🧵 How to outperform the market

Do you consistently want to perform better than the S&P500 and MSCI World? Use these golden investment rules and you'll do great ⬇️⬇️⬇️⬇️

Do you consistently want to perform better than the S&P500 and MSCI World? Use these golden investment rules and you'll do great ⬇️⬇️⬇️⬇️

1. Size matters

In general, small cap stocks perform better than large cap stocks due to the law of large numbers.

Small cap stocks outperformed large cap stocks on average by 3.6% (!) per year between 1927 and 2009.

In general, small cap stocks perform better than large cap stocks due to the law of large numbers.

Small cap stocks outperformed large cap stocks on average by 3.6% (!) per year between 1927 and 2009.

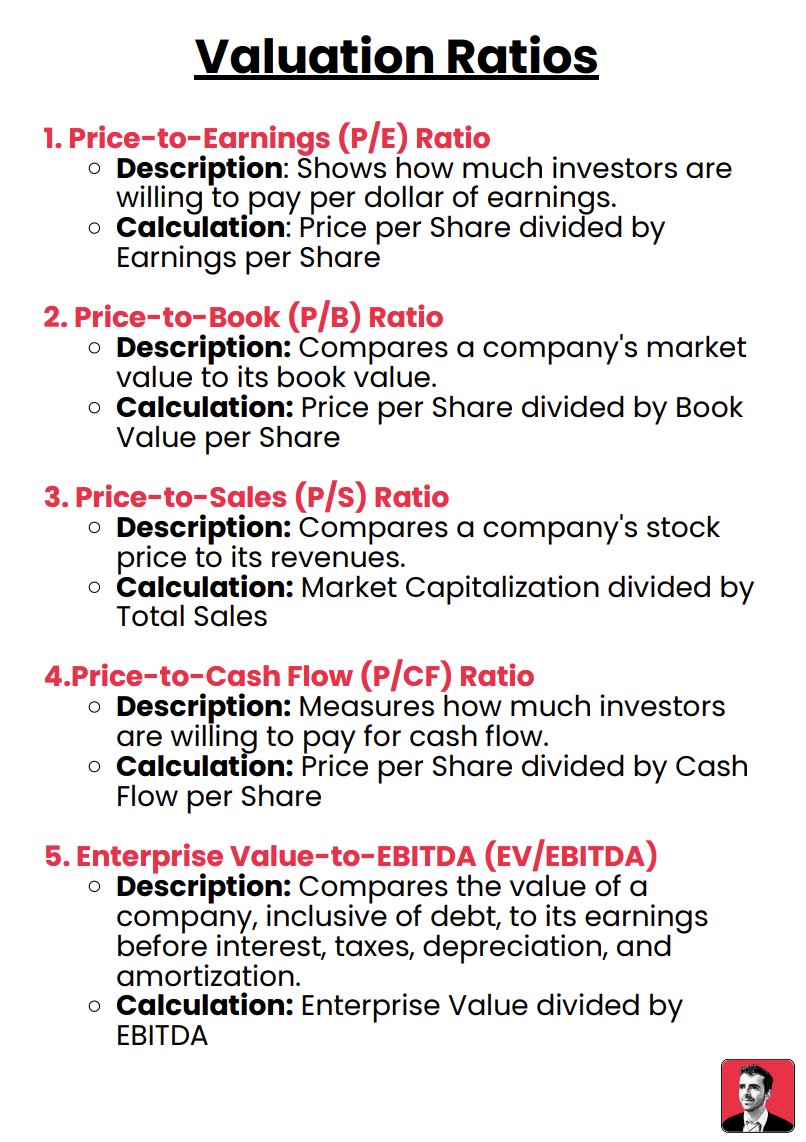

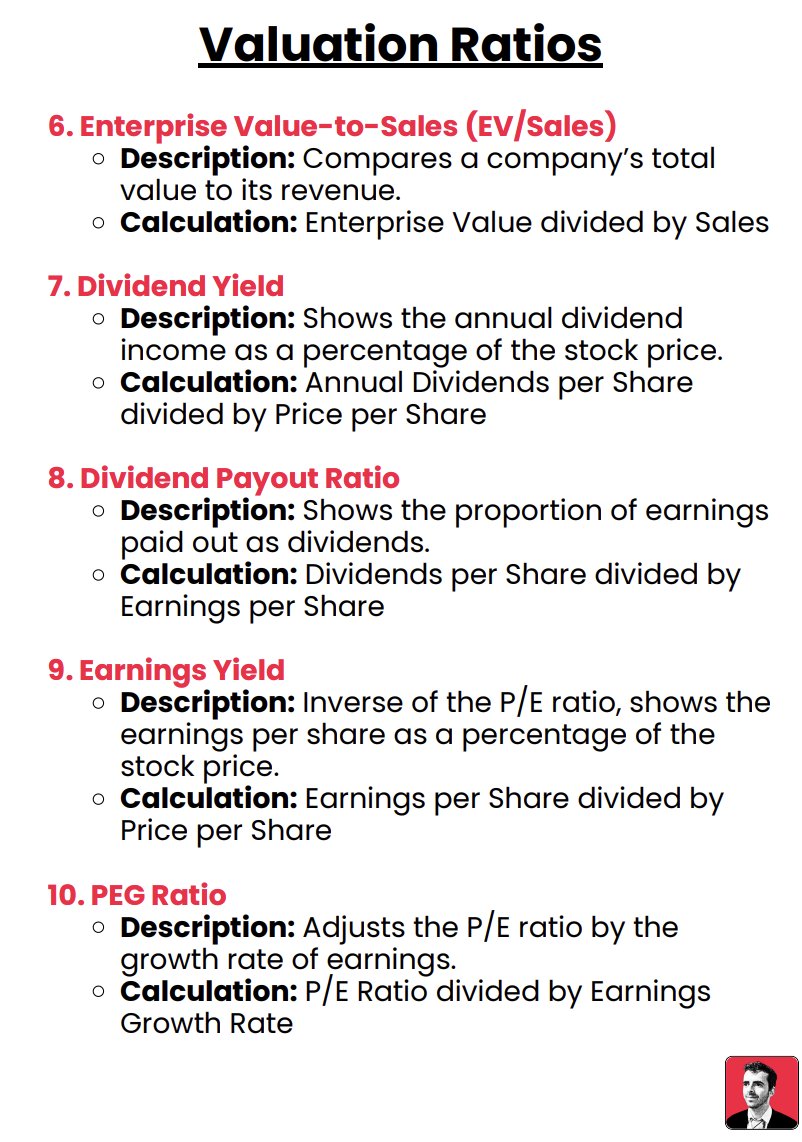

2. Valuation matters too

The cheaper you can buy a stock, the better.

Buying the cheapest stocks based on a simple price-to-sales ratio managed to outperform the market with 3% per year, achieving an annual return of 14.2% (!).

The cheaper you can buy a stock, the better.

Buying the cheapest stocks based on a simple price-to-sales ratio managed to outperform the market with 3% per year, achieving an annual return of 14.2% (!).

Price-to-earnings ratio

Investors who bought the cheapest stocks based on a PE outperformed the market by more than 5% per year, achieving an annual return of 16.3%.

This strategy outperformed the market in 99% (!) of all 10-year periods.

Investors who bought the cheapest stocks based on a PE outperformed the market by more than 5% per year, achieving an annual return of 16.3%.

This strategy outperformed the market in 99% (!) of all 10-year periods.

The best valuation factors

In the picture below, you can find which valuation factors performed well between 1964 and 2019.

A low EV/EBITDA seemed to have worked the best as your $10.000 would have turned into more than $11.6 million.

In the picture below, you can find which valuation factors performed well between 1964 and 2019.

A low EV/EBITDA seemed to have worked the best as your $10.000 would have turned into more than $11.6 million.

Combination of value factors

A combination of value factors allows you to further improve your performance.

When you bought the cheapest stocks based on a combination of the P/E, P/B, EBITDA/EV, P/S and P/CF, you would have achieved a yearly return of 17.2% (!) per year!

A combination of value factors allows you to further improve your performance.

When you bought the cheapest stocks based on a combination of the P/E, P/B, EBITDA/EV, P/S and P/CF, you would have achieved a yearly return of 17.2% (!) per year!

3. High dividend stocks do NOT outperform

When you want to invest in dividends stocks, don’t focus on dividend yield.

Focus on dividend aristocrats (stocks with more than 25 years of consecutive dividend increases) with a durable payout ratio.

When you want to invest in dividends stocks, don’t focus on dividend yield.

Focus on dividend aristocrats (stocks with more than 25 years of consecutive dividend increases) with a durable payout ratio.

4. Free cash flow is king

Companies with the lowest accruals-to-price (where most earnings are translated into free cash flow) outperformed companies with the highest accruals-to-price with 5.3% per year.

Earnings are an opinion. Cash is a fact. Focus on free cash flow.

Companies with the lowest accruals-to-price (where most earnings are translated into free cash flow) outperformed companies with the highest accruals-to-price with 5.3% per year.

Earnings are an opinion. Cash is a fact. Focus on free cash flow.

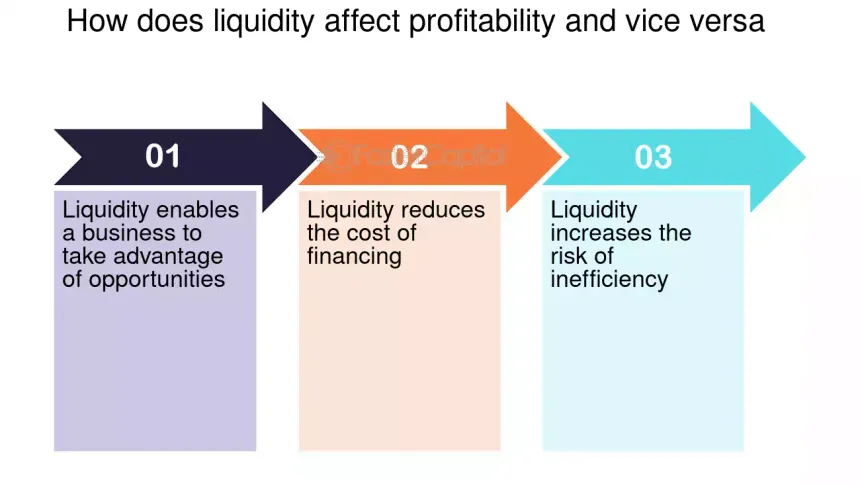

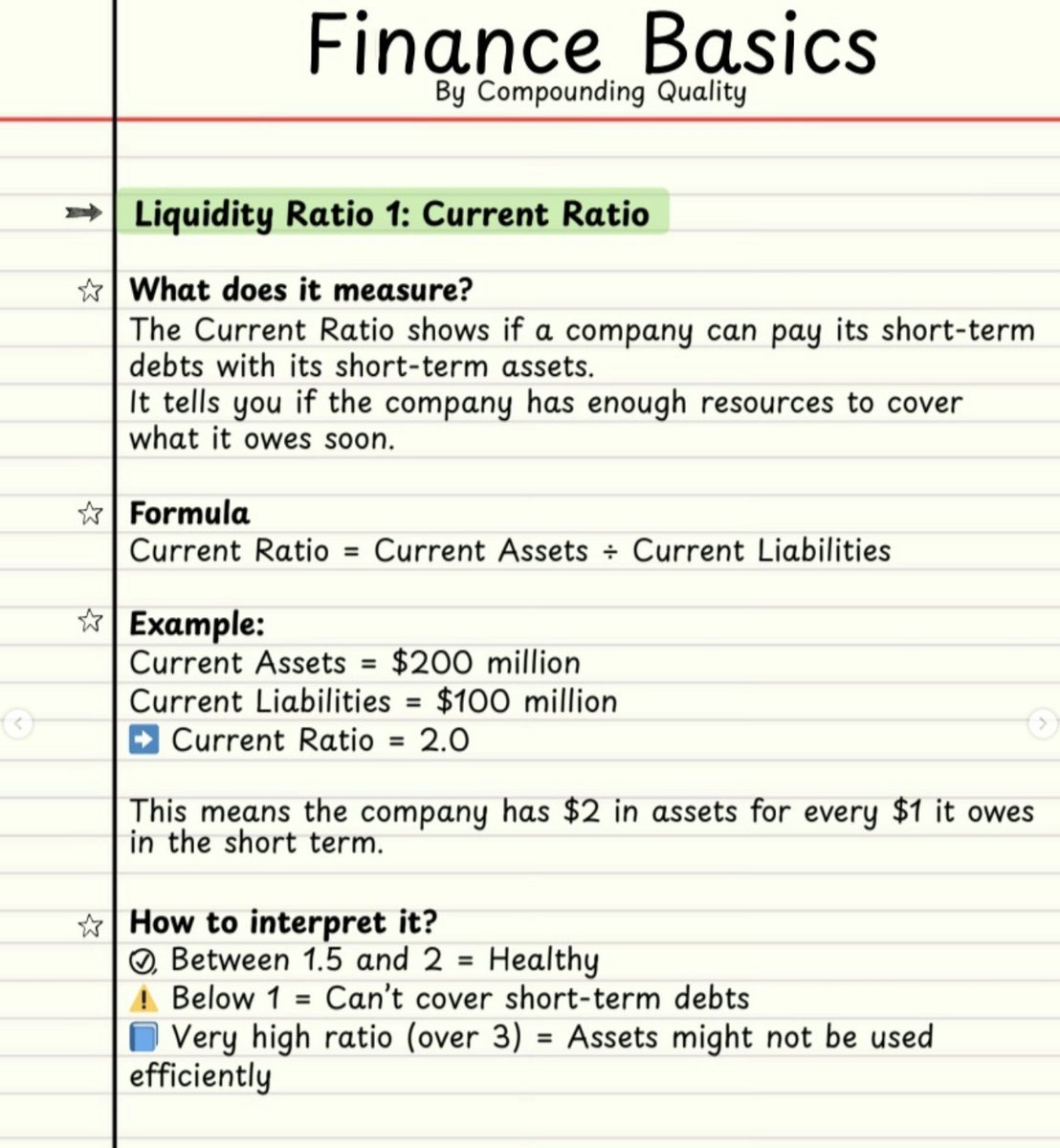

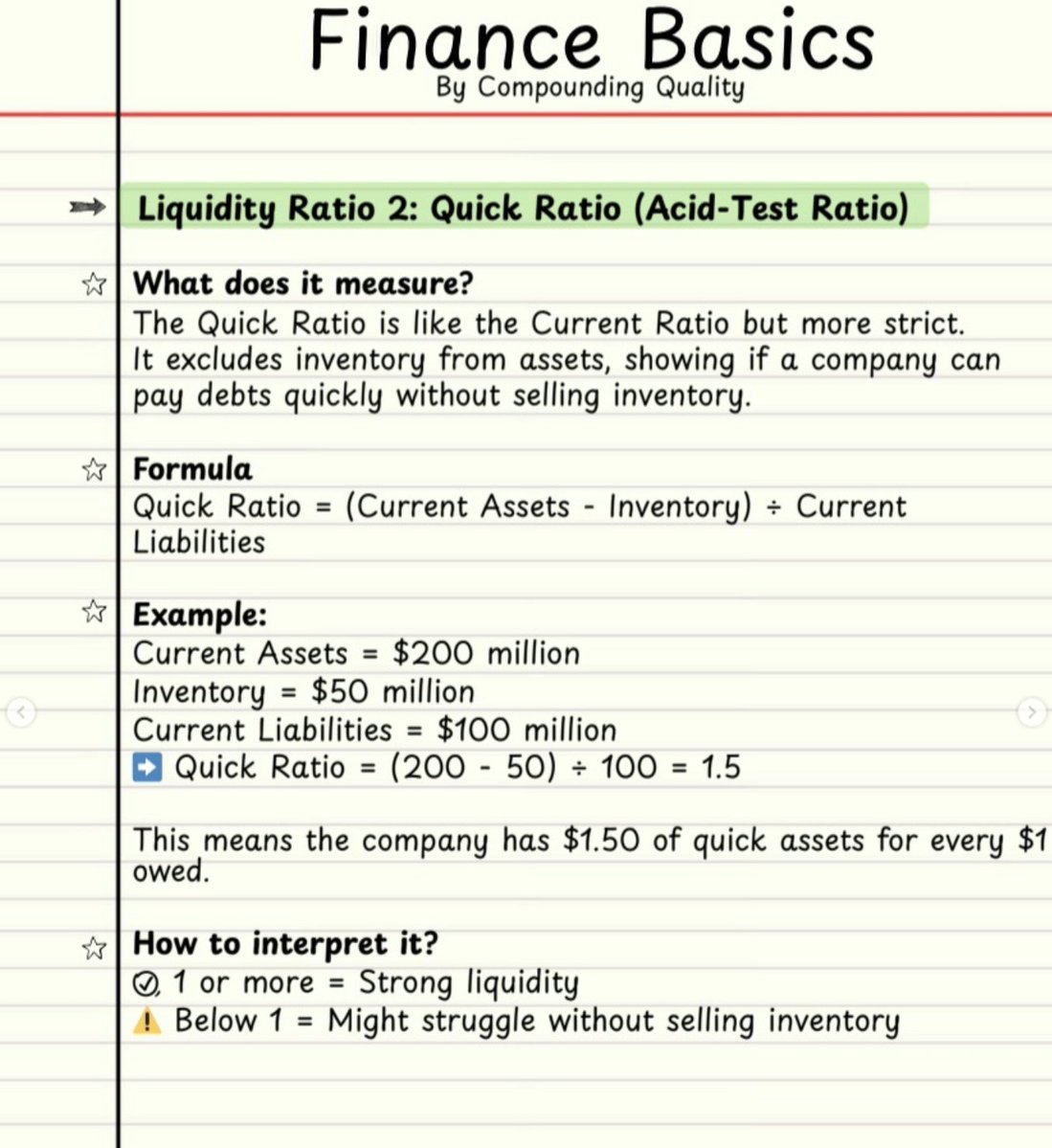

5. The healthier balance sheet, the better

Quality investors invest in companies with a healthy balance sheet.

