Kamadhenu: A Wish-Cow that continues to bless the wise investors

Special situation case study

#demerger #stocks

Special situation case study

#demerger #stocks

Hi folks, it`s been a long time since I wrote about demergers, so I thought I would share one interesting case study wherein the first leg has played out beautifully (more details later) and the second leg is yet to play out.

I started tracking Kamdhenu Ltd when they first announced a scheme of arrangement in January 2020. Promoter group of entities were getting merged into Kamdhenu for simplification of the shareholding structure of promoters and the paint business was getting demerged

Kamdhenu Limited had two businesses under one entity, the Steel and Paints business. Rings a bell? Two unrelated divisions under one entity: One being a low multiple business –Steel and the other being a high multiple business – Paints

It was a classic spin-off where one entity housed two unrelated businesses with no synergies. It made sense to unlock the value for its shareholders by listing these two businesses separately and expecting the SOTP (Sum of the parts) valuation to be much higher.

Some context about these businesses:

Steel:

Kamdhenu is not into the traditional steel-making business. Instead, it manufactures TMT bars and is the largest TMT selling brand in India.

Steel:

Kamdhenu is not into the traditional steel-making business. Instead, it manufactures TMT bars and is the largest TMT selling brand in India.

The company also devised a franchisee model where partners did everything at their end but provided QC (Quality Control) and the brand’s name (Kamdhenu) in exchange for royalty fees. Though the business demand is cyclical, like steel, it is not asset-heavy on the balance sheet

TMT bars business was clocking in sales of roughly INR 400 crores per annum and EBITDA of roughly 35 crores with 20%+ ROC and expected growth rate of 20%+(pent-up demand due to COVID-19 and expansion by the company in own manufacturing and franchisee addition).

Quite interesting, don’t you think?

Now, let’s look at the paint business

Paints:

It is one of the simplest businesses to understand. Only 2 primary things are required – Impactful branding and a Distribution network. Both are not easy by any means

Now, let’s look at the paint business

Paints:

It is one of the simplest businesses to understand. Only 2 primary things are required – Impactful branding and a Distribution network. Both are not easy by any means

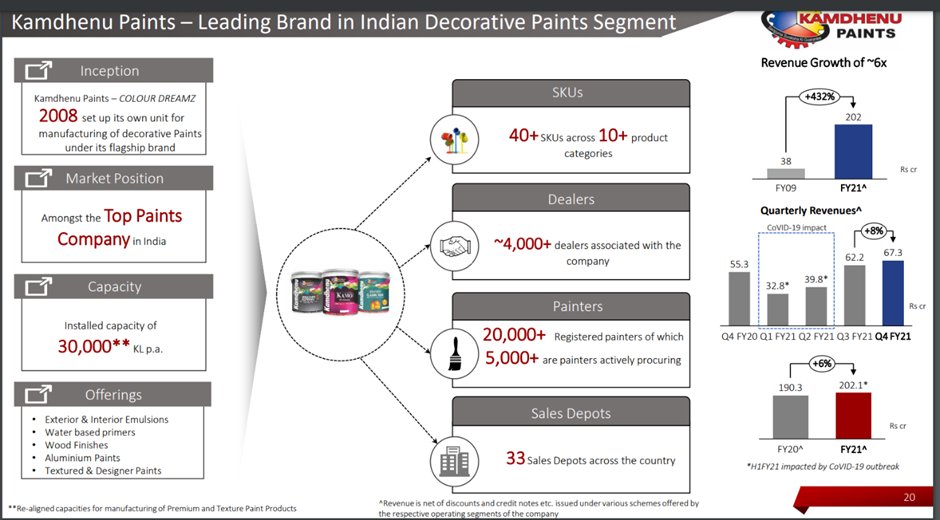

Kamdhenu, having built such a strong distribution network and a decent brand name in the steel business over the years, that it started selling paints as well. It was at a run-rate of INR 200 crores sales which was almost stagnant the last few years

as they had to redo the distribution network simply because one size doesn’t fit all. Steel and paints are like apples and Oranges.

The paint segment had its own challenges.

The paint segment had its own challenges.

The management had things in place for high growth, but unfortunately, a fire incident at their factory in Q1FY20 led them to co-outsource their production to mitigate the impact. However, before they could return to their original growth plans, COVID-19 happened

To conclude, Kamdhenu’s Steel segment had capacity expansion plans, and the pent-up demand post-COVID-19 gave good growth visibility to it, and their paint division’s existing capacity had a turnover potential of INR 600 crores(roughly 3x upside from FY21 levels)(Image above)

So, the question is, how did the valuation stack up at the time of Demerger?

Both the businesses, at the combined price, were available at INR 100/share or roughly INR 270 crores market cap and some working capital debt of INR 60-70 crores.

Both the businesses, at the combined price, were available at INR 100/share or roughly INR 270 crores market cap and some working capital debt of INR 60-70 crores.

I purchased the combined businesses at INR 130/share ~ INR 350 crores market cap. At that time, the steel business was at INR 45 crores of EBITDA run-rate, and the paint business was at INR 250 crores revenue run-rate.

Given a 6-7x EBITDA multiple on fwd earnings (asset heavy steel business multiple) implying INR 350 cr market cap, the market was assigning literally “Zero” valuation to its paints business.

We were getting the paints business which was clocking in INR 240 crores in sales with potentially more than INR 600 crores of sales for “FREE”.

Post spin-off; the standalone steel business is trading at INR 140-150/ per share, higher than my original buying price. As for the paints business, which we got for free, is expected to list at INR 300-400 crores market cap implying 100% returns in less than two years.

As a result, the first leg of the Demerger played out beautifully, where-in the exit in the steel business(exited at 160/share) was at a 23% premium value compared to my purchase price of both the combined business segments.

Let`s look at the second leg of this Demerger – Their Paint Business

Paint business will list in the next couple of months under the entity Kamdhenu Ventures, and its management has guided for onboarding of a strategic investor and pump in INR 200 crores in the business

Paint business will list in the next couple of months under the entity Kamdhenu Ventures, and its management has guided for onboarding of a strategic investor and pump in INR 200 crores in the business

It aims to achieve 1000 cr revenue by FY26(Article Link: bit.ly/3fHcnBq)

It lies on the investors to take the guidance with a pinch of salt, but this should be enough to tell you the direction of the sails for this business

It lies on the investors to take the guidance with a pinch of salt, but this should be enough to tell you the direction of the sails for this business

If they can stay on the course, this investment will be a big winner. One can also look at Shalimar Paints as well, which recently got re-rated post the fund infusion from Infra. Market

You see, the Demerger acted as a catalyst to unlock the value for shareholders; instead of owning shares and hoping for better performance, one can look for such triggers and expect better performance to boost your returns significantly.

Explore and find such special situations. I hope this was insightful! You know whom to follow to learn more or have questions about such special situations. See you next time with more such case studies and live special situations.

Come, say hi if this was helpful :)

Come, say hi if this was helpful :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh