CEO of Reventure App.

Price Forecasts and Valuation Rates for every ZIP code in U.S. Housing Market.

38 subscribers

How to get URL link on X (Twitter) App

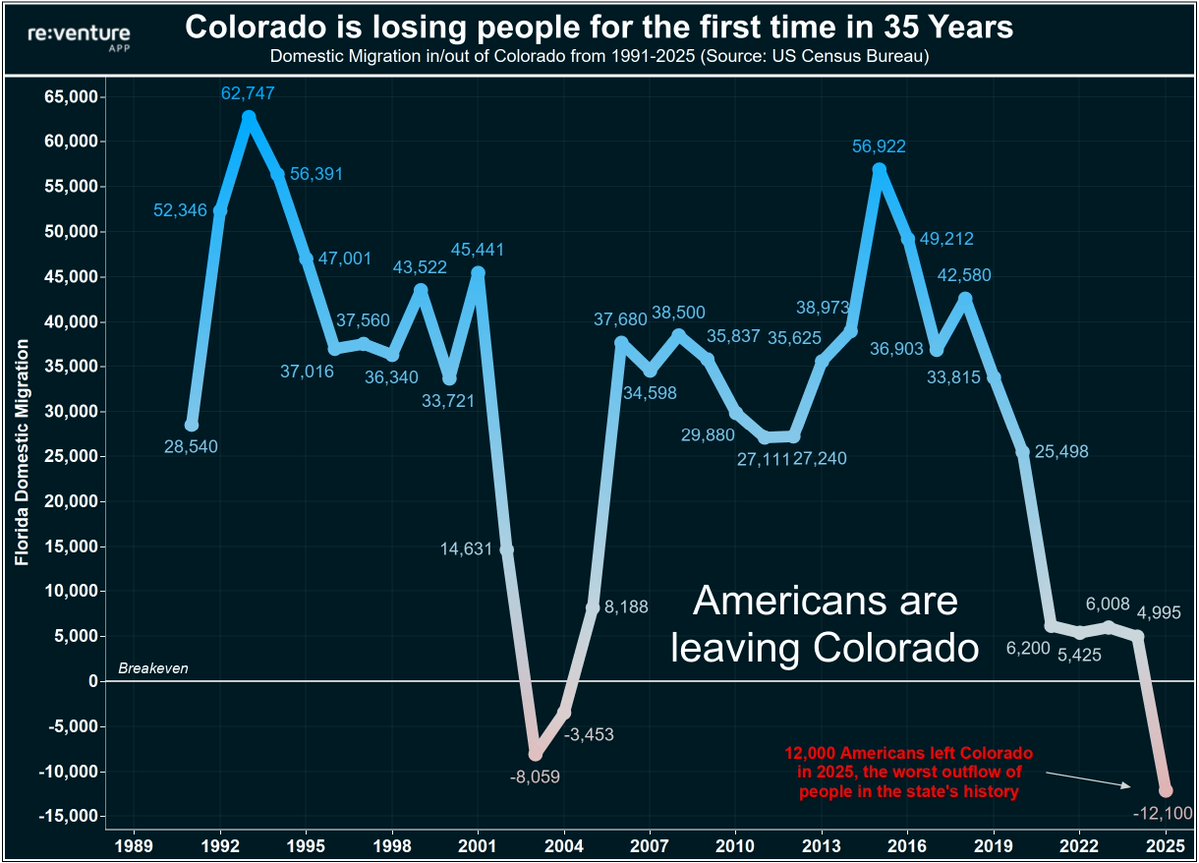

1) Colorado now relies almost exclusively on international migration to drive the bus on remaining population growth.

1) Colorado now relies almost exclusively on international migration to drive the bus on remaining population growth.

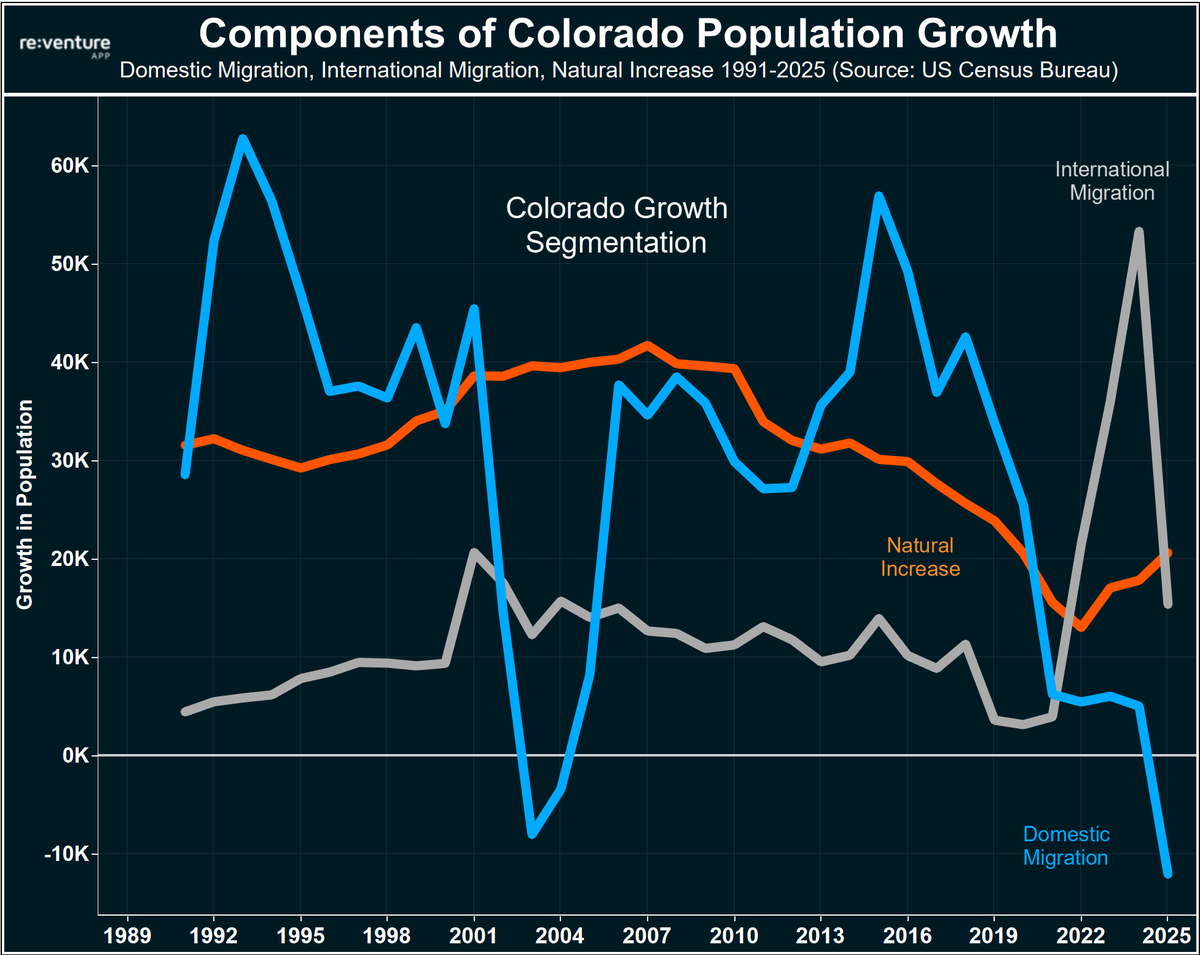

1) Here's the math on the graph from above:

1) Here's the math on the graph from above:

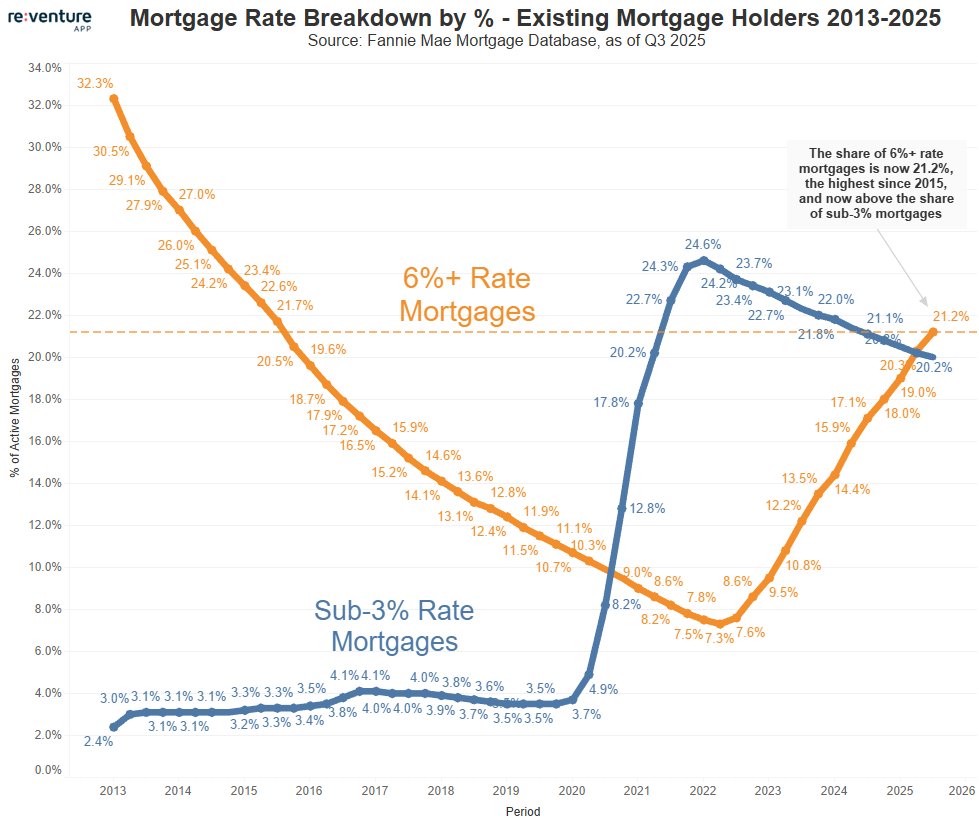

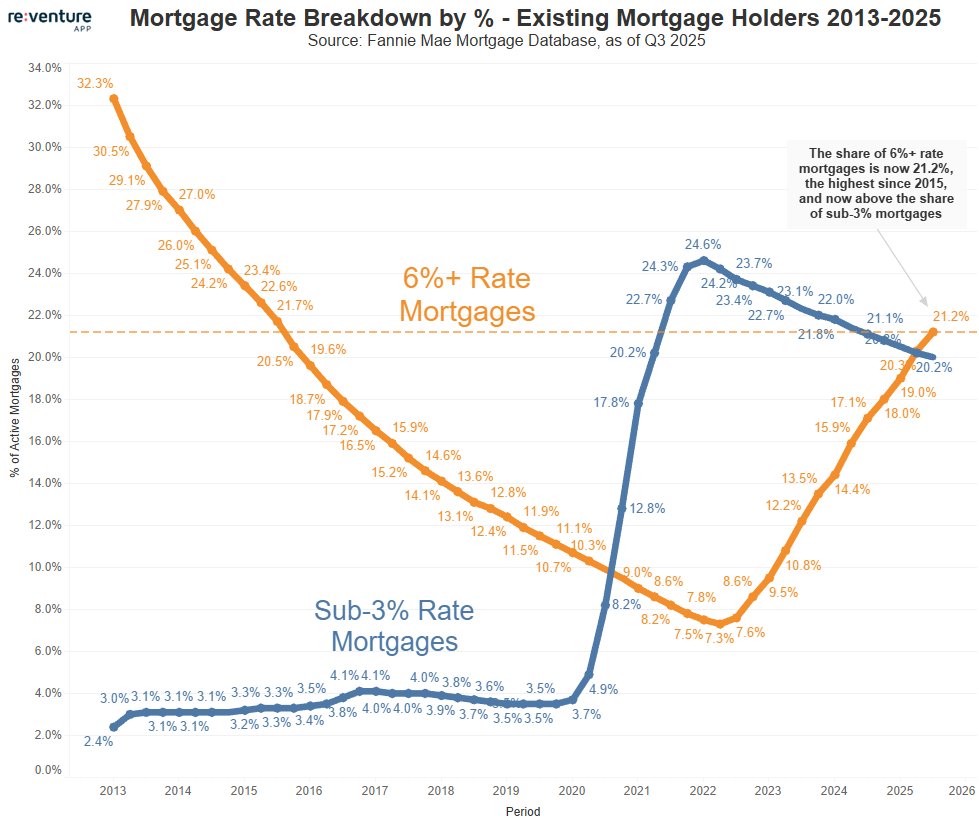

1) I'd like to remind everyone that we've now had 7 rate cuts since August 2024.

1) I'd like to remind everyone that we've now had 7 rate cuts since August 2024.

1) condos are an interesting asset class, because if you are in the wrong building, at the wrong time, the declines in value can be immense.

1) condos are an interesting asset class, because if you are in the wrong building, at the wrong time, the declines in value can be immense.

