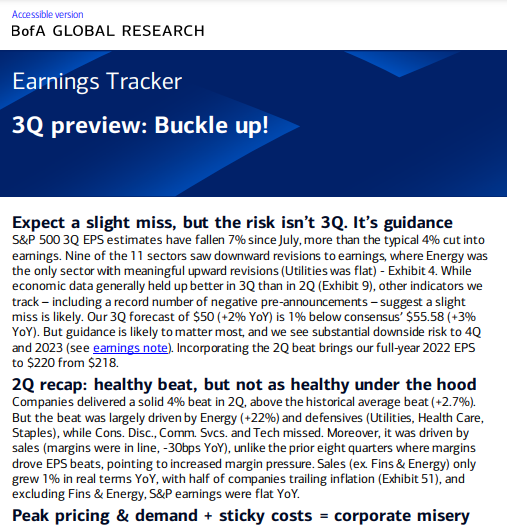

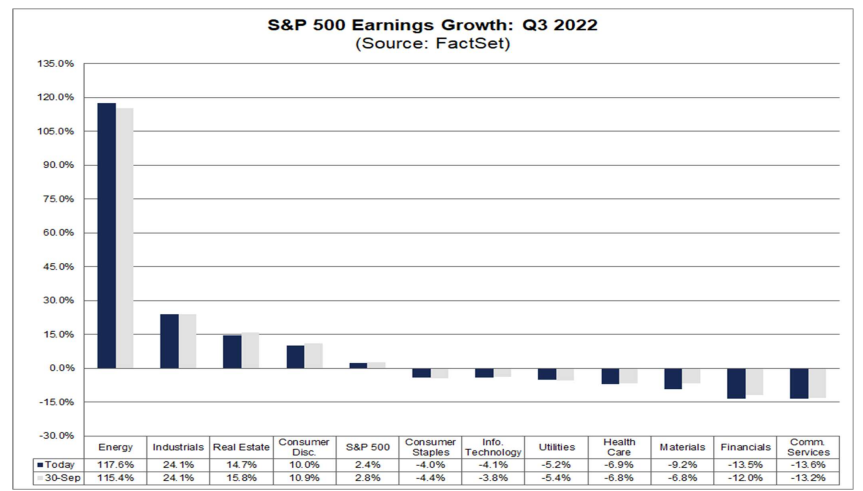

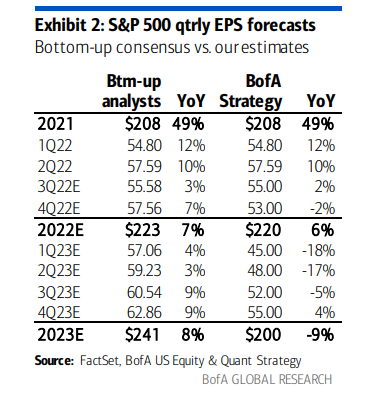

BofA: Our 3Q forecast of $50 (+2% YoY) is 1% below consensus’ $55.58 (+3% YoY)

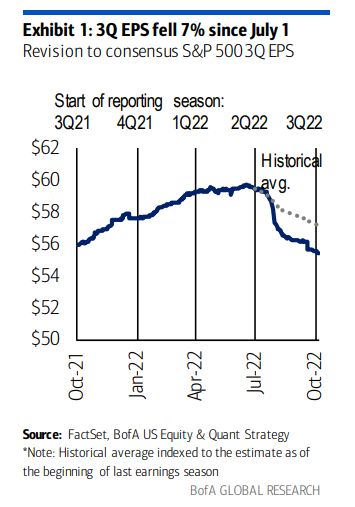

S&P 500 3Q EPS estimates have fallen 7% since July

S&P 500 3Q EPS estimates have fallen 7% since July

S&P 500 EPS estimates: consensus & BofA

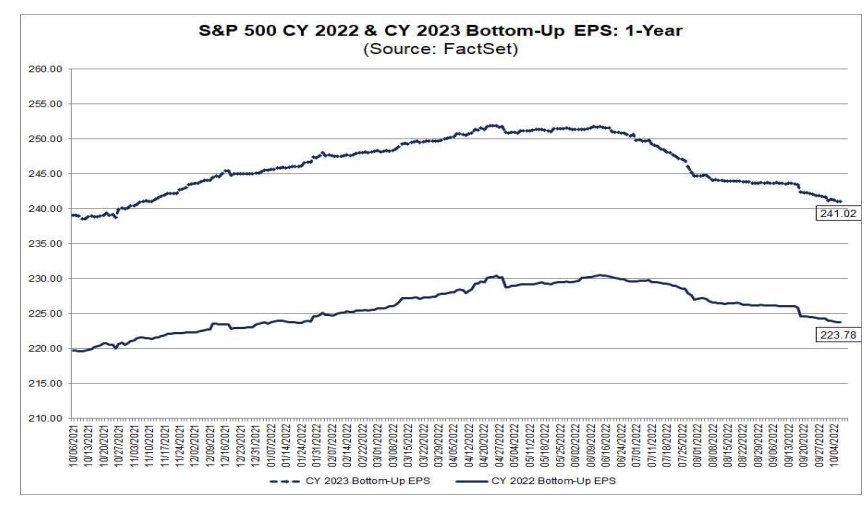

BofA sees $220 this year and

... (ominous music)...

$200 for 2023

BofA sees $220 this year and

... (ominous music)...

$200 for 2023

20 SPX companies have reported Q3 results:

55% have beaten on EPS, 60% on sales and 40% on both.

This is the weakest since 1Q19 and below the historical average EPS/sales/both beat of 69%/64%/49%

55% have beaten on EPS, 60% on sales and 40% on both.

This is the weakest since 1Q19 and below the historical average EPS/sales/both beat of 69%/64%/49%

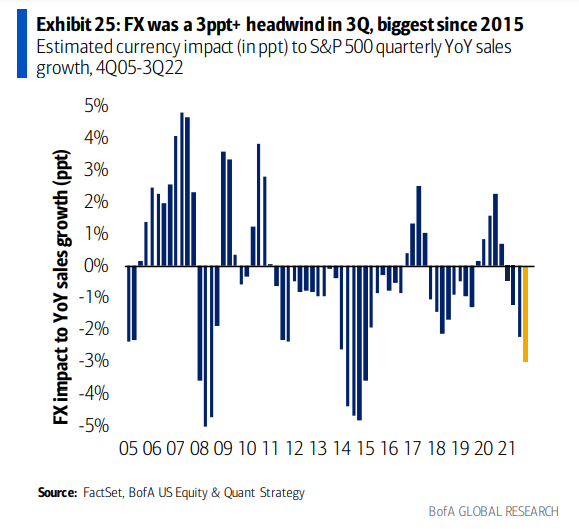

"Following a 16% rise in the USD in 3Q YoY, we calculate FX was a 3ppt hit to sales from translation, representing the biggest headwind since 2015."

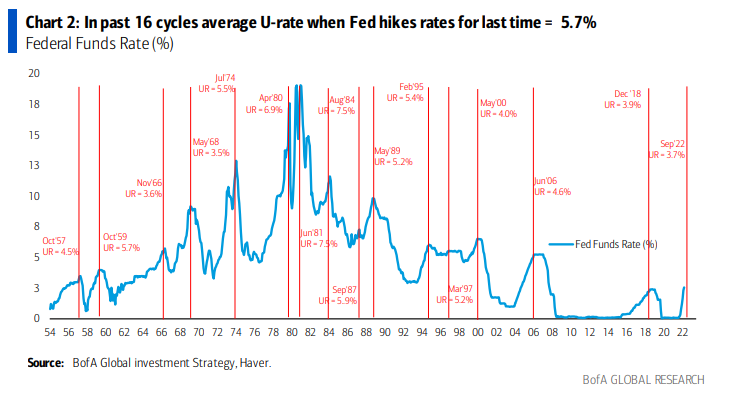

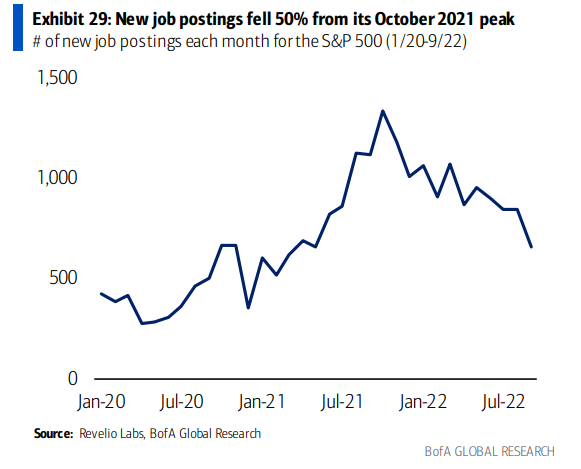

Yo Jay: New job postings are down 50% from its October 2021 peak - @RevelioLabs

• • •

Missing some Tweet in this thread? You can try to

force a refresh