My take on the Crypto Data Landscape 2022

... progress, new products and my predictions, updated from my prev one 1y+ ago

A 🧵 👇 ...

... progress, new products and my predictions, updated from my prev one 1y+ ago

A 🧵 👇 ...

- if you're a crypto user: hope this help you understand the crypto data space in general, and maybe find some products useful to you

- if you work in crypto data (analyst, dev, investor...): hope it cover sth that you missed 🤣🤣.

- if you work in crypto data (analyst, dev, investor...): hope it cover sth that you missed 🤣🤣.

a brief history: abt 1y ago, i outlined the open crypto data platform; after that, dune and nansen both raise at ~1b val, many startups work on crypto data; and recently tons of new things are happening (Dunecon, Smartcon, Nansen ...). it's time to update 🚀🚀

https://twitter.com/zk7hao/status/1412076712444108805

1/ General structure intro

- Data source: where data stored originally (e.g., on-chain in ETH/BSC, or off-chain as in CEX, Twitter)

- Data dev: mostly for developers, like dev subgraph using @graphprotocol, dev dashboards using @DuneAnalytics ...

- Data source: where data stored originally (e.g., on-chain in ETH/BSC, or off-chain as in CEX, Twitter)

- Data dev: mostly for developers, like dev subgraph using @graphprotocol, dev dashboards using @DuneAnalytics ...

- Data app: mostly for users; such as @coinmarketcap @coingecko for general prices and news, or @nansen, @parsec_finance for pro users and advanced analytics.

this order is also the data flow: data source -> data dev -> data app.

this order is also the data flow: data source -> data dev -> data app.

2/ Major devs of existing products

2.1 @DuneAnalytics

- API: potentially a big game-changer; and the community has been asking this for years (?)

- spellbook/dbt: super useful for collab and better abstraction

- v2 engine: better performance and infra

2.1 @DuneAnalytics

- API: potentially a big game-changer; and the community has been asking this for years (?)

- spellbook/dbt: super useful for collab and better abstraction

- v2 engine: better performance and infra

https://twitter.com/DuneAnalytics/status/1575528361249710083

2.2 @nansen_ai

- @nansenportfolio / Apeboard: a good complement for its main product.

- Nansen Institution: API + Query, powerful for advanced use cases.

- Nansen Connect: new use cases for its labels, social interaction.

- @nansenportfolio / Apeboard: a good complement for its main product.

- Nansen Institution: API + Query, powerful for advanced use cases.

- Nansen Connect: new use cases for its labels, social interaction.

https://twitter.com/nansenportfolio/status/1559525498442485760

2.3 @DefiLlama

just so surprised and impressed that they made this far; much better offering than lots of vc-funded projects; shipping nonstop, fully open-source, tracking hundreds of protocols... just incredible.

just so surprised and impressed that they made this far; much better offering than lots of vc-funded projects; shipping nonstop, fully open-source, tracking hundreds of protocols... just incredible.

https://twitter.com/0xngmi/status/1546339528624988166

2.4 @chainlink

- SWIFT collab: a big milestone for the crypto industry

- SCALE: lower fees

- BUILD: more ecosystem projects

for more check #SmartCon

- SWIFT collab: a big milestone for the crypto industry

- SCALE: lower fees

- BUILD: more ecosystem projects

for more check #SmartCon

https://twitter.com/chainlink/status/1575819565283557376

2.5 @parsec_finance

prob the most trader-friendly pro analytics; ships non-stop, and gets adopted a lot more since then. incredible team. but I can't afford the price 🤣

prob the most trader-friendly pro analytics; ships non-stop, and gets adopted a lot more since then. incredible team. but I can't afford the price 🤣

https://twitter.com/wilburforce_/status/1369826939800846339

3/ New things

3.1 Data apps

- @dexscreener: hard to believe after so many charting tools, it can still stand out; `the fastest and most reliable one` from many degens frens, and it's free.

3.1 Data apps

- @dexscreener: hard to believe after so many charting tools, it can still stand out; `the fastest and most reliable one` from many degens frens, and it's free.

https://twitter.com/dexscreener/status/1455782398268948480

- @0xWatchers & @DefinderGlobal: provide sth nansen can't, graph analytics + PNL + more; made by my frens, superb execution

https://twitter.com/0xWatchers/status/1561693565738455042

- @bellosights: new vertical on collector / community analytics (similar to web2 CRM/CDP), quite different from nansen (mostly used for trading). well-received in the community despite being very early.

