The Grand Lies of Gland Pharma : The Story of Two Shortages & How company disguised investors by showcasing company's dwindling situation in another manner

⚠️Redflag & Corporate Governance Issue⚠️

A thread 🧵

#glandpharma

⚠️Redflag & Corporate Governance Issue⚠️

A thread 🧵

#glandpharma

Gland Pharma is a pharma company majnly into business of injectables. The company during IPO laid out a ambitious vision of becoming largest and fastest growing injectable-focused companies.

Cutback to Nov-21, world including India facing shortage of syringes (key raw material of Gland Pharma) mainly due to vaccination drive and some supply chain issues.

India started facing syringe shortage even before in Oct-21.

WHO also warned about global shortage in Nov-21.

India started facing syringe shortage even before in Oct-21.

WHO also warned about global shortage in Nov-21.

In Oct-21 Govt put quantitative restrictions on syringe exports from India

The problem worsened when domestic syringe factories were shut down due to pollution controls

The problem worsened when domestic syringe factories were shut down due to pollution controls

Rough Q3FY21 it seems ? But Gland pharma didn't mentioned anything about syringe shortage or supply chain issues in Q3 FY21 concall. They just mentioned about delay in certain syringe supply but have no impact on business. CONT..

Since co is celebrating another shortage (certain drugs were in shortage as US FDA & Gland had 11 such drugs). Co very smartly hide supply chain issues & celebrated drug shortage so that they can add more flying wings to its Q3 (⬆️Revenue 24%, PAT 34%)

Coming Q4 : As vaccination drive slows down Govt lifted exporrt ban on syringesby Feb-22 as demand goes down

But Gland pharma has said something diff which is not matching with what's happening in industry: Syringe shortage.

They could not export because of Syringe shortage

But Gland pharma has said something diff which is not matching with what's happening in industry: Syringe shortage.

They could not export because of Syringe shortage

In May-22, they said in current quarter (June-22), there will be shortage of 3 to 4 millions syringes but business standard report of June-22 said syringe manufacturers are sitting on inventory of 500 million syringes and Govt now cancelling orders

While India was sitting at 500Mn syringes, Gland said they are airlifting syringes to over come the problem of domestic shortage. Very unusual

Now Q1FY23 was disaster degrowth seen on QoQ & YoY basis in all parameters

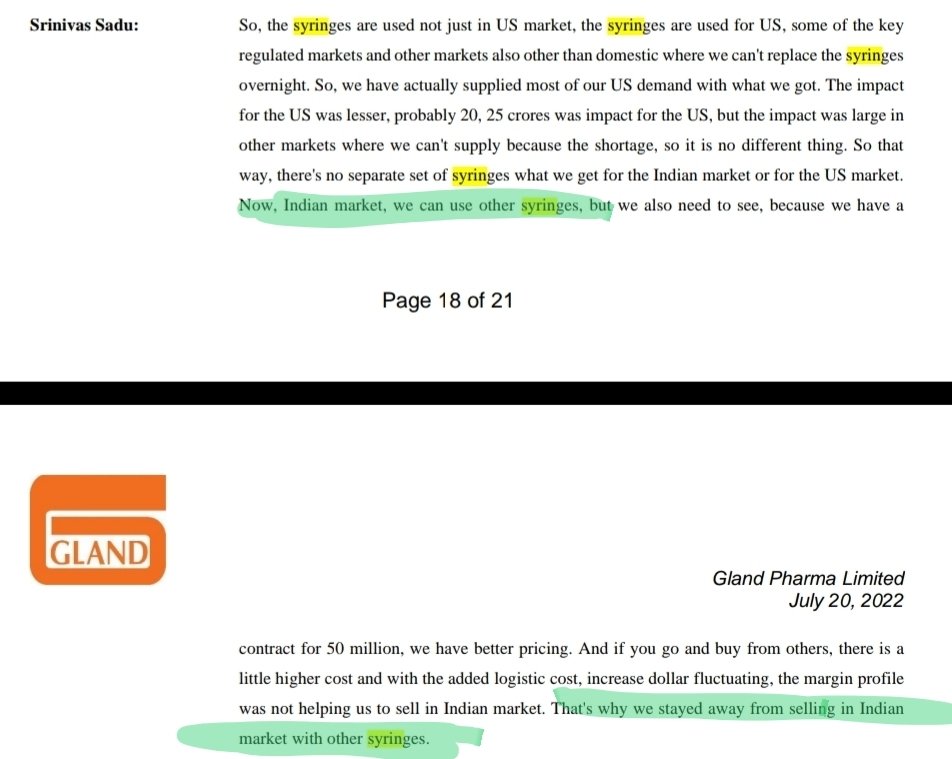

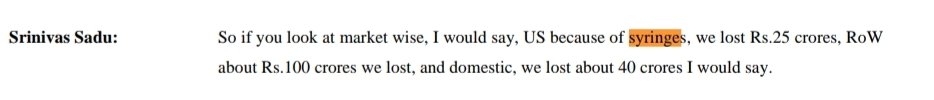

Again they come with same reason supply chain disruption particularly syringe shortage which led to revenue loss of 165 crore

Again they come with same reason supply chain disruption particularly syringe shortage which led to revenue loss of 165 crore

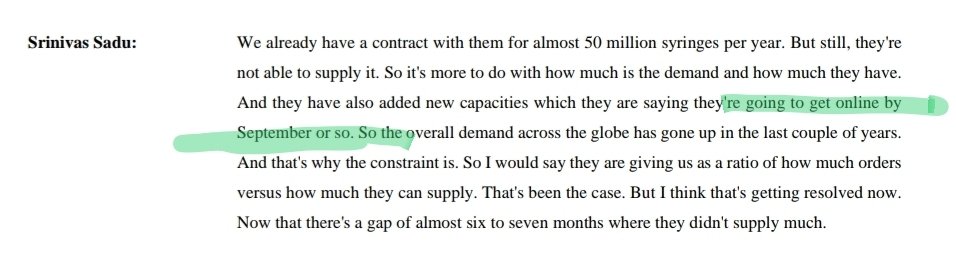

They have just 1 supplier for syringe requirement & could have bought syringes from other supplier atleast for Indian markets but co decided not to do so due to higher cost. Doesn't makes sense that for higher cost I cannot avoid higher sales if I am doing business at 37% OPM

While they were lying on front end very interesting events happened on backend which includes stake sale by insiders.

Company's KMP were continuously selling the stake see how CEO has been selling the stakes during qtr end (pic1)

Full list of stake sale by KMPs trendlyne.com/equity/insider…

Full list of stake sale by KMPs trendlyne.com/equity/insider…

Introducing major stakeholders of this transaction

1. Gland Celsus Bio Chemicals ( Related entity by way of common KMPs or KMPs having significant control)

2. Niromac Machinery (not recognized as related party) but its related as its directors are also director in oth grp Co⬇️

1. Gland Celsus Bio Chemicals ( Related entity by way of common KMPs or KMPs having significant control)

2. Niromac Machinery (not recognized as related party) but its related as its directors are also director in oth grp Co⬇️

Gland Celsus sold 6% stake to Nicomac Machinery via off market transaction in Jan-22.

Nicomac kept on selling that stake 6% stake, reducing it to 2%

All this is happening when Gland Pharma 2as lying about syringe shortage(pic 3)

Nicomac kept on selling that stake 6% stake, reducing it to 2%

All this is happening when Gland Pharma 2as lying about syringe shortage(pic 3)

Why Gland was lying?

Probably its revenue & PAT reduced as covid related biz is no more. But accepting this permanent downsize of biz would have led to steep price fall.

They gave reason of syringer shortage so that price didn't fall much paving way for insiders to exit

Probably its revenue & PAT reduced as covid related biz is no more. But accepting this permanent downsize of biz would have led to steep price fall.

They gave reason of syringer shortage so that price didn't fall much paving way for insiders to exit

Its Chinese promoter is into deep trouble who have also sold stakes in various companies including Gland Pharma

forbes.com/sites/ywang/20…

forbes.com/sites/ywang/20…

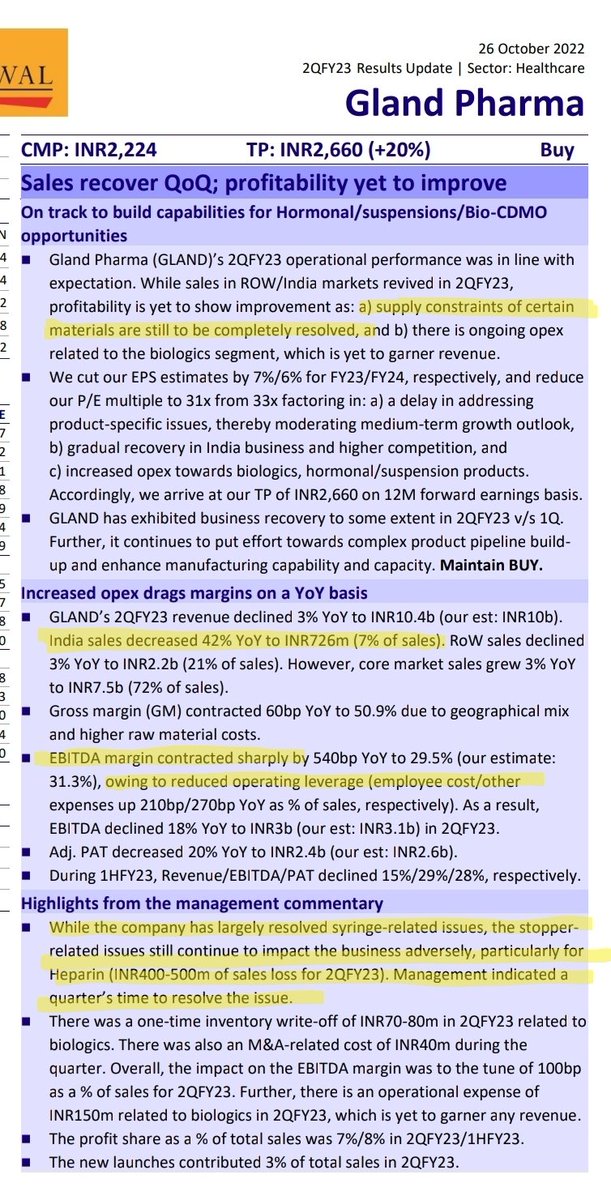

Here are the managment comments on Supply Chain Issues during Q2 concall

- issue not completely resolved

- syringe issue largely resolved

Indian biz has decreased by whopping 42%

- issue not completely resolved

- syringe issue largely resolved

Indian biz has decreased by whopping 42%

Chinese Authorities have asked banks to disclose their exposure to Fosun amid deep debt trouble

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

The company in Q1FY23 call said they expect ease of syringe shortage issue by September earlier in Q4 concall they said by end of June shortage issue will be resolved.

Still facing some issue

All this happening at a time when there is actually no shortage of syringes in India

Still facing some issue

All this happening at a time when there is actually no shortage of syringes in India

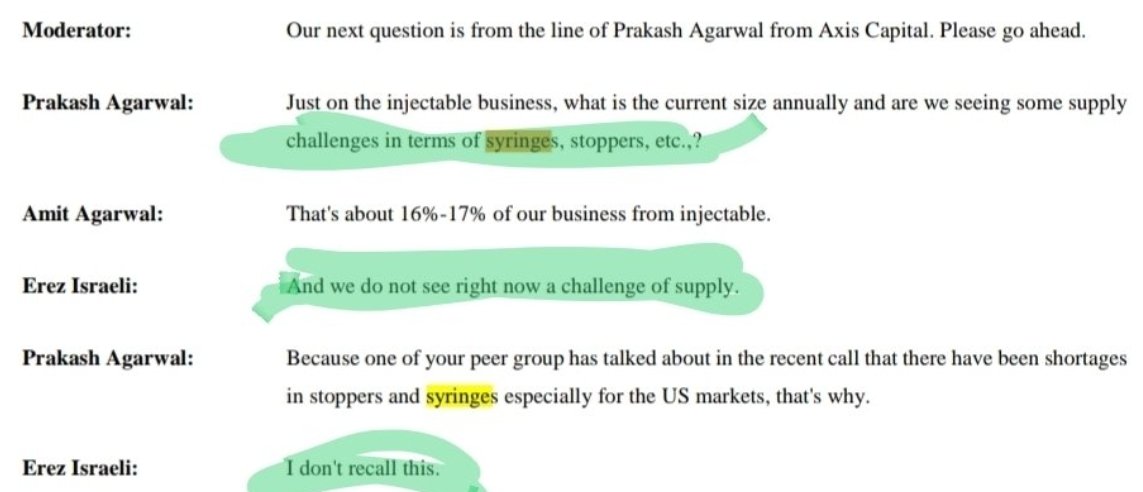

The most interesting part Dr Reddy CEO says there are on syringe shortages in US or Indian markets, we already highlighted through multiple sources that there is no shortage as such.

Apart from syringes Gland also claimed shortage of stoppers which was also denied by Dr Reddy

Apart from syringes Gland also claimed shortage of stoppers which was also denied by Dr Reddy

Interestingly Gland Pharma has trade receivables of 350 cr of FY21 from FosunPharma USA, subsidiary owned by parent company which company didn't realize even after 1 yr

• • •

Missing some Tweet in this thread? You can try to

force a refresh