About -

Rolex Rings Ltd is one of the top 5 forging cos in India in terms of installed capacity & a manufacturer & global supplier of hot rolled forged & machined bearing rings & automotive components for segments of vehicles including two-wheelers, passenger vehicles,

Rolex Rings Ltd is one of the top 5 forging cos in India in terms of installed capacity & a manufacturer & global supplier of hot rolled forged & machined bearing rings & automotive components for segments of vehicles including two-wheelers, passenger vehicles,

commercial vehicles, off-highway vehicles, electric vehicles), industrial machinery, wind turbines & railways, amongst other segments. It supply domestically & internationally to large marquee customers including some of the leading bearing mfg cos, tier-I suppliers to global

auto cos & some auto OEMs. It is one of the key manufacturers of bearing rings in India & caters to most of the leading bearing cos in India.

Diverse Product Portfolio -

Co offers a diverse range of hot forged & machined alloy steel bearing rings weighing from 0.01 kg to over 163 kg, with inner diameter of 25 millimeters to outer diameter of 900 millimeters. This makes its products suitable for a wide range of

Co offers a diverse range of hot forged & machined alloy steel bearing rings weighing from 0.01 kg to over 163 kg, with inner diameter of 25 millimeters to outer diameter of 900 millimeters. This makes its products suitable for a wide range of

end-user industries such as automotive, railways, industrial infrastructure, renewable energy, among others. It also offers auto components such as wheel hubs, shafts and spindles, gears, etc.

Bearing Rings :

Bearing Rings :

Bearings industry -

Indian bearings industry is expected to show healthy growth going forward.

• Increasing localization in Indian bearings industry (currently 40% imports), will help domestic suppliers of components for bearings.

Indian bearings industry is expected to show healthy growth going forward.

• Increasing localization in Indian bearings industry (currently 40% imports), will help domestic suppliers of components for bearings.

• Demand for domestic bearing components (rollers, rings) is expected to grow at a faster rate (~CAGR of 10-12%) than the underlying bearings industry.

Well Diversified in terms of Product offering & Geographic Presence -

• The co has a product portfolio comprising of forged bearing rings, weighing from 0.01 kg to over 163 kg & diameter of 25mm to 900mm along with auto components like wheel hubs, shafts & spindles.

• The co has a product portfolio comprising of forged bearing rings, weighing from 0.01 kg to over 163 kg & diameter of 25mm to 900mm along with auto components like wheel hubs, shafts & spindles.

• Automotive components contribute 42% while rings constitute 58% of the revenue.

• Diversified product offerings helps the company cater to wide range of enduser industries such as auto, railways, industrial infra, renewable energy, etc.

• Diversified product offerings helps the company cater to wide range of enduser industries such as auto, railways, industrial infra, renewable energy, etc.

Long Standing relationship with clients provides business stability -

• Co has been supplying 70% of top 10 clients for more than a decade. This testifies the customer stickiness.

• Major customers of co involve leading bearing manufacturers & auto players & domestic OEMs.

• Co has been supplying 70% of top 10 clients for more than a decade. This testifies the customer stickiness.

• Major customers of co involve leading bearing manufacturers & auto players & domestic OEMs.

• Since components supplied are critical in nature and constitute a large part of RM cost, entry barriers are high & companies usually sign long term supply contracts.

• Long standing relationship with the customers helps co in expanding its customer & geographic footprint.

• Long standing relationship with the customers helps co in expanding its customer & geographic footprint.

• Co is also able to leverage this relationship &increase its share of business amongst existing customers by widening the product offerings.

• Good customer relationships provides business stability.

• Good customer relationships provides business stability.

Financial Summary -

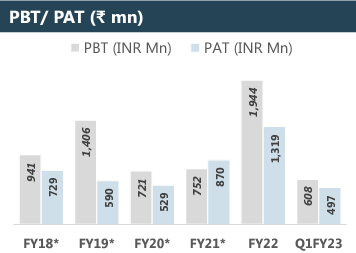

Co reported rev of ₹ 294 cr during the period ended June 30, 22 as compared to ₹ 231 cr during the period ended June 30, 21.

Co posted net profit of ₹ 50 cr for the period ended June 30, 22 as against net profit ₹ 30 cr for the period ended June 30, 21.

Co reported rev of ₹ 294 cr during the period ended June 30, 22 as compared to ₹ 231 cr during the period ended June 30, 21.

Co posted net profit of ₹ 50 cr for the period ended June 30, 22 as against net profit ₹ 30 cr for the period ended June 30, 21.

Key Risk -

• Heavy dependence on auto sector.

• Exchange rate fluctuations.

• Co has defaulted in the past for loan payment.

• The delay repayment to financial institutions & banks for borrowings of w.r.t loan certain periods up to FY19.

• Heavy dependence on auto sector.

• Exchange rate fluctuations.

• Co has defaulted in the past for loan payment.

• The delay repayment to financial institutions & banks for borrowings of w.r.t loan certain periods up to FY19.

A s a consequence of the same , the co may be restric taking some actions including buyback of securities.

Conclusion -

Rolex Rings is in the business of bearing manufacturing for auto cos & among the tier-1 supplier of major auto cos.

Conclusion -

Rolex Rings is in the business of bearing manufacturing for auto cos & among the tier-1 supplier of major auto cos.

The future growth prospects are looking good with growing demand for autos in the future. Co aims to continue to improve profitability by cost optimization ,improving product mix by enhancing contribution of higher value added machined products & increasing capacity utilization.

Please 🙏 like 👍, comment & retweet ♻️ if you find this useful.

@nid_rockz @varinder_bansal @suru27 @sahil_vi

@nid_rockz @varinder_bansal @suru27 @sahil_vi

• • •

Missing some Tweet in this thread? You can try to

force a refresh