Companies with the highest cash flow to debt (healthiest balance sheet) outperformed companies with the least healthy balance sheet with 8.0% (!) per year.

Quality investors invest in companies with a healthy balance sheet.

Companies with the highest cash flow to debt (healthiest balance sheet) outperformed companies with the least healthy balance sheet with 8.0% (!) per year.

6. Don’t look at profit margins alone

Investing in companies with high profit margins does not work if the company doesn't have a competitive advantage.

When a company has a high profit margin but no moat, rivals will enter the market and reversion to the mean takes place.

Investing in companies with high profit margins does not work if the company doesn't have a competitive advantage.

When a company has a high profit margin but no moat, rivals will enter the market and reversion to the mean takes place.

7. Return On Equity (ROE)

When you would have bought the stocks with the highest ROE, you only would have slightly outperformed the market.

However, in general it is a very good idea to combine good capital allocation metrics with a high profitability.

When you would have bought the stocks with the highest ROE, you only would have slightly outperformed the market.

However, in general it is a very good idea to combine good capital allocation metrics with a high profitability.

8. Momentum works great

In the short term, what goes up tends to keep going up and what goes down tends to keep going down.

A momentum-based strategy would have generated a return of 14.1% (!) per year over the studied period. This is an annual performance of 3.6% per year.

In the short term, what goes up tends to keep going up and what goes down tends to keep going down.

A momentum-based strategy would have generated a return of 14.1% (!) per year over the studied period. This is an annual performance of 3.6% per year.

9. Golden egg: momentum + value

Combining momentum and value (Trending Value) achieved an annual return of 21.2% (!) per year between 1964 and 2009.

This is an annual outperformance of 10% (!) per year.

Combining momentum and value (Trending Value) achieved an annual return of 21.2% (!) per year between 1964 and 2009.

This is an annual outperformance of 10% (!) per year.

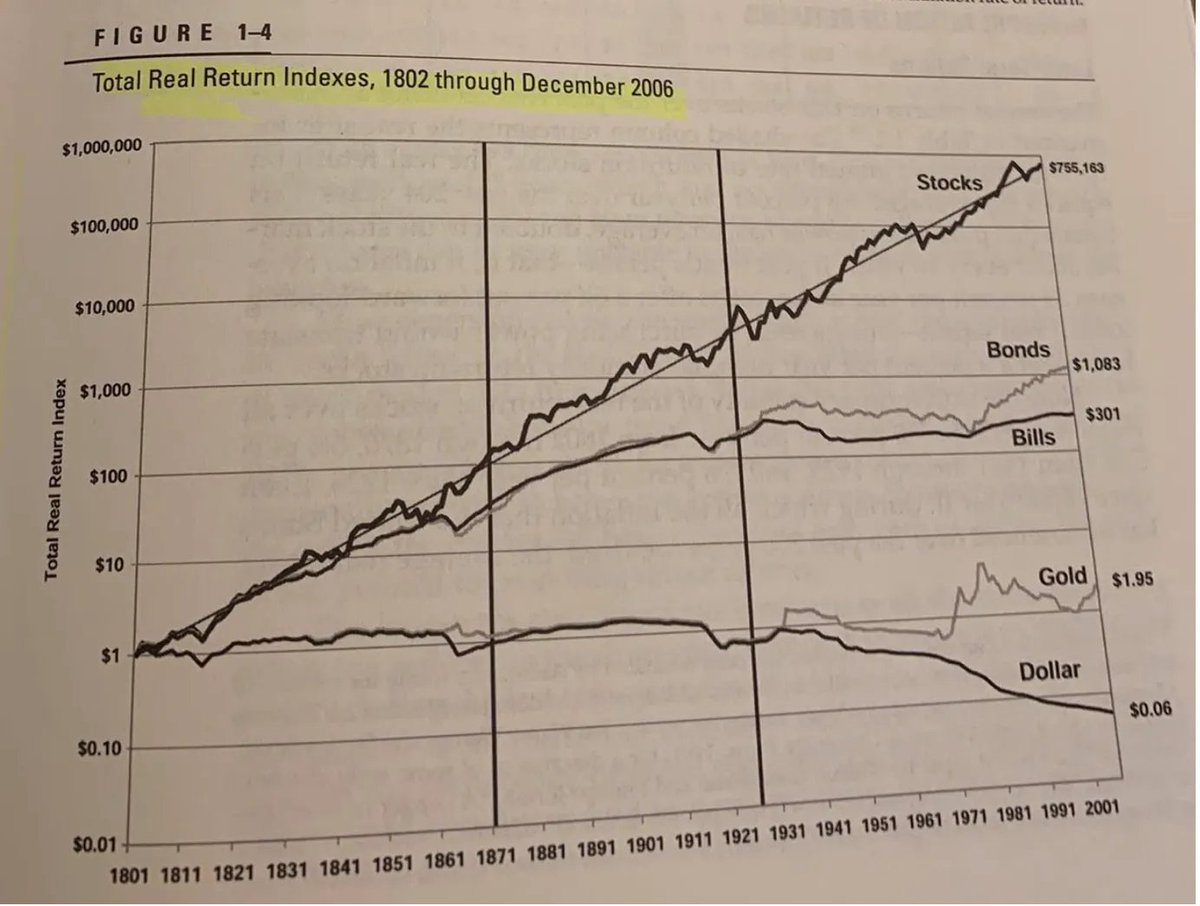

10. Consistency is key

There are a lot of strategies that outperform the market. In general, it is important to note that you should stick to the strategy that suits you as an investor...

There are a lot of strategies that outperform the market. In general, it is important to note that you should stick to the strategy that suits you as an investor...

... by definition, every active strategy will underperform the market from time to time. Discipline and consistency are key.

Keep faith to your strategy and you’ll end up fine.

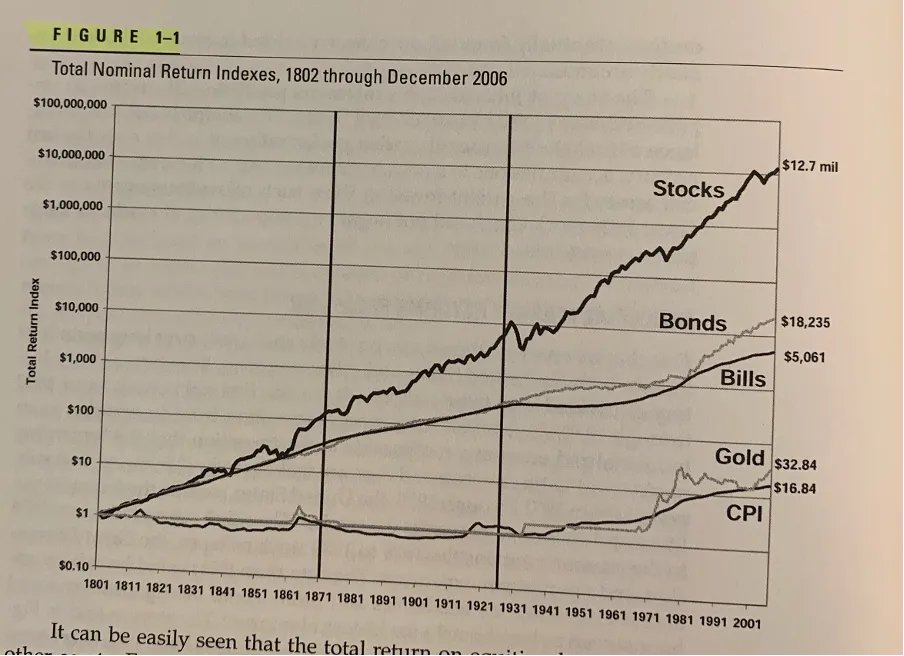

Investing is a marathon, not a sprint.

Keep faith to your strategy and you’ll end up fine.

Investing is a marathon, not a sprint.

If you liked this thread, you will love our website:

qualitycompounding.substack.com

qualitycompounding.substack.com

This thread was based on the great book What Works on Wall Street from @jposhaughnessy.

James is one of the highest quality people on FinTwit I know of.

James is one of the highest quality people on FinTwit I know of.

@jposhaughnessy If you liked this, you will love our website: qualitycompounding.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh