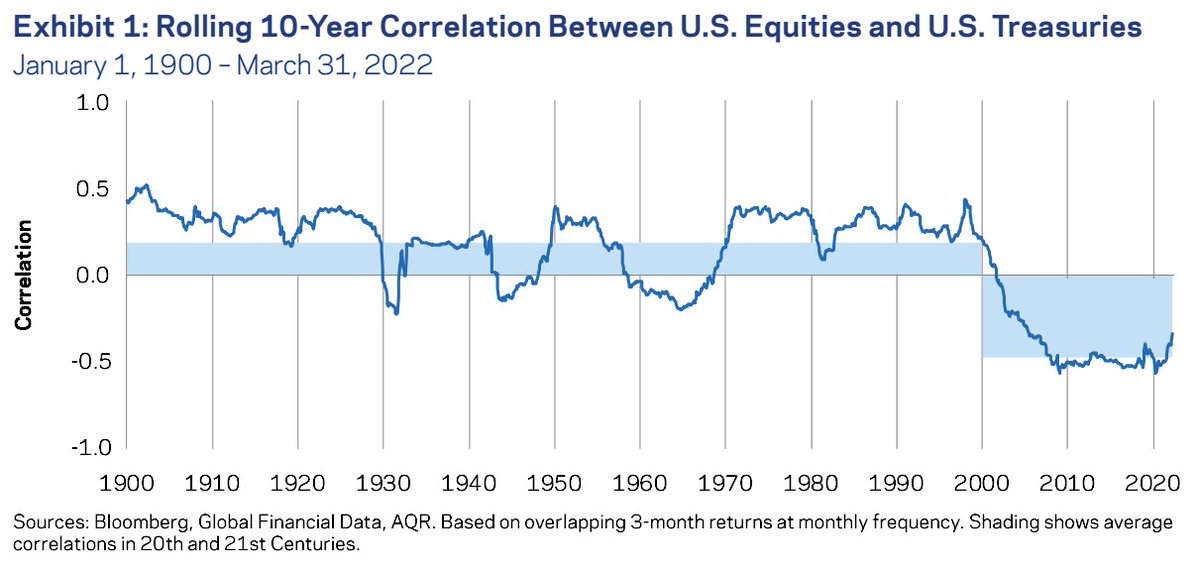

"For the past two decades the stock/bond correlation has been consistently negative, and investors have largely been able to rely on their bond investments for protection.

"But this hasn’t always been the case."

aqr.com/Insights/Resea…

"For the past two decades the stock/bond correlation has been consistently negative, and investors have largely been able to rely on their bond investments for protection.

"But this hasn’t always been the case."

aqr.com/Insights/Resea…

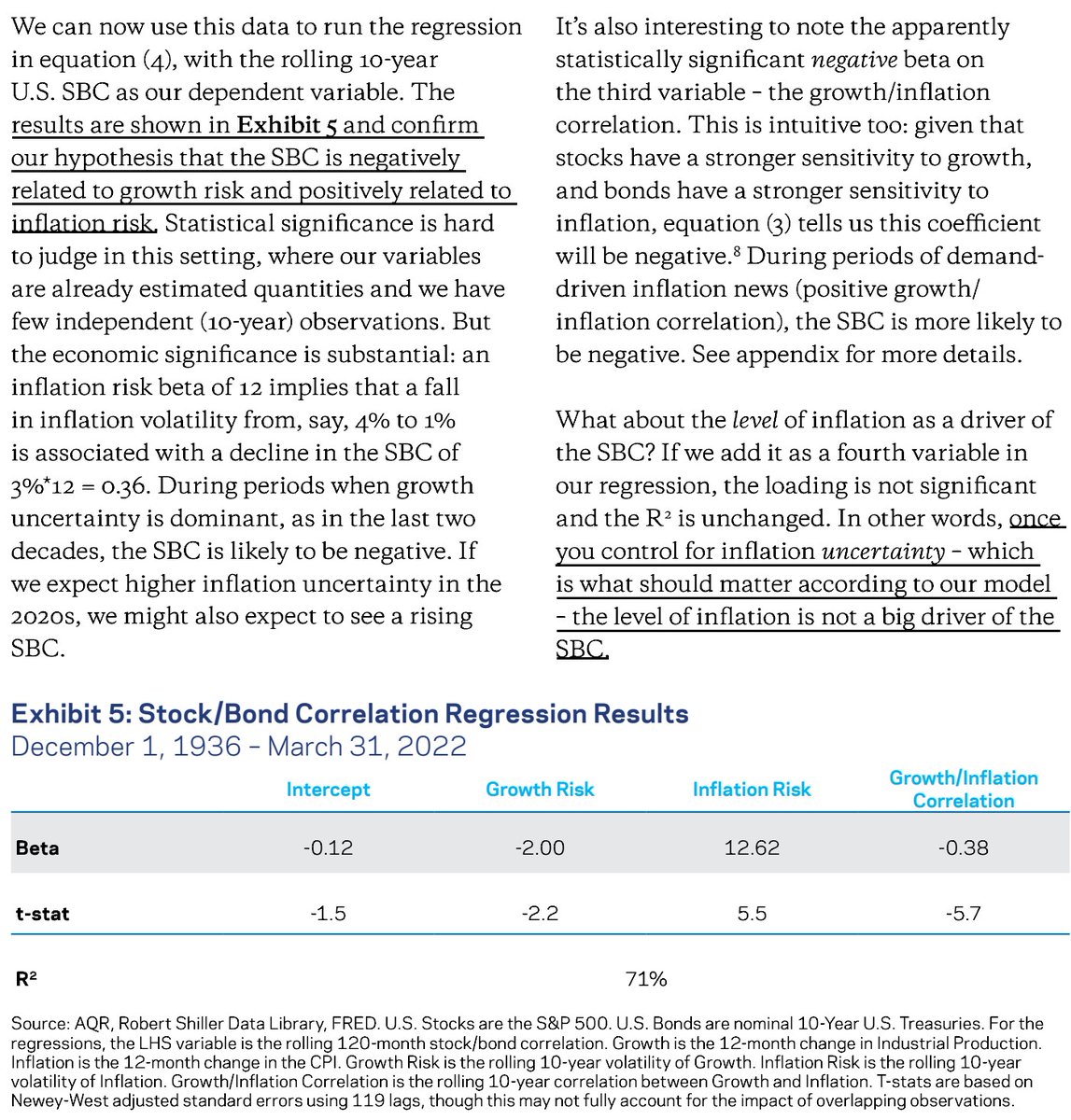

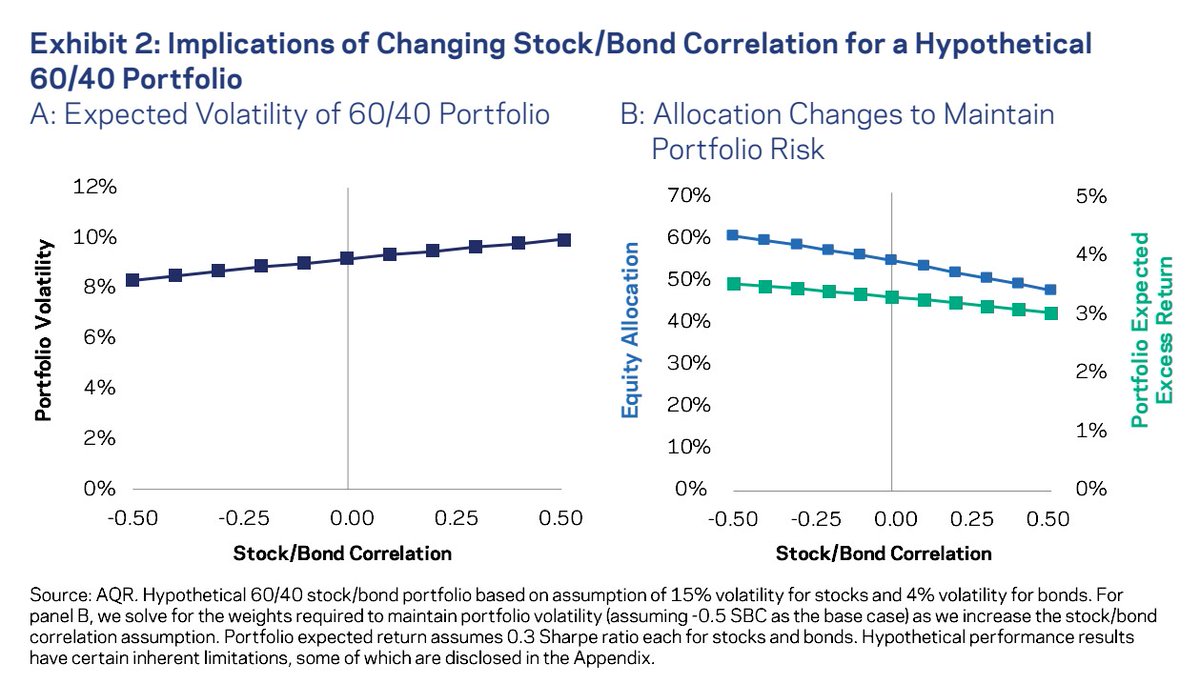

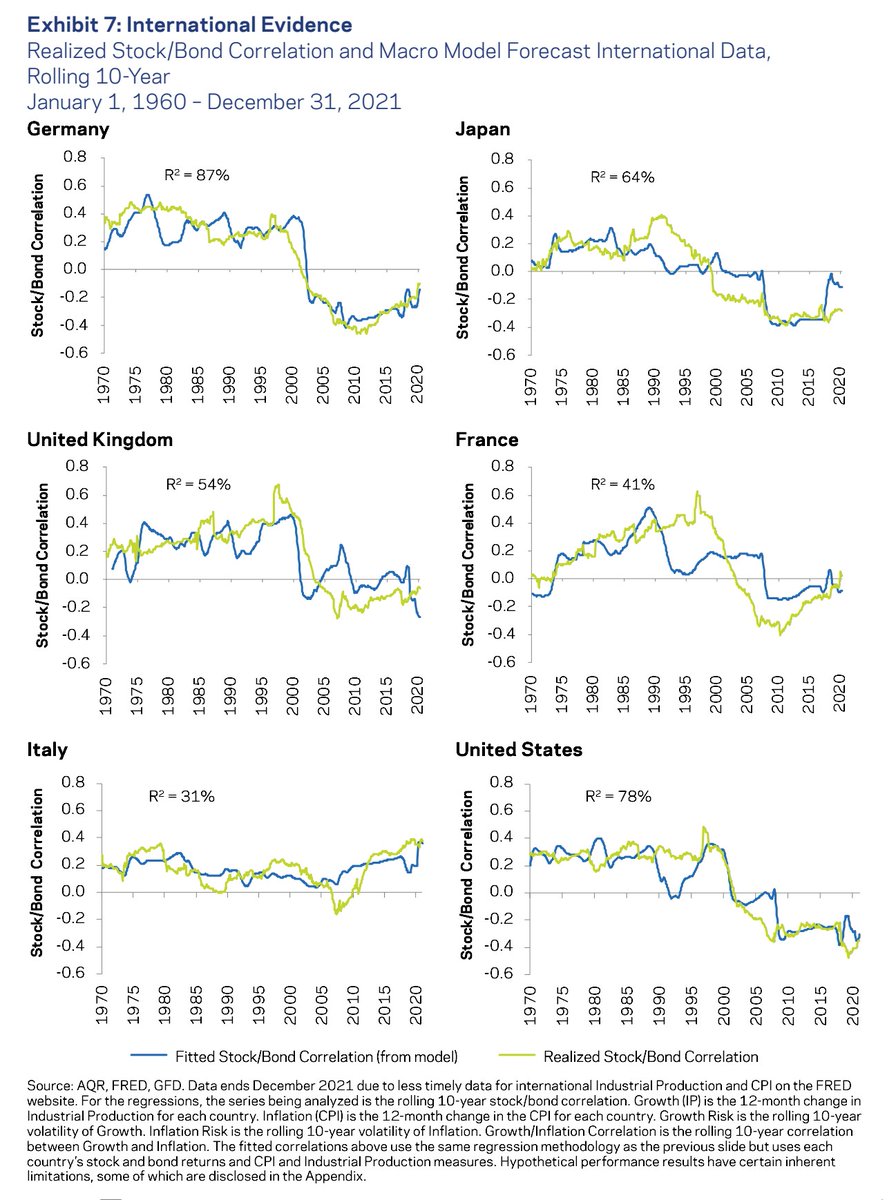

