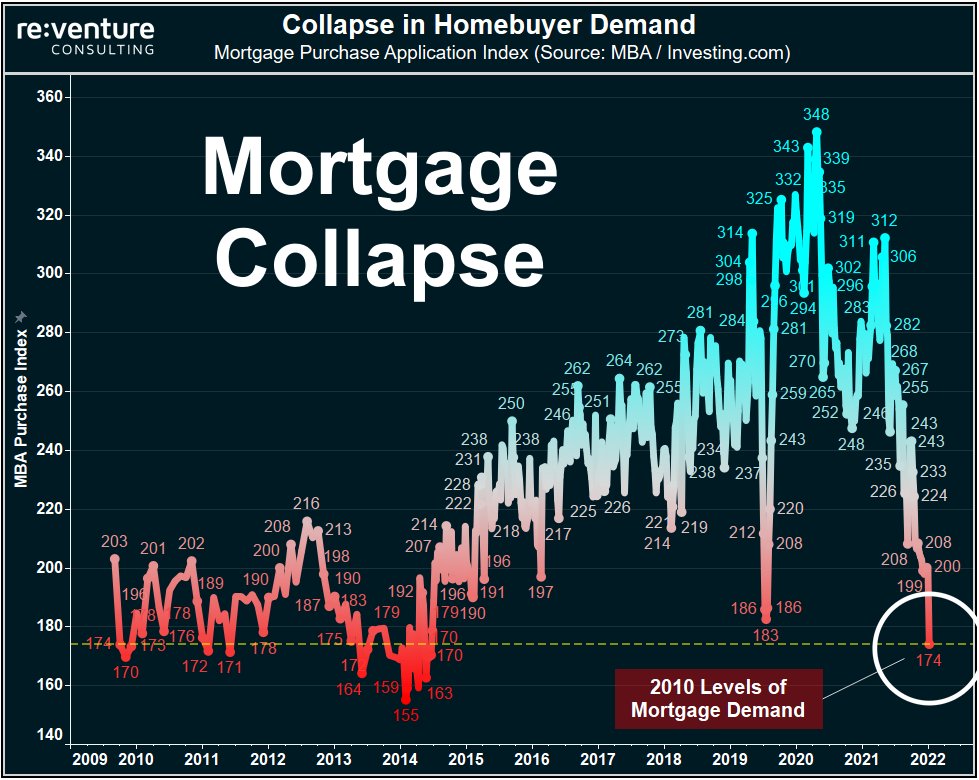

📉Shocking Collapse in Mortgage Applications last week.

Purchase Demand at lowest level in a DECADE. Comparable to lows in 2010 during last Housing Crash.

Purchase Demand at lowest level in a DECADE. Comparable to lows in 2010 during last Housing Crash.

Big Problem considering that 70-80% of Home Purchases are financed with a Mortgage.

High Rates + Declining Housing Market has Buyers on ice. It's a total Boycott of the Housing Market.

