How to spot the perfect entry point to short $SPX

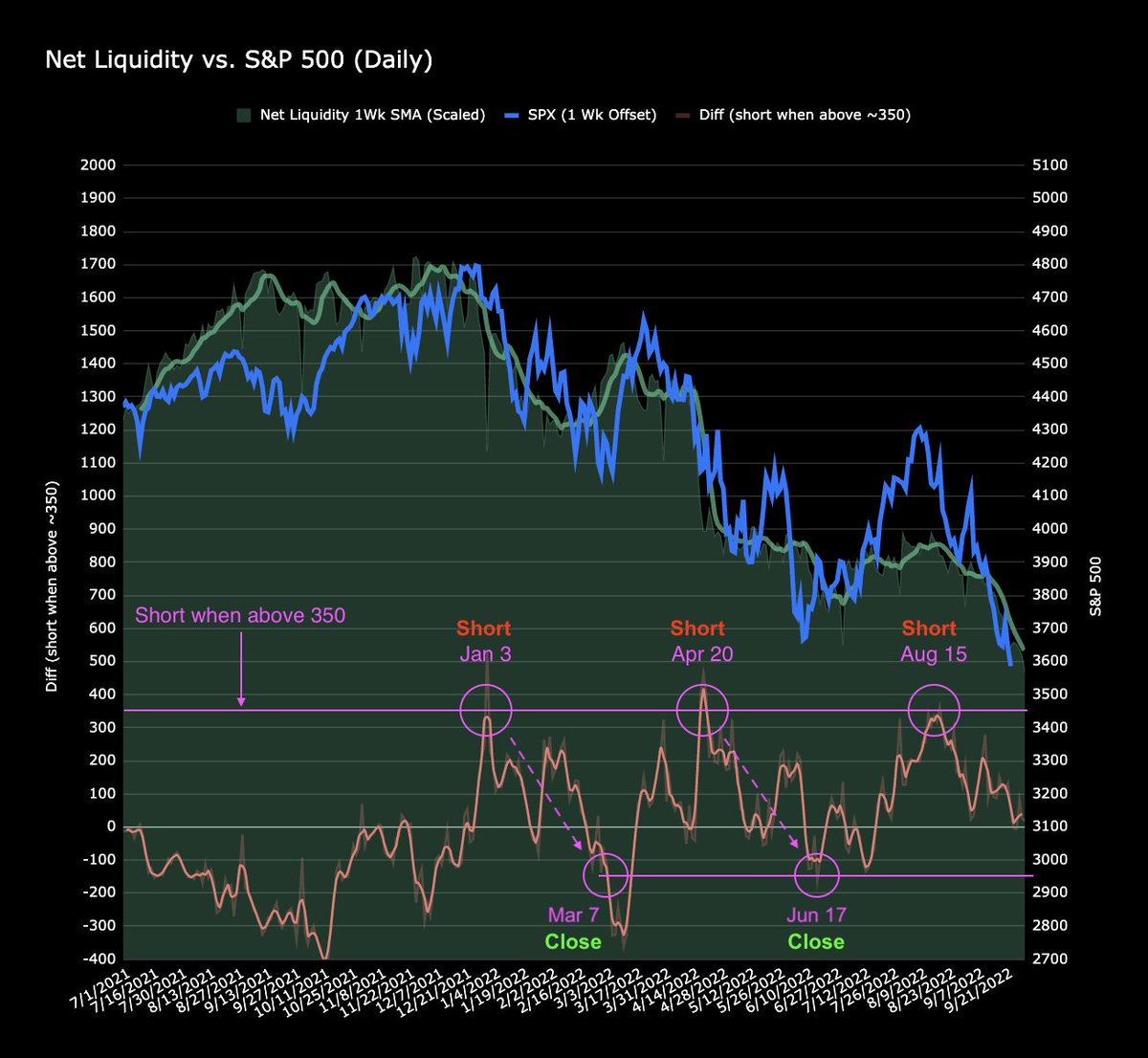

This formula caught 3 of the best short oppty's of 2020, to the day, with 1 day's advance warning:

➡️ Jan 3

➡️ Apr 20

➡️ Aug 15

Here's how it works and how you can use it too

👇

This formula caught 3 of the best short oppty's of 2020, to the day, with 1 day's advance warning:

