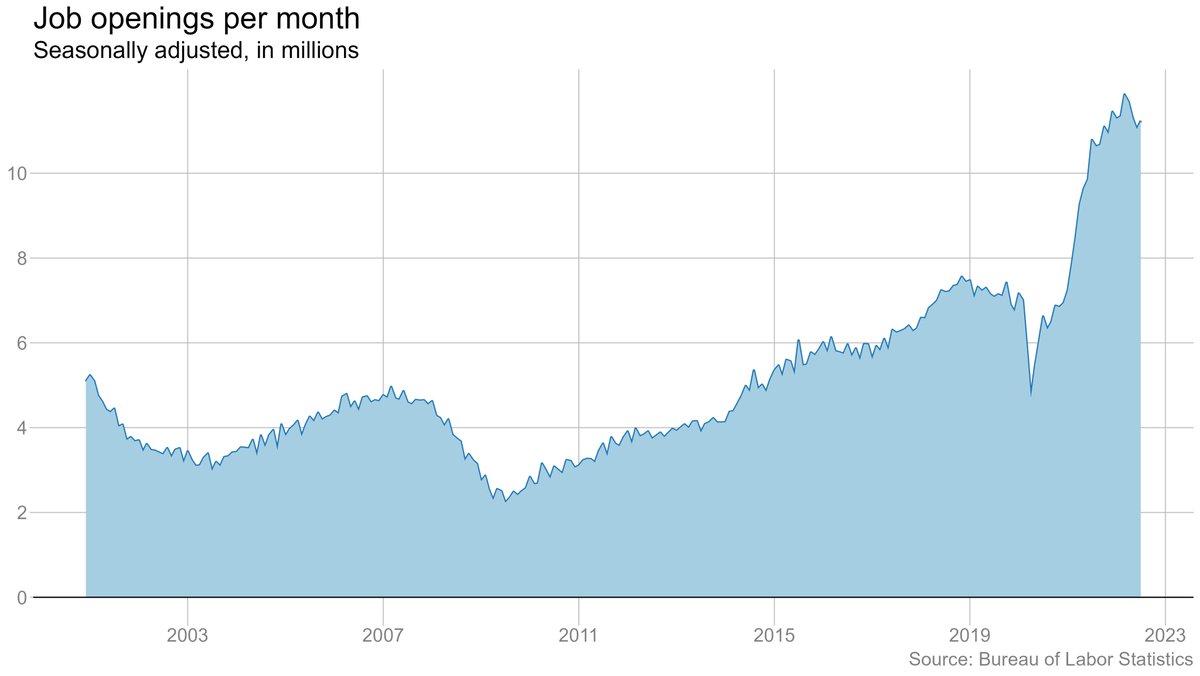

Job openings fell by more than 1 million in August, down to 10 million. Quits edged up (but July was revised down).

#JOLTS

bls.gov/news.release/j…

#JOLTS

bls.gov/news.release/j…

This was the largest one-month drop in openings on record other than in April 2020. Openings still high by historical standards, but this sure looks like the drop in labor demand we've been watching for. #JOLTS

There were 1.7 jobs per unemployed worker in August, down from a 2-to-1 ratio in July. Consistent with other evidence that the labor market has been cooling. cc @melbournecoal nytimes.com/2022/09/30/bus…

Voluntary quits ticked up in August, but July was revised down, and the trend appears to be downward. Quits are a big deal because they're a sign of confidence among workers, and a source of wage pressure for employers.

One place we are not seeing any significant sign of a cooldown is in layoffs. They rose trivially in August but remain well below prepandemic levels (which were already low).

Openings are still elevated in most industries relative to their prepandemic level, but they're down vs a year ago, especially in some of the industries where hiring had been hardest (e.g. leisure & hospitality).

Bit of a different story when we look at the number of hires per job opening. Leisure and hospitality generating fewer hires per job opening than a year ago. A sign of hiring struggles? Or reduced hiring effort? Hard to say

Meanwhile, quits are still *super* elevated in leisure and hospitality (and jumped up in August), even as they're falling some in retail.

One source of mystery in the job market lately had been that job openings in JOLTS had barely fallen, even as private-sector measures (such as from Indeed) had trended down. With today's data and revisions, they now look much more aligned.

Note that a position only counts as an opening in JOLTS if an employer is actively trying to fill it. Indeed's data is just a count of postings. So it's possible for the measures to diverge for "real-world" reasons. But my default assumption is that any divergence is noise.

• • •

Missing some Tweet in this thread? You can try to

force a refresh