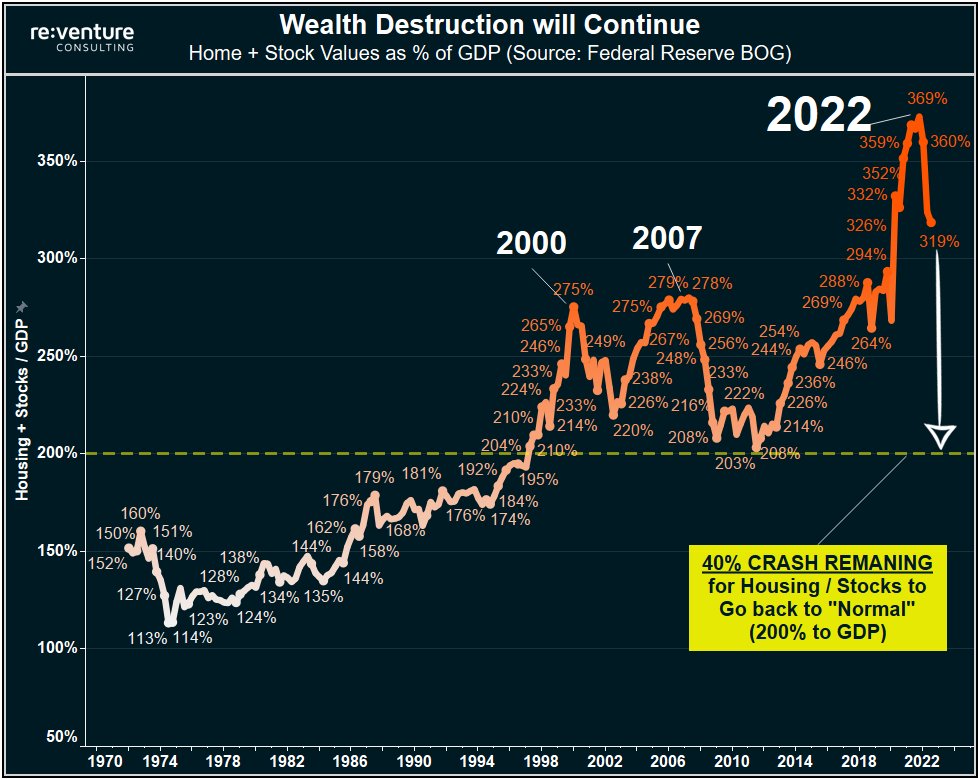

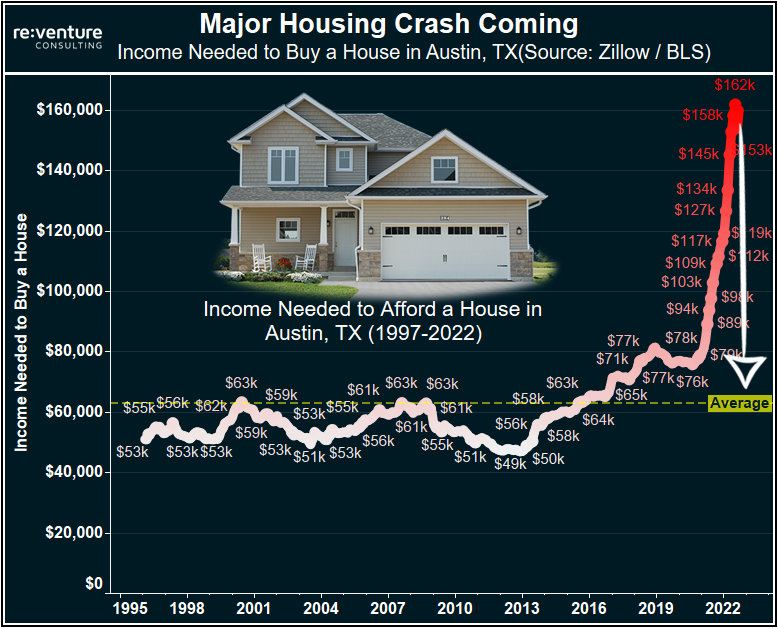

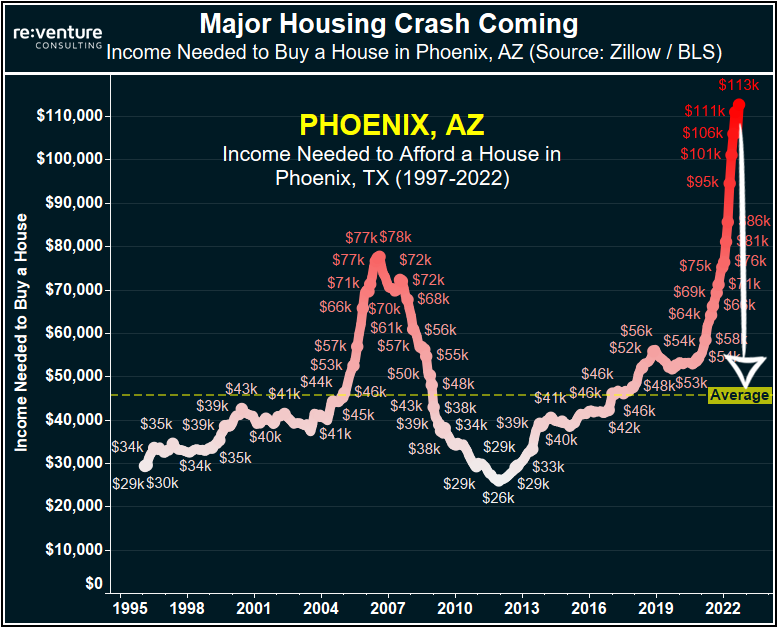

Prices need to come down substantially to entice buyers back in.

High Rates + Declining Housing Market has Buyers on ice. It's a total Boycott of the Housing Market.

Prices need to come down substantially to entice buyers back in.

To put this decline in Mortgage Demand into better perspective:

Today's Index Level of 174 is 37% below last year. And 50% below the pandemic peak in early 2021.

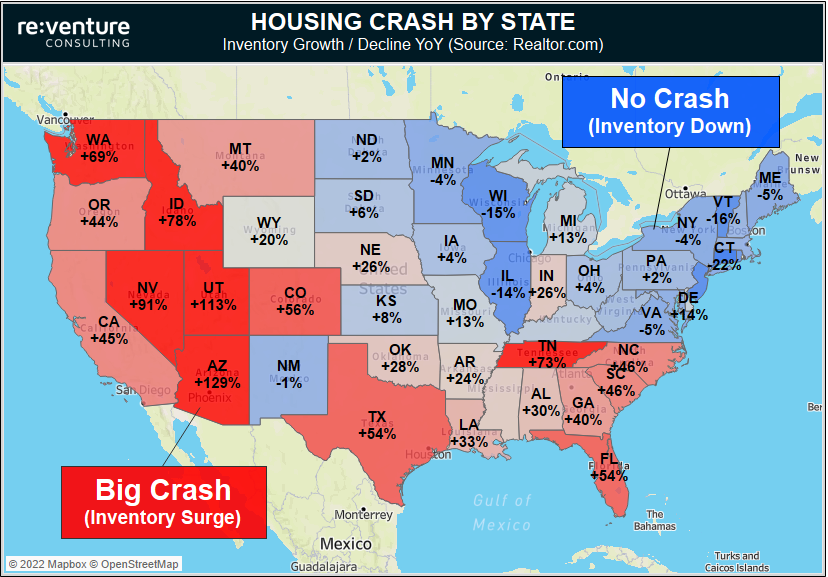

Suggests that Fall/Winter will be see even more Price Drops.

Today's Index Level of 174 is 37% below last year. And 50% below the pandemic peak in early 2021.

Suggests that Fall/Winter will be see even more Price Drops.

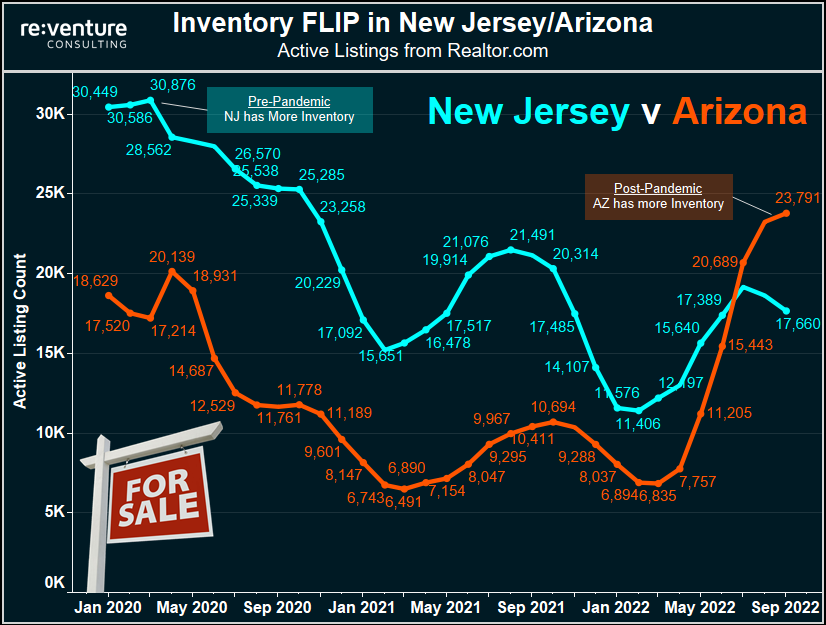

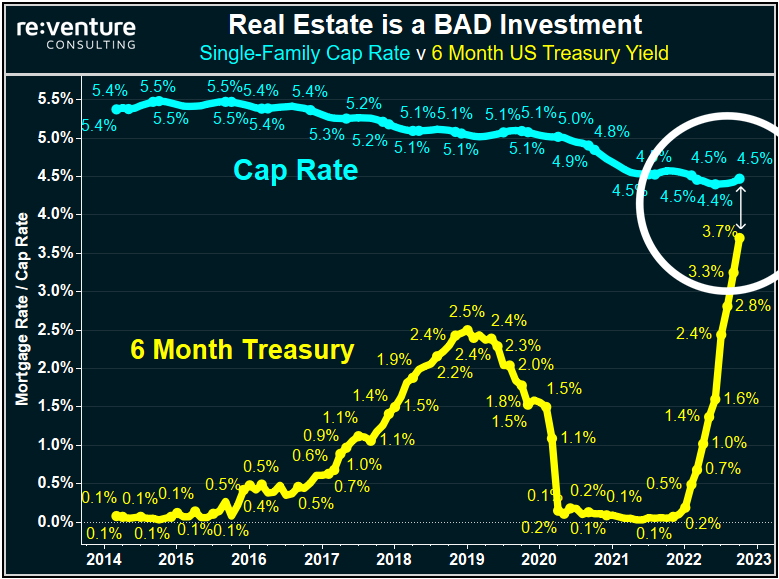

While Mortgage Rates get all the attention for nuking buyer demand (deservedly so), another factor is creeping in...

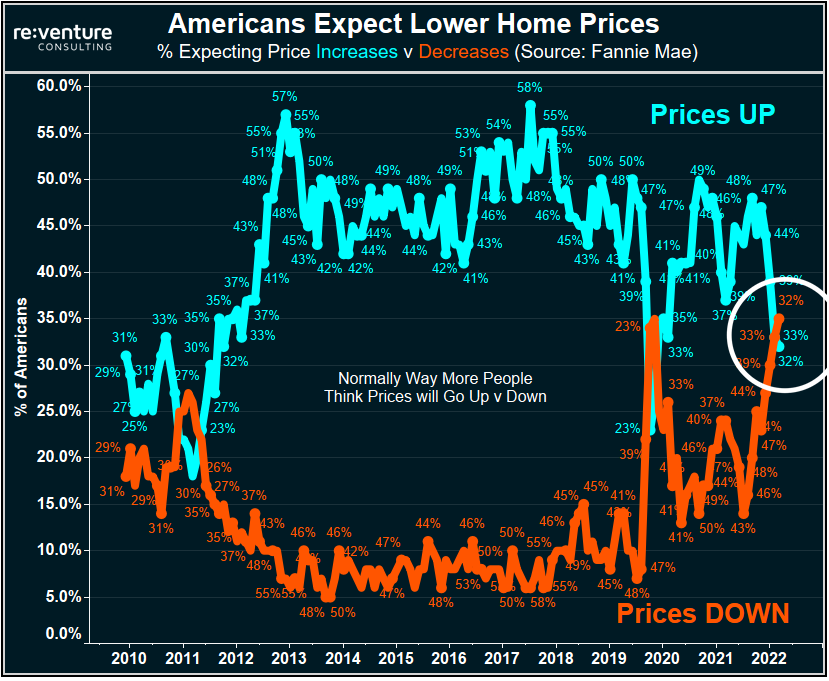

Expectation of Declining Prices.

Fannie Mae's Sept Housing Survey showed more people expect Price Declines v Increases. Very Rare.

Expectation of Declining Prices.

Fannie Mae's Sept Housing Survey showed more people expect Price Declines v Increases. Very Rare.

As the expectation for lower Home Prices becomes entrenched, that reduces buyer demand on its own.

Independent of Mortgage Rates.

Independent of Mortgage Rates.

• • •

Missing some Tweet in this thread? You can try to

force a refresh