➡️ Jan 3

➡️ Apr 20

➡️ Aug 15

Here's how it works and how you can use it too

👇

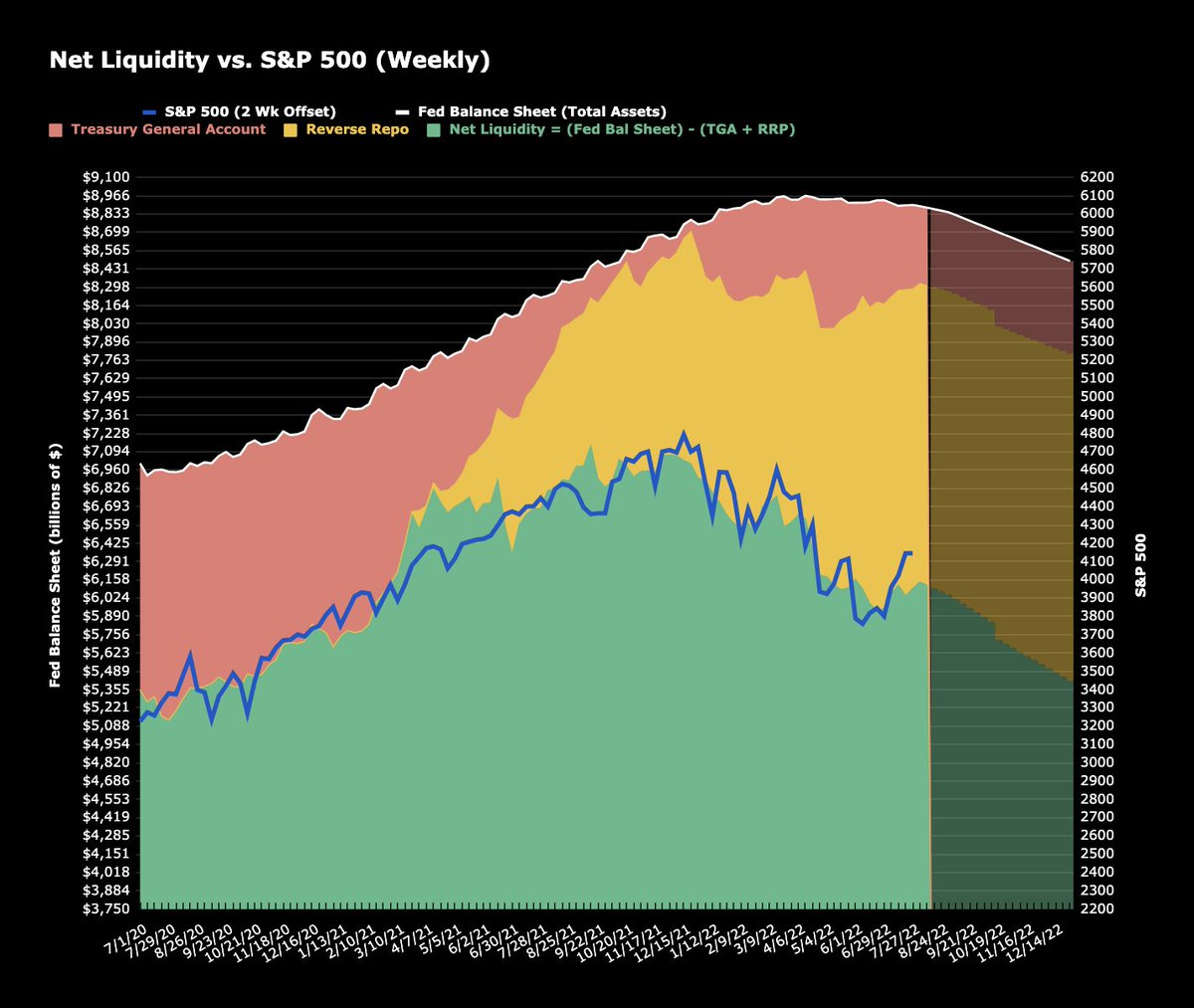

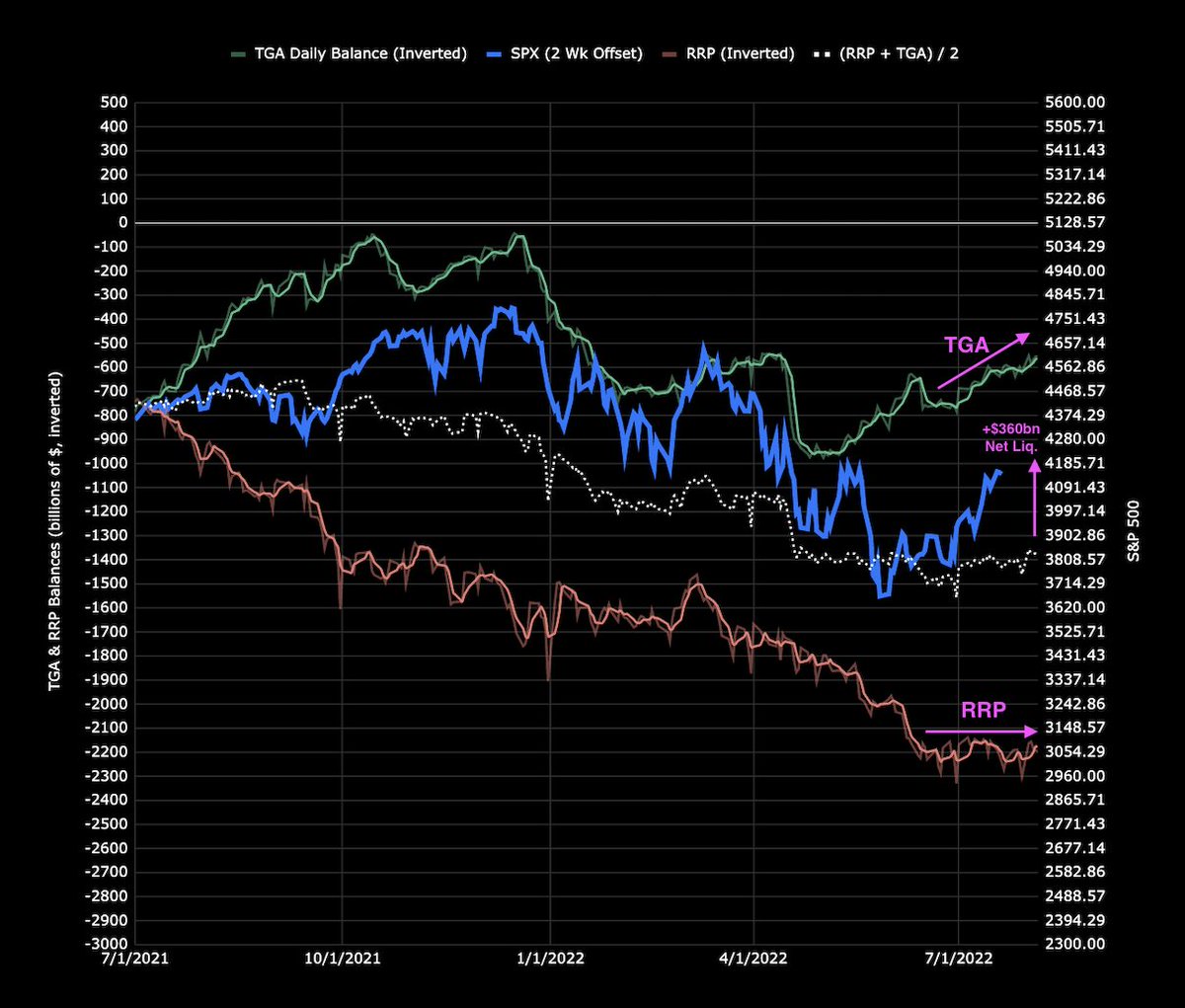

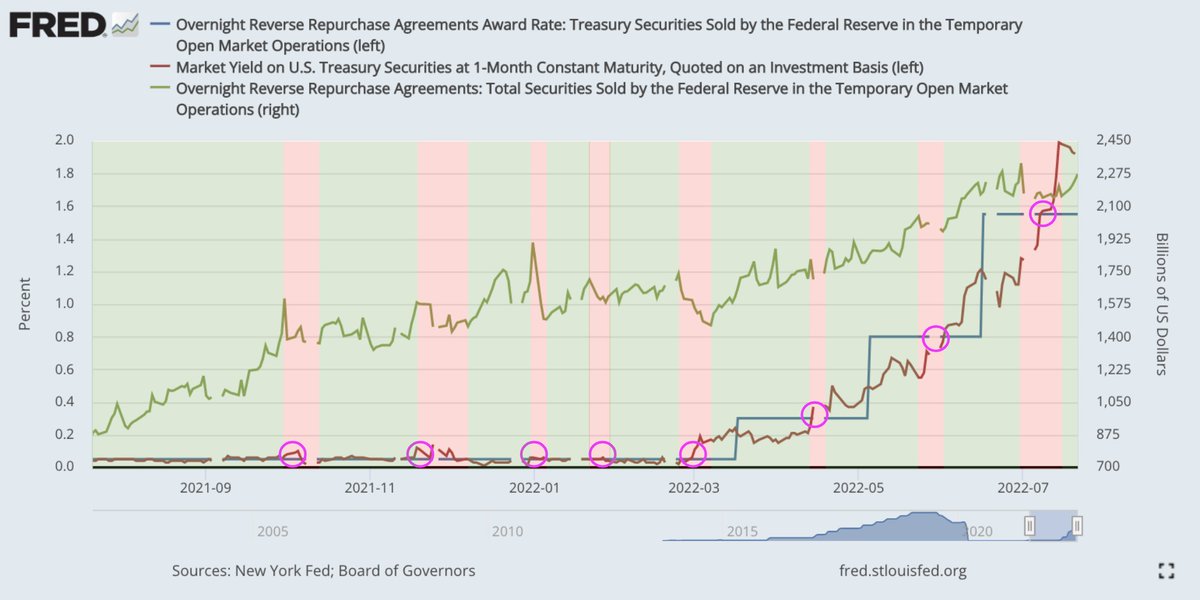

If you're not familiar with Net Liquidity 💦, and $SPX's remarkable correlation to it, take a moment to read this thread:

https://twitter.com/maxjanderson/status/1546472693234470912?s=20&t=hMSYqKQcn2-Nnmx_aKQV8g

Now that you're back, let's continue...

