What is a Credit Default Swap?

(and wtf is going on with Credit Suisse?)

"Lehman-like collapse" flooded the news this week as spreads on $CS hit 2008 levels.

But first, what is a CDS spread? What # is "bad"?

Quick breakdown on what this all means and why it matters:

👇

🧵/

(and wtf is going on with Credit Suisse?)

"Lehman-like collapse" flooded the news this week as spreads on $CS hit 2008 levels.

But first, what is a CDS spread? What # is "bad"?

Quick breakdown on what this all means and why it matters:

👇

🧵/

1/ Definition

A Credit Default Swap (CDS) is a bet on a company/country's chance of defaulting,

i.e. a put option on a bond.

CDS seller: "ABC won't default."

Sells protection for quarterly yield payments.

CDS buyer: "If ABC defaults, I want protection."

Pays quarterly yield.

A Credit Default Swap (CDS) is a bet on a company/country's chance of defaulting,

i.e. a put option on a bond.

CDS seller: "ABC won't default."

Sells protection for quarterly yield payments.

CDS buyer: "If ABC defaults, I want protection."

Pays quarterly yield.

What does "protection" actually mean here?

It means the CDS seller needs to "pay back par" to the CDS buyer in the event of "default."

"Par" = 100% of the original reference bond value.

"Default" = any credit events listed below, all which trigger a material drop in bond value.

It means the CDS seller needs to "pay back par" to the CDS buyer in the event of "default."

"Par" = 100% of the original reference bond value.

"Default" = any credit events listed below, all which trigger a material drop in bond value.

2/ Major Use Cases

CDS seller:

- wants periodic yield/income

- leverages its big balance sheet (can afford to absorb the occasional default event)

CDS buyer:

- wants to anonymously transfer credit risk while still holding the bond

- hedge sovereign exposure

- speculative bet

CDS seller:

- wants periodic yield/income

- leverages its big balance sheet (can afford to absorb the occasional default event)

CDS buyer:

- wants to anonymously transfer credit risk while still holding the bond

- hedge sovereign exposure

- speculative bet

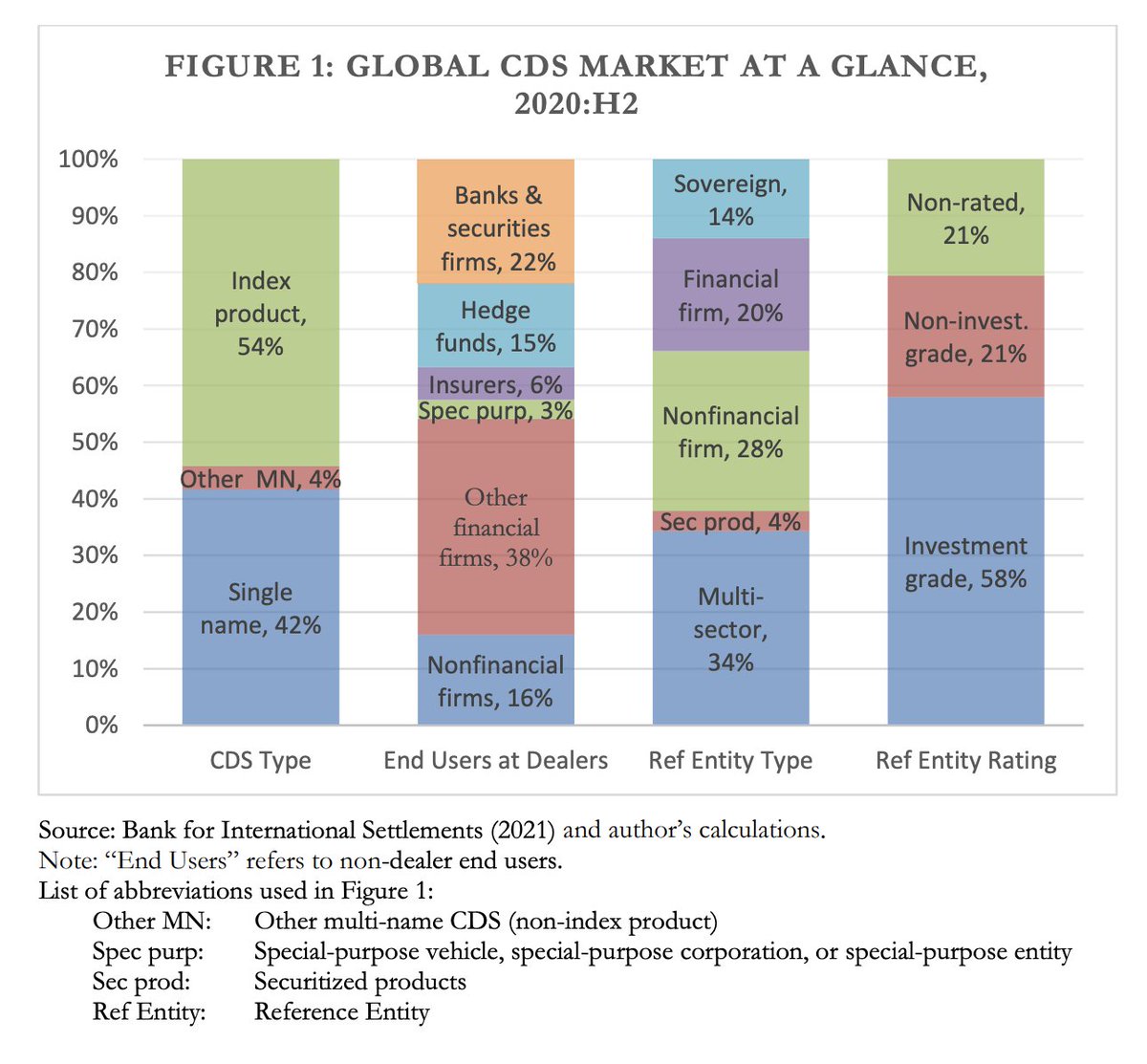

3/ Global CDS Market: size & major players

Size: $8.5 trillion in total notional outstanding [2020]

Buyer & seller identities:

22% banks

15% HF

6% insurance

Reference entity:

>50% of CDS trade as indexes (rather than single names)

14% are on sovereigns

20% on financial firms

Size: $8.5 trillion in total notional outstanding [2020]

Buyer & seller identities:

22% banks

15% HF

6% insurance

Reference entity:

>50% of CDS trade as indexes (rather than single names)

14% are on sovereigns

20% on financial firms

4/ What does the CDS "spread" mean?

The price of a CDS swap (i.e. how much a CDS buyer would pay today) is often referred to as the "spread" or "premium."

e.g. a spread of 300 bps (3%) means that to insure $100 of company ABC's debt, a CDS buyer pays $3 per year

The price of a CDS swap (i.e. how much a CDS buyer would pay today) is often referred to as the "spread" or "premium."

e.g. a spread of 300 bps (3%) means that to insure $100 of company ABC's debt, a CDS buyer pays $3 per year

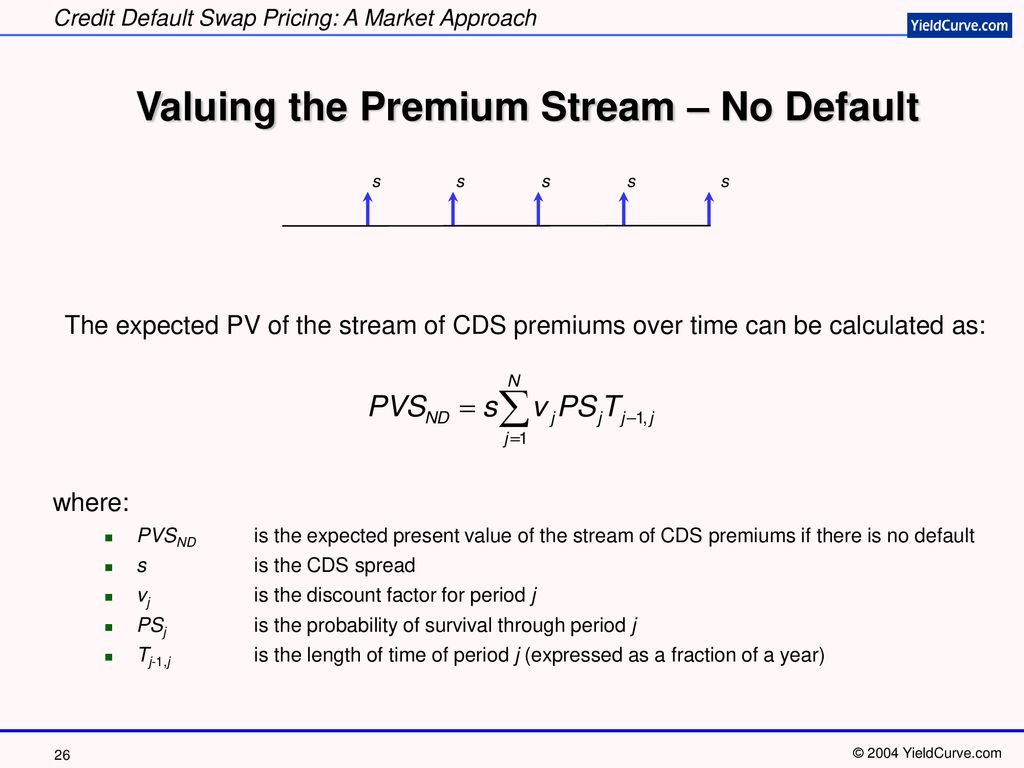

4/ How are CDS swaps priced?

TLDR: Price (aka "premium") of a CDS is determined by setting buyer expected value (EV) equal to seller EV and solving the equation:

buyer EV = sum of quarterly cashflows discounted to present value

seller EV = {probability of default} x {loss amt}

TLDR: Price (aka "premium") of a CDS is determined by setting buyer expected value (EV) equal to seller EV and solving the equation:

buyer EV = sum of quarterly cashflows discounted to present value

seller EV = {probability of default} x {loss amt}

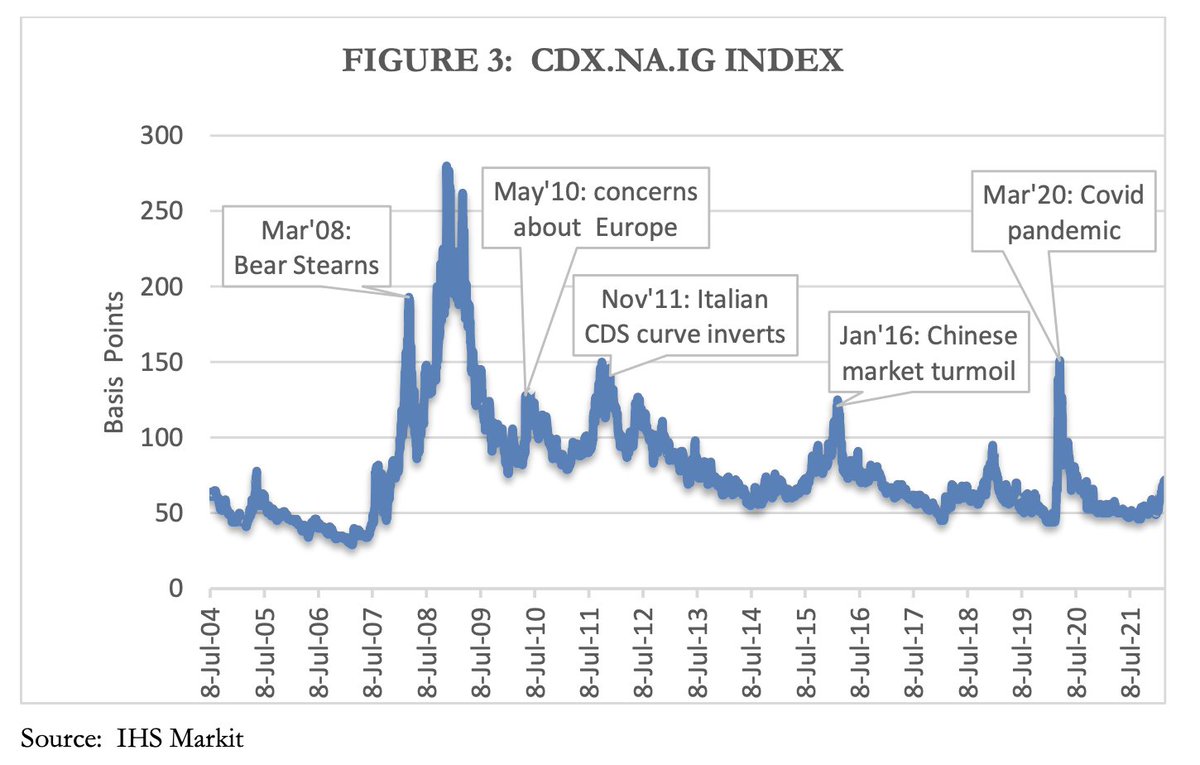

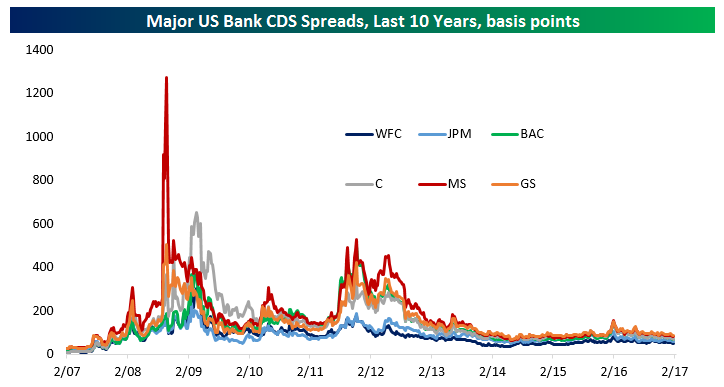

5/ How to read a CDS chart

Y-axis shows spread in bps.

Higher spread means higher risk of default, i.e. buyers paying more to get protection.

What number is "too high"?

It differs widely based on ref entity... see pics below.

Y-axis shows spread in bps.

Higher spread means higher risk of default, i.e. buyers paying more to get protection.

What number is "too high"?

It differs widely based on ref entity... see pics below.

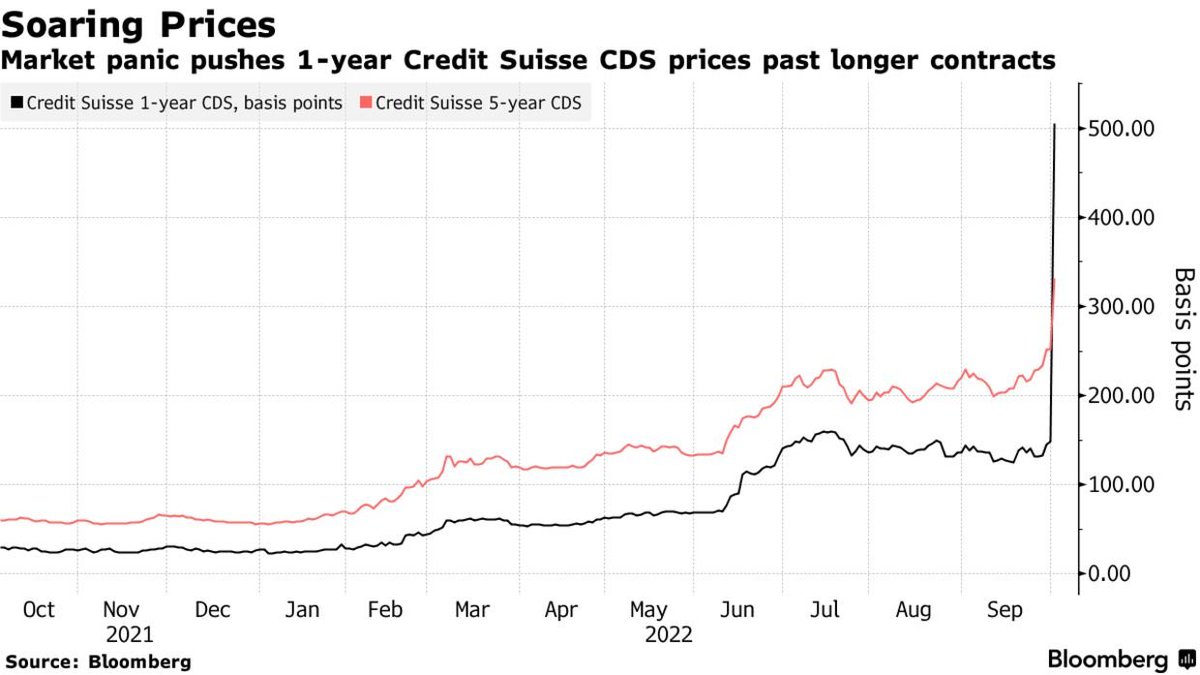

6/ What happened to Credit Suisse's CDS spread this week?

On Oct. 3 $CS's 1Y spread shot over 500bps and 5Y spread over 300bps.

This indicated a >23% chance the Swiss bank will default on its bonds within 5Y.

$CS stock promptly sold off 12% intraday.

What triggered this? ...

On Oct. 3 $CS's 1Y spread shot over 500bps and 5Y spread over 300bps.

This indicated a >23% chance the Swiss bank will default on its bonds within 5Y.

$CS stock promptly sold off 12% intraday.

What triggered this? ...

Late last week, CEO Ulrich Koerne sent a memo to staff saying CS is financial stable.

This backfired & spooked markets as news reports resurfaced CS's recent woes:

- $5.5B loss in Archegos fiasco

- $400M fine for Mozambique “tuna bonds” scandal

- Bulgarian mafia money laundering

This backfired & spooked markets as news reports resurfaced CS's recent woes:

- $5.5B loss in Archegos fiasco

- $400M fine for Mozambique “tuna bonds” scandal

- Bulgarian mafia money laundering

Is CS doomed like Lehman?

TLDR: no

Here's the biggest reason why:

CS CET1 ratio is currently 13.1% (much above the 9.6% regulatory min).

Common Equity Tier 1 (CET1) compares a bank's liquid capital (cash + stock) vs. assets, i.e. an indicator of ability to avoid default.

TLDR: no

Here's the biggest reason why:

CS CET1 ratio is currently 13.1% (much above the 9.6% regulatory min).

Common Equity Tier 1 (CET1) compares a bank's liquid capital (cash + stock) vs. assets, i.e. an indicator of ability to avoid default.

End/

Here are some resources if you want to read up more on credit default swaps:

federalreserve.gov/econres/feds/f… (Fed primer)

And here's Credit Suisse's fixed income investor update from Sept 2022 if you want to learn more about your favorite Swiss bank:

credit-suisse.com/media/assets/a…

Here are some resources if you want to read up more on credit default swaps:

federalreserve.gov/econres/feds/f… (Fed primer)

And here's Credit Suisse's fixed income investor update from Sept 2022 if you want to learn more about your favorite Swiss bank:

credit-suisse.com/media/assets/a…

• • •

Missing some Tweet in this thread? You can try to

force a refresh