1. SJS Enterprises is amongst India’s leading and globally recognised decorative aesthetics players.

2. It is an end-to-end ‘design to delivery’ aesthetics solutions provider with the capability to customize, design, develop, and manufacture a wide range of

2. It is an end-to-end ‘design to delivery’ aesthetics solutions provider with the capability to customize, design, develop, and manufacture a wide range of

products for the world’s leading automobile and consumer appliances companies.

3. It also manufactures products for commercial vehicles, medical devices, farm equipment, and sanitaryware industries.

3. It also manufactures products for commercial vehicles, medical devices, farm equipment, and sanitaryware industries.

4. It has over 6000 SKUs and a client base of 170+ customers, delivering products to 20 countries.

SJS offers over 11 different product categories with over 6000 SKUs, and has a well diversified product portfolio, which also gives opportunities for

SJS offers over 11 different product categories with over 6000 SKUs, and has a well diversified product portfolio, which also gives opportunities for

cross selling to existing clients leveraging the current relationship.

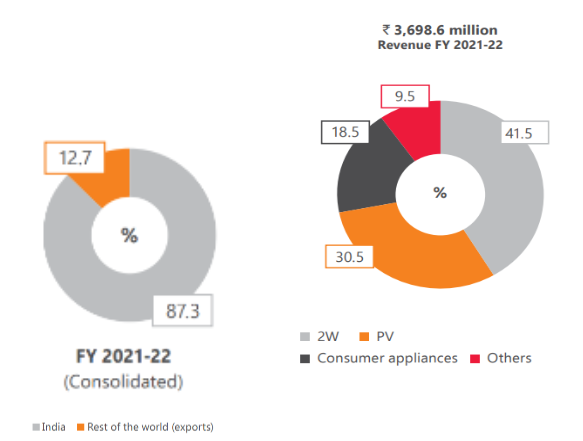

Revenue Split:

41.5% of the revenue comes from 2 Wheelers

30.5% from Passenger vehicles

18.5% from consumer durables and

9.5% from other segments such as Sanitary ware, Healthcare, Farm equipments etc

Revenue Split:

41.5% of the revenue comes from 2 Wheelers

30.5% from Passenger vehicles

18.5% from consumer durables and

9.5% from other segments such as Sanitary ware, Healthcare, Farm equipments etc

87.3% business was from the domestic market and exports were 12.7%

Industry

1. The aesthetics industry in India is headed for high growth at an estimated CAGR of 20% to ₹ 5000 cr during fiscal years 2021-26, as per CRISIL research.

Industry

1. The aesthetics industry in India is headed for high growth at an estimated CAGR of 20% to ₹ 5000 cr during fiscal years 2021-26, as per CRISIL research.

2. International aesthetics market today is ₹20,000 cr which is also expected to grow at 20% cagr till 2026

3. Chrome plating business which they entered last year itself has a domestic market size of ₹1000cr

3. Chrome plating business which they entered last year itself has a domestic market size of ₹1000cr

4. Rising disposable incomes and aspirations along with the advent of e-mobility is driving the shift towards premium, aesthetically superior, and technologically advanced products.

5. Products such as IML/IMD parts, chrome-plated parts, and optical plastics will constitute approximately 20-22%, 26-28%, and 7-9% of the market demand, respectively, by fiscal 2026.

6. The ₹ 1.2 lakh crore Indian consumer electricals industry has recovered smartly after the downturn induced by COVID

7. Demand for 2 Wheelers and Passenger vehicle remains strong, but supply crunch due to various global factors such as

7. Demand for 2 Wheelers and Passenger vehicle remains strong, but supply crunch due to various global factors such as

the Russia-Ukraine war, rising inflation, higher fuel prices, and semiconductor chip shortage pose challenges for the industry

Segments:

SJS has delivers products across 7 segments which are:

1. 2 Wheeler

2. Passenger Vehicle

3. Commercial Vehicle

4. Consumer Durables

Segments:

SJS has delivers products across 7 segments which are:

1. 2 Wheeler

2. Passenger Vehicle

3. Commercial Vehicle

4. Consumer Durables

5. Farm Equipments

6. Health care

7. Sanitary ware

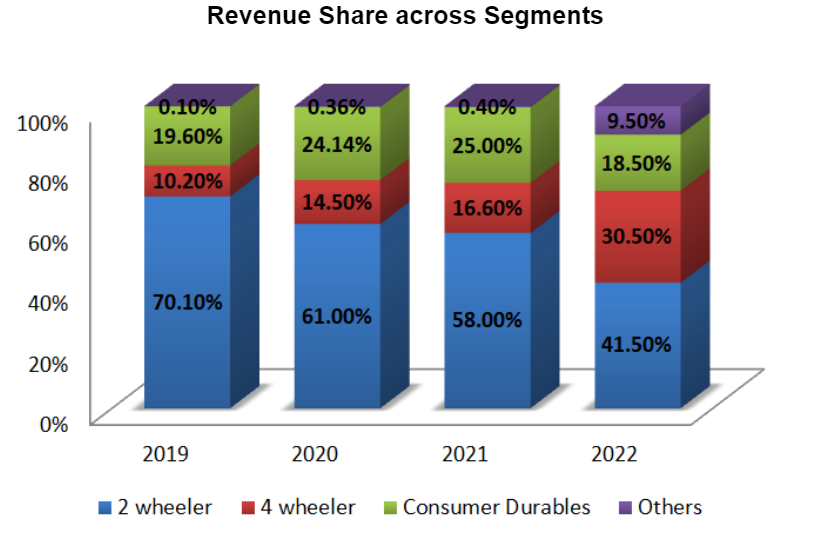

Over the years it has very well diversified its revenue stream, by reducing its dependency from 2Wheelers by increasing share from 4 wheelers, farm equipment, and sanitary ware.

6. Health care

7. Sanitary ware

Over the years it has very well diversified its revenue stream, by reducing its dependency from 2Wheelers by increasing share from 4 wheelers, farm equipment, and sanitary ware.

Products

SJS offers over 11 different product categories with over 6000 SKUs, and has a well diversified product portfolio, which also gives opportunities for cross selling to existing clients leveraging the current relationship.

SJS offers over 11 different product categories with over 6000 SKUs, and has a well diversified product portfolio, which also gives opportunities for cross selling to existing clients leveraging the current relationship.

Product categories include

1. Decals & Body Graphics

Decal stickers are printed on vinyl films for decorative purposes on automobiles, particularly two-wheelers in India. Within two-wheelers, economy and executive segment motorcycles and mostly basic scooters produced

1. Decals & Body Graphics

Decal stickers are printed on vinyl films for decorative purposes on automobiles, particularly two-wheelers in India. Within two-wheelers, economy and executive segment motorcycles and mostly basic scooters produced

in India have decal finishes. They are applied to the body of a vehicle to enhance its appearance.

2. 3D Lux badges

3D lux badges are complex products with different finishes, colors, shapes, and curvatures typically used in two-wheelers and passenger vehicles to showcase a customer’s logo or brand.

3D lux badges are complex products with different finishes, colors, shapes, and curvatures typically used in two-wheelers and passenger vehicles to showcase a customer’s logo or brand.

3. 2D and 3D Appliques and Dials

The instrument clusters in automobiles is the key source of vehicle information for drivers and immensely adds to the visual appeal of the overall product. These dials have a cluster of gauges, fuel level indicators, engine RPM, speedometers,

The instrument clusters in automobiles is the key source of vehicle information for drivers and immensely adds to the visual appeal of the overall product. These dials have a cluster of gauges, fuel level indicators, engine RPM, speedometers,

engine temperature, safety warnings, trip configuration, driving efficiency indicators, etc.

Compared to 2D dials, 3D dials are manufactured using complex printing techniques along with high pressure thermoforming on plastics materials,

Compared to 2D dials, 3D dials are manufactured using complex printing techniques along with high pressure thermoforming on plastics materials,

such as polycarbonate involving printing of graphics in several passes through the printing machine

4. Domes

Domes are typically used in two-wheelers and passenger vehicles and consumer appliances to showcase a customer’s logo or brand with special embossing effects and can be featured in different colors and shapes.

Domes are typically used in two-wheelers and passenger vehicles and consumer appliances to showcase a customer’s logo or brand with special embossing effects and can be featured in different colors and shapes.

5. Chrome-plated and Painted Products

Chrome-plated and painted products include wheel covers, monograms, nameplates, rear and front appliques, radiator grills, door handles, bezels, bumper parts, etc.

Chrome-plated and painted products include wheel covers, monograms, nameplates, rear and front appliques, radiator grills, door handles, bezels, bumper parts, etc.

6. Overlays

Overlays are used in consumer appliances control panels and work as the interface between users and machines

Overlays are used in consumer appliances control panels and work as the interface between users and machines

7. IMLs/IMDs

IMD/IML is a process for decorating or labeling injection molded plastic parts or components during the plastic injection molding cycle. IMD/IML techniques allow for the integration of decoration/labeling activities in the plastic injection molding process.

IMD/IML is a process for decorating or labeling injection molded plastic parts or components during the plastic injection molding cycle. IMD/IML techniques allow for the integration of decoration/labeling activities in the plastic injection molding process.

IMD/IML processes produce high quality and visually appealing parts. These processes offer more durable and long-lasting decorations compared to traditional molding and decorating techniques, such as painted/ printed injection molded parts

8. Optical Plastics

Optical plastics are high-quality plastic parts that allow a display to be clearly visible without any distortion and also used to provide mechanical protection to thin-film transistor (“TFT”) screens without impacting the visibility of the (Continued...)

Optical plastics are high-quality plastic parts that allow a display to be clearly visible without any distortion and also used to provide mechanical protection to thin-film transistor (“TFT”) screens without impacting the visibility of the (Continued...)

underlying display device. Optical plastics are typically made of acrylics/polycarbonate material, providing desired mechanical strength.

9. Aluminium and Nickel logos and badges.

These logos or stickers are designed on aluminum, nickel plates. These badges find applications in automobiles and consumer durables. Few prominent examples include Whirlpool, LG, and Dell logos.

These logos or stickers are designed on aluminum, nickel plates. These badges find applications in automobiles and consumer durables. Few prominent examples include Whirlpool, LG, and Dell logos.

Manufacturing Facility:

Currently the company has 2 manufacturing facilities in Pune and Bangalore.

Current capacity utilization of SJS is only 50% to 55%, which gives it huge operating leverage

Manufacturing facility in bangalore is the main unit which constitutes to around

Currently the company has 2 manufacturing facilities in Pune and Bangalore.

Current capacity utilization of SJS is only 50% to 55%, which gives it huge operating leverage

Manufacturing facility in bangalore is the main unit which constitutes to around

75% of the total sale.

Clients

It supplies to all major OEMs in India along with Tier 1 auto component manufacturers like Visteon and Marelli.

Stellantis, a leading global automotive player and mobility provider is among many other marquee names like Ola Electric,

Clients

It supplies to all major OEMs in India along with Tier 1 auto component manufacturers like Visteon and Marelli.

Stellantis, a leading global automotive player and mobility provider is among many other marquee names like Ola Electric,

Kia Motors India, MG Motors, etc.

It also bagged prestigious projects from key customers like Continental, Morris Garage, Honda, Hyundai, etc.

It also grabbed export orders from Whirlpool and Allodio, two large manufacturers of consumer durables in America.

It also bagged prestigious projects from key customers like Continental, Morris Garage, Honda, Hyundai, etc.

It also grabbed export orders from Whirlpool and Allodio, two large manufacturers of consumer durables in America.

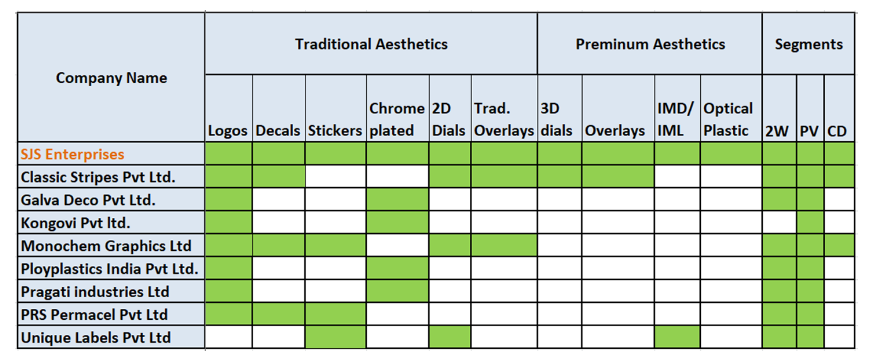

Competition:

SJS is the only listed company in the Indian decorative aesthetics sector, and it caters across all segments and even to all traditional as well as premium aesthetics products even among its private competitors..

SJS is the only listed company in the Indian decorative aesthetics sector, and it caters across all segments and even to all traditional as well as premium aesthetics products even among its private competitors..

Capex and future plans

Capex for this fiscal year is ₹60 cr

Company is building a green field manufacturing facility for chrome plating business in Pune at a cost of ₹100cr, it will take 18-24 months for the plant to operationalize. And at full capacity

Capex for this fiscal year is ₹60 cr

Company is building a green field manufacturing facility for chrome plating business in Pune at a cost of ₹100cr, it will take 18-24 months for the plant to operationalize. And at full capacity

the company expects a revenue of 30cr from the current 13cr in its chrome plating business.

It are actively seeking value accretive inorganic growth opportunities

The company expect to grow at 25% cagr for the next 2-3 years

It are actively seeking value accretive inorganic growth opportunities

The company expect to grow at 25% cagr for the next 2-3 years

SJS is focussed on introducing in-mold electronic(IME) parts and other new generation technologies in the coming future

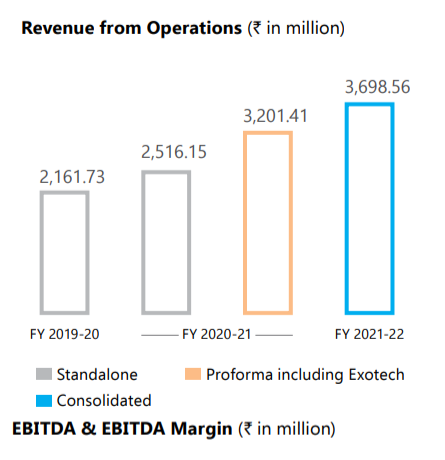

Financials:

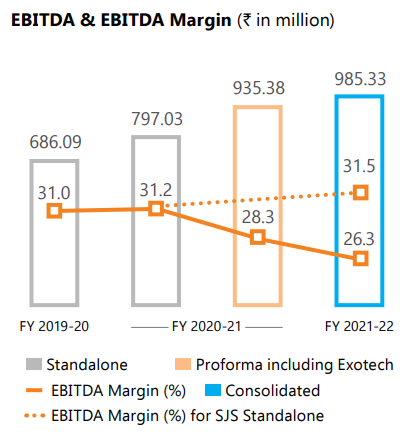

Consolidated revenues in FY 2021-22 (including Exotech) grew by 15.5% to ₹ 369.8 cr. EBITDA stood at ₹ 98.5 cr while

Financials:

Consolidated revenues in FY 2021-22 (including Exotech) grew by 15.5% to ₹ 369.8 cr. EBITDA stood at ₹ 98.5 cr while

Profit after Tax (PAT) stood at ₹55.01 cr in FY 2021-22.

It generated a free cash flow of ₹50 cr

Recently acquired EXO Tech showed a 50% y-o-y growth

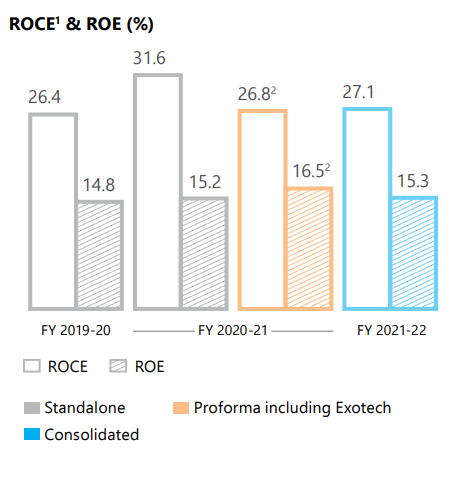

Consolidated ROCE and ROE is 27.1% and 15.3%, respectively

Company is debt free

It generated a free cash flow of ₹50 cr

Recently acquired EXO Tech showed a 50% y-o-y growth

Consolidated ROCE and ROE is 27.1% and 15.3%, respectively

Company is debt free

Revenue from passenger vehicles increased from 10.2% to 28.7% of the sales mix while that of consumer durables grew from 19.6% to 22.2% from FY 2018-19 (SJS Standalone) to FY 2021-22 (SJS Consolidated)

Export revenue doubled in the past three years and stood at ₹ 46.81 cr as of FY 2021-22

It has cash of ₹102cr which is invested in FDs and Mutual Funds

It has cash of ₹102cr which is invested in FDs and Mutual Funds

• • •

Missing some Tweet in this thread? You can try to

force a refresh