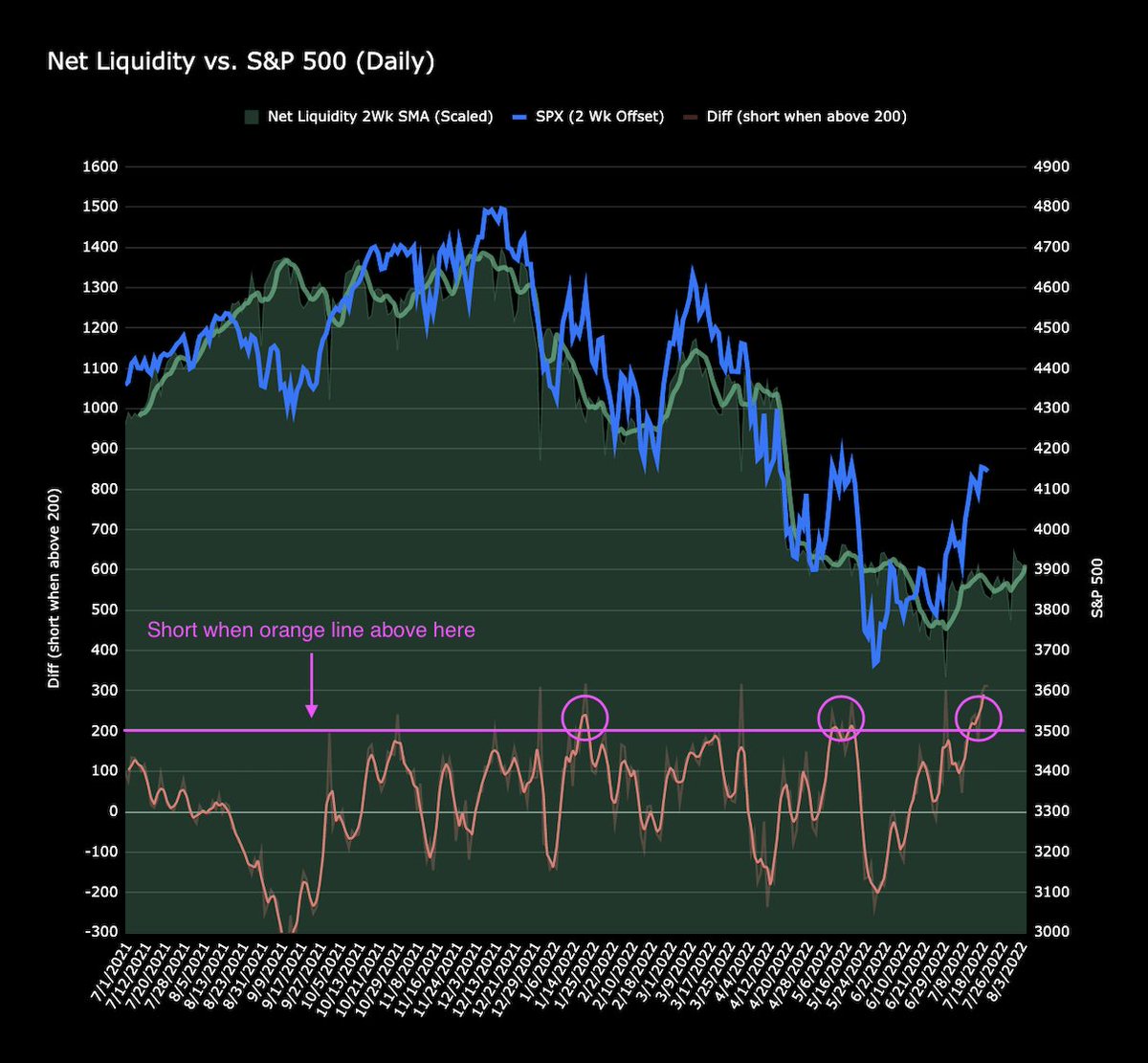

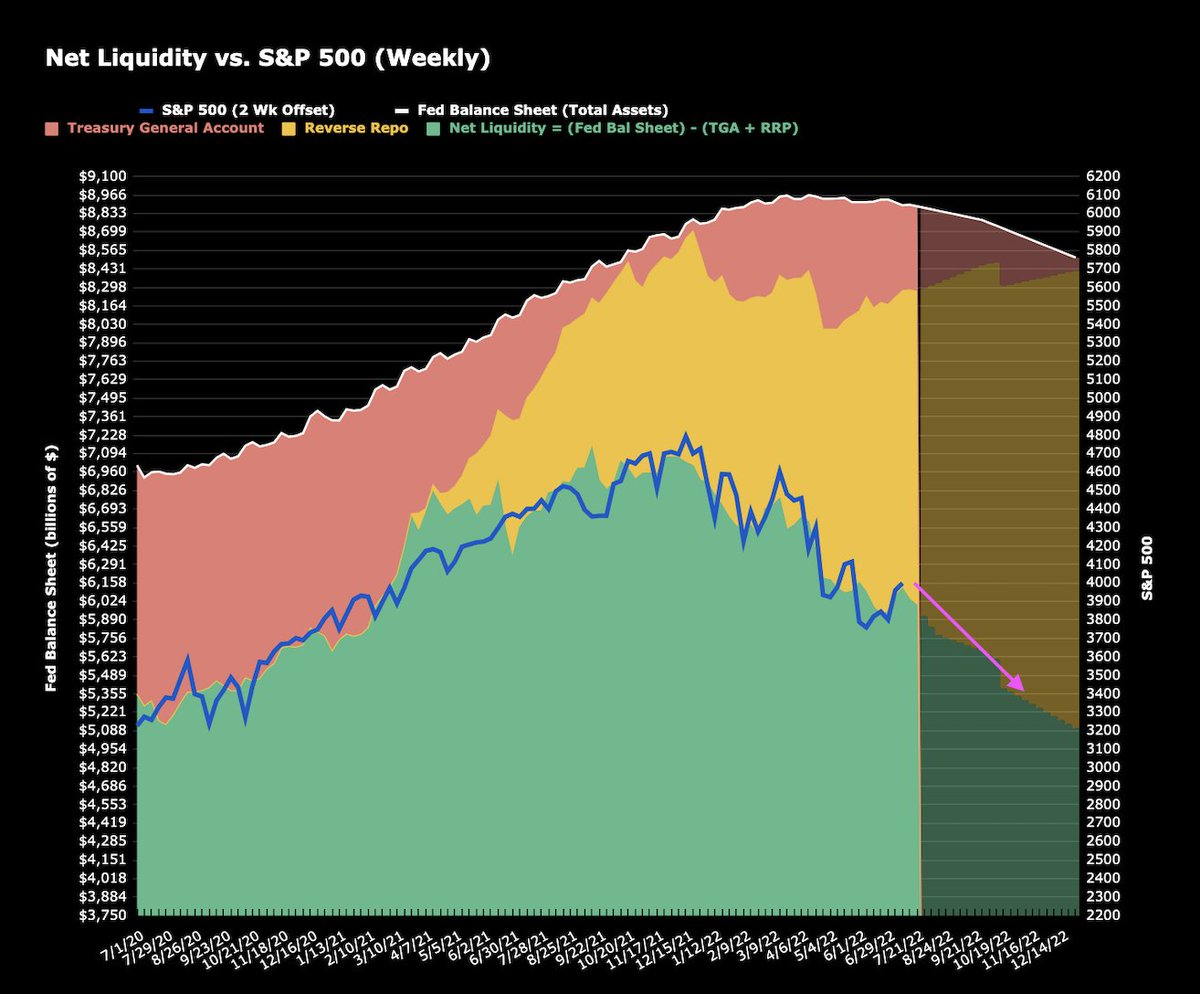

Net Liquidity 💦 sets the fair value for $SPX, or put another way, its mean reversion target

However, other factors (sentiment, positioning, world events, etc) can drive extreme *temporary* deviations from this level

Net Liquidity 💦 sets the fair value for $SPX, or put another way, its mean reversion target

However, other factors (sentiment, positioning, world events, etc) can drive extreme *temporary* deviations from this level

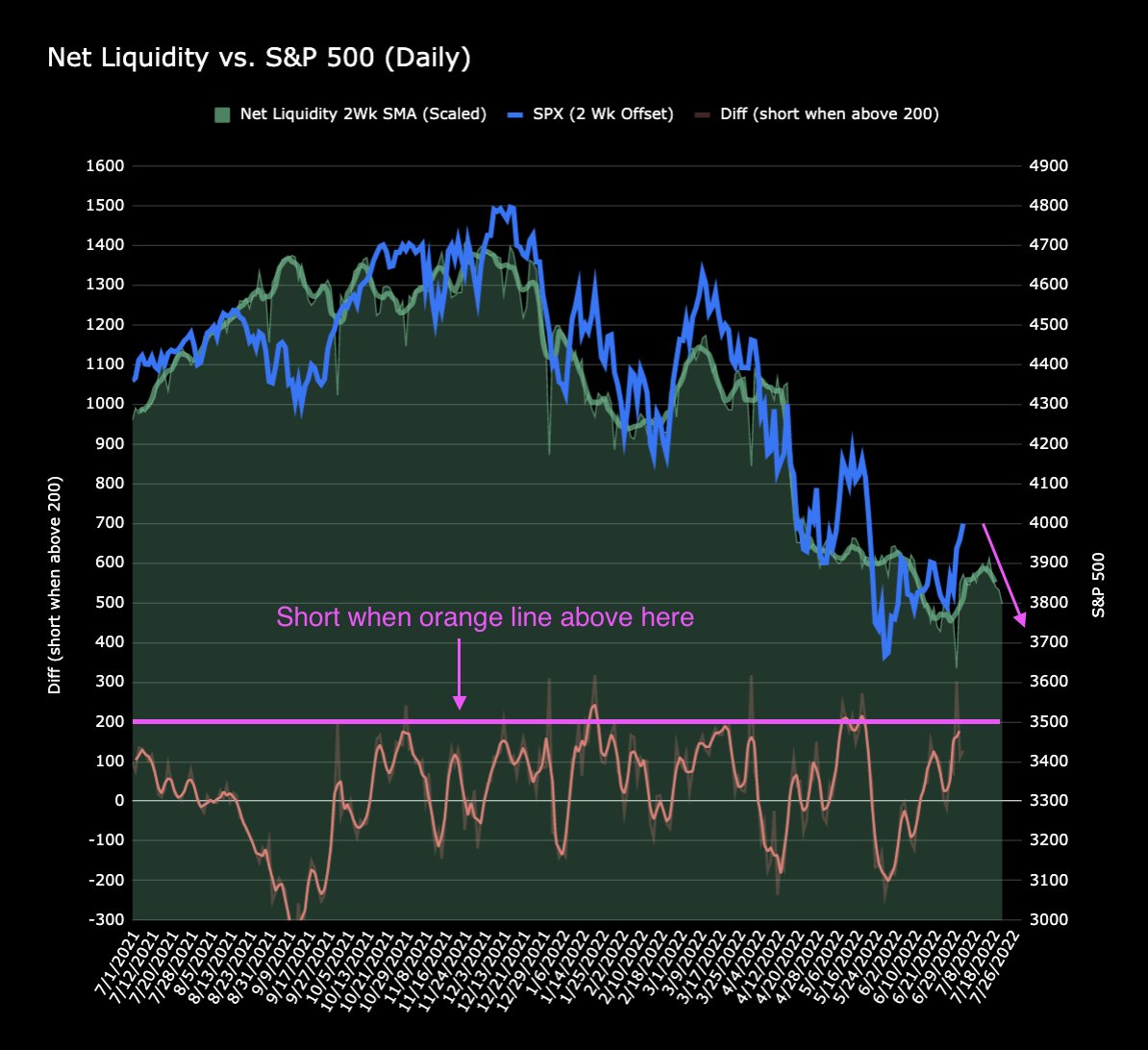

By determining fair value for $SPX based on Net Liquidity 💦, and then subtracting that from the actual level of SPX, we get a diff

This diff is positive when SPX is overvalued and negative when SPX is undervalued

This diff is positive when SPX is overvalued and negative when SPX is undervalued

The idea that follows is simple:

Short when $SPX reaches extreme levels of overvaluation, and close out when SPX returns to being undervalued

Short when $SPX reaches extreme levels of overvaluation, and close out when SPX returns to being undervalued

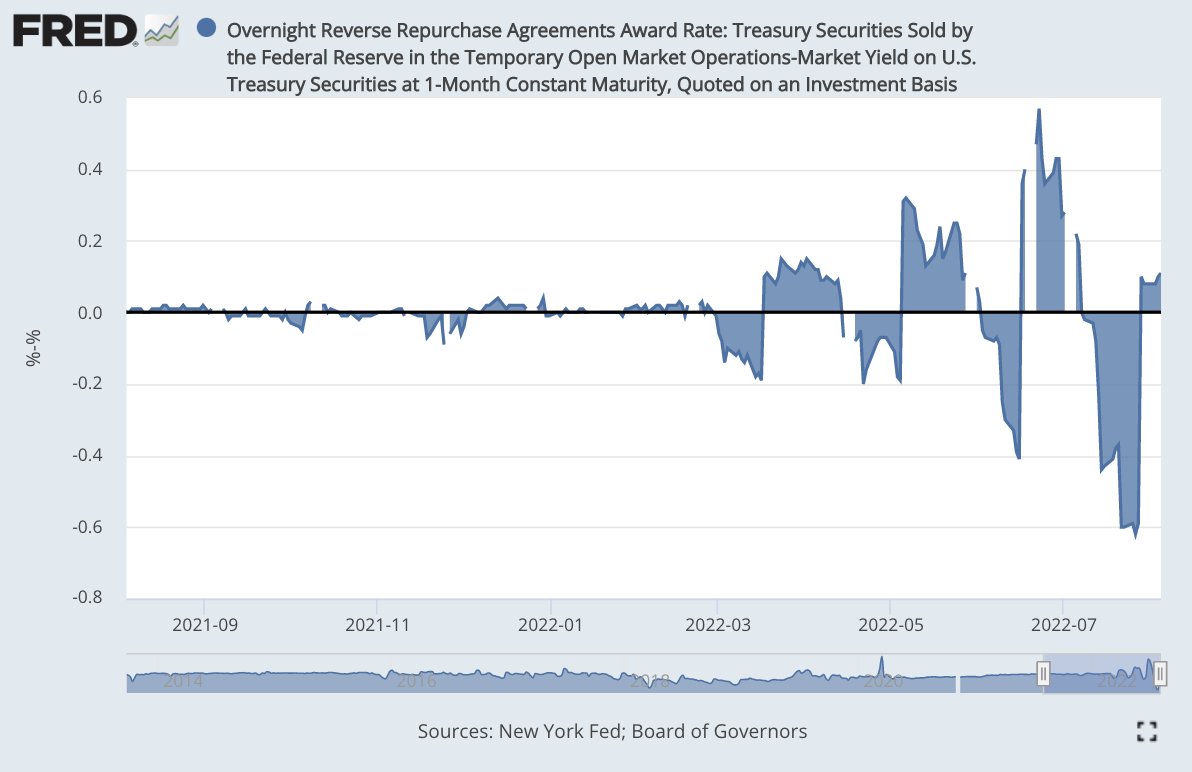

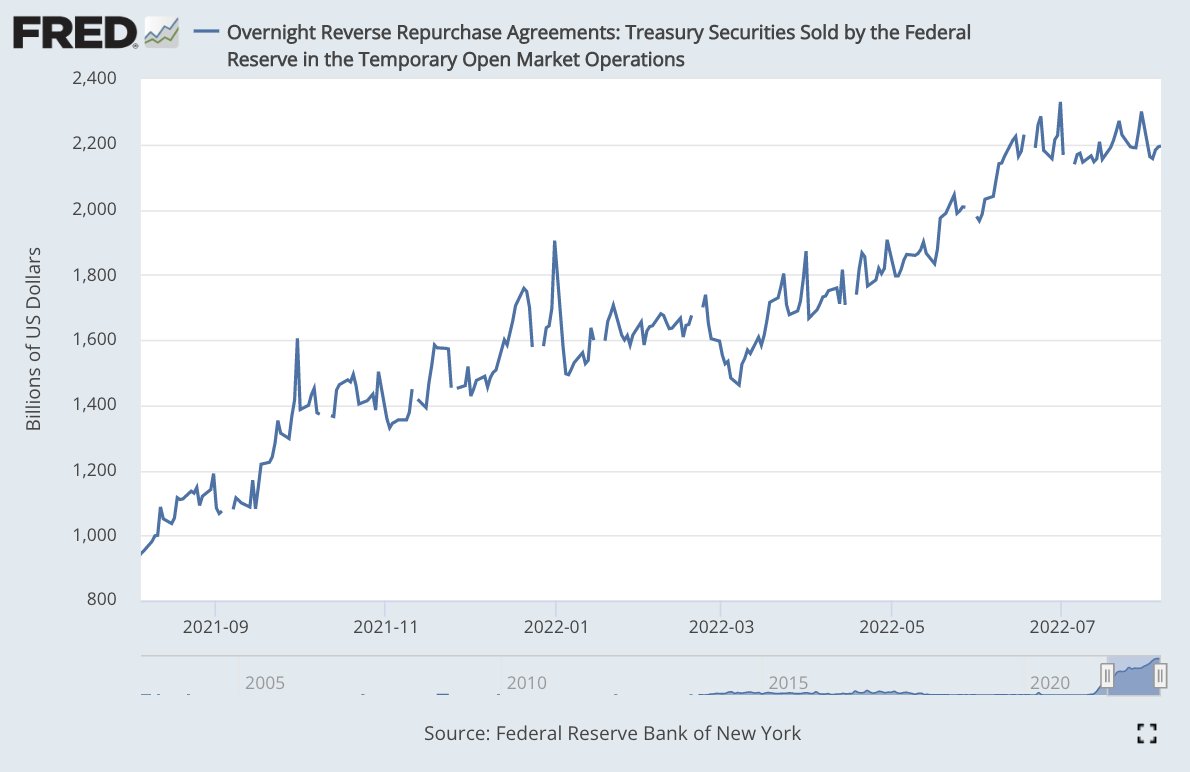

Here's the formulas I currently use to determine fair value:

Fair Value = (Fed Bal Sheet - TGA - RRP)/1.1 - 1625

Fair Value = (Fed Bal Sheet - TGA - RRP)/1.1 - 1625

And here's the trading rules I currently follow:

Short when diff of $SPX - Fair Value > 350

Close when diff of $SPX - Fair Value < 150

When one of these rules is triggered upon market close on a given day, trades are entered at open of the following day

Short when diff of $SPX - Fair Value > 350

Close when diff of $SPX - Fair Value < 150

When one of these rules is triggered upon market close on a given day, trades are entered at open of the following day

Here are the results so far in 2022:

- Short Jan 3 / close Mar 7 (+12.4%)

- Short Apr 20 / close Jun 17 (+17.6%)

- Short Aug 15 (+16.6% so far, still running)

- Short Jan 3 / close Mar 7 (+12.4%)

- Short Apr 20 / close Jun 17 (+17.6%)

- Short Aug 15 (+16.6% so far, still running)

Edit:

1st tweet should say 2022, not 2020

1st tweet should say 2022, not 2020

https://twitter.com/maxjanderson/status/1576609692675362817

• • •

Missing some Tweet in this thread? You can try to

force a refresh