"The most important number in #finance", the London Interbank Offered Rate (#LIBOR), died a shameful death at the age of 52.

The interest rate benchmark underpinned more than $300 trillion in financial contracts before being marred in a scandal that lasted ~ a decade.

A short🧵

The interest rate benchmark underpinned more than $300 trillion in financial contracts before being marred in a scandal that lasted ~ a decade.

A short🧵

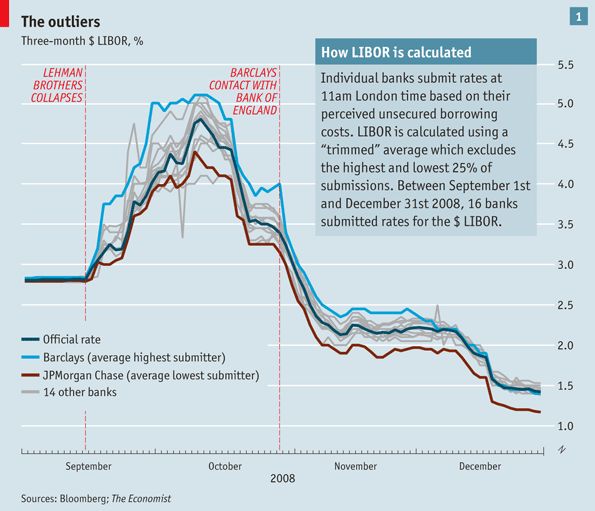

2/ The scandal came into the limelight in 2008 but there is evidence that collusion between banks was going on since 2003.

🤥 “We know that we’re not posting, um, an honest” rate, a Barclays employee told a New York Fed official in April 2018.

How was it done?

🤥 “We know that we’re not posting, um, an honest” rate, a Barclays employee told a New York Fed official in April 2018.

How was it done?

3/ #Barclays was a key player.

Barclays would submit its #LIBOR estimate, claiming that it was lower than what other banks actually charged it.

A lower rate indicated a smaller risk of default & is considered a sign that a bank is in better shape than another bank.

Barclays would submit its #LIBOR estimate, claiming that it was lower than what other banks actually charged it.

A lower rate indicated a smaller risk of default & is considered a sign that a bank is in better shape than another bank.

4/ It wasn’t just Barclays, though.

The "LIE-bor" affair involved individual bankers within a number of major financial organizations, including Deutsche Bank, Citigroup, JPMorgan Chase, and the Royal Bank of Scotland.

🤠🤠🤠🤠🤠

The "LIE-bor" affair involved individual bankers within a number of major financial organizations, including Deutsche Bank, Citigroup, JPMorgan Chase, and the Royal Bank of Scotland.

🤠🤠🤠🤠🤠

5/ At UBS, one trader manipulating the benchmark, Thomas Hayes, managed to rake in hundreds of millions of dollars for the bank over the course of three years.

Since >thousands of derivatives contracts were based on the LIBOR, however, it took years to phase it out.

Since >thousands of derivatives contracts were based on the LIBOR, however, it took years to phase it out.

6/ We have #DeFi now, can we do better?

Of course.

The most liquid DeFi lenders, including @AaveAave and @compoundfinance, auto-publish their lending & borrowing rates on-chain enabling "immutable transparency".

That's one part of the "manipulation-proof benchmarks" puzzle. 🧩

Of course.

The most liquid DeFi lenders, including @AaveAave and @compoundfinance, auto-publish their lending & borrowing rates on-chain enabling "immutable transparency".

That's one part of the "manipulation-proof benchmarks" puzzle. 🧩

7/ The second part (also an IPOR special trick) is to

(🚨) calculate the benchmark on-chain.

And the third is, you guessed it, to publish it on-chain. ⛓️

That's how you create a #TrueDeFi public good and lay the foundations of an entire blockchain-based financial ecosystem. 💪

(🚨) calculate the benchmark on-chain.

And the third is, you guessed it, to publish it on-chain. ⛓️

That's how you create a #TrueDeFi public good and lay the foundations of an entire blockchain-based financial ecosystem. 💪

8/ Finally, to make the IPOR Indices adaptable to the fluid state of DeFi, a DAO is responsible for the parameters adjustment and the protocols (incl. their wights) to be included in the on-chain calculation. 🎯

🤔 But do we REALLY need such benchmarks in #DeFi?

🤔 But do we REALLY need such benchmarks in #DeFi?

9/ Only if we want the #DeFi industry to mature. (which we do!)

Currently, #exotics are the prevalent form of assets being traded on-chain.

That's a VERY small part of portfolios in #TradFi.

One of the largest markets there is actually:

👉 Interest Rate Derivatives (#IRDs)

Currently, #exotics are the prevalent form of assets being traded on-chain.

That's a VERY small part of portfolios in #TradFi.

One of the largest markets there is actually:

👉 Interest Rate Derivatives (#IRDs)

10/ It's where #DeFi is headed. 💯

✔️ High-liquidity players are risk-averse.

✔️ Healthy #creditmarkets NEED tools to #hedge risk.

✔️ #Traders WANT to #arbitrage & speculate with directional positions.

✔️ On-chan derivatives REQUIRE reliable & transparent reference indices.

✔️ High-liquidity players are risk-averse.

✔️ Healthy #creditmarkets NEED tools to #hedge risk.

✔️ #Traders WANT to #arbitrage & speculate with directional positions.

✔️ On-chan derivatives REQUIRE reliable & transparent reference indices.

11/ That's #IPOR

The IPOR 28-day maturity benchmarks for $USDT, $USDC, and $DAI already reflect the true cost of borrowing & lending in #DeFi.

➕ More assets & longer maturities are coming.

🎓 Curious about the future of #DeFi?

▶️ Visit docs.ipor.io

The IPOR 28-day maturity benchmarks for $USDT, $USDC, and $DAI already reflect the true cost of borrowing & lending in #DeFi.

➕ More assets & longer maturities are coming.

🎓 Curious about the future of #DeFi?

▶️ Visit docs.ipor.io

• • •

Missing some Tweet in this thread? You can try to

force a refresh