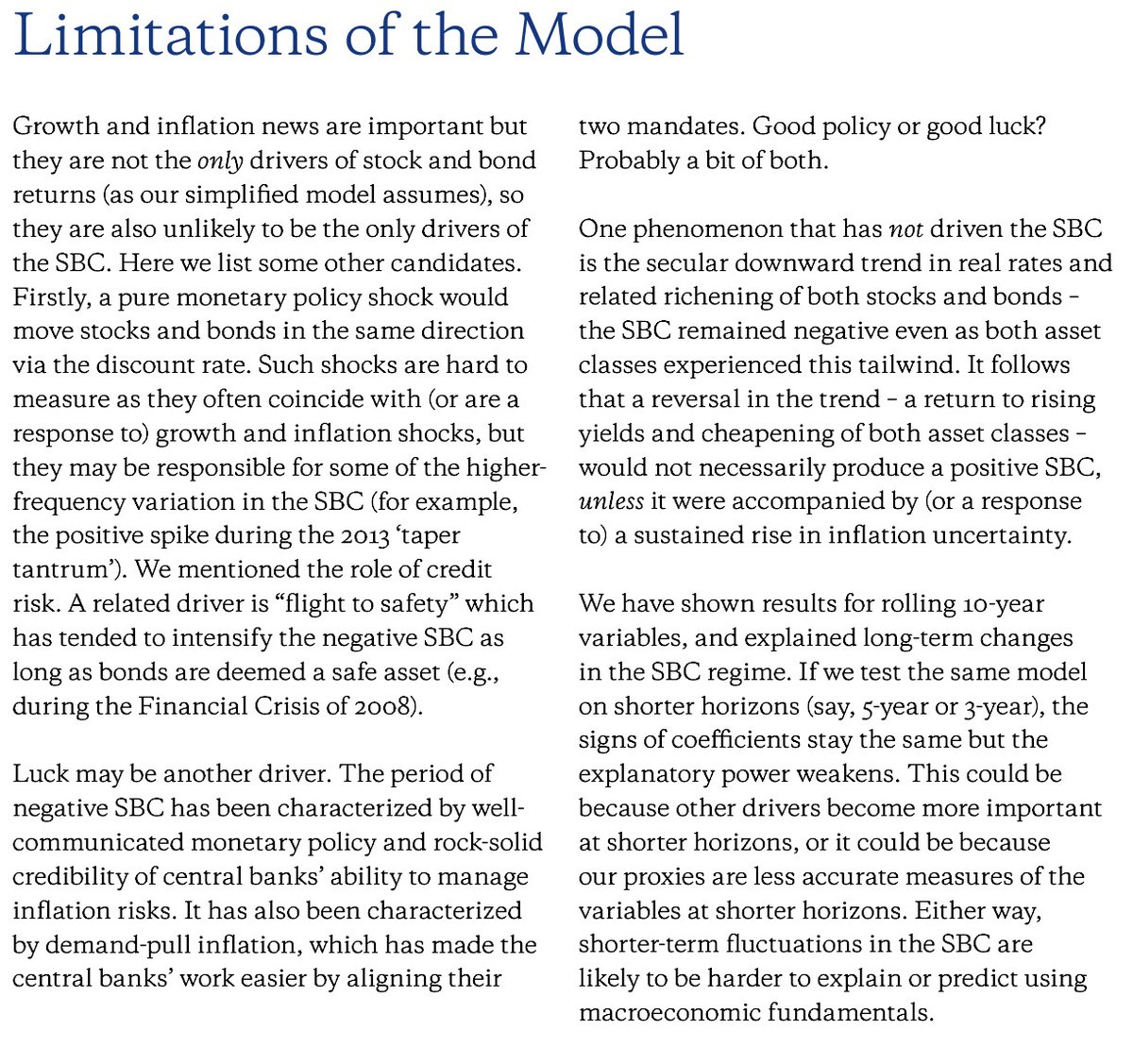

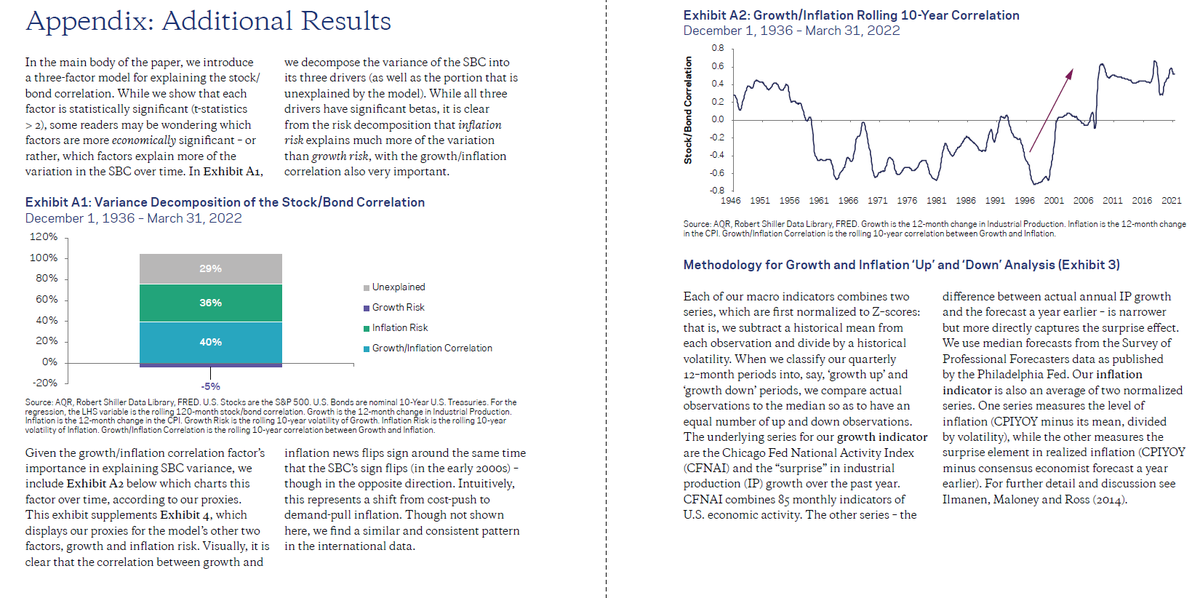

2/ "Macroeconomic changes – such as higher inflation uncertainty – could lead to a reappearance of the positive stock/bond correlation of the ‘70s, ‘80s and ‘90s.

"This would either increase portfolio risk or force allocation changes likely to reduce expected returns."

"This would either increase portfolio risk or force allocation changes likely to reduce expected returns."

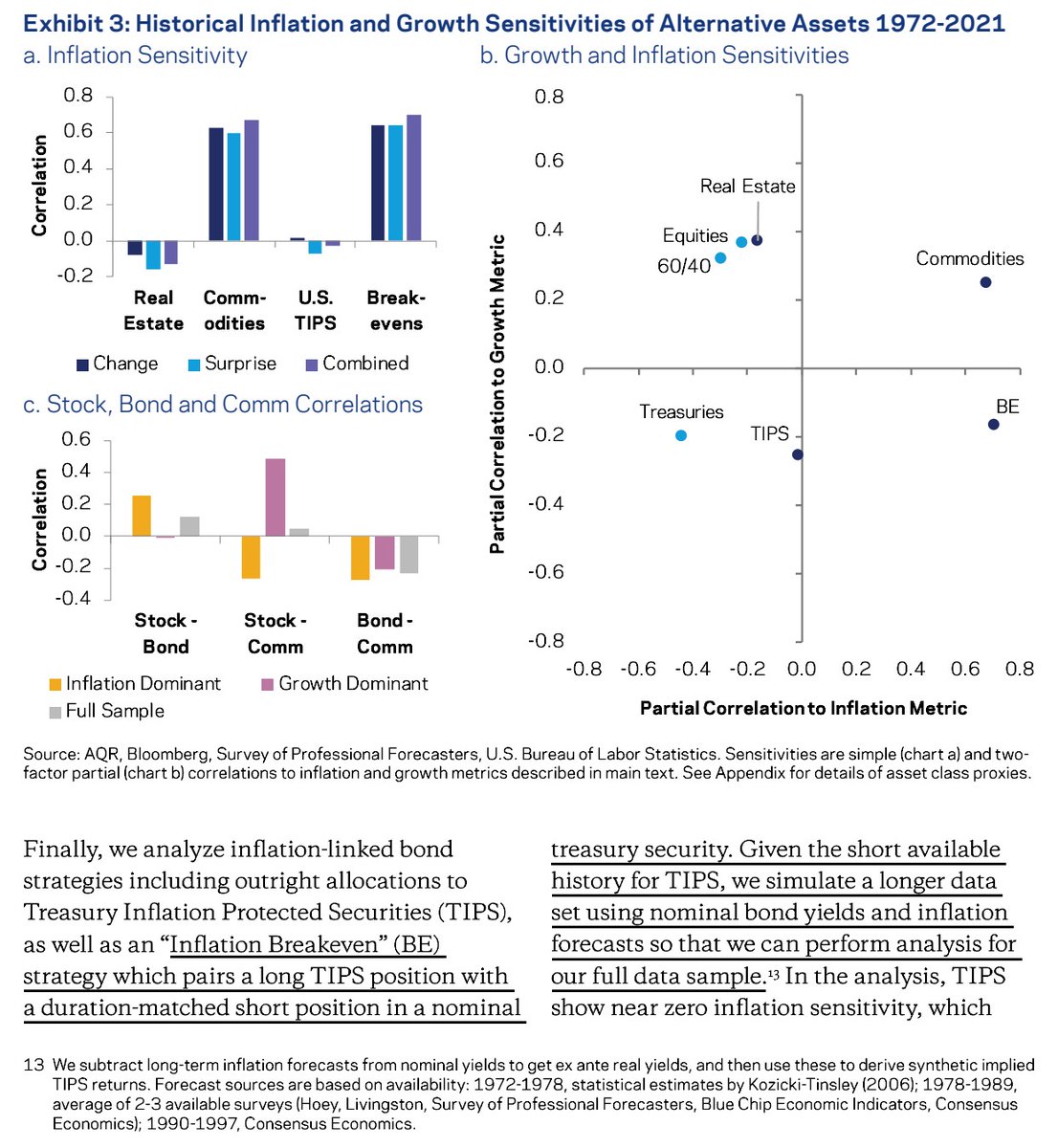

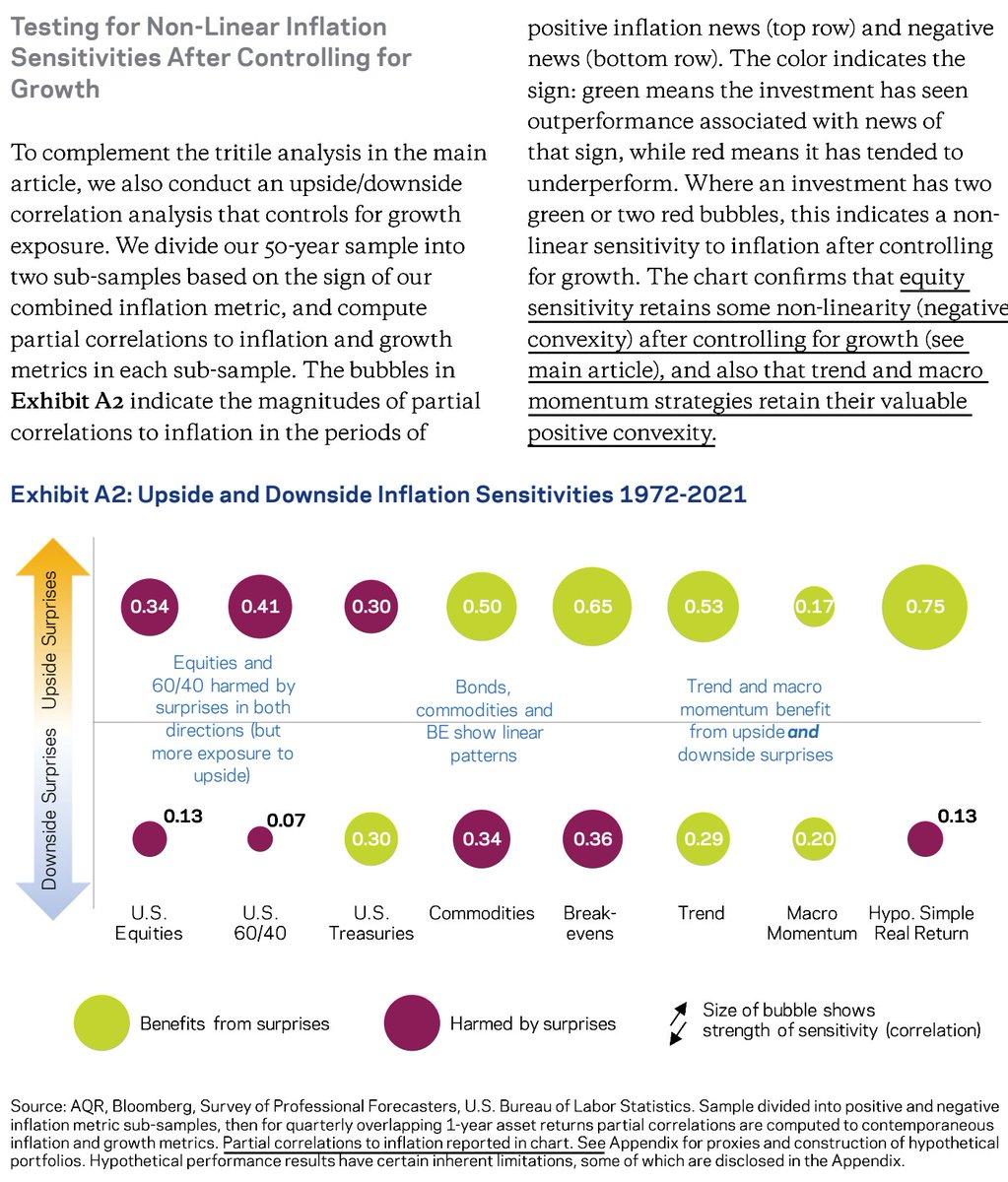

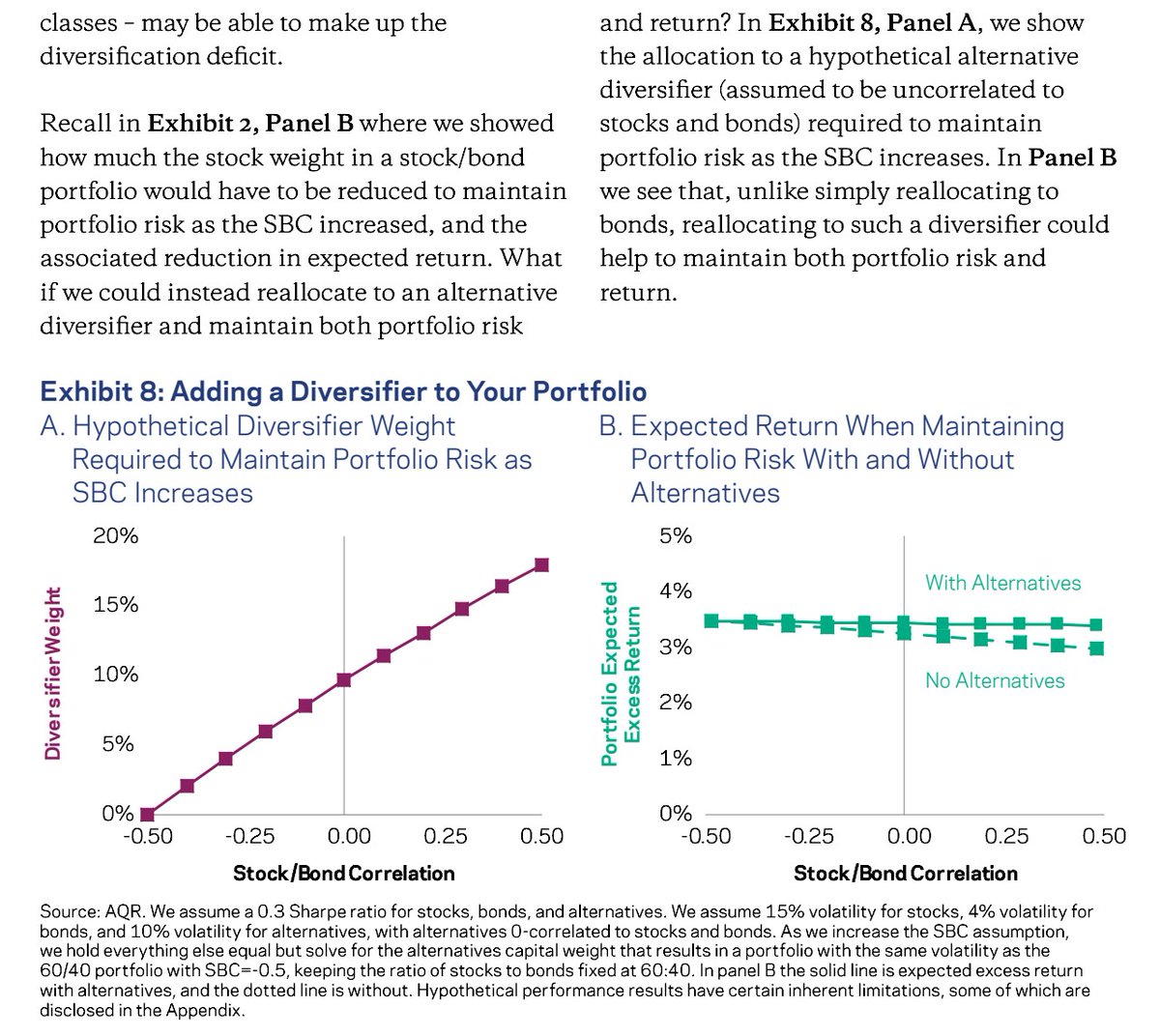

3/ "We set out practical steps to prepare for such an outcome.

"Understand the drivers and implications of this ‘golden parameter’ before it loses its luster.

"Revisit alternatives, which could play a crucial investment role in a positive stock/bond correlation world."

"Understand the drivers and implications of this ‘golden parameter’ before it loses its luster.

"Revisit alternatives, which could play a crucial investment role in a positive stock/bond correlation world."

