Two Prime has analyzed the history of energy derivatives and compared them to the trajectory of BTC mining derivatives. A 🧵:

2. Very few miners deploy sophisticated hedging or yield strategies to generate long-term operating predictability.

3. Crude Oil and Natural Gas markets faced similar challenges in the nascency of their industries as well, price volatility, lack of market structure, lack of price discovery.

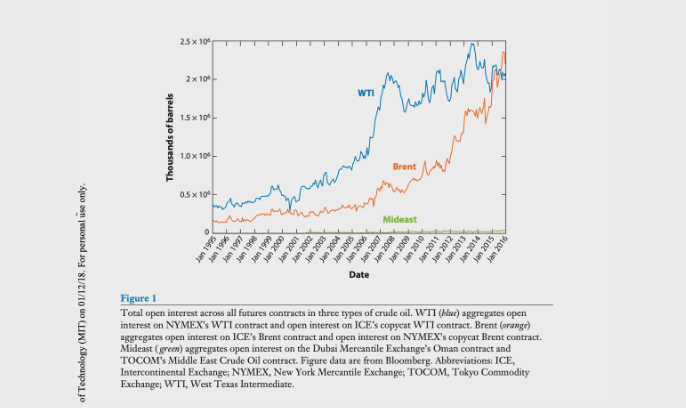

4. Crude Oil market financing and trading grew exponentially with the maturation of derivatives. Contracts grew from 25,910 in 1978 to 9.6MM in 2000.

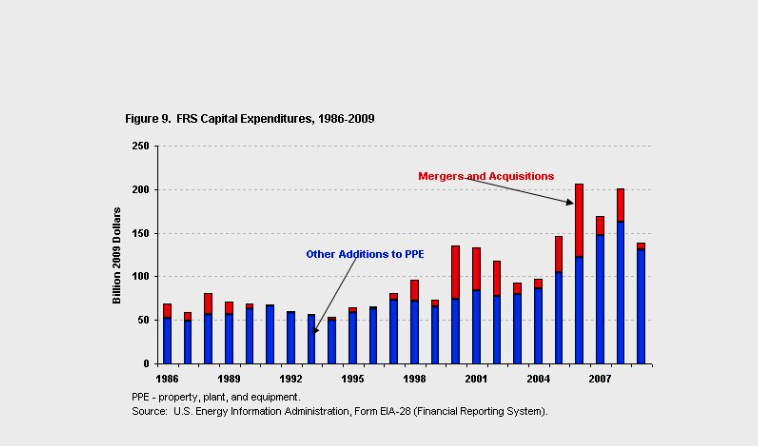

5. With the ability to contain risk all along the price curve with futures and options, CAPEX investment into energy infrastructure skyrocketed.

6. In energy markets today, scalable projects almost always include an element of derivative-based risk management if they hope to find investment.

7. SEC filings show that nearly all large energy producers engage in derivatives trading for risk management.

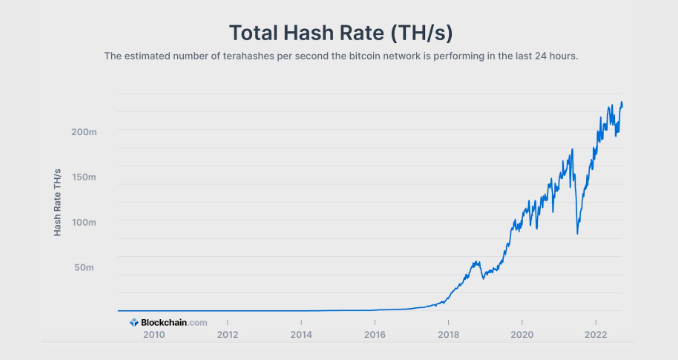

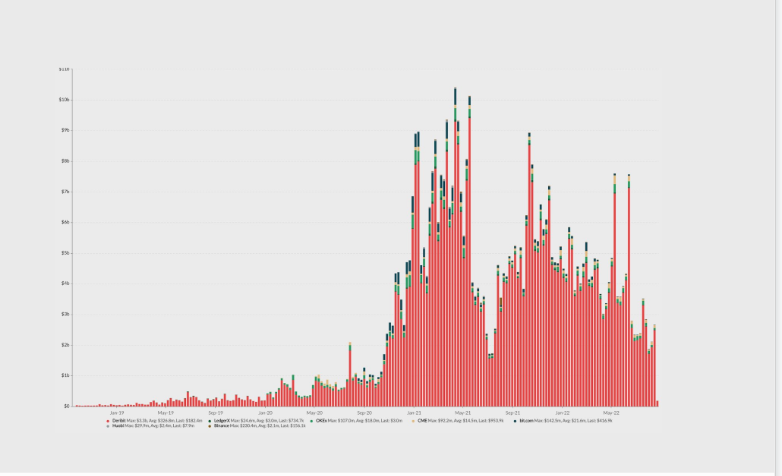

8. BTC mining is at the early part of this same trajectory with BTC weekly options volume growing from $50,000 USD in 2019 to over $10B in 2021.