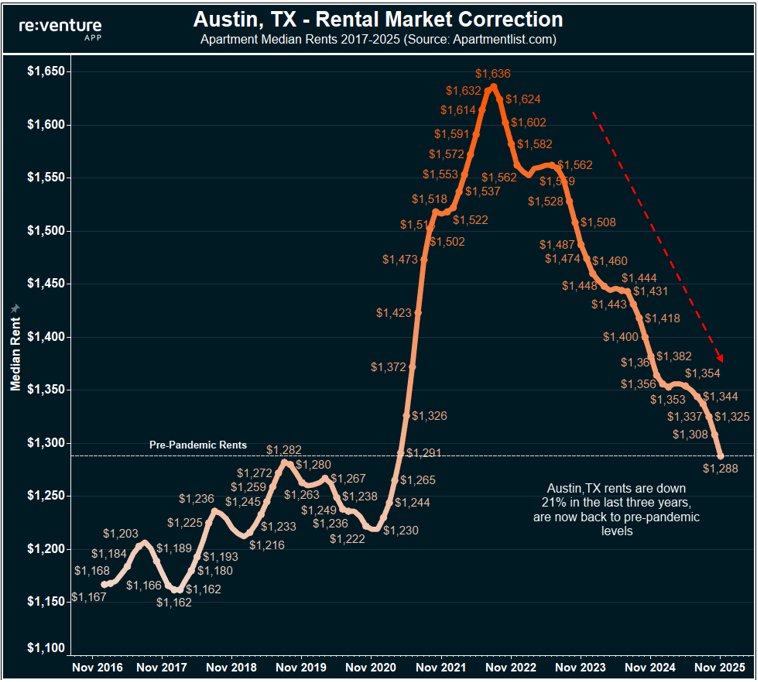

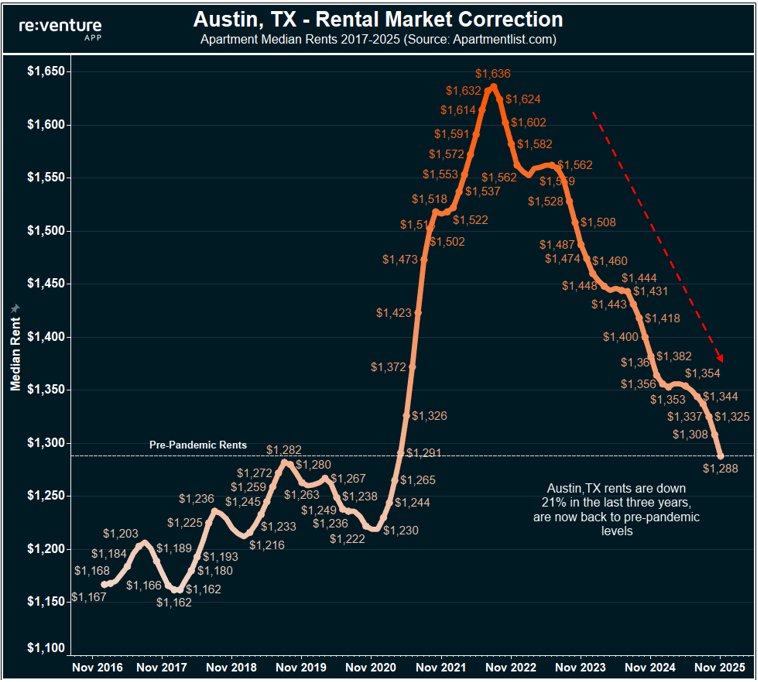

1) A different way to view this data is by comparison today's rents to pre-pandemic.

1) A different way to view this data is by comparison today's rents to pre-pandemic.

1) The one thing keeping inventory constrained, even in the midst of its rebound from the pandemic, has been sellers delisting homes.

1) The one thing keeping inventory constrained, even in the midst of its rebound from the pandemic, has been sellers delisting homes.

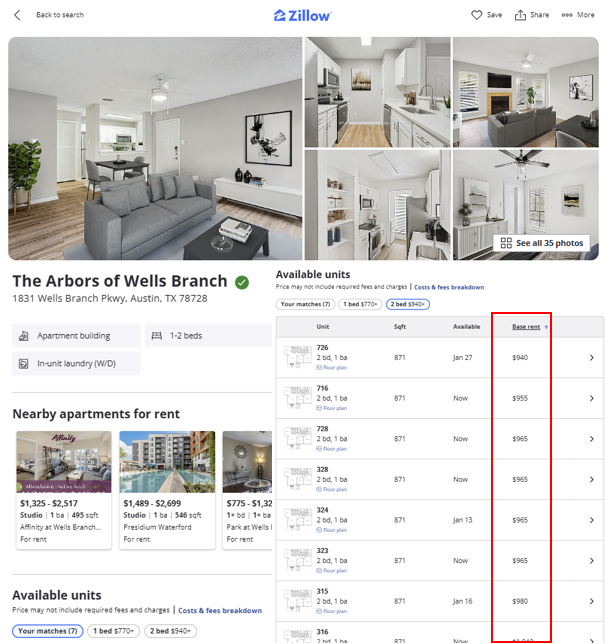

1) Here's an example of what's out there now.

1) Here's an example of what's out there now.

1) if we want to re-stimulate the housing market, and make the American dream accessible again, it all comes down bringing down Mortgage Costs and making the housing market more affordable again.

1) if we want to re-stimulate the housing market, and make the American dream accessible again, it all comes down bringing down Mortgage Costs and making the housing market more affordable again.

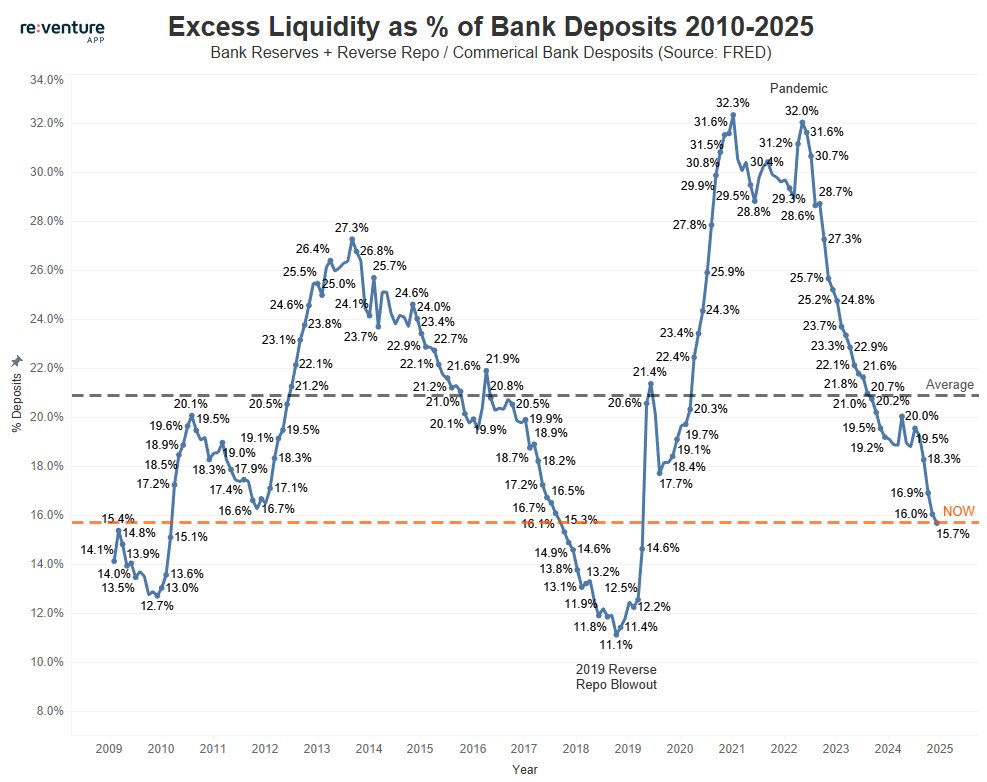

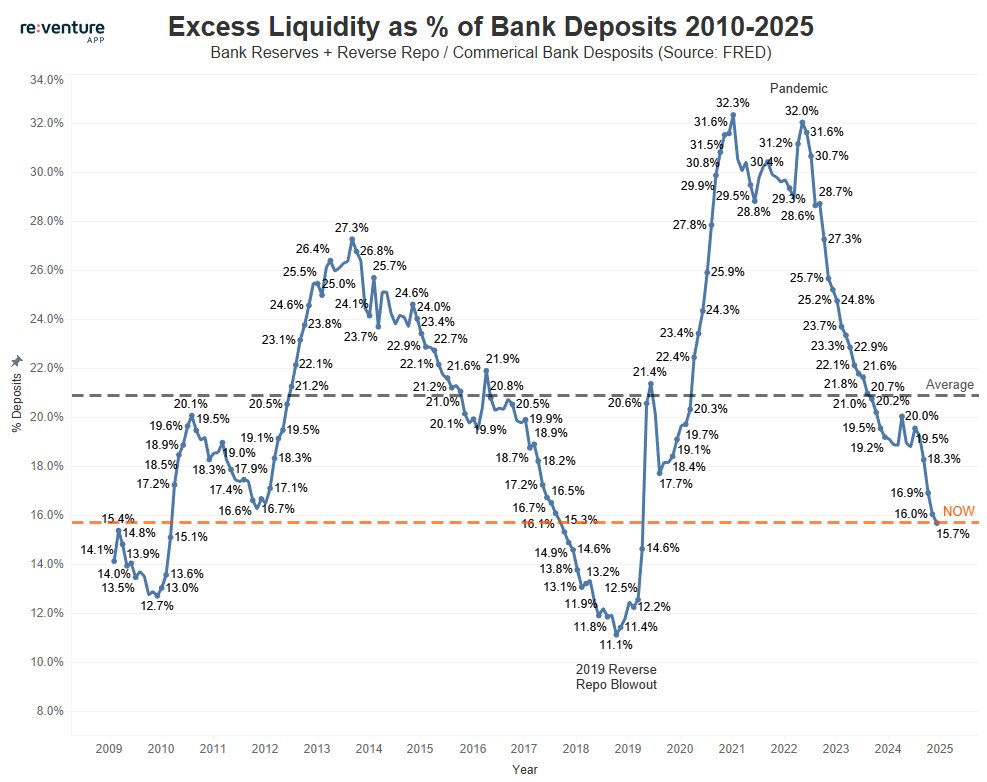

1) There are several metrics you can use to gauge how much reserve liquidity the Fed needs in the system for their "ample reserves" regime - one is GDP, another is M2, but my personal favorite to gauge this is bank deposits.

1) There are several metrics you can use to gauge how much reserve liquidity the Fed needs in the system for their "ample reserves" regime - one is GDP, another is M2, but my personal favorite to gauge this is bank deposits.

1) The other obvious conclusion from the graph above is that finding a way to drive down the cost to buy a house would help unlock the housing market.

1) The other obvious conclusion from the graph above is that finding a way to drive down the cost to buy a house would help unlock the housing market.

1) The deflationary rental environment, particularly in the Sun Belt area of America, is one reason why I believe we'll continue to see more inventory hit the market next year.

1) The deflationary rental environment, particularly in the Sun Belt area of America, is one reason why I believe we'll continue to see more inventory hit the market next year.

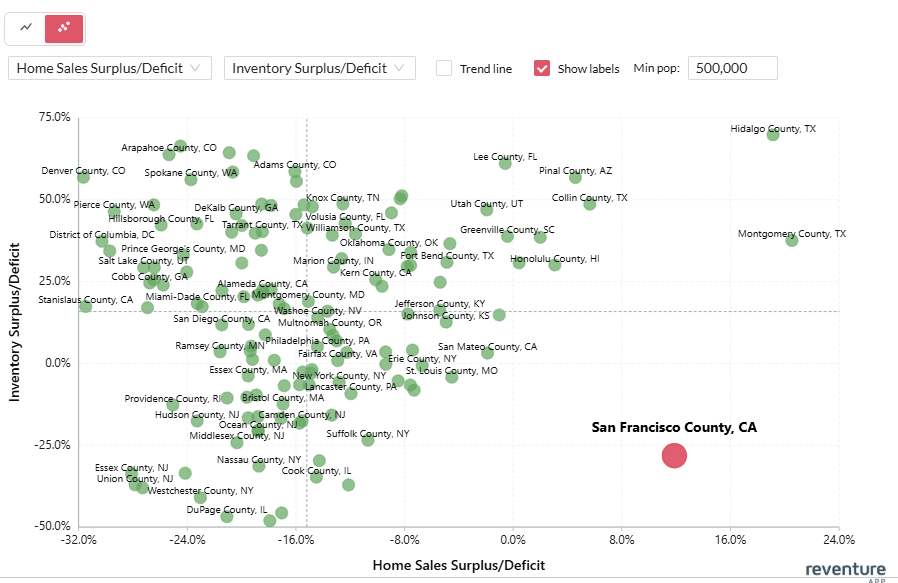

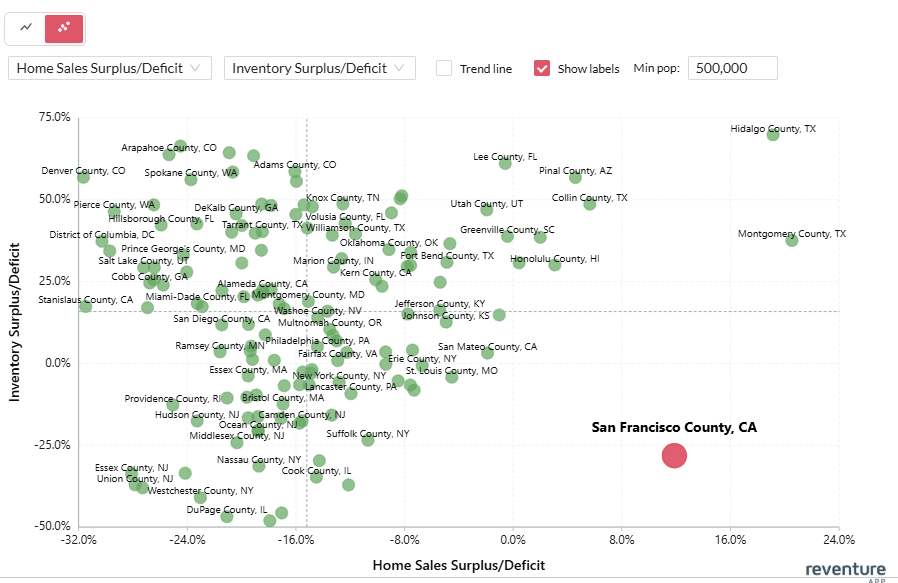

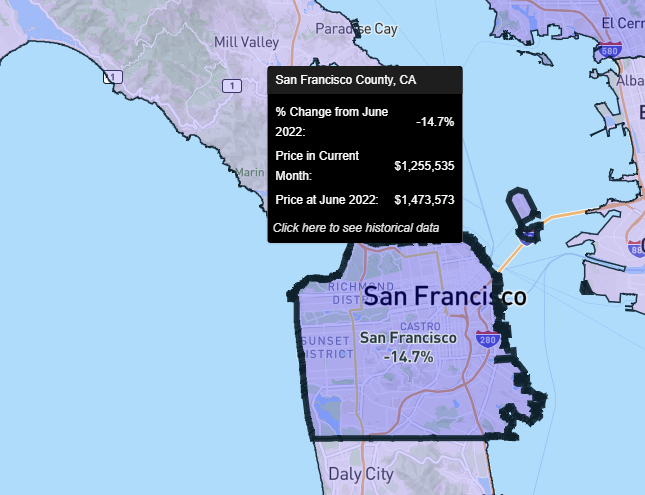

1) Of course - let's not forget that San Francisco was one of the weakest housing markets in America since the pandemic.

1) Of course - let's not forget that San Francisco was one of the weakest housing markets in America since the pandemic.

