Bootstrapped SaaS co to $15mm ARR. Helped take another from 0 to NASDAQ IPO

18 subscribers

How to get URL link on X (Twitter) App

If you’re an American who spends most of your money traveling abroad, then yes, it feels amazing when the dollar is strong

If you’re an American who spends most of your money traveling abroad, then yes, it feels amazing when the dollar is strong

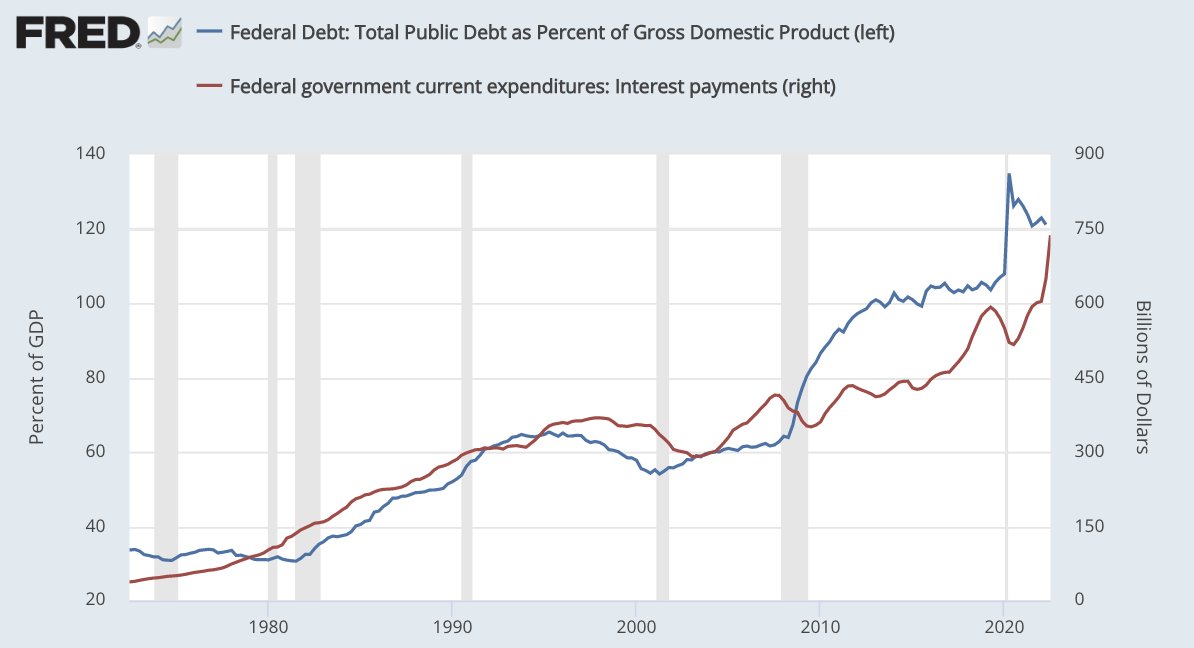

Coming out of WW2, the US federal debt hit a whopping 120% of GDP

Coming out of WW2, the US federal debt hit a whopping 120% of GDP

https://twitter.com/maxjanderson/status/1588039111973257221

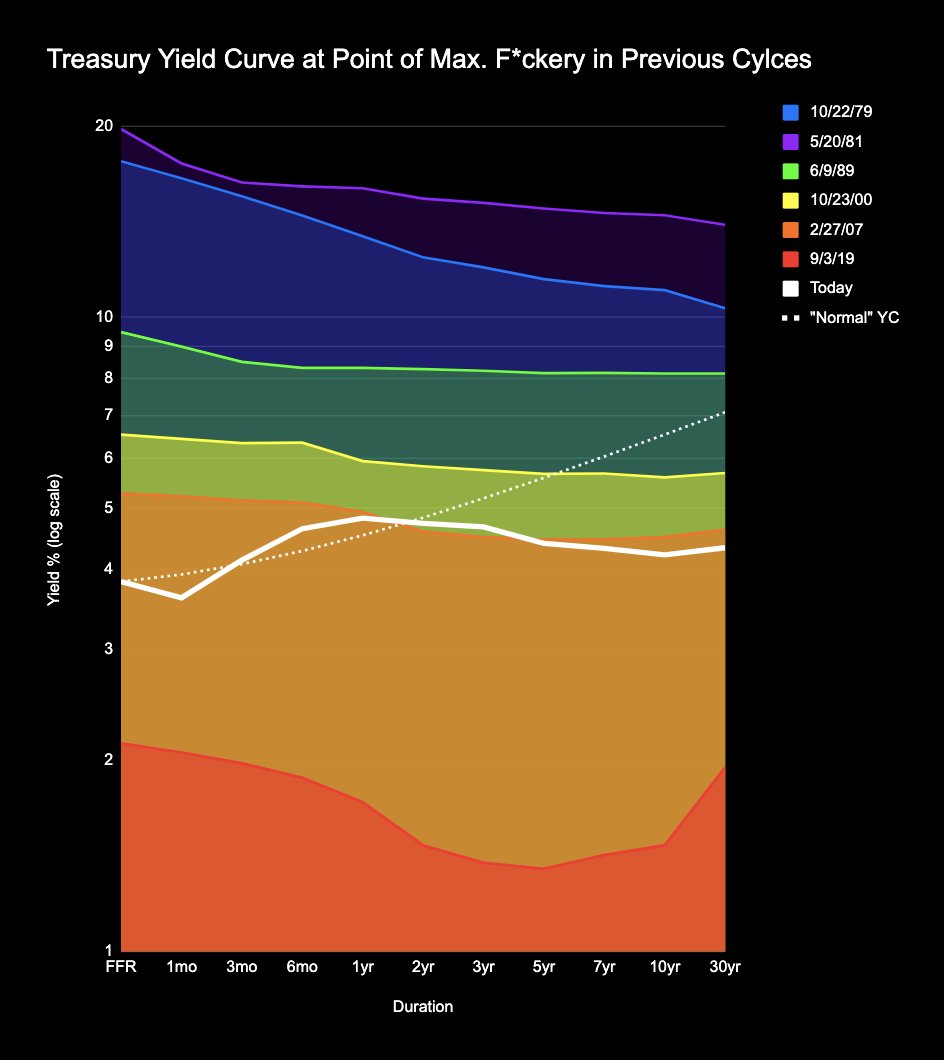

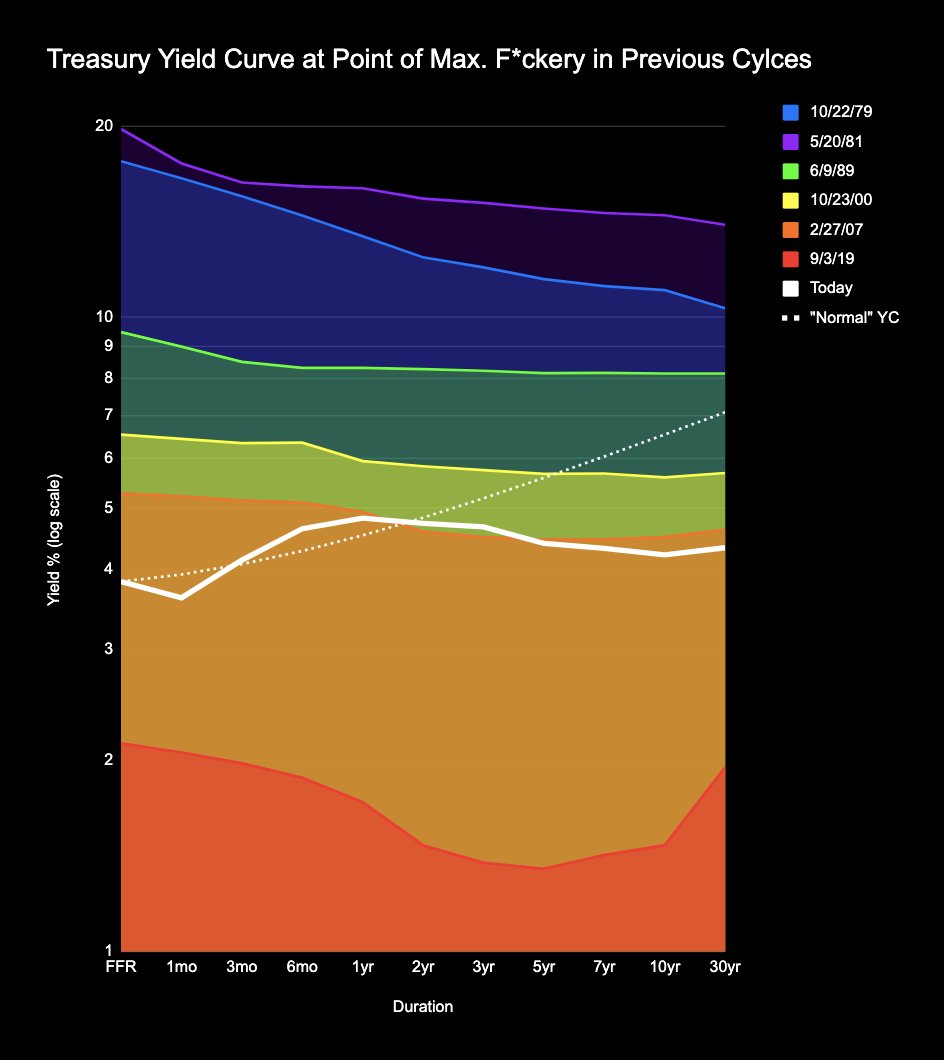

If rates stay at 5.5%

If rates stay at 5.5%

Watch RRP closely over the coming days. If RRP continues drawing down aggressively (esp by more than what's required to fill the TGA) it may indicate the time has finally come for that sidelined $2T to re-enter the game

Watch RRP closely over the coming days. If RRP continues drawing down aggressively (esp by more than what's required to fill the TGA) it may indicate the time has finally come for that sidelined $2T to re-enter the game

Based on most recent TBAC recommendations:

Based on most recent TBAC recommendations:

There’s $2tn of excess liquidity still trapped in RRP

There’s $2tn of excess liquidity still trapped in RRP

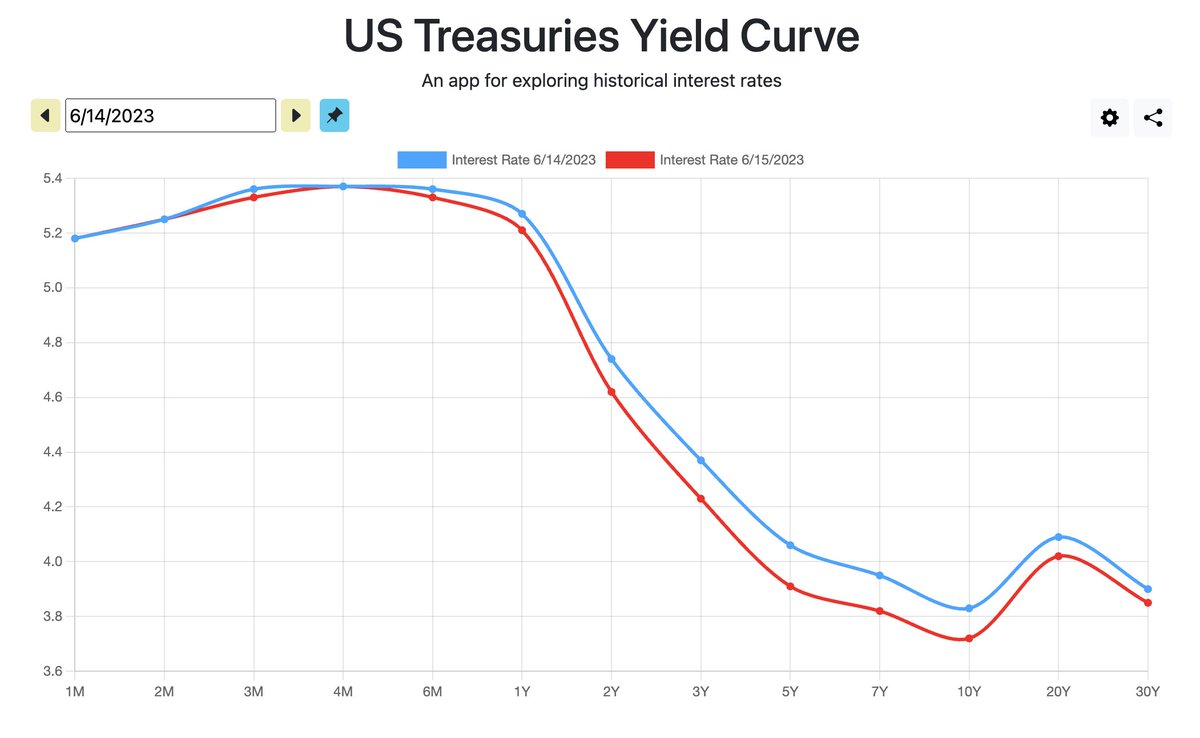

You'll hear a lot of talk about the 2y/10y and 3m/10yr both being *technically* inverted right now

You'll hear a lot of talk about the 2y/10y and 3m/10yr both being *technically* inverted right nowhttps://twitter.com/maxjanderson/status/1587653110117371904

https://twitter.com/michaelaarouet/status/1583846218664357888How?

If you're not familiar with Net Liquidity 💦, and $SPX's remarkable correlation to it, take a moment to read this thread:

If you're not familiar with Net Liquidity 💦, and $SPX's remarkable correlation to it, take a moment to read this thread: https://twitter.com/maxjanderson/status/1546472693234470912?s=20&t=hMSYqKQcn2-Nnmx_aKQV8g

No obvious moves here, but if $SPX drifts above ~4050 (>200pts above fair value), I will likely put on an unlevered short via $SH to hold through EOY or retest of June lows, whichever comes sooner

No obvious moves here, but if $SPX drifts above ~4050 (>200pts above fair value), I will likely put on an unlevered short via $SH to hold through EOY or retest of June lows, whichever comes sooner

Looking ahead, one major potential downside catalyst to be aware of:

Looking ahead, one major potential downside catalyst to be aware of: