The U.S. economy added 263k jobs in September and the unemployment rate fell back to 3.5 percent.

Data: bls.gov/news.release/e…

Full coverage: nytimes.com/live/2022/10/0…

Data: bls.gov/news.release/e…

Full coverage: nytimes.com/live/2022/10/0…

August unrevised at +315k jobs. July's very strong gains revised up another 11k to +537k.

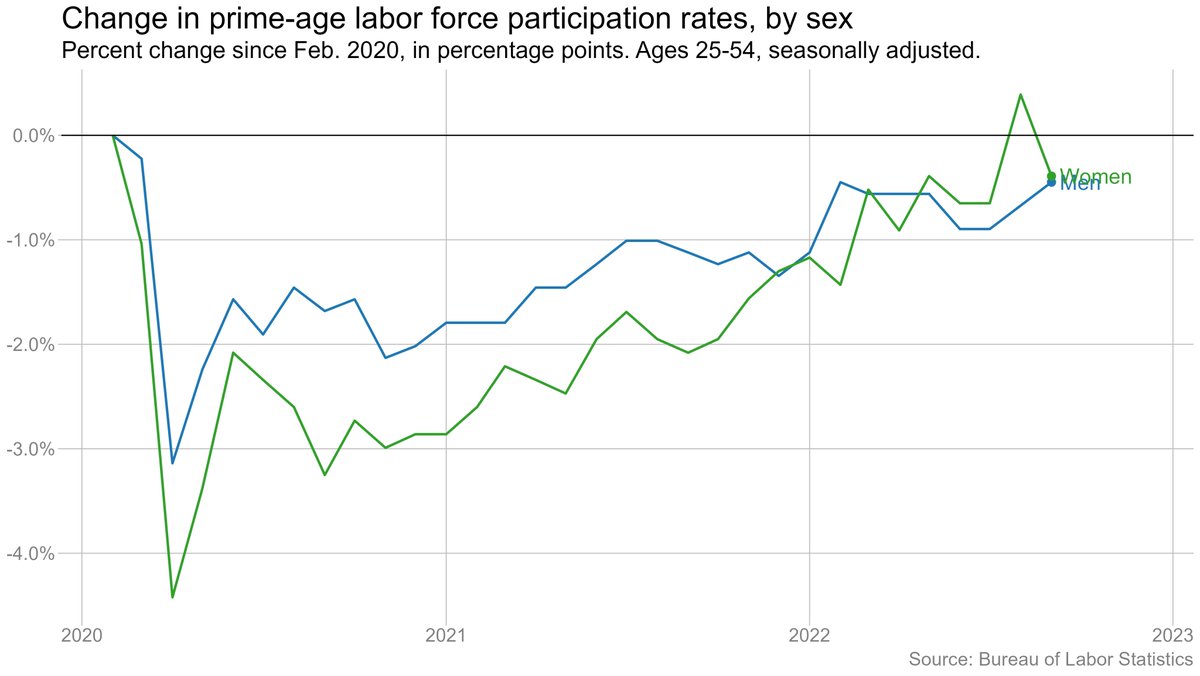

Labor force shrank slightly (-57k), participation rate ticks down a tenth, following August's big jump. These month-to-month changes are noisy, so this seems consistent with a gradual rebound in the labor force.

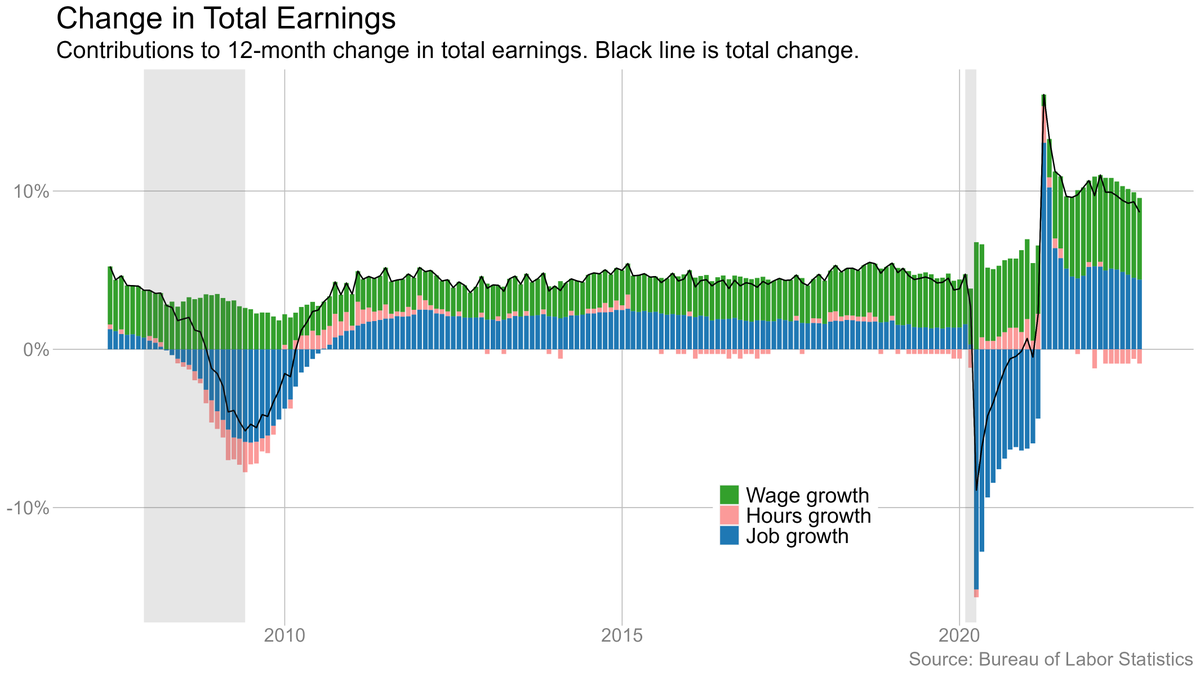

Average hourly earnings rose 0.3% (+10 cents/hour), up 5% from a year earlier. For non-managers, up 0.4% (also +10 cents/hour), 5.8% from a year ago.

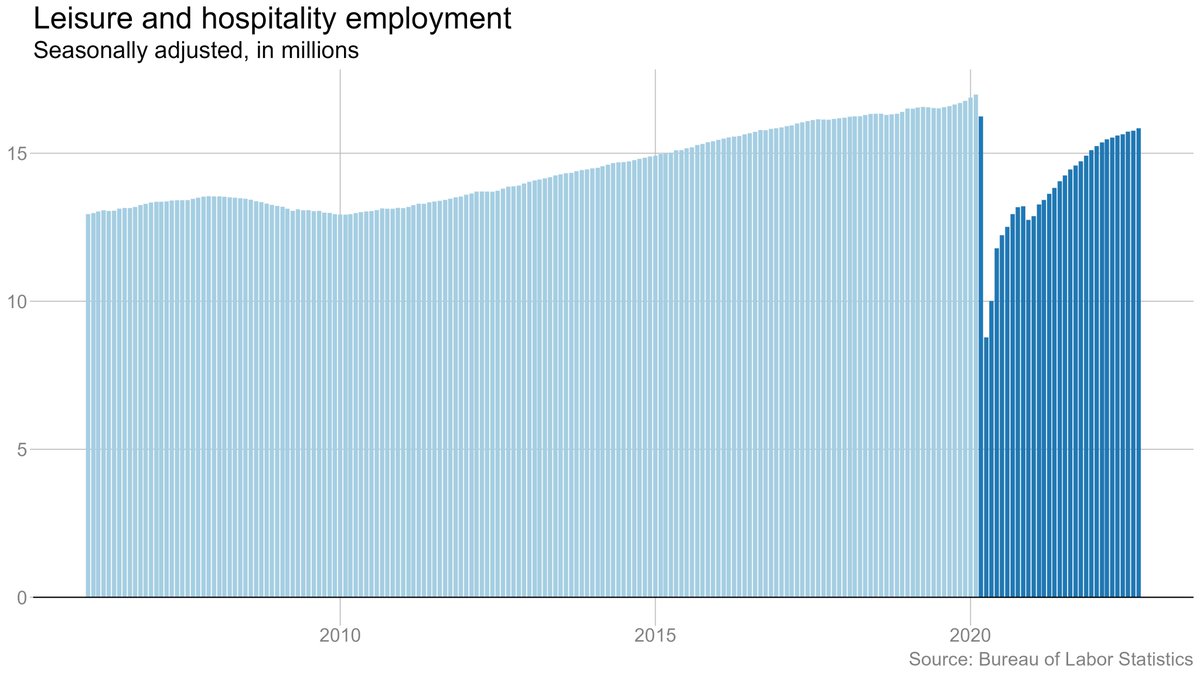

Another strong month for leisure and hospitality (+83k). Construction still positive (+19k) despite cooling housing market. But retail and warehousing both slightly negative, in line with other evidence of weakness there.

The 263k jobs added in September were the fewest since April 2021, but still a very solid month by prepandemic standards. Consistent with a story of a job market that remains strong but is gradually cooling.

The U.S. now has half a million more jobs than in February 2020, a remarkable recovery given the depth of the hole left by the pandemic. But we're still well below where we would have been if job growth had continued on its prepandemic path.

The unemployment rate fell back to 3.5 percent in September, reversing its bump up in August. Unemployment is back to where it was before the pandemic, a five-decade low.

Labor force participation ticked down in September, but I wouldn't read much into these monthly moves. The basic trend looks unchanged: The labor force is growing, but only slowly (and probably not enough to do much to ease pressure on wages).

Employment among prime-age (25-54) workers edged down in September, but is within 3 tenths of a point of its prepandemic level. For all the talk of 'no one wants to work anymore,' a lot of people are working.

Another look at this: Adjusting for demographic shifts (mostly the aging population), Americans are working at a rate well above the pre-Great Recession level, though below prepandemic peak.

Wage growth has cooled since late last year. Is it still cooling? That's a bit harder to say. Hanging out at around a 4.5% annual rate in recent months

One thing that is clear, though, is that wage growth in leisure and hospitality has slowed dramatically since last year, despite ongoing job growth.

Slower job growth + slower wage growth + a (slight) decline in avg hours = slower growth in aggregate earnings. Still rising a bit faster than inflation, though, which is part of why real consumer spending has been able to keep growing.

Like it or not, #RTO is happening: The share of employees reporting they worked from home because of the pandemic fell to a pandemic-era low in September.

I will caution that the wording of this question makes the results a bit tough to interpret. Are people still working remotely "because of the pandemic"? BLS is planning to update the language of this question this fall, so perhaps we'll learn more then.

Leisure and hospitality once again led the way last month, adding 83k jobs. But note that the sector still has more than 1 million fewer payroll jobs than before the pandemic.

The signs of the cooling retail economy are showing up in the job market. Retail jobs basically flat last month, and warehousing/transportation jobs down for the first time since the early days of the pandemic.

The construction sector continued to add jobs in September, which is pretty remarkable on the surface given pullback in homebuilding. But it takes time for that to flow through the system -- a lot of homes were already under construction.

It's easy to cherry-pick industries. The diffusion index of private-sector hiring provides a more holistic view. It shows that most industries are still adding jobs, not cutting them -- but that share has fallen off sharply the past few months.

The number of people entering the labor force each month has been pretty steady lately. Labor force growth/decline has been driven more by shifts in the number of people leaving the labor force. (Note this chart shows three-month average.)

The unemployment rates for Black and Hispanic Americans both fell in September. Encouraging because we'd been seeing them edge up lately. Unemployment rates for all racial groups are now at or below their 2019 avg.

Black employment rate also rebounded a bit after a sharp drop.

Black employment rate also rebounded a bit after a sharp drop.

It's tempting to read narratives into changes in participation by sex, but the monthly numbers are noisy. My interpretation is that both men and women have seen a strong but incomplete rebound that has slowed recently.

Last year, wages were rising fastest in the lowest-paying industries. That's much less true today. In recent months, low-wage industries have seen only modestly higher hourly earnings growth than other industries.

• • •

Missing some Tweet in this thread? You can try to

force a refresh