4/ More reading:

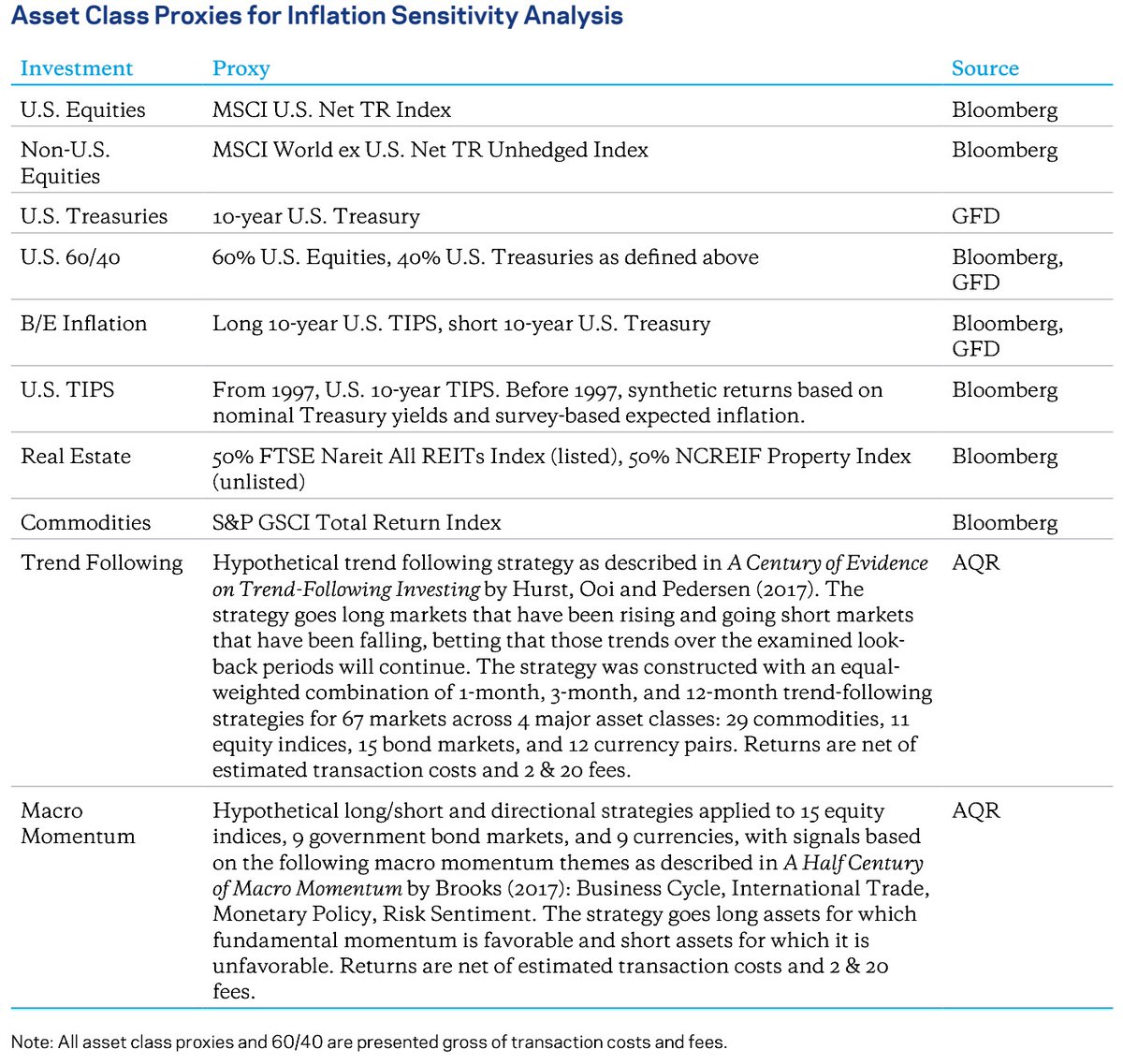

Best Strategies for Inflationary Times

Investing Under Inflation Risk

Mapping Investable Return Sources to Macro Environments

When Stock-Bond Diversification Fails

Best Strategies for Inflationary Times

https://twitter.com/ReformedTrader/status/1379188472750071809

Investing Under Inflation Risk

https://twitter.com/ReformedTrader/status/1574450602662207490

Mapping Investable Return Sources to Macro Environments

https://twitter.com/ReformedTrader/status/1410309893425287171

When Stock-Bond Diversification Fails

https://twitter.com/ReformedTrader/status/1575999424643203072

• • •

Missing some Tweet in this thread? You can try to

force a refresh