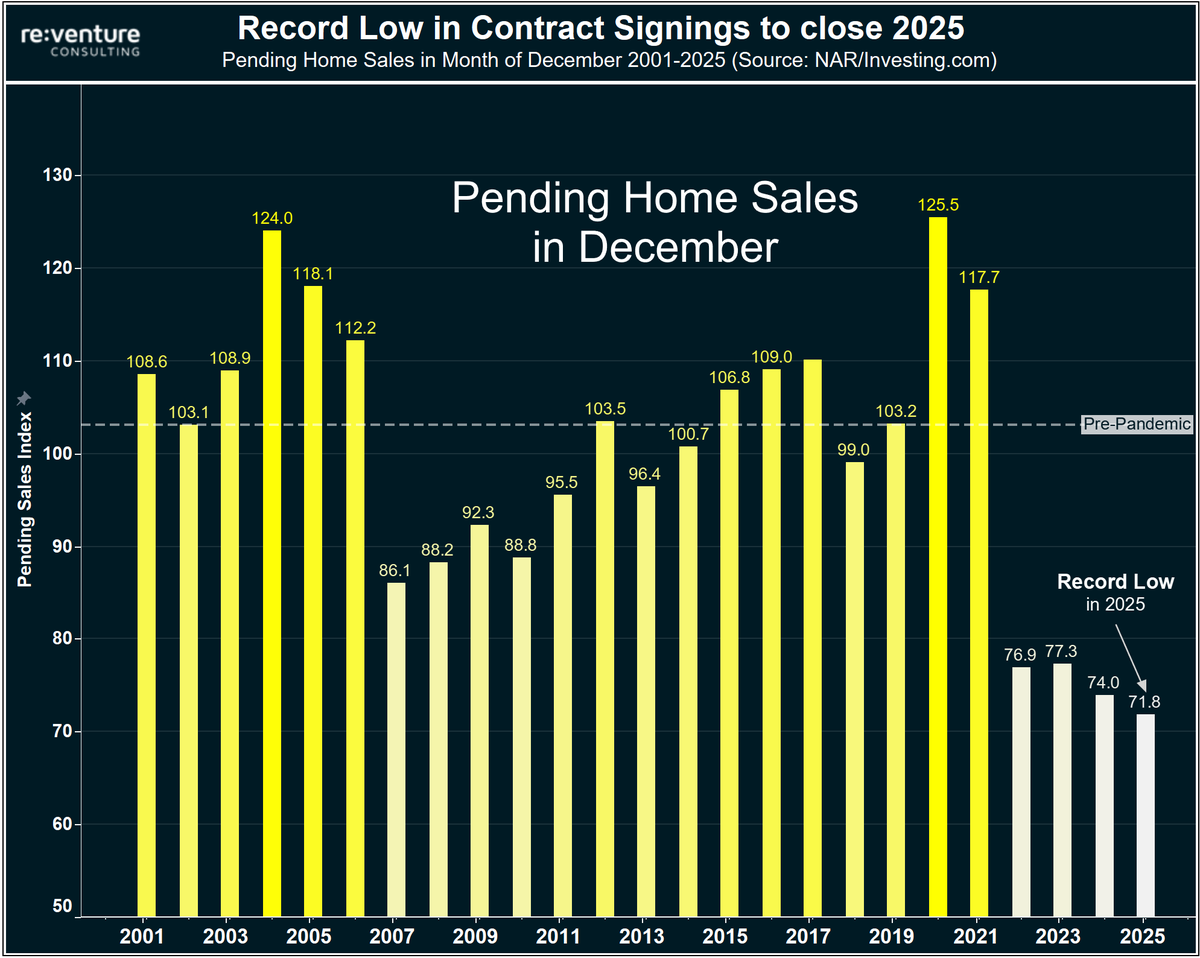

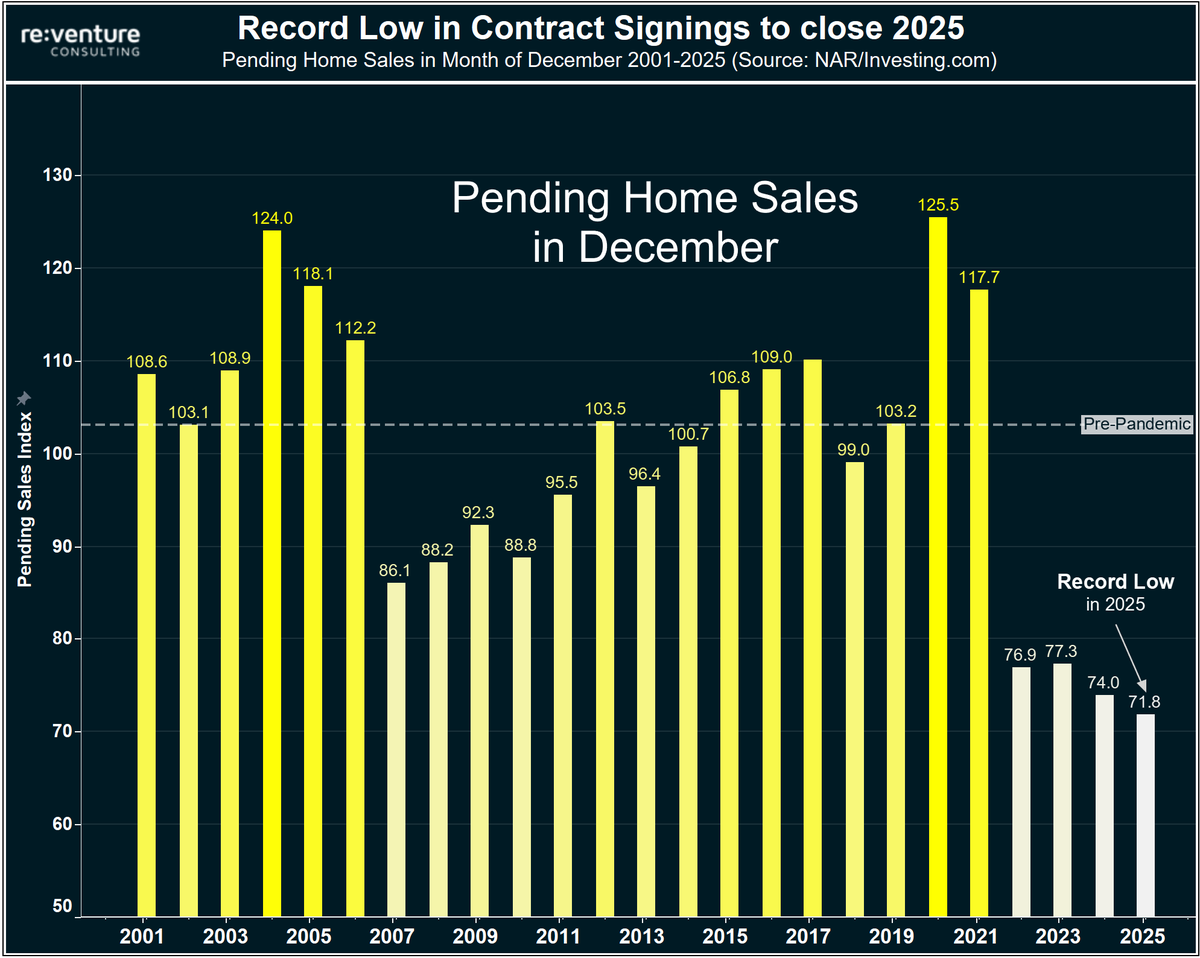

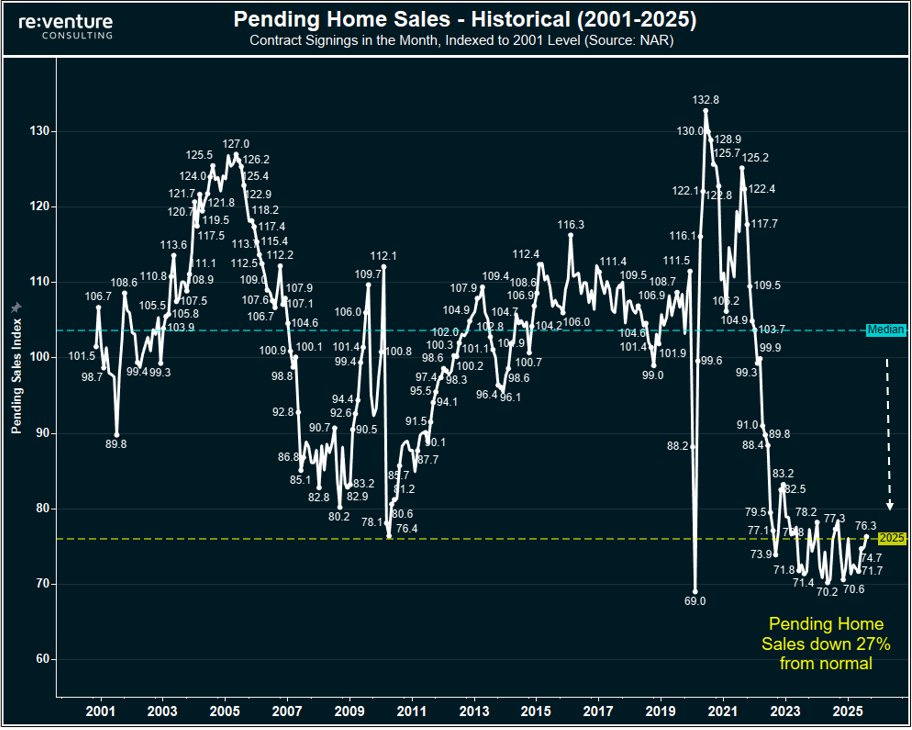

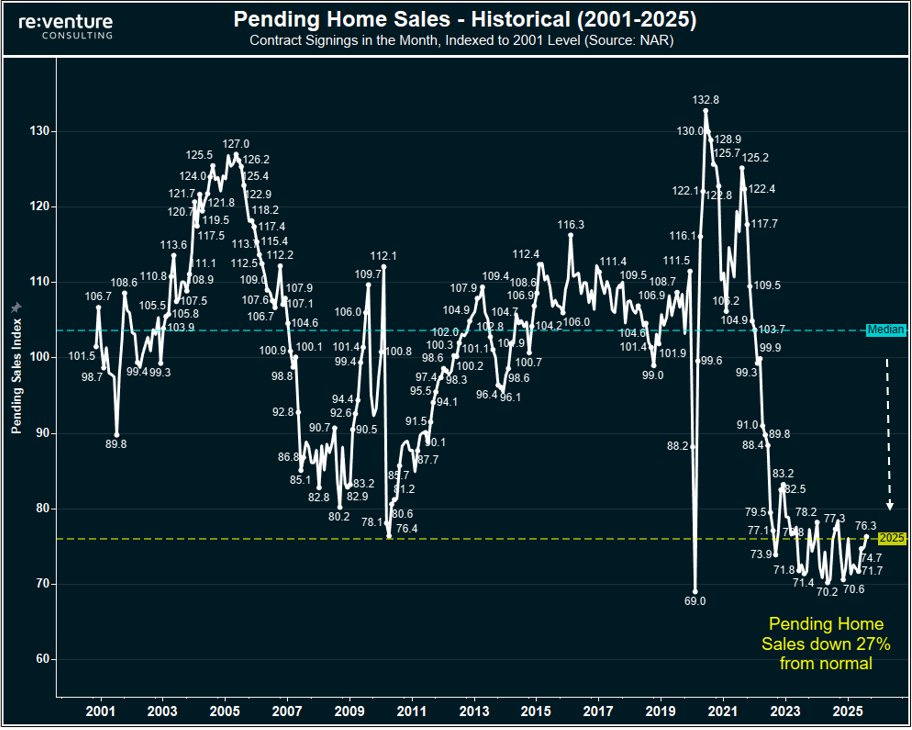

1) I can't stress enough how crazy it is that NAR's Pending Sales figures just came in -1.2% below last year.

1) I can't stress enough how crazy it is that NAR's Pending Sales figures just came in -1.2% below last year.

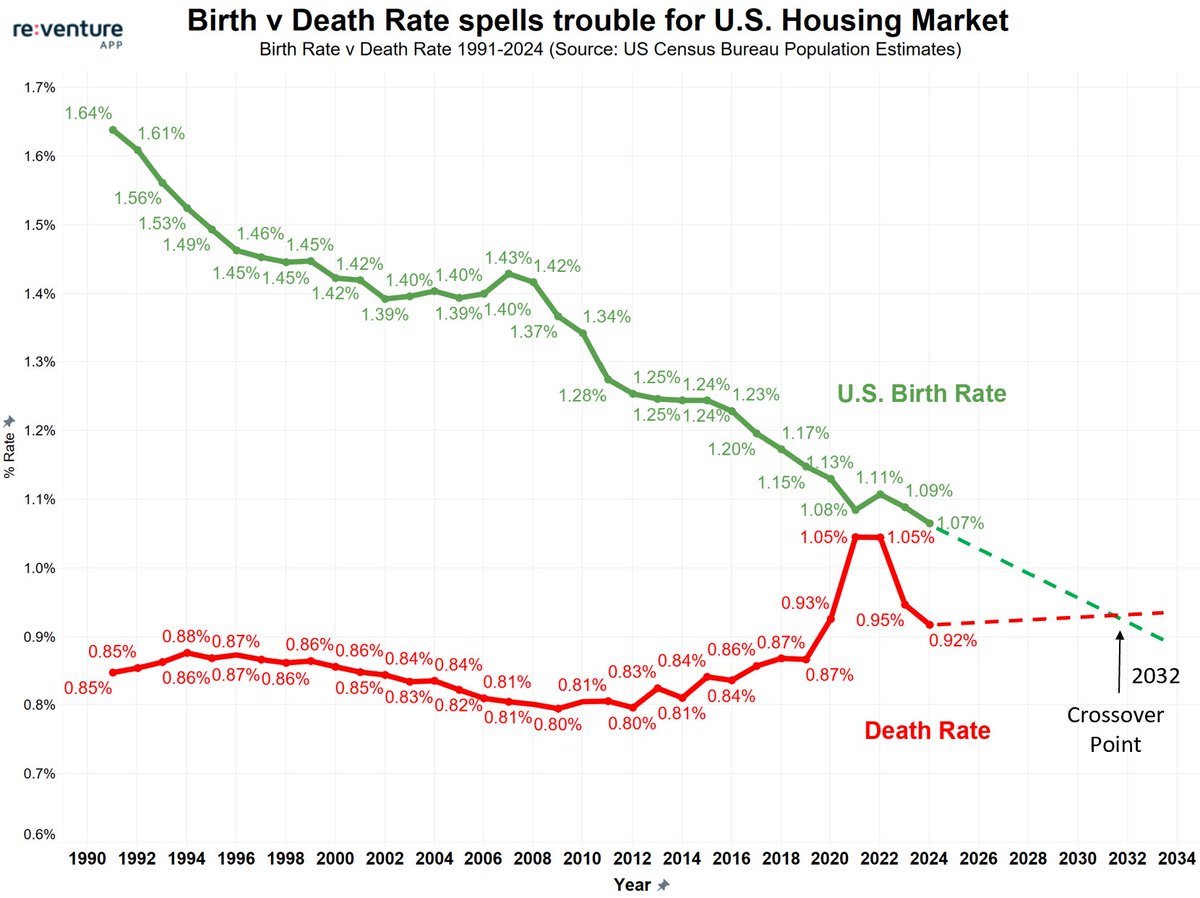

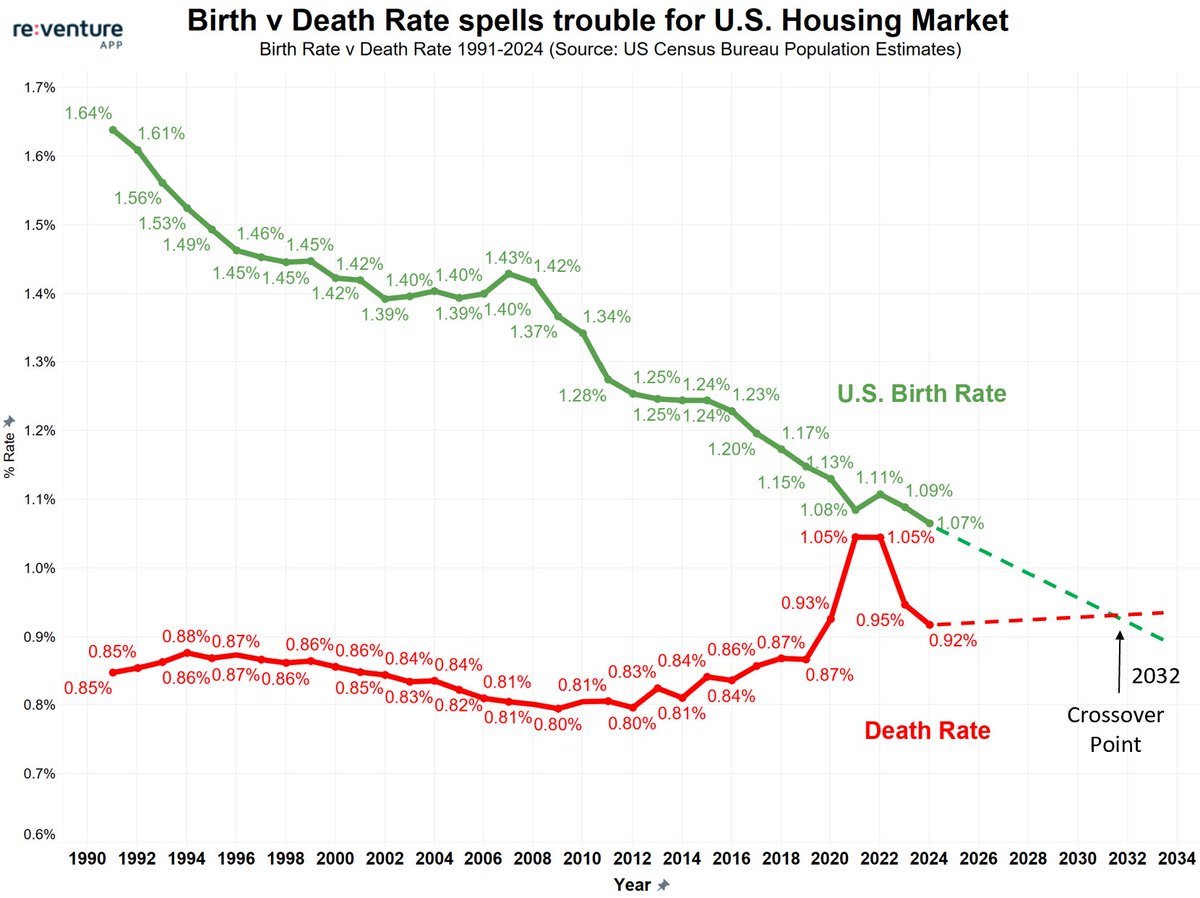

1) Many participants in the housing market are ignoring this issue, as if it does not provide a positive outlook for home prices, and it's also still another 6-7 years off.

1) Many participants in the housing market are ignoring this issue, as if it does not provide a positive outlook for home prices, and it's also still another 6-7 years off.

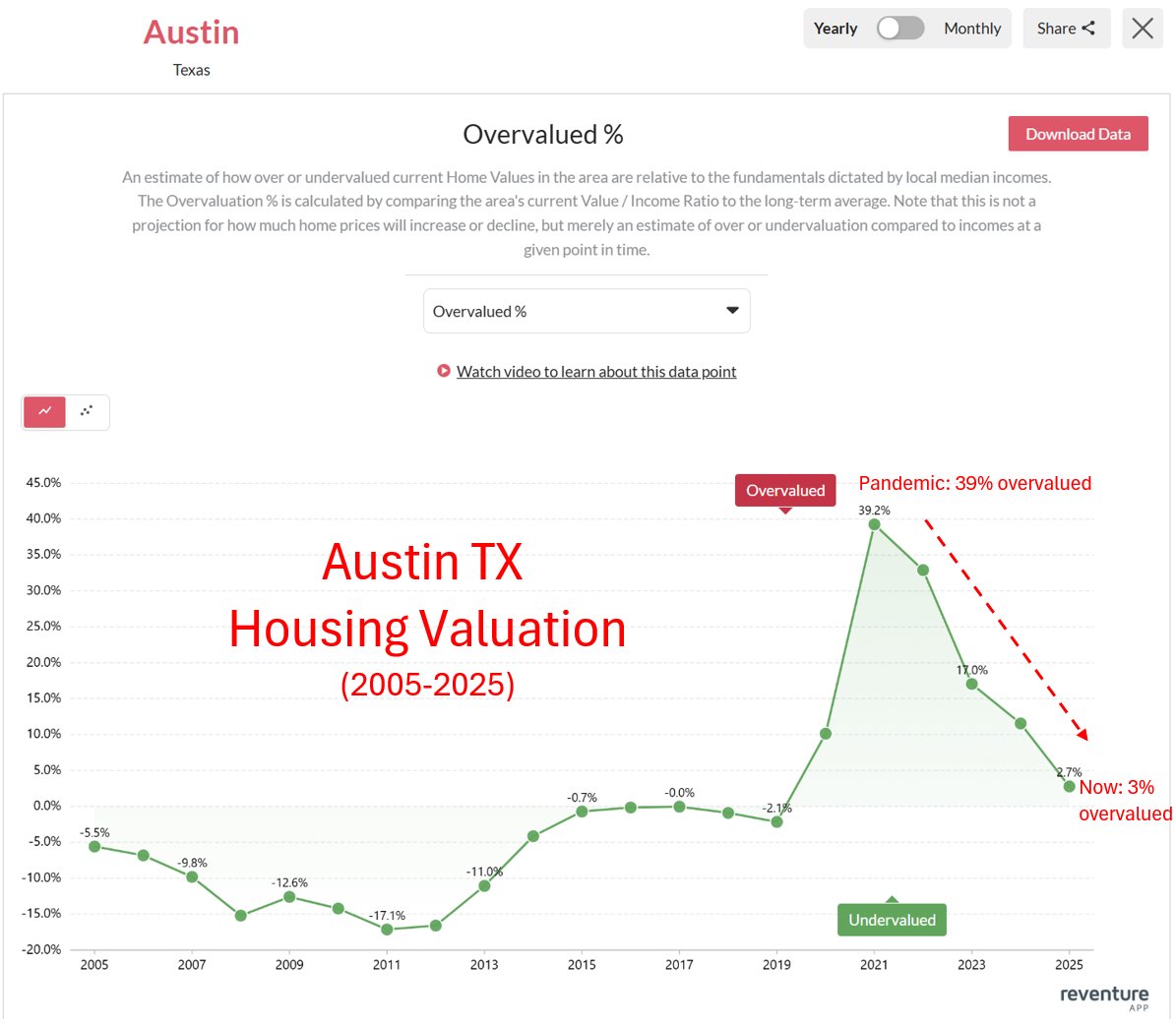

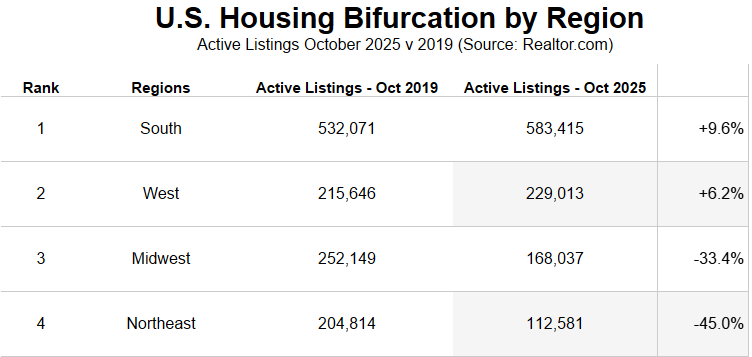

1) This bifurcated market has taken many in the housing industry by surprise, as most analysts expected the boomtown Southern states to continue appreciating.

1) This bifurcated market has taken many in the housing industry by surprise, as most analysts expected the boomtown Southern states to continue appreciating.

1) Here's the chart from the CoStar article. -0.31 rent growth in October.

1) Here's the chart from the CoStar article. -0.31 rent growth in October.

1) While many are frustrated that home prices are still near all-time highs, the reality is that a housing market trending towards 0% nominal home price growth is one already well into a recession, given how abnormally low this appreciation is.

1) While many are frustrated that home prices are still near all-time highs, the reality is that a housing market trending towards 0% nominal home price growth is one already well into a recession, given how abnormally low this appreciation is.

1) The housing market is actually fairly simple when you adopt a longer term outlook:

1) The housing market is actually fairly simple when you adopt a longer term outlook:

1) It's interesting to think about how different the real estate investing landscape was back in the 1950s.

1) It's interesting to think about how different the real estate investing landscape was back in the 1950s.

1) Home builder inventory is actually near a record high in 2025, while existing inventory is not even close to a record.

1) Home builder inventory is actually near a record high in 2025, while existing inventory is not even close to a record.

1) Rising stock market valuations are continuing to drive consumer spending in America, with the Top 10% of U.S. households by income now driving nearly 50% of Consumer spending, according to Moody's.

1) Rising stock market valuations are continuing to drive consumer spending in America, with the Top 10% of U.S. households by income now driving nearly 50% of Consumer spending, according to Moody's.