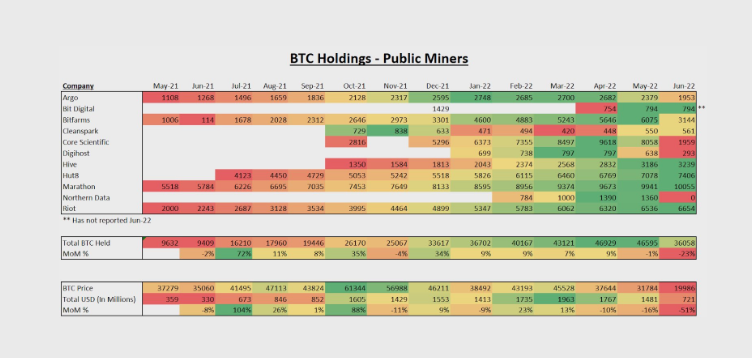

10. Many miners purchased equipment during the bull market, with BTC and the price of ASICs at much higher prices.

11. The purchase of equipment was financed, largely by groups like @NYDIG_BTC, @BlockFi, @FoundryServices, and @galaxyhq.

12. Many miners, including the publicly traded ones, have liquidated BTC near market lows, either forced to sell holdings to service loan interest or pay for operating costs.

13. This adds further downward pressure on BTC price, further exacerbating the cycle.

14. > 90% of #BTC options volume is traded on @DeribitExchange, with much of it traded via @tradeparadigm for block trades of large size. Deribit does not allow for US firms to access their exchange, but trading firms and OTC options still provide more than sufficient volume.

15. @ftx_us_derivs and @coinbase have purchased derivatives exchanges and await approval from the @CFTC to be allowed to offer onshore, regulated access to crypto derivatives markets.

16. The @CMEGroup already offers access, but markets do not function 24/7 and minimum size requirements, USD collateral requirements, and a lack of liquidity are all prohibitive to use.

17. Market downturns are entirely manageable for miners with proper strategies in place.

18. Some common strategies worth considering include:

19. Call Overwrite for Yield: Miners focused on pure dollar returns can generate additional income through a covered call strategy. Miners can set a desired income rate in % terms and sell a call the appropriate distance out of the money to achieve this yield.

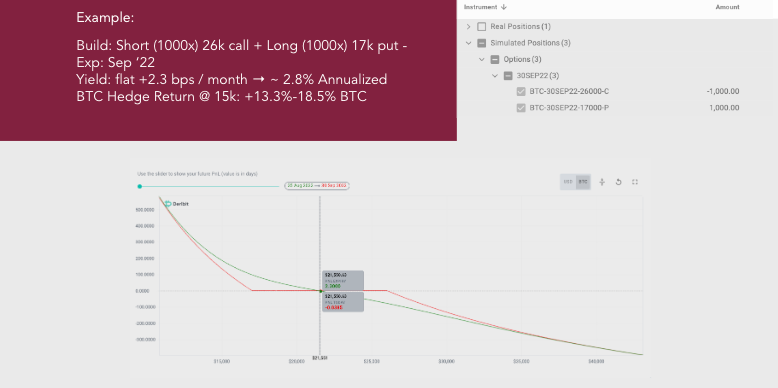

20. Call Overwrite with a Put Collar for Downside Hedging. In this strategy, the sale of a call offsets the cost of buying a put. This caps upside, but also sets a price floor that can ensure breakevens on BTC price always remain available.

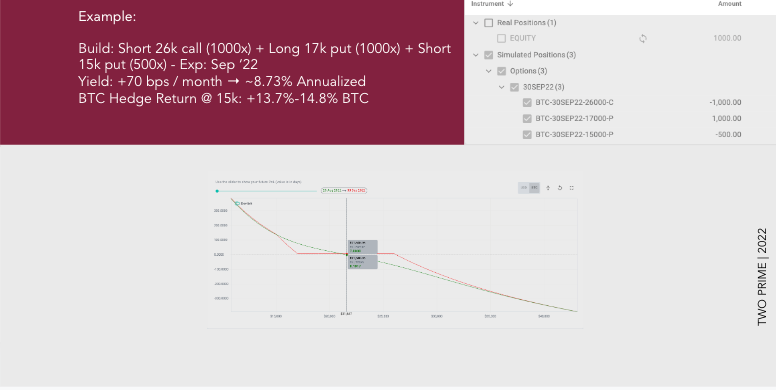

21. Call Overwrite with a Put Ratio Spread for Yield and Downside Hedging. In this strategy, we build upon the previous two, creating downside risk protection, but also generating yield.

22. Market volatility is a source of pain for investors, but also a source of innovation. For capital-intensive businesses like oil and gas exploration, market participants required a sophisticated way to reduce volatility and manage risk, and crypto markets draw many parallels.

23. As the bitcoin mining industry continues to mature , these risk-management strategies will become requirements for market participants, much like in energy markets today.

• • •

Missing some Tweet in this thread? You can try to

force a refresh