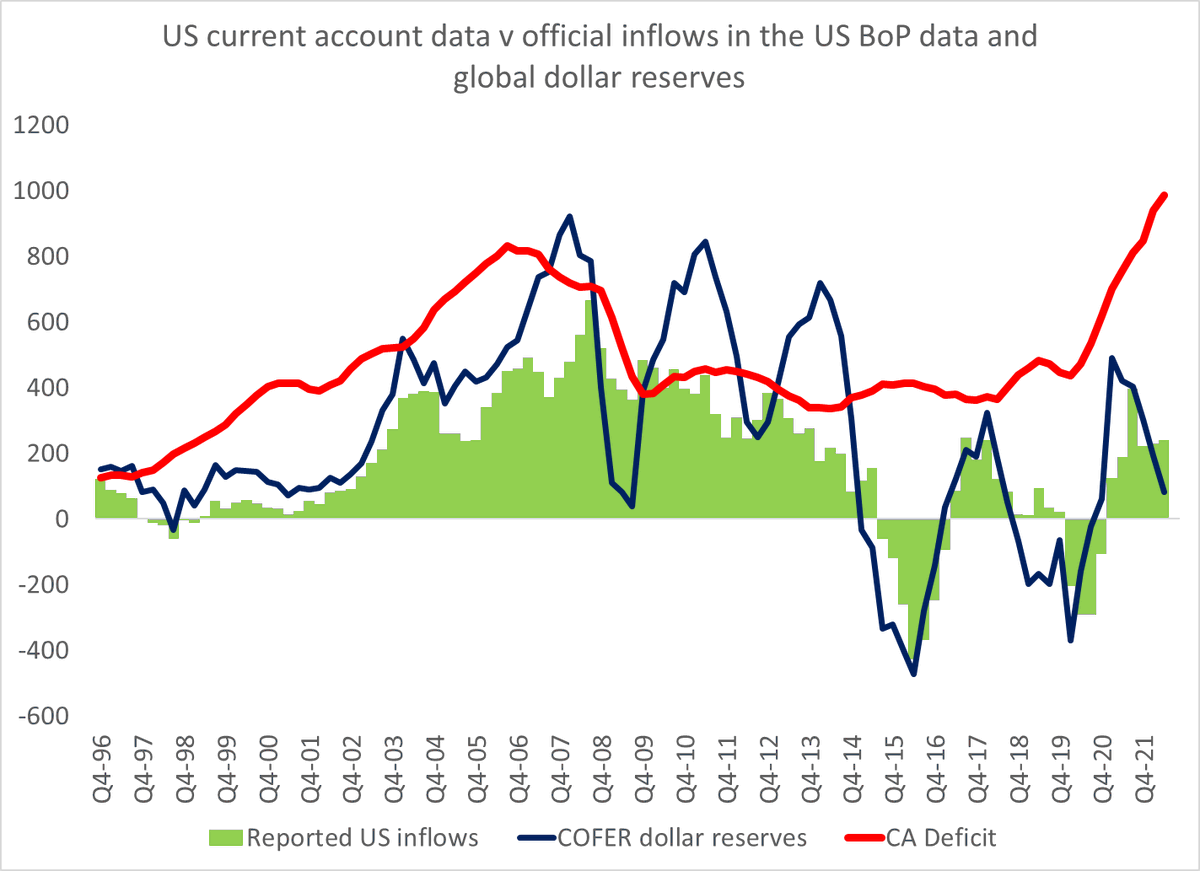

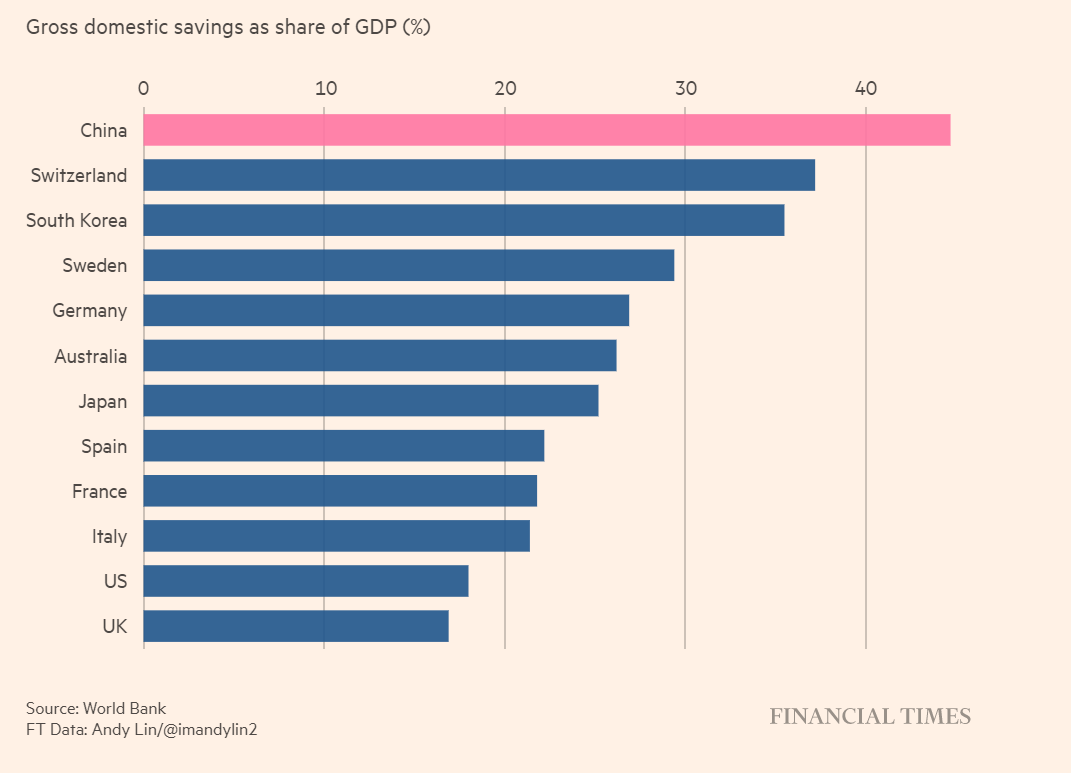

The big current account surpluses in the world today are in China, Russia and Saudi Arabia (and the GCC).

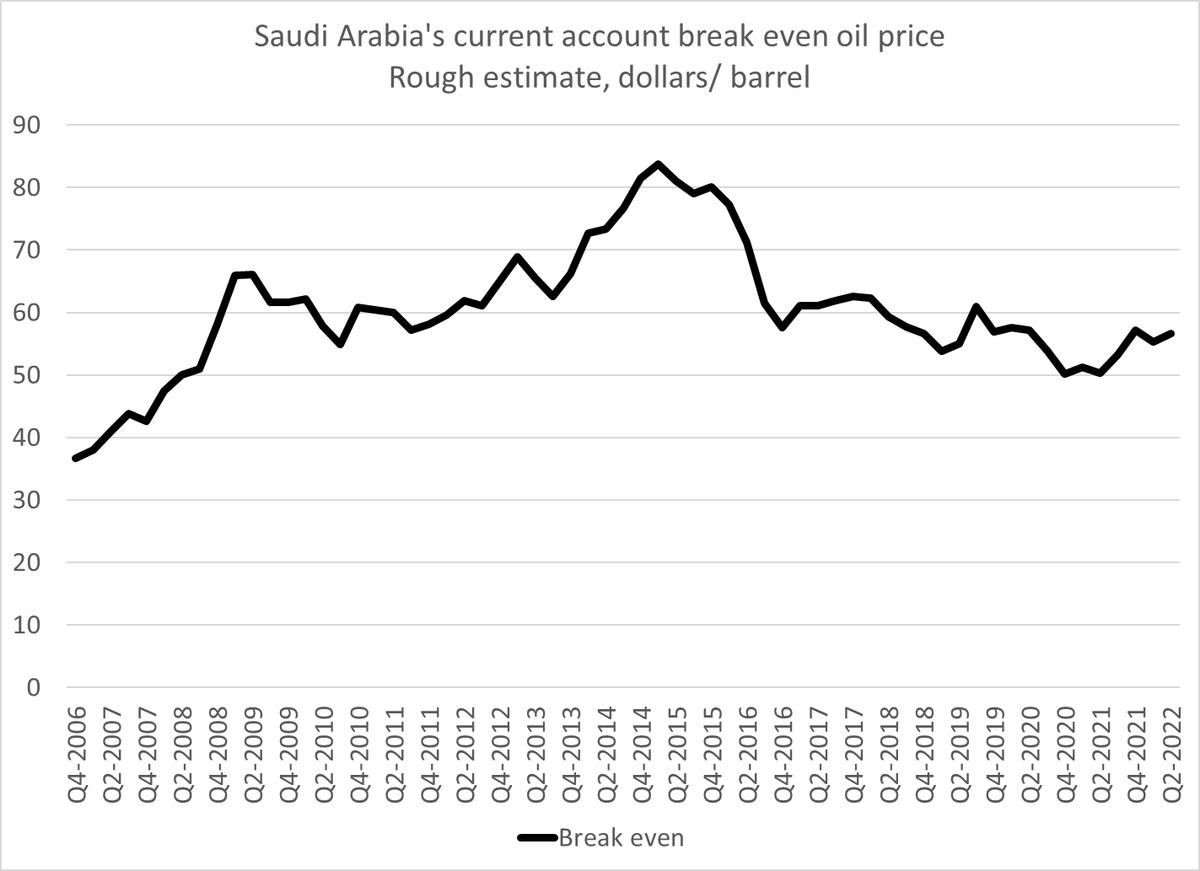

Seems like the Saudis want keep their share of the global surplus too. Their "current account" break even oil price is only $60 a barrel.

1/x

ft.com/content/476d81…

Seems like the Saudis want keep their share of the global surplus too. Their "current account" break even oil price is only $60 a barrel.

1/x

ft.com/content/476d81…

Saudi production and oil export by volume numbers aren't released quickly, so calculating the Saudi break even (the price that balances the current account) takes a bit of guess work. But it is clearly well below the current oil price.

2/x

2/x

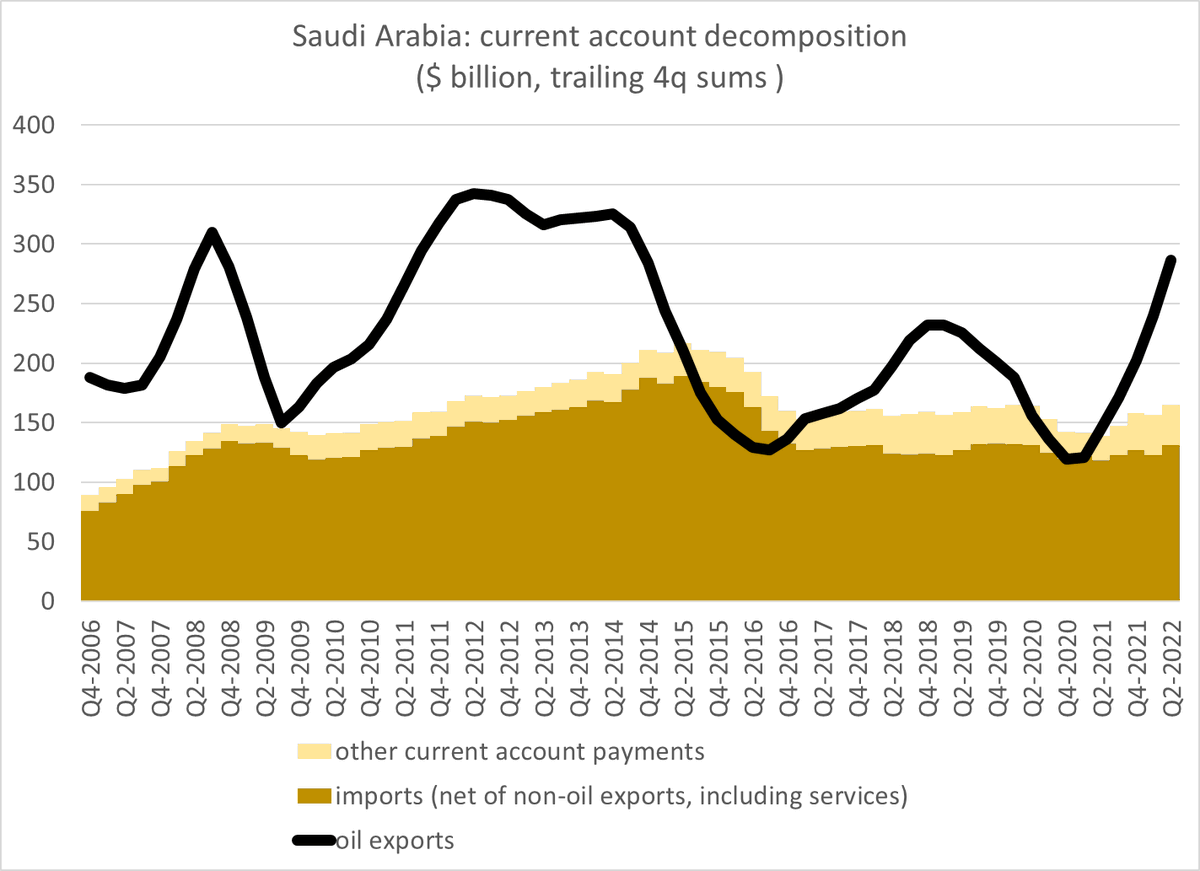

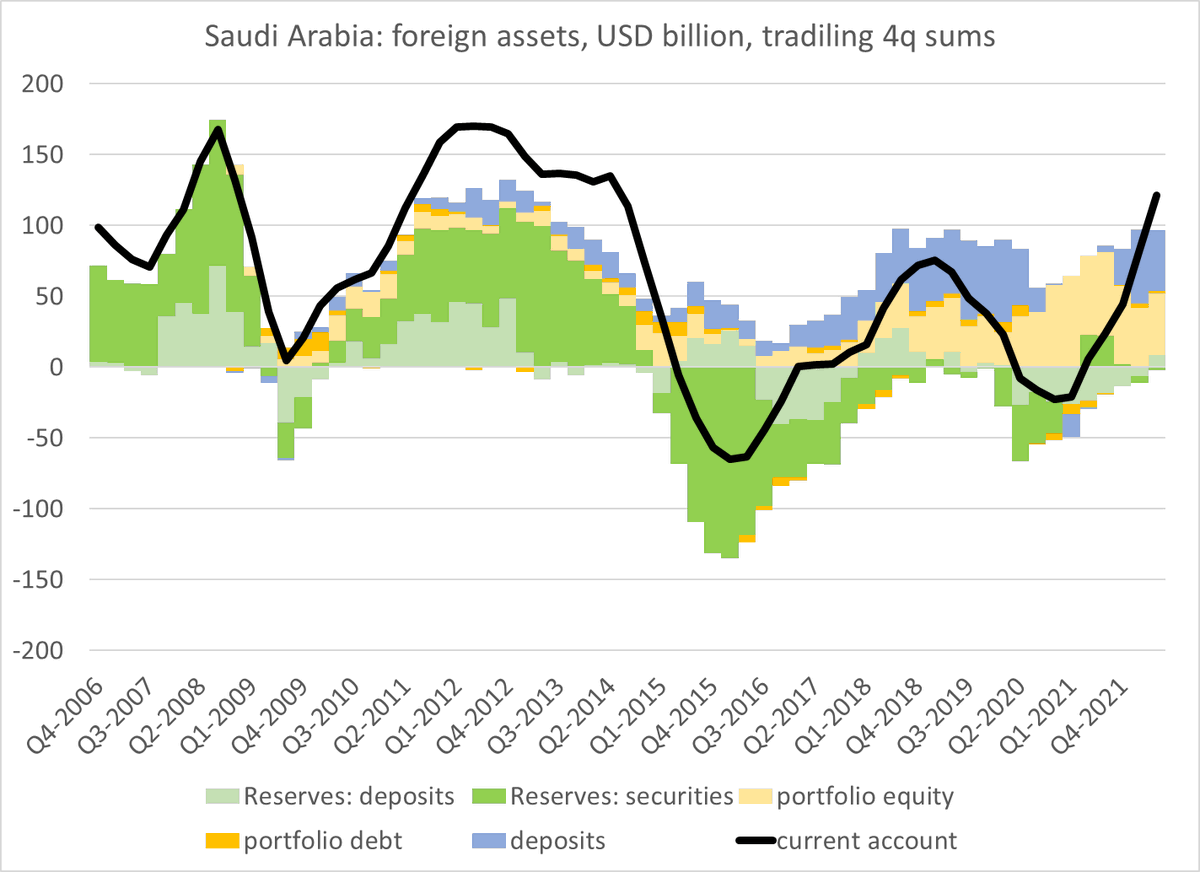

The Saudi break even has been pretty constant since 2008, apart from a brief spending spree from 2012 to 2014. I assume that the Crown Prince's big ambitions (Neom, etc) will raise imports over time, but it hasn't really happened yet.