https://twitter.com/levychain/status/1555683823861391360

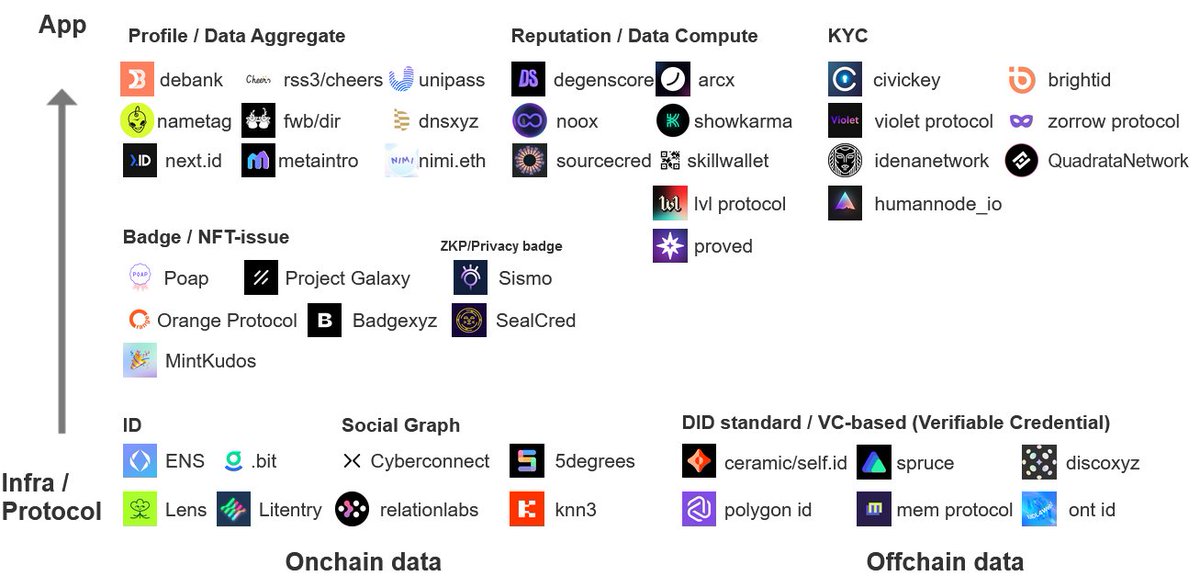

3.2 Web3 Database

if you're building a decentralized twitter/facebook, where do you store your data? eth just too expensive.

that's where web3 db comes in.

if you're building a decentralized twitter/facebook, where do you store your data? eth just too expensive.

that's where web3 db comes in.

while web3 apps are at the earliest age, these dbs are getting adopted (bc no other way)

- @ceramicnetwork is prob the most popular and growing very organic; series A led by top-tier funds.

- @KwilTeam, @tableland__ newly founded w/ great backers; love to see how they work

- @ceramicnetwork is prob the most popular and growing very organic; series A led by top-tier funds.

- @KwilTeam, @tableland__ newly founded w/ great backers; love to see how they work

https://twitter.com/ceramicnetwork/status/1493972553962041355

3.3 Unified data warehouse

can we merge Dune and Graph? since dune starts providing API, and indexing service starts providing SQL.

this brings us to the unified data warehouse (see below, cross analytics and indexing sub-section).

can we merge Dune and Graph? since dune starts providing API, and indexing service starts providing SQL.

this brings us to the unified data warehouse (see below, cross analytics and indexing sub-section).

- @SpaceandTimeDB is offering low-latency queries and tamperproof analytics (proof-of-sql); top backers @M12vc @chainlink and seasoned team from @Teradata.

- @ZettaBlockHQ is working on an alternative of @databricks for web3.

both from great web2 data companies and ...

- @ZettaBlockHQ is working on an alternative of @databricks for web3.

both from great web2 data companies and ...

really expect to see what they bring to web3. idea is super bold (esp. @SpaceandTimeDB , can be the infra for decentralized ML models?). but I'm a bit worried on how many enterprise clients they can acquire, as web3 is still so early.

https://twitter.com/SpaceandTimeDB/status/1575879931459907586

3.4 Indexing

- @goldskyio is a brave take on thegraph; offering real-time data w/ GraphQL, SQL on indexing

- @CoherentAPI nails down a specific use case, providing the most easy-to-use user data api for devs.

both great team, great backers and great execution.

- @goldskyio is a brave take on thegraph; offering real-time data w/ GraphQL, SQL on indexing

- @CoherentAPI nails down a specific use case, providing the most easy-to-use user data api for devs.

both great team, great backers and great execution.

https://twitter.com/goldskyio/status/1569719103891308545

3.5 Communities / DAOs

@MetricsDAO: finally a DAO for ppl work w/ data, but sadly no time to get involved 😭. Analysts are rare assets in crypto (prob more data startups than analysts atm 🤣), and I believe communities can bring amazing value to the industry in the long term.

@MetricsDAO: finally a DAO for ppl work w/ data, but sadly no time to get involved 😭. Analysts are rare assets in crypto (prob more data startups than analysts atm 🤣), and I believe communities can bring amazing value to the industry in the long term.

3.6 NFT Analytics

[just too big and should write a another thread for it LOL🤣]

[just too big and should write a another thread for it LOL🤣]

4/ Predictions and Implications

4.1 Consolidation begins

- nansen portfolio, query vs. debank, dune

- nansen nft vs. so many nft analytics tools

- dune w/ solana vs. team raising for `solana dune` last summer

- skew acquired by cb; dovemetrics by messari ...

4.1 Consolidation begins

- nansen portfolio, query vs. debank, dune

- nansen nft vs. so many nft analytics tools

- dune w/ solana vs. team raising for `solana dune` last summer

- skew acquired by cb; dovemetrics by messari ...

you get the idea. as predicted last year, it's easy to see teams expand both vertically and horizontally across the crypto data stack, bc data can be freely obtained while monetization is an issue. so I think teams w/ funding can keep shipping and expanding, ...

providing better products for their customers, while teams w/o enough funding would simply be competed out during the bear.

I think

- dominant players will keep winning, and be much stronger in next bull.

- new players should be extra careful of GTM strategies.

I think

- dominant players will keep winning, and be much stronger in next bull.

- new players should be extra careful of GTM strategies.

4.2 Community matters, a lot

last year when talking w/ @hagaetc, I was wondering how dune can stay relevant since features can be easily copied and data is freely available. `It's the community, stupid.` 🤣. 1y later, now quite self-explanatory, esp w/ dunecon ...

last year when talking w/ @hagaetc, I was wondering how dune can stay relevant since features can be easily copied and data is freely available. `It's the community, stupid.` 🤣. 1y later, now quite self-explanatory, esp w/ dunecon ...

easy to see how it's loved by its users. also a bit sad for @flipsidecrypto , bc it nailed the strategies (called out community-first, bounty, API all before dune), but lacks a strong community, so didn't deliver that much. but great for web3 to have them both.

4.3 Infra >> Features

when interviewed at most comp (as a PM), I often get asked what features can be built, `it doesn't matter`. as the case of @dexscreener, it's just more reliable; same for exchanges, dapps. `don't crash, don't get hacked`, and users would be immensely happy.

when interviewed at most comp (as a PM), I often get asked what features can be built, `it doesn't matter`. as the case of @dexscreener, it's just more reliable; same for exchanges, dapps. `don't crash, don't get hacked`, and users would be immensely happy.

5/ Open questions

5.1 Alpha sustainability?

`Nansen is not that useful compared to Dune, not much alpha anymore`, is what I increasingly heard from frens. I'm still thinking how to understand this (bc obviously different use cases).

5.1 Alpha sustainability?

`Nansen is not that useful compared to Dune, not much alpha anymore`, is what I increasingly heard from frens. I'm still thinking how to understand this (bc obviously different use cases).

5.2 Competition & Distrbution?

While nansen is winning in crypto twitter, what if coinmarketcap / coingecko launches a Pro ver? (they get distribution over mainstream users). This depends on execution, as gecko terminal & santiment don't get that much attention.

While nansen is winning in crypto twitter, what if coinmarketcap / coingecko launches a Pro ver? (they get distribution over mainstream users). This depends on execution, as gecko terminal & santiment don't get that much attention.

5.3 New paradigm?

skew, dovemetrics, defillama, token terminal, deepdao and various detailed dune dashboard ... so many great insights from these vertical analytics.

but it's hard for them to stay independent financially and ppl don't want to pay them individually either

skew, dovemetrics, defillama, token terminal, deepdao and various detailed dune dashboard ... so many great insights from these vertical analytics.

but it's hard for them to stay independent financially and ppl don't want to pay them individually either

What if we can build a web3 tradingview, aggregate all metrics and visualize whatever you want? they can split fee based on query

technically speaking, bring abstraction down to metrics level (product → dashboard → metrics → source data), creating more composability.

technically speaking, bring abstraction down to metrics level (product → dashboard → metrics → source data), creating more composability.

6/

And that's it! Thanks for feedback from @BobieLiu @hildobby_ and many frens.

Feel free give me any advice on this, or any error or things I missed.

And that's it! Thanks for feedback from @BobieLiu @hildobby_ and many frens.

Feel free give me any advice on this, or any error or things I missed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh