🏰 Quality Stocks 🧑💼 Former Professional Investor ➡️ Teaching people about investing on our website.

139 subscribers

How to get URL link on X (Twitter) App

1. Elon Musk

1. Elon Musk

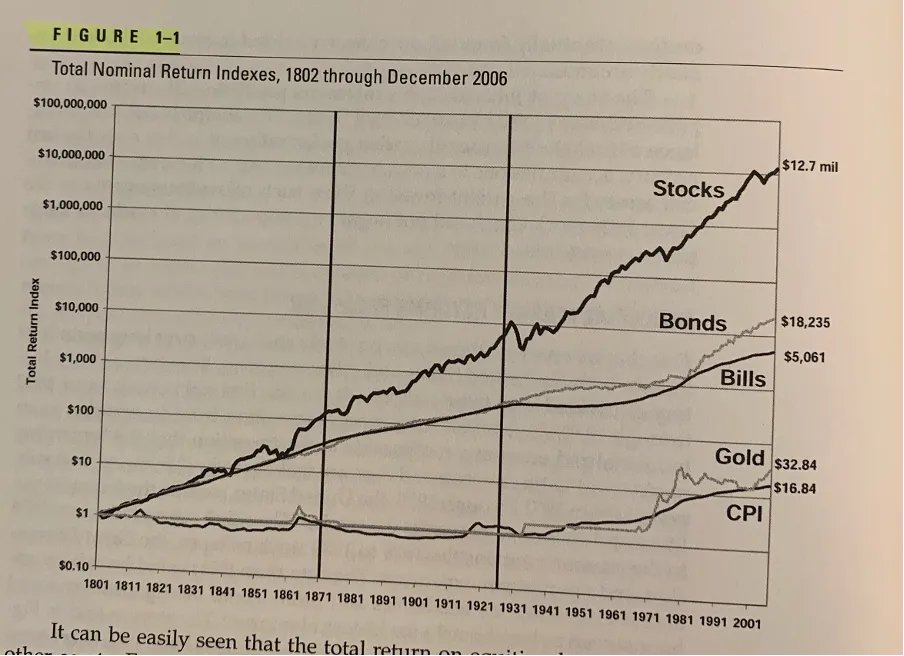

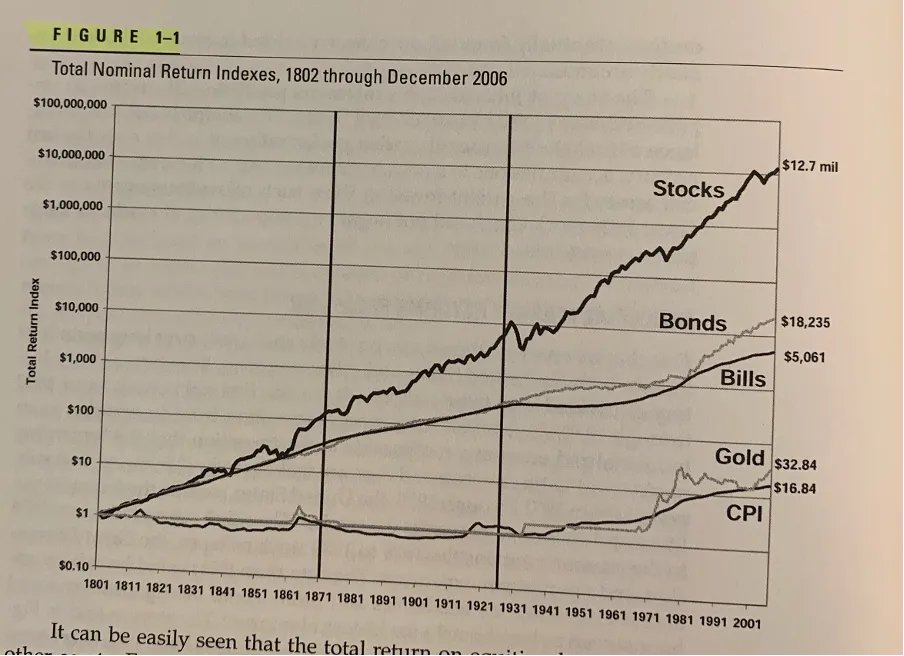

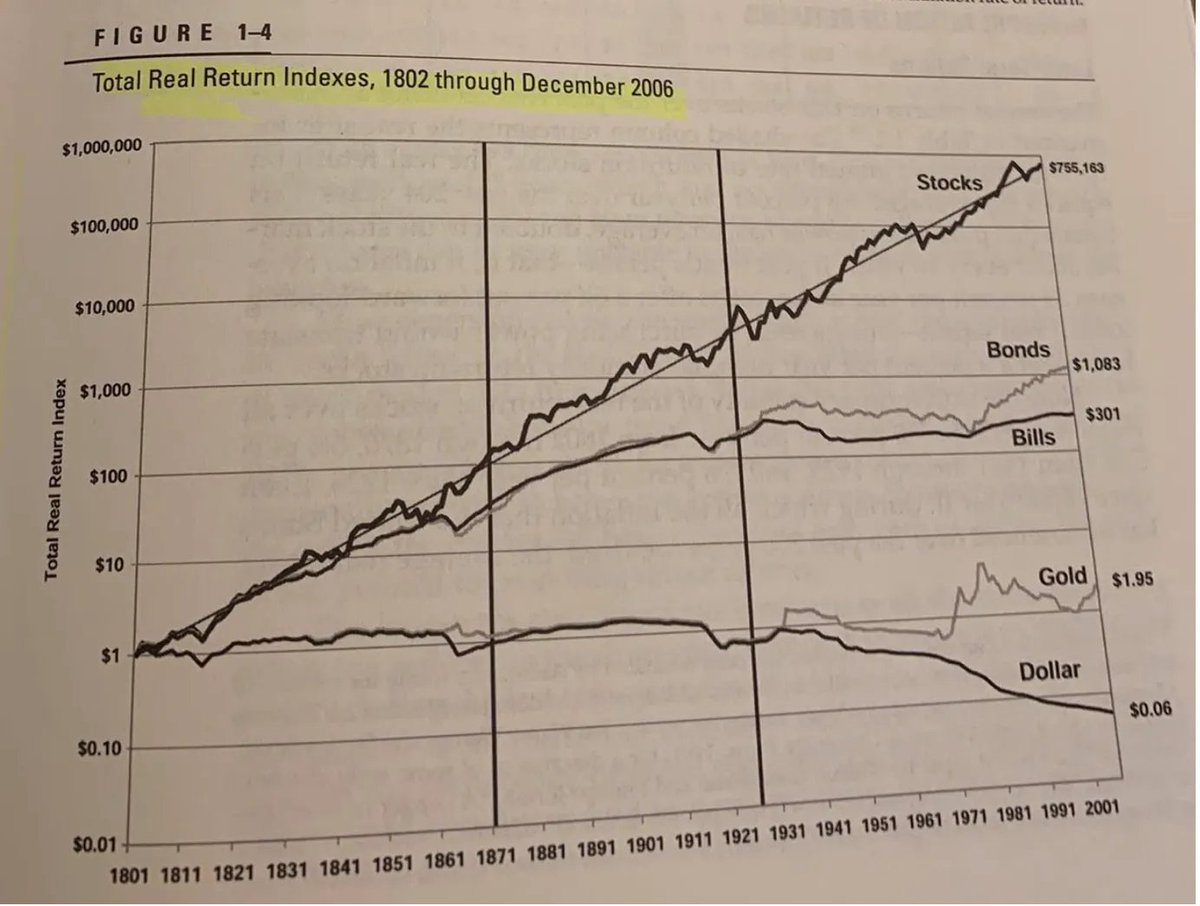

Lesson 2: On average, you double your money in the stock market every 10 years.

Lesson 2: On average, you double your money in the stock market every 10 years.

1. Security Analysis

1. Security Analysis

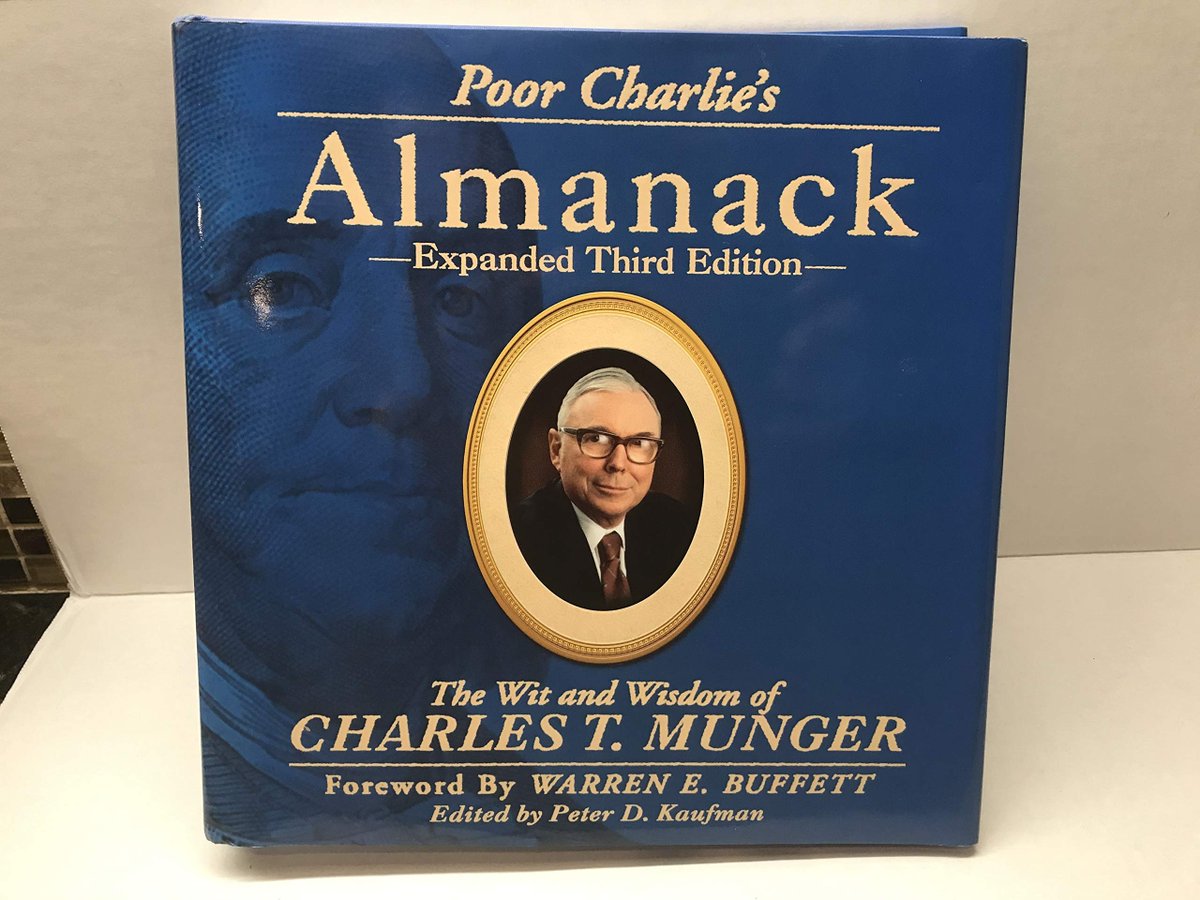

2. Poor Charlie’s Almanack — Charlie Munger

2. Poor Charlie’s Almanack — Charlie Munger

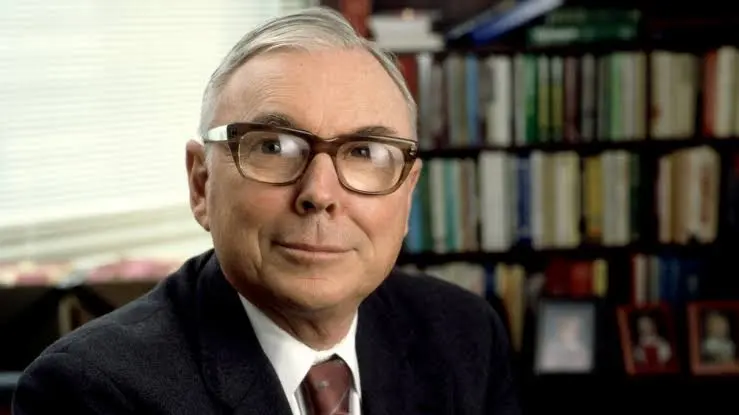

3. Like Warren, I had a considerable passion to get rich, not because I wanted Ferrari's - I wanted the independence. I desperately wanted it.

3. Like Warren, I had a considerable passion to get rich, not because I wanted Ferrari's - I wanted the independence. I desperately wanted it.

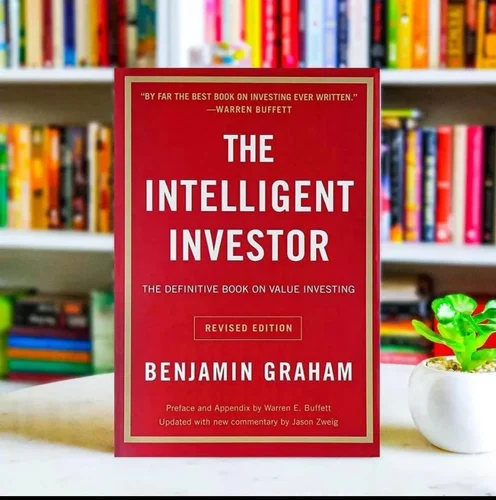

2. The Intelligent Investor – Benjamin Graham

2. The Intelligent Investor – Benjamin Graham

Charlie Munger spent decades studying why smart people make bad decisions.

Charlie Munger spent decades studying why smart people make bad decisions.

Charlie Munger spent decades studying why smart people make bad decisions.

Charlie Munger spent decades studying why smart people make bad decisions.

1. Gross domestic product (GDP)

1. Gross domestic product (GDP)

1. Security Analysis

1. Security Analysis