3/

3/

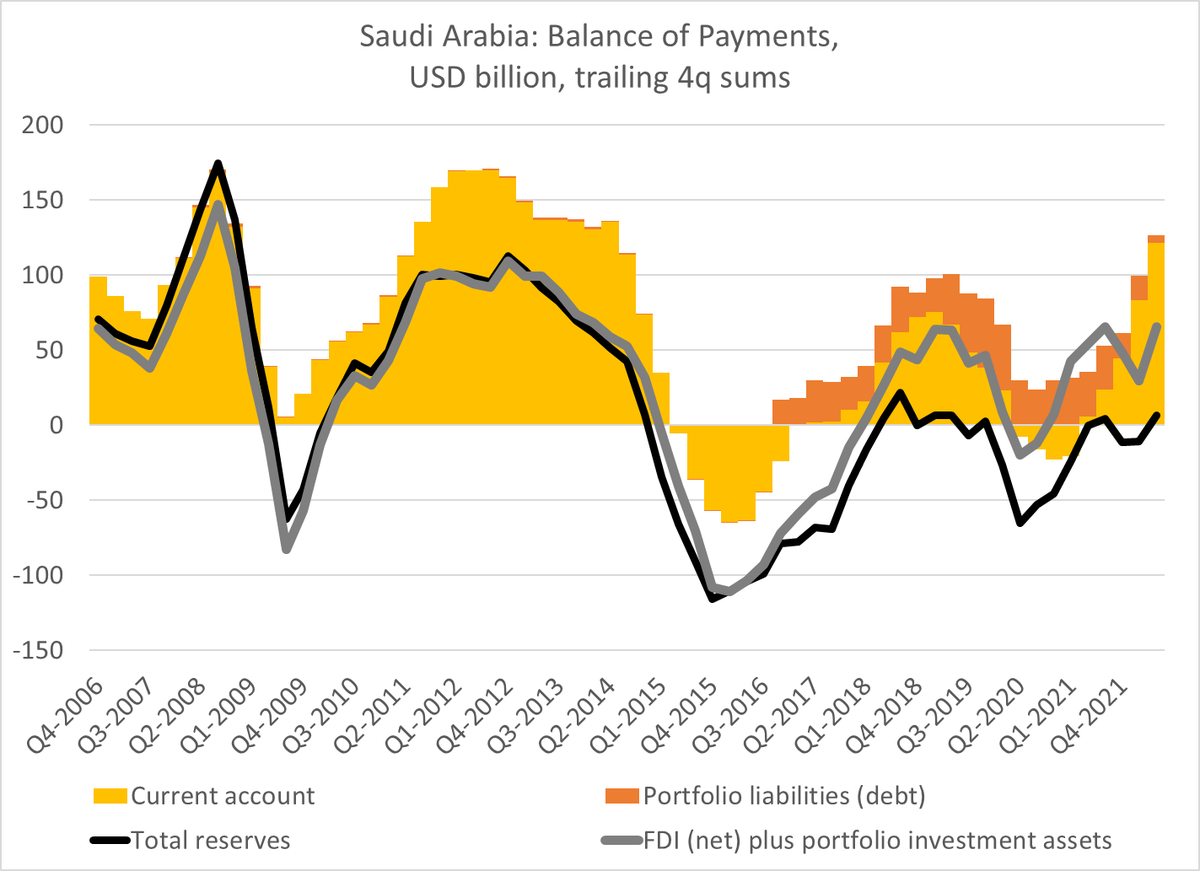

What has happened is a big shift in how the external surplus that the Saudis appear intent on maintaining through production cuts is managed -- it no longer primarily goes into reserves. As @jnordvig has noted, the Saudis now primarily buy equities.

4/

4/

OPEC decisions are of course primarily viewed through their impact on the oil market. But higher oil prices also have implications for global capital flows given the size of the Saudi surplus. And now, unlike in the past, the Saudis aren't buying bonds ...

5/5

5/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh